- Home

- »

- Medical Devices

- »

-

U.S. Breast Prosthetic Market Size, Industry Report, 2033GVR Report cover

![U.S. Breast Prosthetic Market Size, Share & Trends Report]()

U.S. Breast Prosthetic Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Full Breast Prosthesis, Partial Breast Prosthesis), By Material Type, By Application/Indication, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-656-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Breast Prosthetic Market Summary

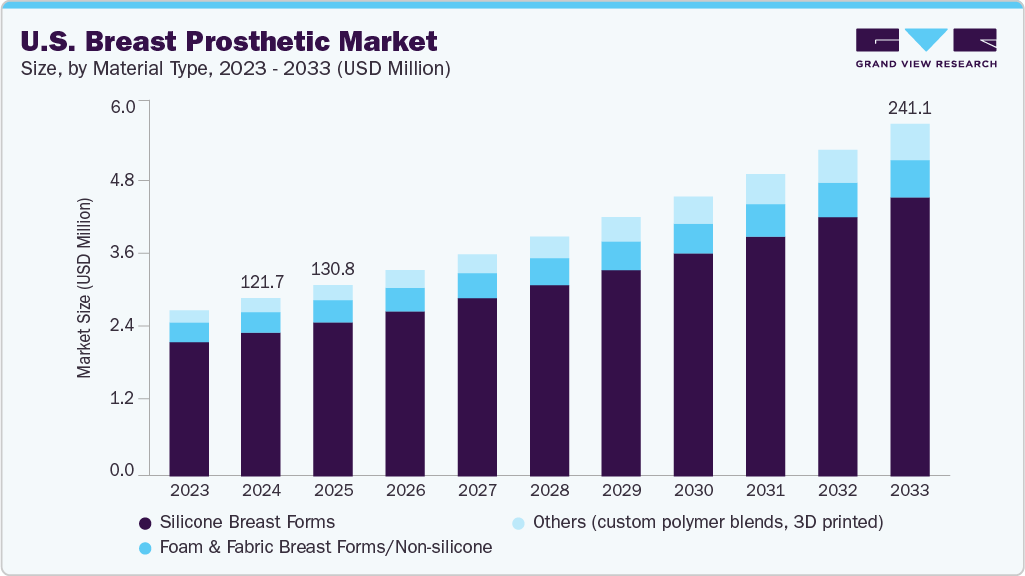

The U.S. breast prosthetic market size was estimated at USD 121.75 million in 2024, and is projected to reach USD 241.11 million by 2033, growing at a CAGR of 7.94% from 2025 to 2033. This growth is attributed to the rising incidence of breast cancer, increasing rates of mastectomy procedures, advancements in prosthetic materials and design, growing awareness regarding post-mastectomy options, and improved insurance coverage and reimbursement policies.

Key Market Trends & Insights

- By product, the full breast prosthesis segment led the market with the largest revenue share of 72.05% in 2024.

- By material type, the silicone breast forms segment led the market with the largest revenue share of 80.56% in 2024.

- By application/indication, the breast augmentation (non-surgical) segment is anticipated to grow with the highest CAGR from 2025 to 2033.

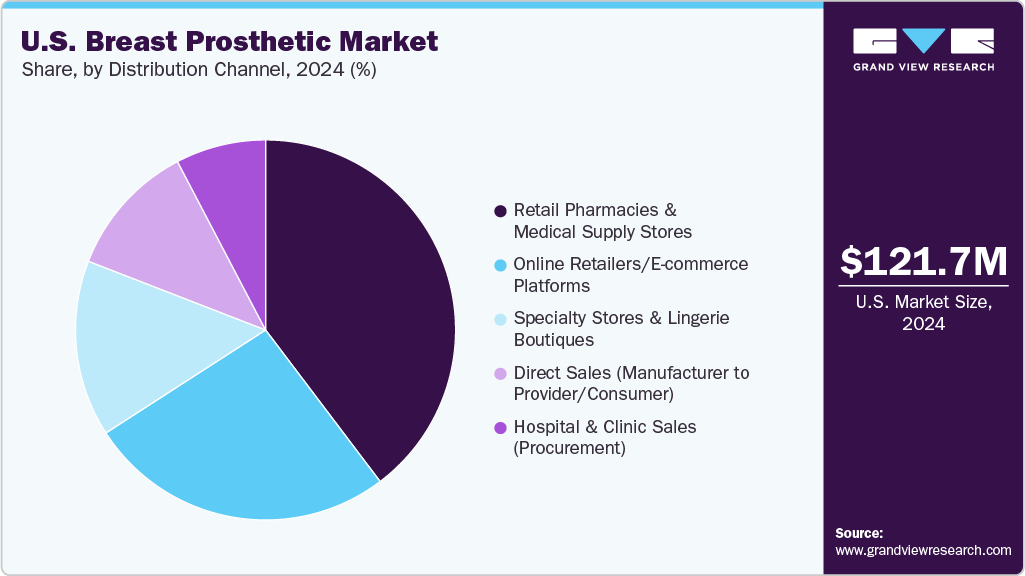

- By distribution channel, the retail pharmacies and medical supply stores segment led the market with the largest revenue share of 39.70% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 121.75 Million

- 2033 Projected Market Size: USD 241.11 Million

- CAGR (2025-2033): 7.94%

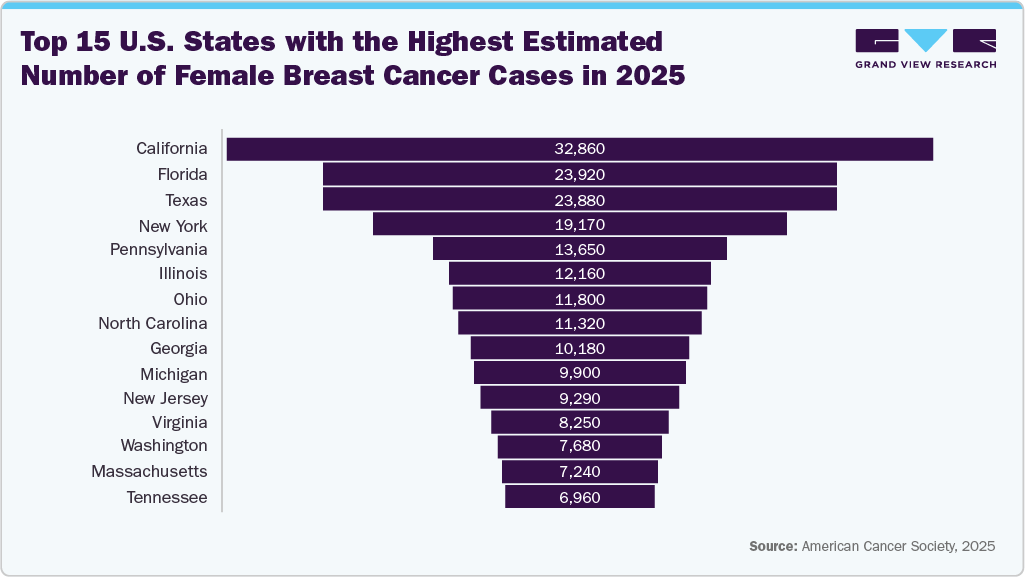

According to the Breast Cancer Organization, in 2025, approximately 316,950 women will be diagnosed with invasive breast cancer, with 59,080 new cases of ductal carcinoma in situ, which is non-invasive. About 16% of women with breast cancer are younger than 50 years of age.

Increasing investment in breast cancer research, awareness campaigns, and healthcare infrastructure is a key driver of the breast prosthetic market. Government bodies, non-profit organizations, and private companies are channeling substantial funds into early detection programs, public education, and improved treatment options. These investments have led to earlier diagnoses and higher survival rates, which in turn raise the demand for post-mastectomy solutions such as breast prostheses. Furthermore, funding has enabled the development of advanced, more comfortable, and aesthetically realistic prosthetic products, enhancing patient satisfaction and adoption. Investments also support training programs for healthcare providers, ensuring better post-surgical counseling and expanding access to prosthetic care. Collectively, these initiatives contribute to a more supportive ecosystem for breast cancer survivors, thereby boosting the market growth in the U.S.

- In 2025, Susan G. Komen invested USD 11 million across 25 research projects at 17 institutions to accelerate breakthroughs in breast cancer treatment, particularly focusing on metastatic disease, precision medicine, and reducing health disparities. This significant investment advances treatment outcomes and directly impacts the breast prosthetic market. As survival rates improve due to more effective and personalized therapies, the number of women living post-mastectomy continues to rise, driving demand for high-quality breast prostheses.

“Komen’s commitment to breast cancer research comes at a pivotal time and will drive meaningful advances in our understanding of the disease and care of patients. By fueling science that is both innovative and inclusive, we’re accelerating progress where patients need it most - while building a foundation for individualized care for all.” - Ann Partridge, M.D., M.P.H., Chief Scientific Advisor for Komen.

-

As of May 1, 2024, the American Cancer Society supported over USD 81 million in breast cancer research across 156 active research and training grants. These projects align with ACS’s six research priority areas and include efforts such as developing novel strategies to target circulating tumor cells, harnessing immune responses for breast cancer treatment, creating wearable imaging devices to monitor therapy effectiveness, studying the role of the immune system in metastasis, and exploring how specific diets may influence breast cancer recurrence.

The rising incidence of female breast cancer in the U.S., projected to reach over 316,000 new cases in 2025, is a key driver of the U.S. breast prosthetic industry. A significant proportion of these patients undergo mastectomy, creating a growing demand for breast prostheses as an essential part of post-surgical recovery. As survival rates improve and awareness of reconstructive options increases, more women are opting for external breast prostheses, especially those who are elderly, have limited access to reconstructive surgery, or prefer non-invasive alternatives. In addition, advancements in prosthetic design, including lightweight materials and custom-fitted solutions, have enhanced comfort and aesthetics, further boosting adoption.

“The biggest danger of breast cancer is that it can spread through the bloodstream to other parts of the body before we even know about it.” -Abram Recht, M.D., a breast radiation oncologist at Beth Israel Deaconess Medical Center in Boston.

Insurance coverage and reimbursement policies play a crucial role in driving the U.S. breast prosthetic industry by making products more accessible and affordable for patients. The Women’s Health and Cancer Rights Act (WHCRA) mandates that group health plans and insurers providing coverage for mastectomy must also cover all stages of breast reconstruction, including external breast prostheses. This legal framework ensures that women undergoing mastectomy are financially supported in obtaining prosthetic solutions, significantly reducing out-of-pocket costs. Medicare and Medicaid also reimburse breast prostheses and related accessories, expanding access to underserved and elderly populations. The assurance of coverage encourages more women to seek prosthetic options rather than forgo reconstruction entirely. This support drives product demand and stimulates innovation as manufacturers respond to a growing, insurance-supported consumer base with improved and diverse product offerings.

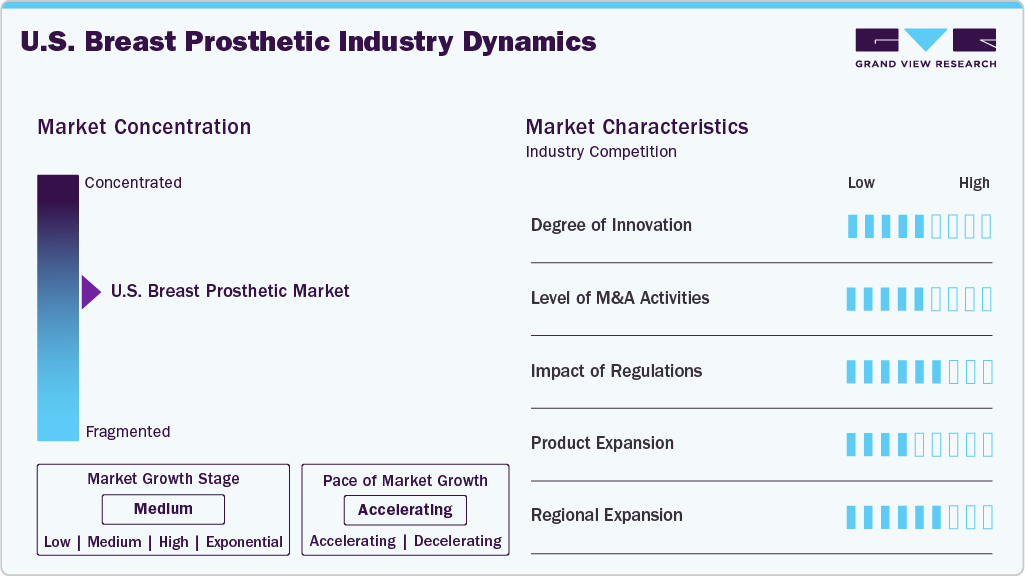

Market Concentration & Characteristics

The U.S. breast prosthetic industry is in a high-growth phase, fueled by a confluence of medical, technological, and social factors. Rising breast cancer incidence and improved survival rates due to advancements in early detection and treatment have led to a growing population of post-mastectomy patients seeking non-surgical restoration options.

The degree of innovation in the U.S. breast prosthetic industry is steadily advancing, driven by patient demand for more personalized, comfortable, and natural-looking solutions. Manufacturers leverage technologies like 3D scanning and printing to offer custom-fit prostheses that closely match the individual's body shape, skin tone, and contour. Using lightweight, breathable, and hypoallergenic materials-such as advanced silicone gels-has significantly improved user comfort and wearability. Innovations in adhesive systems and attachable prostheses have enhanced ease of use and stability, eliminating the need for heavy bras or inserts.

The level of mergers and acquisitions (M&A) in the U.S. breast prosthetic industry is moderate, with activity primarily driven by the desire to expand product portfolios, enter new geographic markets, and integrate complementary technologies. At the same time, the market is niche compared to broader medical devices, major players in the breast care space have been involved in strategic acquisitions to strengthen their positions. In addition, larger medical and surgical device companies occasionally acquire specialized prosthetic manufacturers to enhance their reconstructive and post-mastectomy offerings.

The regulatory framework significantly impacts the U.S. breast prosthetic industry by shaping product development, safety standards, reimbursement policies, and market access. The U.S. Food and Drug Administration (FDA) classifies external breast prostheses as Class I or II medical devices, depending on the complexity and intended use. This means manufacturers must comply with regulations related to quality assurance, labeling, safety testing, and manufacturing practices (21 CFR Part 820). These requirements ensure that products are safe, effective, and meet minimum performance standards. The Women’s Health and Cancer Rights Act (WHCRA) mandates insurance coverage for post-mastectomy breast reconstruction and prostheses, making the regulatory environment more supportive for patients and providers.

End-user concentration in the U.S. breast prosthetic industry is relatively high, with a significant portion of demand coming from a focused group of users-post-mastectomy breast cancer survivors. This includes women who have undergone unilateral or bilateral mastectomy and either choose not to have reconstructive surgery or require prostheses temporarily before reconstruction.

Product Type Insights

The full breast prosthesis segment led the market with the largest revenue share of 72.05% in 2024, due to its widespread use among women who undergo total mastectomy, particularly those who opt not to pursue reconstructive surgery. These prostheses are designed to replace the entire breast mound and offer a realistic shape, size, and feel. They are popular for patients seeking a non-surgical, comfortable, and immediate solution post-surgery. Their dominance is also driven by advancements in design and materials-such as lightweight silicone, temperature-regulating technology, and custom-fit options-which enhance comfort and aesthetic appeal. Moreover, full breast prostheses are covered by insurance and Medicare, increasing accessibility and affordability for a large portion of patients.

The specialty/functional prosthesis segment is expected to register at the fastest CAGR during the forecast period, driven by rising demand for personalized and lifestyle-specific solutions. This segment includes partial breast prostheses, swim-friendly forms, gender-affirming prosthetics, and products tailored for cosmetic or recreational use, such as cosplay and cross-dressing. Increasing awareness of body diversity, inclusive healthcare, and gender identity is expanding the user base beyond traditional post-mastectomy patients. Advancements in materials, AI-enabled customization, and ergonomic design enhance comfort, fit, and usability, making these products more appealing. As consumers seek functional and aesthetic solutions that align with their needs and lifestyles, the Specialty/Functional Prosthesis segment is experiencing robust growth. It is projected to be the fastest-expanding category in the market.

Material Type Insights

The silicone breast forms segment led the market with the largest revenue share of 80.56% in 2024, due to their superior realism, comfort, and widespread medical acceptance. These forms closely mimic natural breast tissue's weight, texture, and movement, offering a more lifelike appearance than alternatives like foam or fiberfill. Silicone forms are preferred for post-mastectomy patients seeking a durable and natural-feeling solution, especially when worn under clothing or swimwear. Their high level of customization-available in various sizes, shapes, skin tones, and adhesive options-further enhances their appeal. In addition, many insurance providers cover silicone breast prostheses as part of post-surgical care, making them more accessible to patients. Continued innovation in lightweight silicone technology and skin-safe materials reinforces their market dominance, positioning them as the gold standard in medical and cosmetic breast prosthetic applications.

The other segment is expected to grow at the fastest CAGR during the forecast period, due to rising demand for hyper-personalized, lightweight, and skin-friendly solutions. 3D printing technology allows for precise customization based on individual anatomy, offering enhanced comfort and symmetry, particularly for women with unique surgical outcomes or asymmetric chest walls. On the other hand, custom polymer blends provide advanced features such as breathability, hypoallergenic properties, and flexible support, making them ideal for long-term wear. These innovations cater to medical users and niche markets such as gender-affirming care, cross-dressing, and performance wear. As consumers seek more functional, customizable, and lifestyle-adapted prosthetics, the adoption of next-generation materials is accelerating rapidly, positioning the other category as one of the market's most dynamic and fastest-growing segments.

Application/Indication Insights

The post-mastectomy care segment accounted for the largest market revenue share in 2024, due to the high prevalence of breast cancer and the widespread adoption of mastectomy as a primary or preventive treatment option. A significant portion of women undergoing mastectomy opt for external breast prostheses as part of their physical and emotional rehabilitation. These prostheses offer a non-surgical, affordable, and immediate solution to restore body symmetry and self-confidence, particularly for patients who are not candidates for reconstructive surgery or choose to avoid it. Furthermore, increasing awareness through breast cancer support programs, improved reimbursement policies, and the presence of specialized breast care centers have further strengthened the demand in this segment. The growing emphasis on personalized post-operative care and quality-of-life improvements continues to position post-mastectomy care as the leading application in the breast prosthetic market.

The breast augmentation (non-surgical) segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing consumer demand for minimally invasive cosmetic procedures. Unlike traditional surgical implants, non-surgical methods-primarily using injectable fillers like hyaluronic acid-offer temporary enhancement with reduced risks, minimal downtime, and lower costs. These procedures appeal especially to younger women seeking subtle, customizable changes without the permanence or recovery time associated with surgery. Advancements in filler technology, growing aesthetic awareness, and the rise of med-spa and outpatient cosmetic centers further fuel this trend. As patients prioritize convenience, safety, and natural-looking results, the non-surgical breast augmentation segment is rapidly gaining popularity and is projected to expand rapidly in the forecast years.

Distribution Channel Insights

The retail pharmacies and medical supply stores segment led the market with the largest revenue share of 39.70% in 2024, owing to their widespread accessibility, personalized customer service, and ability to cater to the unique fitting needs of post-mastectomy patients. These channels offer a wide range of prosthetic options, including full and partial breast forms, and trained staff to assist in proper selection and fitting. In addition, insurance reimbursement support and strong relationships with healthcare providers further enhanced the growth of this distribution channel. Their ability to deliver both convenience and customization has positioned them as the preferred choice among patients seeking breast prostheses.

The direct sales segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing patient preference for personalized fittings, improved patient education, and the expansion of manufacturer-led initiatives such as home consultations and mobile fitting services. Direct sales eliminate intermediary costs, allowing for better pricing, faster delivery, and enhanced customization. As awareness around post-mastectomy care rises and technological advancements improve product quality, more consumers directly engage with manufacturers or certified fitters, boosting the segment's traction. In addition, the growing popularity of e-commerce and telehealth has further supported the shift toward direct distribution, aligning with broader trends in healthcare consumerism and convenience.

Key U.S. Breast Prosthetic Company Insights

Amoena Medizin-Orthopädie-Technik GmbH, Elkem, American Breast Care are some of the major players in the U.S. breast prosthetic industry. The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. breast prosthetic industry.

Key U.S. Breast Prosthetic Companies:

- Trulife

- Elkem

- American Breast Care

- Amoena Medizin-Orthopädie-Technik GmbH

- Nearly Me

- Anita international Corporation

U.S. Breast Prosthetic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 130.82 million

Revenue forecast in 2033

USD 241.11 million

Growth rate

CAGR of 7.94% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product type, material type, application/indication, distribution channel

Country Scope

U.S.

Key companies profiled

Trulife, Elkem, American Breast Care, Amoena Medizin-Orthopädie-Technik GmbH, Nearly Me, Anita international Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breast Prosthetic Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 - 2033. For this study, Grand View Research has segmented the U.S. breast prosthetic market report based on product type, material type, application/indication, distribution channel.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Full Breast Prosthesis

-

Partial Breast Prosthesis (Shapers/Shells)

-

Specialty/Functional Prosthesis

-

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone breast forms

-

Standard Silicone

-

Lightweight

-

-

Foam and fabric breast forms/Non-silicone

-

Others (custom polymer blends, 3D printed)

-

-

Application/Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Post-Mastectomy Care

-

Lumpectomy/Partial Mastectomy

-

Breast Augmentation (Non-Surgical)

-

Congenital Asymmetry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online Retailers/E-commerce Platforms

-

Retail Pharmacies & Medical Supply Stores

-

Specialty Stores & Lingerie Boutiques

-

Direct Sales (Manufacturer to Provider/Consumer)

-

Hospital & Clinic Sales (Procurement)

-

Frequently Asked Questions About This Report

b. The global U.S. breast prosthetic market size was estimated at USD 121.75 million in 2024.

b. The global U.S. breast prosthetic market is expected to grow at a compound annual growth rate of 7.94% from 2025 to 2033 to reach USD 241.11 million by 2033.

b. The full breast prosthesis segment dominated the U.S. breast prosthetic market with a share of 72.05% in 2024, primarily driven by the high prevalence of total mastectomies and the growing preference for non-surgical, affordable alternatives to breast reconstruction.

b. Some key players operating in the U.S. breast prosthetic market include Trulife, Elkem, American Breast Care, Amoena Medizin-Orthopädie-Technik GmbH, Nearly Me, Anita International Corporation

b. Key factors driving the growth of the U.S. breast prosthetic market include the rising incidence of breast cancer, increasing preference for non-surgical alternatives post-mastectomy, and favorable insurance coverage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.