- Home

- »

- Next Generation Technologies

- »

-

U.S. C4ISR Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. C4ISR Market Size, Share & Trends Report]()

U.S. C4ISR Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Command & Control, Communications), By End Use (Ground, Naval, Air, Space), By Vertical, By Type, And Segment Forecasts

- Report ID: GVR-4-68040-645-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. C4ISR Market Size & Trends

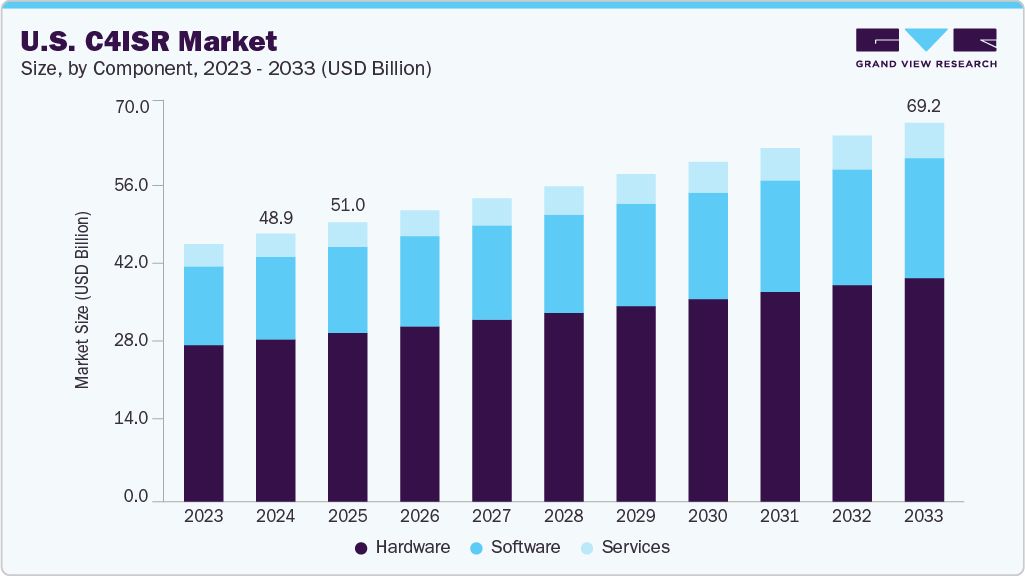

The U.S. C4ISR market size was estimated at USD 48.93 billion in 2024 and is projected to reach USD 69.18 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. Driven by the increasing need for real-time situational awareness and enhanced battlefield communication, the C4ISR industry is experiencing robust growth across the defense and intelligence sectors. Defense organizations are investing heavily in advanced command and control systems, integrated surveillance platforms, and secure communication networks to enable faster and more informed decision-making. The growing adoption of AI, machine learning, and data fusion technologies is further transforming C4ISR capabilities, allowing for predictive analytics and autonomous operations. This surge in demand reflects a global shift toward modernizing military infrastructure to counter evolving threats and support multi-domain operations.

The C4ISR industry in the U.S. is rapidly adopting artificial intelligence (AI) and machine learning (ML) technologies to enhance operational decision-making and automate complex data analysis. AI enables real-time threat detection, predictive analytics, and situational awareness by synthesizing data from multiple sources. ML algorithms are being embedded into ISR platforms and command centers to improve mission outcomes and reduce cognitive overload on analysts. This trend reflects the growing recognition of intelligent systems as a strategic force multiplier in modern military operations.

The growing demand for agile and cost-effective deployment is pushing the U.S. C4ISR industry toward service-based delivery models like C4ISR-as-a-Service (C4ISRaaS). These offerings allow defense agencies to access ISR, analytics, and communication tools without heavy capital investment. C4ISRaaS supports modular upgrades, faster fielding, and customization aligned with operational tempo. This trend enables the U.S. C4ISR market to better serve dynamic mission requirements and optimize resource allocation.

The integration of multiple intelligence sources-including SIGINT, GEOINT, and HUMINT-is becoming central to the U.S. C4ISR market approach to real-time threat detection. Fusing data streams enhances situational awareness, enabling commanders to make faster and more informed decisions. AI-powered platforms help correlate vast datasets at the edge, improving mission planning and response times. As operations become more data-driven, the U.S. C4ISR industry is prioritizing advanced fusion capabilities.

With the increasing demand for rapid data access and scalable intelligence sharing, the U.S. C4ISR industry is accelerating its shift toward cloud-based architectures. These solutions provide secure, flexible, and real-time collaboration capabilities for multi-domain operations. Cloud platforms allow defense forces to deploy mission applications remotely while reducing infrastructure complexity. To maintain operational agility, the U.S. C4ISR market is investing in defense-compliant, cloud-native systems.

Component Insights

The hardware segment dominated the market with a share of over 60% in 2024. Driven by the need for real-time situational awareness and mission agility, the segment is witnessing accelerated innovation and modernization. Defense forces are investing in advanced sensors, tactical communication units, and rugged computing platforms that support multi-domain operations. Emphasis is placed on modular, compact, and power-efficient designs that can be easily integrated across manned and unmanned systems. As operational environments grow more complex, the U.S. C4ISR market is responding with resilient and scalable hardware solutions that ensure performance in both conventional and asymmetric warfare scenarios.

The services segment is expected to register the fastest CAGR of 4.6% from 2025-2033. Driven by the rising complexity of multi-domain operations, the services segment of the U.S. C4ISR industry is expanding rapidly to support system integration, training, logistics, and lifecycle management. Military agencies increasingly rely on external service providers to maintain operational readiness, manage networked systems, and upgrade aging C4ISR infrastructure. Specialized services such as cybersecurity support, data analytics, and AI integration are in high demand to complement hardware and software deployments. To sustain mission-critical capabilities, the U.S. C4ISR market is enhancing its service offerings through public-private partnerships and long-term support contracts.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment dominated the market in 2024. Due to the growing need for real-time threat detection and mission-critical decision support, the ISR segment of the U.S. C4ISR market is experiencing significant technological advancement. Defense forces are enhancing ISR capabilities with AI-enabled data processing, autonomous sensors, and high-altitude surveillance platforms. These systems are crucial for achieving operational dominance across air, land, sea, space, and cyber domains. To ensure information superiority in complex environments, the U.S. C4ISR market is focusing on scalable, interoperable ISR solutions that support multi-domain operations.

The electronic warfare segment is expected to grow at the fastest CAGR in the coming years. The increasing demand for electromagnetic spectrum dominance is driving significant investment in the Electronic Warfare segment of the U.S. C4ISR industry. As adversaries develop advanced jamming, spoofing, and electronic attack capabilities, U.S. defense agencies are prioritizing next-generation EW systems that can detect and neutralize threats in real time. Cutting-edge technologies, including AI-enabled spectrum analysis and cognitive jamming, are enhancing the adaptability and speed of EW responses. To ensure operational superiority in contested and denied environments, the U.S. C4ISR market is advancing integrated EW platforms that function seamlessly across air, land, sea, and space domains.

Vertical Insights

The defense & military segment dominated the market in 2024, primarily driven by the need for real-time operational awareness and strategic command superiority. The Defense & Military segment of the U.S. C4ISR industry is undergoing rapid transformation. Military forces are increasingly integrating AI-powered intelligence systems, secure communications, and autonomous platforms to strengthen command, control, and situational responsiveness. These technologies enable synchronized operations across multiple domains, enhancing lethality and coordination in complex mission environments. To maintain a competitive edge against peer adversaries, the U.S. C4ISR market is focused on delivering advanced, interoperable, and mission-resilient solutions for defense applications.

The government segment is expected to grow significant CAGR in the coming years. Primarily driven by the need for real-time operational awareness and strategic command superiority, the Defense & Military segment of the U.S. C4ISR market is undergoing rapid transformation. Military forces are increasingly integrating AI-powered intelligence systems, secure communications, and autonomous platforms to strengthen command, control, and situational responsiveness. These technologies enable synchronized operations across multiple domains, enhancing lethality and coordination in complex mission environments. To maintain a competitive edge against peer adversaries, the U.S. C4ISR market is focused on delivering advanced, interoperable, and mission-resilient solutions for defense applications.

Type Insights

The new installation segment dominated the market in 2024, primarily driven by the modernization of defense infrastructure and the shift toward digital battlefield environments. The New Installation segment of the U.S. C4ISR market is experiencing strong growth. Defense and government agencies are deploying next-generation C4ISR systems in newly commissioned platforms, ranging from unmanned aerial systems to command centers and naval vessels. These installations often feature integrated AI, edge computing, and secure communication technologies to enable faster decision-making and enhanced situational awareness. To support future operational readiness, the U.S. C4ISR market is focused on flexible, scalable, and mission-adaptive systems purpose-built for new deployments.

The retrofit segment is expected to grow at the fastest CAGR in the coming years. The increasing demand for upgrading legacy defense platforms without the high costs of complete replacement is fueling growth in the segment of the U.S. C4ISR market. Armed forces are enhancing existing systems with advanced sensors, secure communications, and real-time data processing capabilities to meet modern battlefield requirements. These retrofits enable improved performance, interoperability, and situational awareness across multi-domain operations. As budgets remain tight and operational needs expand, the U.S. C4ISR industry is focusing on modular, cost-effective retrofit solutions to extend the life and relevance of aging defense infrastructure.

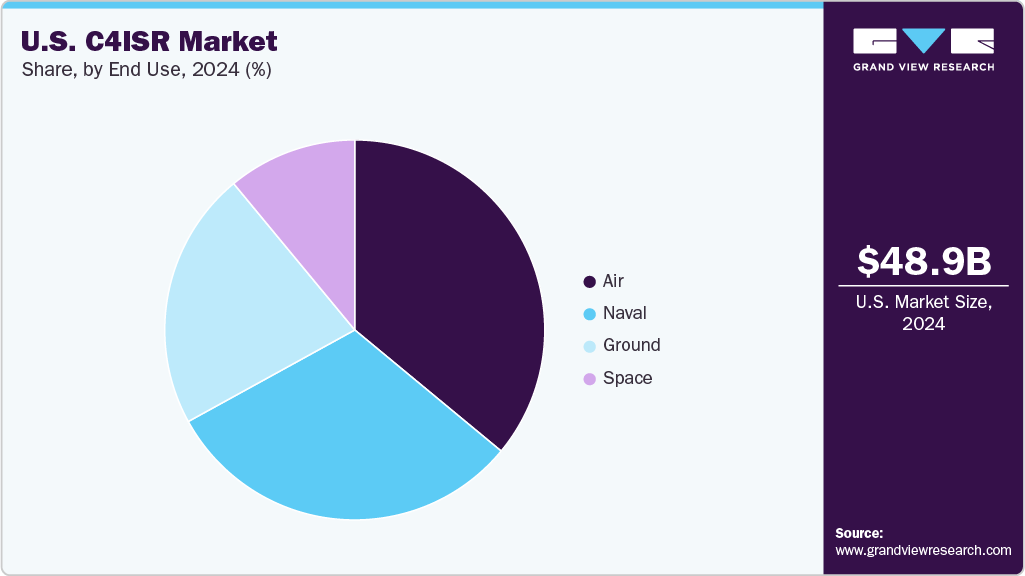

End Use Insights

The air segment dominated the market in 2024. Due to the need for real-time intelligence and rapid response in dynamic combat environments, the air segment of the U.S. C4ISR market is experiencing significant advancements. Airborne platforms are being enhanced with high-resolution sensors, multi-spectral targeting systems, and secure communication networks to support precision strikes and coordinated operations. Integration with AI and edge computing enables faster data processing and decision-making directly on airborne assets. To sustain air superiority, the U.S. C4ISR market is investing in agile, interoperable, and next-generation airborne C4ISR solutions.

The naval segment is expected to grow at the fastest CAGR in the coming years. The growing demand for enhanced maritime domain awareness and secure naval operations is accelerating technological innovation in the naval segment of the U.S. C4ISR industry. Modern naval vessels are being equipped with integrated C4ISR suites, including advanced radar, sonar, and secure communication systems, to improve threat detection and mission coordination. Unmanned surface and underwater vehicles are also being deployed to extend surveillance capabilities and reduce risk to personnel. In response to evolving naval threats and contested waters, the U.S. C4ISR market is emphasizing interoperability, automation, and real-time data sharing across joint maritime forces.

Key U.S. C4ISR Company Insights

Key players operating in the U.S. C4ISR market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. C4ISR Companies:

- BAE Systems plc

- CACI International Inc.

- Elbit Systems Ltd.

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Leidos Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- The Boeing Company

Recent Developments

-

In May 2025, MISCO Speaker Company launched cobot-assisted micro-speaker manufacturing at its facility in Minnesota, becoming the first to do so in the U.S. The initiative boosts precision, quality, and scalability for critical applications in defense, aerospace, medical devices, and IoT. The advanced facility is ITAR-compliant and ISO-certified, reinforcing secure and high-performance domestic production.

-

In May 2025, Raytheon, an RTX business, was awarded a USD 580 million contract by the U.S. Navy for low-rate production of Next Generation Jammer Mid-Band (NGJ-MB) pods. These pods will enhance electronic warfare capabilities on EA-18G Growler aircraft by disrupting enemy radar and communications. The contract also supports international cooperation, with some systems headed to the Royal Australian Air Force.

-

In February 2025, Kalyani Strategic Systems Limited (KSSL) partnered with U.S.-based L3Harris Technologies to co-develop next-generation C4ISR and tactical communication solutions for the Indian Armed Forces. The collaboration combines L3Harris’s global leadership in military radios with KSSL’s domestic manufacturing capabilities. This alliance strengthens U.S.-India defense ties and contributes to building resilient supply chains for advanced battlefield technologies.

U.S. C4ISR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.01 billion

Revenue forecast in 2033

USD 69.18 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, vertical, type

Country scope

U.S.

Key companies profiled

Lockheed Martin Corporation; Northrop Grumman Corporation; BAE Systems plc; The Boeing Company; RTX Corporation; Leidos Inc.; L3Harris Technologies Inc.; Elbit Systems Ltd.; Honeywell International Inc.; CACI International Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. C4ISR Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. C4ISR market report based on component, application, end use, vertical, and type.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Command & Control

-

Communications

-

Computers

-

Intelligence, Surveillance and Reconnaissance (ISR)

-

Electronic Warfare

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ground

-

Naval

-

Air

-

Space

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Defense & Military

-

Government

-

Commercial

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

New Installation

-

Retrofit

-

Frequently Asked Questions About This Report

b. The global U.S. C4ISR market size was estimated at USD 48.93 billion in 2024 and is expected to reach USD 51.01 billion in 2025.

b. The global U.S. C4ISR market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2033 to reach USD 69.18 billion by 2033.

b. The hardware segment dominated the U.S. C4ISR market with a share of over 60.0% in 2024, driven by the increasing procurement of advanced surveillance systems, communication equipment, and radar technologies to enhance battlefield awareness and operational efficiency.

b. Some key players operating in the U.S. C4ISR market include Lockheed Martin Corporation, Northrop Grumman Corporation, BAE Systems plc, The Boeing Company, RTX Corporation, Leidos Inc., L3Harris Technologies Inc., Elbit Systems Ltd., Honeywell International Inc., and CACI International Inc.

b. Key factors that are driving the market growth include rising defense modernization programs, increasing demand for real-time data sharing, and growing investments in integrated command and control systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.