- Home

- »

- Next Generation Technologies

- »

-

U.S. C5ISR Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. C5ISR Market Size, Share & Trends Report]()

U.S. C5ISR Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End Use (Ground, Naval, Air, Space), By Application (Intelligence, Surveillance, and Reconnaissance, Command and Control), And Segment Forecasts

- Report ID: GVR-4-68040-630-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S C5ISR Market Summary

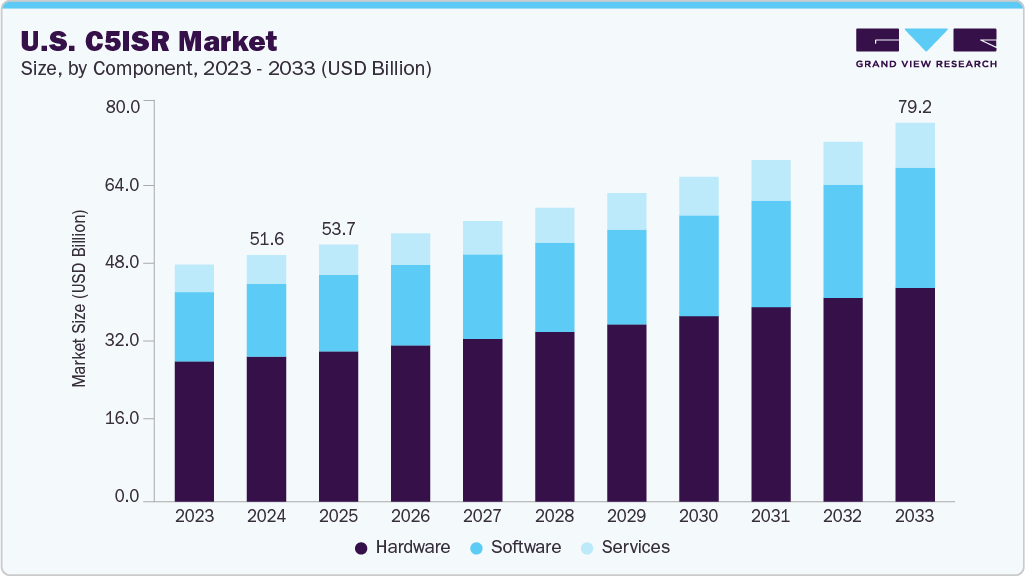

The U.S. C5ISR market size was estimated at USD 51.59 billion in 2024 and is projected to reach USD 79.24 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. This growth is primarily driven by increasing geopolitical tensions, rising defense modernization programs, and the growing need for integrated battlefield awareness and real-time intelligence.

Key Market Trends & Insights

- By component, hardware segment led the market and held the largest revenue share of 58.8% in 2024.

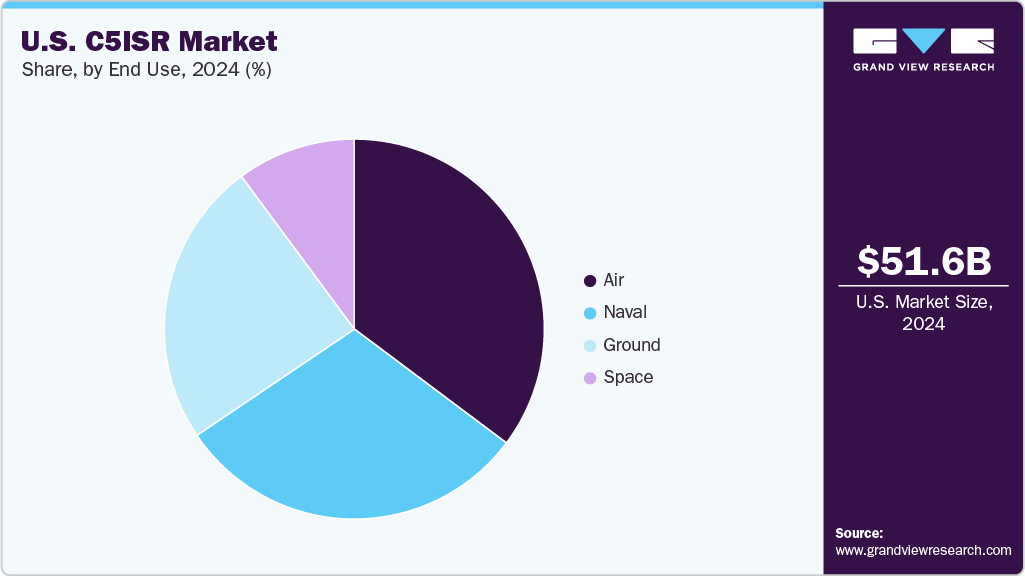

- By end use, air segment held the dominant position in the market and accounted for the leading revenue share of 35.2% in 2024.

- By application, intelligence, surveillance, and reconnaissance held the largest revenue share of 45.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 51.59 Billion

- 2033 Projected Market Size: USD 79.24 Billion

- CAGR (2025-2033): 5.0%

The market is largely driven by increasing geopolitical tensions and the growing need for advanced situational awareness across defense and homeland security operations. Rising investments in modernizing military infrastructure have prompted governments to adopt integrated C5ISR systems that enhance decision-making and battlefield coordination. In addition, the demand for real-time data sharing, advanced surveillance technologies, and secure communication networks is increasing across defense forces and border security agencies. The growing emphasis on interoperability between platforms and adopting AI and machine learning for intelligence processing further propel the adoption of sophisticated C5ISR solutions.A notable trend in the market is the increasing integration of next-generation technologies such as artificial intelligence (AI), machine learning (ML), and edge computing into defense and intelligence systems. These technologies enable real-time data analysis, autonomous decision-making, and faster threat detection, significantly improving operational efficiency and battlefield awareness. There is also a growing emphasis on cyber-resilience and secure communication protocols to counter rising threats in electronic and information warfare.

Furthermore, armed forces are increasingly investing in modular, interoperable, and platform-agnostic C5ISR systems to enhance mission flexibility and coordination across domains. These trends underscore the market’s shift toward digital transformation, agility, and multi-domain integration.

Moreover, leading companies in the U.S. C5ISR industry are actively investing in R&D to develop advanced situational awareness platforms, unmanned systems integration, and AI-powered decision-support tools. Strategic collaborations with defense ministries, NATO members, and technology firms are becoming more prevalent to ensure compatibility and operational readiness.

Moreover, mergers and acquisitions are also being pursued to consolidate technological capabilities and expand service offerings. Companies are prioritizing network-centric and software-defined systems to support joint operations and coalition warfare. These initiatives help the U.S. C5ISR industry remain at the forefront of innovation while addressing evolving defense needs and maintaining global competitiveness.

Component Insights

The hardware segment dominated the market and accounted for a market share of over 58% in 2024, owing to increased defense modernization programs and the ongoing need for robust and resilient communication infrastructure. Nations across the globe are prioritizing the procurement of advanced sensors, radars, and tactical communication equipment to enhance real-time situational awareness. The surge in cross-border tensions and asymmetric warfare has driven the demand for reliable, mission-critical hardware. These efforts aim to strengthen operational capabilities, increase force protection, and enable strategic dominance across all domains, thus contributing to the segment’s leading market position.

The software solution segment is expected to witness the highest CAGR of over 5% from 2025 to 2033. This growth is fueled by increasing reliance on AI, machine learning, and big data analytics for enhanced situational awareness and decision-making. Modern defense systems have become more network-centric, and the demand for advanced software solutions, including cybersecurity, data fusion, and predictive analytics, is rising. Software-driven upgrades offer cost-effective solutions for extending the lifecycle of existing U.S. C5ISR industry hardware, reducing the need for frequent hardware replacements. The shift toward cloud-based and edge computing solutions for real-time intelligence processing further accelerates software adoption, driving its rapid growth in the coming years.

Application Insights

The intelligence, surveillance, and reconnaissance segment dominated the market and accounted for the largest market share in 2024. This segment’s dominance is driven by the increasing demand for real-time intelligence gathering, vital for modern defense operations. ISR solutions enable the collection and analysis of crucial data from various sources such as satellites, UAVs, and ground sensors. As geopolitical tensions and security concerns continue rising, governments and defense agencies prioritize ISR capabilities to enhance national security and military effectiveness. The growing sophistication of ISR technologies, including advanced sensors and data analytics, further fuels this segment’s growth.

The command and control segment is expected to witness the highest CAGR from 2025 to 2033. The rapid expansion of this segment is attributed to the increasing need for effective management and coordination of military forces in complex, multi-domain environments. C2 systems enable seamless communication, decision-making, and the orchestration of tactical operations across air, land, sea, and cyberspace. Developing more integrated and automated systems drives the demand for advanced C2 solutions. The growing trend of network-centric warfare and the need for interoperability between military branches and allied forces further accelerates the adoption of C2 technologies.

End Use Insights

The air segment accounted for the largest market share in 2024, owing to the growing dependence on airborne ISR platforms like UAVs (Unmanned Aerial Vehicles), reconnaissance aircraft, and radar systems, which are critical for gathering intelligence in distant or hostile environments. The increasing demand for real-time intelligence, surveillance, and reconnaissance in strategic military operations drives the evolution of airborne ISR systems. These systems are being further combined with other defense systems, such as data processing tools, further to enhance the responsiveness and precision of intelligence reporting.

The naval segment is expected to witness the highest CAGR from 2025 to 2033. The segment's growth is fueled by the growing emphasis on securing sea borders, safeguarding key shipping routes, and countering threats in foreign waters, which has spurred heavy investment in naval ISR technologies. Autonomous platforms like unmanned maritime vehicles (UMVs) and autonomous underwater vehicles (AUVs) are becoming key assets for naval forces. The expanding requirement for greater maritime surveillance further fueled the application of autonomous naval platforms capable of performing ISR missions in degraded environments.

Key U.S. C5ISR Company Insights

Some key players operating in the market include Lockheed Martin Corporation and Northrop Grumman, among others.

-

Lockheed Martin Corporation is a leading defense contractor providing advanced C5ISR solutions through integrated platforms that include command and control systems, space-based ISR, tactical communication systems, and AI-enabled decision-making tools. The company supports a wide range of programs for the U.S. Department of Defense, such as the Aegis Combat System and SBIRS, enhancing real-time situational awareness and threat detection across air, land, sea, and space domains.

-

Northrop Grumman specializes in C5ISR industry integration with key offerings including unmanned aerial systems, missile warning and defense systems, cyber-hardened communications, and electronic warfare technologies. Their solutions, such as the Global Hawk and Battlefield Airborne Communications Node (BACN), are essential for persistent ISR and seamless command coordination for joint and coalition forces.

Kratos Defense & Security Solutions, Inc. and CACI International Inc. are some of the emerging market participants.

-

Kratos Defense & Security Solutions, Inc. develops advanced, low-cost C5ISR solutions for unmanned systems, satellite communications, and electronic warfare. The company is gaining attention for its autonomous drone systems, like the Valkyrie, and its work on space and cyber-resilient communication platforms tailored for rapid deployment in contested environments.

-

CACI International Inc. provides high-end C5ISR industry solutions with a strong focus on signals intelligence (SIGINT), electronic warfare, and next-gen battlefield IT infrastructure. The company plays a vital role in delivering agile and secure systems to the U.S. Army and intelligence community, especially in cyber and multi-domain convergence.

Key U.S. C5ISR Companies:

- Lockheed Martin Corporation.

- Northrop Grumman.

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Leidos

- Raytheon Technologies Corporation

- BAE Systems

- CACI International Inc

- ADS

- Kratos Defense & Security Solutions, Inc.

Recent Developments

-

In February 2025, Lockheed Martin introduced an AI-driven counter-drone system tailored for the U.S. defense landscape. Featuring a modular, layered architecture, the system can detect, track, identify, and neutralize small unmanned aerial systems (sUAS). This innovation is designed to enhance threat response in contested environments and reinforces the advancement of battlefield autonomy and layered situational awareness within the U.S. market.

-

In March 2025, General Dynamics unveiled the Pandur SHORAD 6×6 vehicle equipped with Moog’s Reconfigurable Integrated-weapons Platform (RIwP) turret at the AUSA Global Force 2025 event. This advanced short-range air defense solution integrates radar, weapons, and C5ISR industry subsystems into a mobile platform to enhance maneuver force protection. The innovation supports the evolving needs of the U.S. C5ISR industry by delivering real-time situational awareness, mobility, and threat response capabilities for modern battlefield environments.

-

In January 2025, Northrop Grumman launched a next-generation naval market integrating advanced 5G capabilities. This innovation is designed to improve maritime surveillance effectiveness by 40% through the seamless integration of sensors, secure communications, and high-speed processing technologies. The new system significantly enhances situational awareness and real-time decision-making for naval operations, reinforcing Northrop Grumman’s leadership in the U.S. C5ISR industry and contributing to modernizing maritime defense infrastructure.

U.S. C5ISR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.75 billion

Revenue forecast in 2033

USD 79.24 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use, application

Country Scope

U.S.

Key companies profiled

Lockheed Martin Corporation; Northrop Grumman; General Dynamics Corporation; L3Harris Technologies, Inc.; Leidos; Raytheon Technologies Corporation; BAE Systems; CACI International Inc.; ADS; Kratos Defense & Security Solutions, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. C5ISR Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the C5ISR market report based on component, end use, and application:

- Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

- End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ground

-

Naval

-

Air

-

Space

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Intelligence, Surveillance, and Reconnaissance

-

Command and Control

-

Electric Warfare

-

Missile Defense and Radar

-

Combat Systems

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. C5ISR market size was estimated at USD 51.59 billion in 2024 and is expected to reach USD 53.75 billion in 2025.

b. The U.S. C5ISR market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 79.24 billion by 2033.

b. Hardware segment led the market and held the largest revenue share of over 58% in 2024 owing to the high demand for sensors, monitors, and analyzers used in real-time data collection and pollution detection across various environmental applications.

b. The key players in the U.S. C5ISR market include Lockheed Martin Corporation., Northrop Grumman., General Dynamics Corporation, L3Harris Technologies, Inc., Leidos, Raytheon Technologies Corporation, BAE Systems, CACI International Inc, ADS, Kratos Defense & Security Solutions, Inc.

b. Key factors driving market growth in the U.S. C5ISR market include rising defense spending, demand for real-time situational awareness, adoption of advanced technologies, and growing geopolitical tensions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.