- Home

- »

- Consumer F&B

- »

-

U.S. And Canada Premium Bottled Water Market Report 2030GVR Report cover

![U.S. And Canada Premium Bottled Water Market Size, Share & Trends Report]()

U.S. And Canada Premium Bottled Water Market Size, Share & Trends Analysis Report By Product (Spring Water, Mineral Water, Sparkling Water), By Distribution Channel, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-144-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

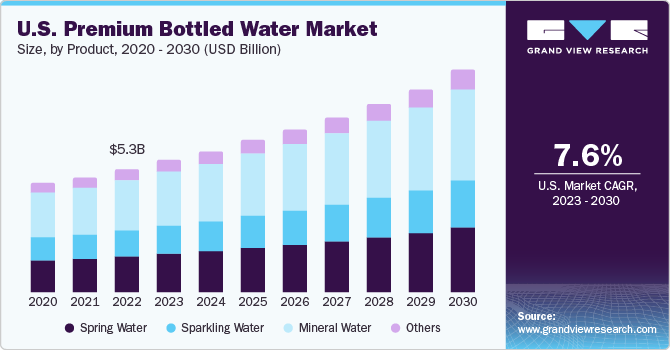

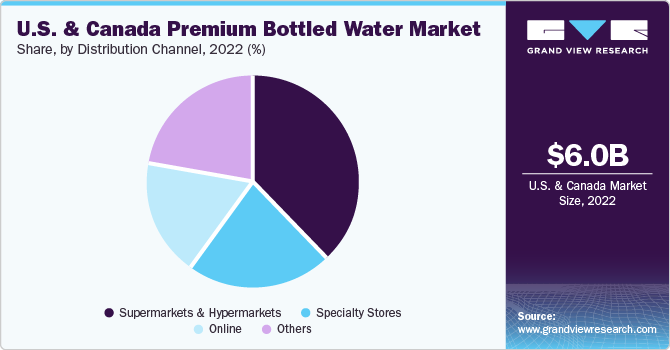

The U.S. and Canada premium bottled water market size was valued at USD 6.02 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. Mineral content, source of the water, and additional composition are some of the unique selling points that create a premium image of bottled water. With increased awareness about hydration, ingredients, and the source of materials, consumers in the U.S. and Canada have been demanding premium bottled water. This trend is expected to drive the market over the forecast period.

Premium bottled water has proved to be not only a key component of the U.S. and Canada liquid refreshment beverage market but is also on track for additional increase in per capita consumption in the coming years. Beverage Marketing Corporation predicts that it could climb to around 50 gallons in the upcoming years. Premium bottled water sets itself apart from the mass market using a unique selling point, attracting a target consumer group and commanding a higher product value than the mass market. The rising awareness among consumers with regard to premium-quality drinking water is a major factor driving market growth.

In the past few years, Canadians and Americans have switched to premium bottled water from carbonated beverages, as these premium products are claimed to be calorie-free and healthier. With growing awareness regarding hydration, ingredients, and their sources, consumers in the U.S. and Canada have driven a strong demand for premium bottled water. This trend is expected to ensure market expansion over the forecast period.

Rising concerns about the decreasing groundwater levels in these countries, which result in the deterioration of water quality, along with the increasing incidence rates of floods, drive regional demand for bottled water. Moreover, several factors drive premium bottled water demand in the U.S. and Canada, including portability, convenience, and minimal maintenance costs. The scarcity of drinking water in several regions necessitates the requirement of safe drinking water, leading to increased product sales.

The U.S. has some of the global premium bottled water companies, including The Coca-Cola Company, Nestlé S.A., PepsiCo Inc., and Dr Pepper Snapple Group, among others. These companies mainly focus on product launches, which boost product visibility among consumers. Numerous bottled water manufacturers in the U.S. are introducing flavored products as a rising number of Americans are switching from high-sugar carbonated drinks to premium flavored water.

For example, in March 2021, The Coca-Cola Company introduced the smartwater+ line of premium wellness waters that utilize unique ingredients and flavor extracts. The company has been selling this product through select retailers across the United States. As per the company, the growth of the premium water segment is backed by the fact that consumers have been rapidly embracing an evolving definition of health and wellness and the important role of hydration in their lives.

Distribution Channel Insights

Based on distribution channels, the supermarkets & hypermarkets segment led the U.S. and Canada premium bottled water market in 2022 with a 37.9% revenue share. Supermarkets and hypermarkets are optimum distribution channels for premium bottled water due to their convenience and reach. Consumers are increasingly seeking more sophisticated and healthier beverage options, with premium bottled water emerging as a popular choice. They offer a one-stop shopping experience, enabling customers to easily access a variety of products, including different types and brands of bottled water.

The online segment is anticipated to exhibit the highest CAGR of 9.3% in revenue during the forecast period. Online channels have become increasingly important for the sales of premium bottled water. E-commerce platforms offer convenience, a wide reach, and the ability to target specific customer segments. Nowadays, many traditional supermarkets and grocery chains provide online ordering and home/doorstep delivery services, which is likely to drive the sales of premium bottled water through these channels.

Product Insights

The mineral water segment dominated the market in 2022 with a 42.0% share in revenue. Bottled mineral water usually contains ingredients such as calcium, magnesium, sodium, and zinc, which offer numerous health benefits such as lowering blood pressure, regulating blood circulation, and strengthening bones. These benefits boost the uptake of premium mineral bottled water. The growing awareness regarding the health benefits of premium mineral water, coupled with the increased spending on premium products including premium mineral water, is likely to boost the mineral water demand over the forecast period.

The sparkling bottled water industry is estimated to grow at a CAGR of 8.2% in the forecast period (2023-2030) in revenue. With the growing trend of leading a healthy lifestyle among people of all ages, individuals across the world are gradually turning to healthier and more inventive drinks, such as sparkling water. Over the forecast period, the market is expected to be driven by consumers' escalating preference for sparkling water over sodas and sugary carbonated drinks.

Country Insights

In developed countries such as the U.S., premium bottled water has become a particularly dynamic commercial beverage category by registering as an attractive option for health-conscious consumers. A few consumers in the country view premium bottled water as not only a way of achieving hydration but also as a functional beverage. North America contains two of the three largest individual bottled water markets in the world, with the U.S. holding 82.5% of the overall regional revenue in 2022.

The consumption of premium bottled water is gradually gaining impetus in Canada and the country is expected to register a CAGR of 7.1%. With consumers carrying bottled water with them while traveling, as well as to workplaces, parks, and gyms. A noteworthy consequence of this transformation is that the number of calories Canadian consumers take in from beverages has declined. Canadian consumers are buying premium bottled water (flavored or plain) as a healthy and convenient beverage option.

Key Companies & Market Share Insights

The U.S. and Canada premium bottled water market is characterized by the presence of some large multinational and regional companies. Leading manufacturers hold a significant market share in the region. Companies have been implementing various expansion strategies such as mergers & acquisitions, marketing partnerships, capacity expansions, and strengthening of online presence to gain a competitive advantage over others in the market.

-

In January 2022, Liquid Death Mountain Water landed USD 75 million in Series C funding led by the Startup Studio Science, which helped launch the company and now owns a “strong minority” position.

-

In March 2021, Nestlé USA announced that it had acquired Essentia Water. Nestlé is sharpening its portfolio to focus on international premium and mineral water brands and healthy hydration products, such as functional water. This transaction was part of the continued transformation of Nestlé’s global water business, which was announced in June 2020.

Key U.S. And Canada Premium Bottled Water Companies:

- Flow Hydration

- ESENTIA WATER, LLC

- Liquid Death Mountain Water

- JUST Goods, Inc

- Bling H2O

- Roiwater

- Beverly Hills Drink Company

- Alpine Glacier Water Inc.

- BLVD Water

- Berg Water

U.S. And Canada Premium Bottled Water Marke Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.79 billion

Growth rate

CAGR of 7.6 % from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment Covered

Product, Distribution Channel, Country

Country scope

U.S. and Canada

Key companies profiled

Flow Hydration, ESENTIA WATER, LLC, Liquid Death Mountain Water, JUST Goods, Inc., Bling H2O, Roiwater, Beverly Hills Drink Company, Alpine Glacier Water Inc., BLVD Water, Berg Water

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Canada Premium Bottled Water Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. and Canada premium bottled water market based on product, distribution channel and country.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The U.S. and Canada premium bottled water market size was estimated at USD 6.02 billion in 2022 and is expected to reach USD 6.43 billion in 2023.

b. The U.S. and Canada premium bottled water market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 10.79 billion by 2030.

b. U.S. dominated the U.S. and Canada premium bottled water market with a share of 82.5% in 2022. This is attributable to the with increased awareness about hydration, ingredients, and the source of materials, consumers in the U.S.

b. Some key players operating in the U.S. and Canada premium bottled water market include Flow Hydration, ESENTIA WATER, LLC, Liquid Death Mountain Water, JUST Goods, Inc.

b. Key factors that are driving the U.S. and Canada premium bottled water market growth include Rising concerns regarding decreasing ground water levels in the country, which results in the deterioration of water, and increasing instances of floods and others

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."