- Home

- »

- Consumer F&B

- »

-

Sparkling Water Market Size & Share, Industry Report, 2030GVR Report cover

![Sparkling Water Market Size, Share & Trends Report]()

Sparkling Water Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Natural/Mineral, Caffeinated), By Distribution Channel (Hypermarket & Supermarket, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-845-9

- Number of Report Pages: 58

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sparkling Water Market Summary

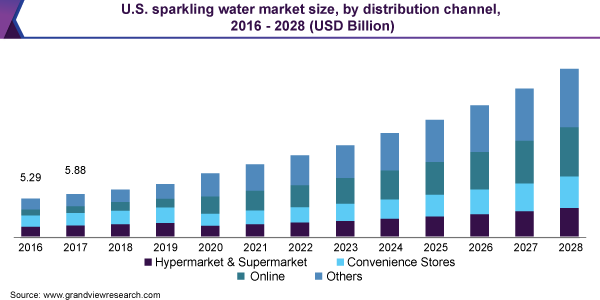

The global sparkling water market size was valued at USD 29.71 billion in 2020 and is projected to reach USD 76.95 billion by 2028, growing at a CAGR of 12.6% from 2021 to 2028. With the growing trend of leading a healthy lifestyle among all age groups, people around the globe are gradually shifting to healthy and innovative drinks, including sparkling water.

Key Market Trends & Insights

- The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%.

- The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period.

- By product, Natural/mineral sparkling water held the largest share of more than 60.0% in 2020.

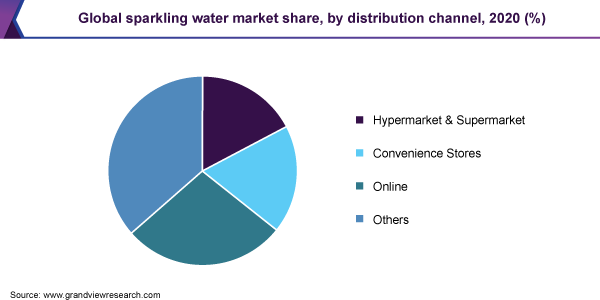

- By distribution channel Insights, others segment domina, others segment dominated the market and held a share of 36.4% in 2020.

Market Size & Forecast

- 2020 Market Size: USD 29.71 Billion

- 2028 Projected Market Size: USD 76.95 Billion

- CAGR (2021-2028): 12.6%

- North America: Largest market in 2020

The growing consumer preference for sparkling water over sodas and sugary carbonated drinks is projected to drive the market over the forecast period. During the initial months of the Covid-19 pandemic, a majority of public places and offices were shut, which led to a significant drop in the commercial demand for sparkling water. However, widespread home isolation orders have spurred the demand for bottled water of various kinds among households across the globe, including sparkling water. According to the International Bottled Water Association (IBWA), bottled water businesses have boosted their production capacity to cater to this surge in demand, which, in turn, has benefitted the market.

With the growing awareness regarding the importance of leading a healthy lifestyle, people are switching to sparkling water due to the presence of a variety of minerals, including sodium, magnesium, and calcium, in the product. Furthermore, the product has a number of advantages; for instance, it helps improve digestion and may help relieve constipation.

Various studies suggested that sparkling water is not as harmful as sodas for dental and bone health. Hence, several consumers consider carbonated water as a healthier alternative to soda and sugary carbonated drinks. Furthermore, over the past few years, an increase in the number of commercial advertisements for bottled water has been playing an important role in boosting brand visibility. These advertisements highlight the quality and hydration benefits of the product, and also emphasize taste and convenience.

Key players of bottled water are launching sparkling water to gain maximum market share. For instance, in February 2021, PepsiCo, Inc. introduced five new caffeinated sparkling water flavors, namely mango passion fruit, blood orange grapefruit, triple berry, blueberry pomegranate, and citrus cherry flavors, under its bubbly brand. These launches are increasing product visibility in the market and are anticipated to boost the market growth over the forecast period.

Product Insights

Natural/mineral sparkling water held the largest share of more than 60.0% in 2020. The growing demand for natural and healthy water among consumers is driving the segment. The flavored variants are increasingly preferred owing to their taste, dizziness, and health benefits.

Key players are launching new products in the market in accordance with the demands of health-conscious consumers. For instance, in May 2019, National Beverage Corp. launched a new flavor, Hi-Biscus! under its LaCroix brand. This new sparkling beverage has no carbohydrates, sweeteners, or sodium, and has a unique flavor of the hibiscus flower.

The caffeinated segment is projected to register the fastest CAGR of 12.6% from 2021 to 2028. Caffeinated sparkling water is calorie- and sugar-free but contains added caffeine to boost energy levels. These drinks are a good substitute for coffee drinks, sweetened teas, and conventional energy drinks.

As consumers are seeking sparkling water with added benefits, manufacturers are trying to launch new variants of the product with caffeine in it. Flavored caffeinated sparkling water held the largest share of 85.4% in 2020. The growth of this segment is attributed to rising consumer demand for different flavors such as berry, orange, cucumber, and lemon.

Distribution Channel Insights

The others segment dominated the market and held a share of 36.4% in 2020. The hypermarket and supermarket and convenience stores together held a significant share in 2020. Moreover, the wide availability of both premium and private label brands at these stores attract consumers to purchase products through these channels. Furthermore, membership programs offered by these stores include benefits such as discounts and access to unlimited free delivery to enhance the shopping experience of the customers.

The online distribution channel is expected to register the fastest CAGR of 13.3% from 2021 to 2028. The shift in consumers’ shopping behavior is one of the major factors driving sales through the online channel. Benefits offered by online platforms, including shopping from the comfort of one’s home, doorstep delivery, free shipping, subscription services, and discounts, are attracting millennials and the younger generation to opt for this channel.

Regional Insights

North America held the largest share of over 35.0% in 2020. The rising consumer preference for healthy alternatives to soft drinks is the major factor driving the segment. Benefits such as improved intake, better digestion, and enhanced bone and heart health are influencing consumers to drink sparkling water. Moreover, the easy availability of this product across distribution channels is anticipated to boost the growth of this segment.

Europe accounted for a significant share in 2020. In Europe, there is a strong demand for sparkling water in several countries, such as Germany, the U.K., Italy, Spain, France, and the Netherlands, where the product is often served with meals in restaurants. In Europe, quick-service restaurants are expanding at a notable growth rate. They have been introducing several new beverages and food items inspired by national as well as international cuisines in order to further their footprint in an increasingly competitive environment. This is foreseen to bode well for the regional market in the coming years.

Key Companies & Market Share Insights

Mergers & acquisitions and product launches are among the key strategies taken up by the market players. For instance, in January 2020, Keurig Dr Pepper Inc. acquired Limitless, a U.S.-based caffeinated sparkling water company. This acquisition has widened Keurig Dr Pepper’s water portfolio and through this acquisition, the company entered the caffeinated sparkling water market. Some prominent players in the global sparkling water market include:

-

Nestlé

-

PepsiCo, Inc.

-

National Beverage Corp.

-

Talking Rain

-

Keurig Dr Pepper Inc.

-

The Coca-Cola Company

-

Danone S.A.

-

SANPELLEGRINO S.P.A

-

Clear Cut Phocus

-

Caribou Coffee Operating Company, Inc.

-

Hiball

-

RHODIUS Mineralquellen und Getränke GmbH & Co. KG

-

AQUA Carpatica

-

Northwest Coffee

-

Volay Brands, LLC

-

WakeWater Beverage Co.

-

Big Watt Cold Beverage Co.

Sparkling Water Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 33.43 billion

Revenue forecast in 2028

USD 76.95 billion

Growth Rate

CAGR of 12.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; Italy; Spain; France; China; India; Brazil

Key companies profiled

Nestlé; PepsiCo, Inc.; National Beverage Corp.; Talking Rain; Keurig Dr Pepper Inc.; The Coca-Cola Company; Danone S.A.; SANPELLEGRINO S.P.A.; Clear Cut Phocus; Caribou Coffee Operating Company, Inc.; Hiball; RHODIUS Mineralquellen und Getränke GmbH & Co. KG; AQUA Carpatica; Northwest Coffee; Volay Brands, LLC; WakeWater Beverage Co.; Big Watt Cold Beverage Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global sparkling water market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Natural/Mineral Sparkling Water

-

Flavored

-

Unflavored

-

-

Caffeinated Sparkling Water

-

Flavored

-

Unflavored

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global sparkling water market size was estimated at USD 29.71 billion in 2020 and is expected to reach USD 33.43 billion in 2021.

b. The global sparkling water market is expected to grow at a compound annual growth rate of 12.6% from 2021 to 2028 to reach USD 76.95 billion by 2028.

b. Natural/mineral sparkling water contributed to the highest share of more than 60% in the global revenue in 2020. The growing demand for natural and healthy water among consumers is driving the growth of this market.

b. The others segment dominated the global sparkling water market and held a share of 36.4% in 2020.

b. North America led the global sparkling water market and held the largest share of over 35.0% in 2020.

b. Some of the key players operating in the sparkling water market are Nestlé, PepsiCo, Inc., National Beverage Corp., Talking Rain, Keurig Dr Pepper Inc., The Coca-Cola Company, Danone S.A., SANPELLEGRINO S.P.A., Clear Cut Phocus, and RHODIUS Mineralquellen und Getränke GmbH & Co. KG.

b. Key factors that are driving the sparkling water market growth include increasing consumer preference for healthy alternatives for carbonated and other types of sugary soft drinks, and new product launches on a global level.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.