- Home

- »

- Medical Devices

- »

-

U.S. & Canada Skin Cancer Dermatology Market Report, 2022-2030GVR Report cover

![U.S. & Canada Skin Cancer Dermatology Market Size, Share & Trends Report]()

U.S. & Canada Skin Cancer Dermatology Market Size, Share & Trends Analysis Report By Test Type (Skin Biopsy, Diagnostic Imaging), By Facility Type (Hospital OPDs, Stand-alone Practices), By Age Group, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-463-5

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

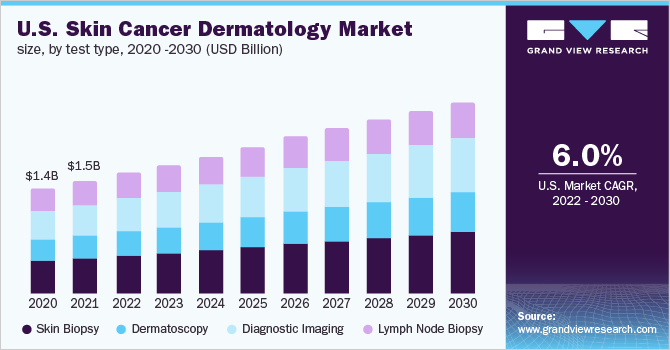

The U.S. and Canada skin cancer dermatology market size was valued at USD 2.07 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030. The growing prevalence of skin cancer is contributing largely to the high market demand. Furthermore, growing awareness among people about skin cancer and technological advancements in the dermatology field is also considered as the important factors driving the market growth. The skin cancer dermatology markets in U.S. and Canada witnessed a negative impact during the COVID-19 pandemic as dermatology practices and medical supply chains were hampered.

According to a One Access journal called Plos One, Ontario Province in Canada witnessed a precipitous drop in total skin biopsies (15% of expected) with the onset of COVID-19 cases, and the majority of the females in the region were less likely to be biopsied during the pandemic. However, the rates of biopsy increased substantially in the second half of 2020. According to the American Academy of Dermatology, 3.3 million people in the U.S. are diagnosed with basal and squamous cell skin cancers. Moreover, it is estimated that one in every five individuals in the U.S. is likely to be diagnosed with skin cancer in their lifetime. Meanwhile, in 2019, in Canada, nearly 7,800 melanoma cases and nearly 1,300 deaths due to the same were reported.

The high incidence rate of melanoma in Canada and the U.S. is anticipated to fuel market growth. The U.S diagnostic imaging test type segment is expected to witness the fastest growth rate of 6.7% during the forecast period. The presence of organizations that aim to increase awareness regarding skin cancer and reduce its incidence rate is anticipated to fuel market growth. The American Academy of Dermatology (AAD) intends to reduce skin cancer-related incidence and mortality by educating the public about the techniques that aid in minimizing the risk of skin cancer and facilitate them in the identification of skin cancer or a potentially cancerous skin lesion.

AAD also aims to set high clinical practice standards and undertake public awareness programs and research activities in the field of dermatology to enhance patient care whereas the Canadian Dermatology Association aims to increase public awareness levels regarding sun protection and prevention of skin cancer. Technology plays a key role in the clinical decision-making behavior of dermatologists. The introduction of teledermatology and the growing number of smartphone-compatible diagnostic devices has enabled dermatologist to undertake remote patient diagnosis and monitoring, thus reducing the number of unnecessary office procedures. Furthermore, the EHR technology also enables dermatologists to select a cost-effective therapy for the patient.

The advent of COVID-19 impacted the operations and supply of many critical medical devices in 2020. Agilent Technologies stated that they faced supply-chain bottlenecks during the pandemic and the revenue growth was slower than forecasted. However, after the lockdown eased in the second quarter of 2020, the company recovered from the losses and reported strong financial performance despite the turbulence caused by COVID-19. The International Dermoscopy Society reported that the outbreak had a negative impact on most dermatology services, with a significant reduction in consultation time spent for chronic patients, and an increased risk of missed melanoma and nonmelanoma skin cancer.

Test Type Insights

On the basis of test types, the market is further segmented into skin biopsy, dermatoscopy, diagnostic imaging, and lymph node biopsy. The skin biopsy test type segment held the largest market share of 32.3% in 2021. Skin biopsy is a procedure where a small amount of tissue is removed from the targeted area for examination under a microscope. This can be attributed to the adoption of this procedure for the diagnosis of a wide range of skin conditions, such as melanoma, skin infection, skin tags, dermatitis, basal cell carcinoma, and squamous cell carcinoma. A biopsy is often the only test needed to diagnose and find out the stage, or extent, of cancer.

The diagnostic imaging segment is anticipated to grow at the fastest CAGR over the forecast period due to the introduction of advanced non-invasive techniques, such as laser scanning confocal microscopy, optical coherence tomography, high-frequency ultrasound, terahertz pulsed imaging, magnetic resonance imaging, and photoacoustic microscopy, which have increased the accuracy of diagnosis. Furthermore, the combination of RCM with dermatoscopes is also expected to enhance the accuracy of diagnosis and aid in the differentiation between malignant and benign skin cancers.

Facility Type Insights

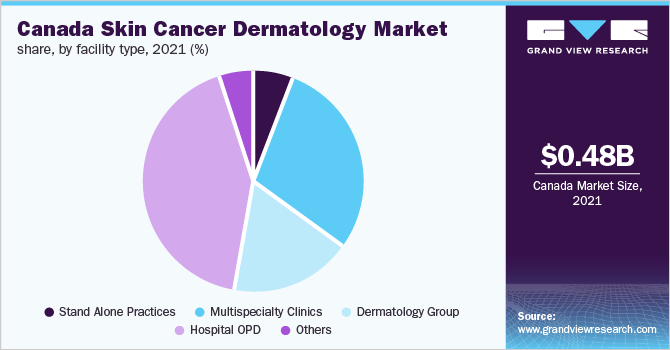

On the basis of facility types, the market has been further divided into stand-alone practices, multispecialty clinics, dermatology groups, hospital Outpatient Departments (OPDs), and others. The hospital OPD facility type segment held the largest market share of 40.2% in 2021 and is also expected to witness the fastest growth rate from 2022 to 2030. The purchase of devices in large numbers accompanied by the high demand for healthcare services and procedures in this setting is considered to play a vital role in the growth of the hospital OPD segment over the coming years. The presence of public insurance systems and the availability of advanced technologies and procedures in hospitals are also expected to drive the segment growth.

The multispecialty clinics and dermatology group segments held relatively higher market shares than the stand-alone practices segment in 2021. This can be attributed to the increased costs and complexities of solo practices along with relatively higher dermatologist compensation in the group setting and higher bargaining power of group practices. Multispecialty clinic offers a comprehensive range of effective services and diagnosis of cancer treatments, which allows effective treatment plans and easy patient management. These clinics are equipped with latest, technologically advanced devices and offer 24/7 emergency facilities along with pharmacy, assistance with the blood bank, ICU, NICU, PICU, and ambulance services etc. All these factors are projected to boost the segment's growth.

Age Group Insights

On the basis of age groups, the market has been further categorized into 0-19, 20-39, 40-59, 60-64, 65-74, 75-84, and 85 and above. The 40-59 years age group segment held the highest market share of 26.3% in 2021. This growth was attributed to the high prevalence of skin cancer in this age group as a result of prolonged sun exposure. The 20-39 years age group segment is anticipated to witness the fastest growth rate over the forecast period. The segment’s growth can be attributed to the popularity of tanning equipment and tanning salons among the individuals in this age group.

According to the data published by the AIM at Melanoma Foundation in 2018, the incidence of skin cancer in the population less than 20 years of age is approximately 1%. Skin cancer is the most common form of cancer in the United States and more than 90% of skin cancers are caused by sun exposure. The incidence of melanoma in children increased by 1.7% every year from 1975 to 1994; however, it decreased by 0.6% from 1995 to 2014. Approximately, 400 patients are diagnosed with melanoma each year in population younger than 20 years in the U.S. The increasing sun exposure due to climate change is expected to increase the prevalence of skin cancer among younger population.

Key Companies & Market Size Insights

Advancement in the field of skin cancer diagnosis and treatment is the key focus of competitors. The rising burden of skin cancer is expected to force major players to collaborate and discover advanced techniques for the efficient diagnosis of the disease. The key companies are concentrating on strategic initiatives, such as geographical expansions and strategic collaborations. For instance, in 2019, MetaOptima signed a national agreement with Sonic Healthcare to implement DermEngine software across Australian skin cancer centers. Some of the prominent players in the U.S. & Canada skin cancer dermatology market include:

-

Firefly

-

SkinIO

-

Canfield Scientific, Inc.

-

FotoFinder Systems, Inc.

-

3Gen

-

MetaOptima

-

Agilent Technologies

-

SkinVision

-

Speclipse, Inc.

-

Skin Analytics

U.S. & Canada Skin Cancer Dermatology Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2,026.28 million

Revenue forecast in 2030

USD 3,395.97 million

Growth rate

CAGR of 5.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, facility type, age group

Country scope

U.S.; Canada

Key companies profiled

Firefly; SkinIO; Canfield Scientific, Inc.; FotoFinder Systems, Inc.; 3Gen; MetaOptima; Agilent Technologies; SkinVision; Speclipse, Inc.; Skin Analytics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. & Canada skin cancer dermatology market report on the basis of test type, facility type, and age group:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Biopsy

-

Dermatoscopy

-

Diagnostic Imaging

-

Lymph Node Biopsy

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

0-19

-

Male

-

Female

-

-

20-39

-

Male

-

Female

-

-

40-59

-

Male

-

Female

-

-

60-64

-

Male

-

Female

-

-

65-74

-

Male

-

Female

-

-

75-84

-

Male

-

Female

-

-

85 & above

-

Male

-

Female

-

-

-

Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stand Alone Practices

-

Multispecialty Clinics

-

Dermatology Group

-

Hospital OPD

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The U.S. & Canada skin cancer dermatology market size was estimated at USD 2.0 billion in 2021 and is expected to reach USD 2,026.28 million in 2022.

b. The U.S. & Canada skin cancer dermatology market is expected to grow at a compound annual growth rate of 6.0% from 2022 to 2030 to reach USD 3,395.97 billion by 2030.

b. The hospital OPD segment held a significant share of the U.S. & Canada skin cancer dermatology market in 2021 owing to the presence of public insurance systems is expected to enhance the patient influx in this setting

b. Some key players operating in the U.S. & Canada skin cancer dermatology market include Firefly, SkinIO, Canfield Scientific, Inc., FotoFinder Systems, Inc., 3Gen, MetaOptima, Agilent Technologies, SkinVision, Speclipse, Inc., Skin Analytics.

b. Technological advancements and the increasing prevalence of skin cancer are anticipated to fuel market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."