- Home

- »

- Medical Devices

- »

-

U.S. Cath Labs Market Size & Share Analysis Report, 2030GVR Report cover

![U.S. Cath Labs Market Size, Share & Trends Report]()

U.S. Cath Labs Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Services, Equipment), By Facility Type (Independent Labs, Hospital-based Labs), And Segment Forecasts

- Report ID: GVR-4-68039-160-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

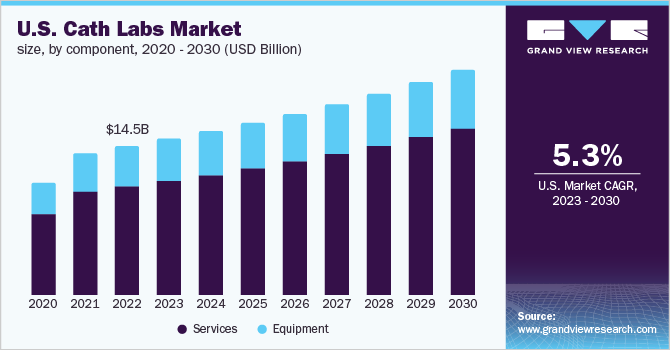

The U.S. cath labs market size was valued at USD 14.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.34% from 2023 to 2030. Major factors facilitating market growth are the high incidence of cardiovascular diseases and the technological advancements in diagnostic techniques. In addition, the growing expenditure on healthcare by the citizens and the initiatives by the federal government to increase awareness regarding cardiac health are increasing the growth opportunities for the market. About 20.1 million residents in the U.S. above 20 years of age have coronary artery disease. 805,000 Americans have a heart attack annually. West Virginia has the highest prevalence of heart disorders in the U.S. with an age-weighted prevalence of 6.3 % as per the CDC.

The state has nearly 25% of its population above 65 years of age and a 37.7% prevalence of obesity, contributing to the high incidence of heart disease. Overall, the southern states in the U.S. have the worst cardiac health as per a survey by the University of Alabama and the CDC. The high incidence of cardiovascular disorders is increasing the requirement for early diagnosis, thus increasing the demand for cath labs.

Moreover, the advent of technology is significantly impacting market growth. The innovation in diagnostic techniques is enabling accurate, non-invasive, and quick diagnosis. For instance, Beaumont adopted a new cardiac lab technology, control rad to reduce the patient and staff exposure to hazardous radiation while imaging. The control rad is reported to reduce the exposure to radiation by 50-85%, thus highly increasing safety during diagnostic procedures. The improvements in soft tissue visualization and the adoption of robots in the cath labs are transforming the level of diagnosis provided. The manufacturers of diagnostic equipment are focused on developing compact, workflow-compatible, and cost-effective robots for effectively managing diagnostic operations while keeping the operating cost low for the labs.

The federal government is taking initiatives for increasing awareness regarding cardiac health and reducing the increasing prevalence of heart disease. Million Hearts, an initiative supported by the CDC, works for the prevention of heart attacks throughout the nation. The goal of the initiative is to reduce 1 million cardiovascular disease incidences in the next 5 years. The heart truth, a national health education program by the national heart lung and blood institute, is increasing awareness about heart disease in the U.S. and is the first initiative by the federal government in response to the increased prevalence of cardiac disorders. The month of February is declared American Heart Month to spread awareness regarding cardiovascular health among people. Such initiatives are resulting in residents’ options for diagnostics.

COVID-19 U.S. cath labs market impact: 4.8% growth from 2021 to 2022

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic resulted in a huge decline in the procedures conducted at the cath labs. As per the national library of medicines, from March to April 2020, 2,548 procedures were performed, which was way less compared to 4,671 procedures performed in the same months during 2019. The cath labs also witnessed staffing challenges reporting a 30% higher vacancy rate compared to the pre-pandemic levels.

The prevalence of heart disease is expected to rise post-COVID-19. The key reason behind this is the risk of cardiovascular disorders in patients post-recovery from COVID-19 infections. There is also an upward trend in obesity during the pandemic and lockdowns, which impacted the demand for cath lab services.

In the later phase of the pandemic, the opening of new cardiac ambulatory centers and new cath labs within hospitals in the U.S. is increasing market growth opportunities. For instance, states such as Michigan and Mississippi are adjusting their certification rules for setting up a cath lab, which is supporting the market growth in the region.

The key market players invested in developing new technology during the pandemic. The development of artificial intelligence-based solutions is changing the operations in the cath labs and enabling faster diagnosis. In later 2021 and 2022, the cath labs adopted equipment that makes diagnosis more effective. For instance, Jennings Cath Lab upgraded equipment for angiography in November 2021 for improved patient care. The adoption of such technologies is resulting in better patient outcomes, thus reducing recovery times.

However, the cost of catheterization is very high in the U.S. The average cost of diagnostic catheterization in the U.S. goes up to USD 8,565, which is very expensive. Medicare part B covers 80% of the cost of the procedure, despite which the average cost goes above USD 1,500. The state of Alaska has the highest cost for catheterization procedures where the cost of diagnostic catheterization followed by required surgery procedures goes up to USD 159,800. The new requirement rule by the CMS in 2022 proposed only a 2.3% increase in reimbursement for inpatient service providers and up to 3% for outpatient providers. The CMS removed 258 of 267 procedures to be reimbursed at outpatient facilities, significantly impacting the sustainability of these labs and affordability for the patients.

Component Insights

In 2022, the services segment dominated the market with a revenue share of over 70.0%. This is due to the rising prevalence of cardiovascular diseases in the U.S. The service segment is sub-segmented into therapeutic and diagnostic services. Therapeutic services accounted for a dominant share in 2022 due to the majority of patients having heart diseases in the U.S. requiring long therapy. Based on components, the market is categorized into service and equipment.

Alabama, West Virginia, Louisiana, and Kentucky are the least heart-healthy states in the U.S., thus having a higher need for diagnostic and therapeutic services. Among all cardiovascular disorders, heart attacks are most prevalent, with every 40 seconds one American having a heart attack wherein 1 in 5 attacks is a silent one. In such cases, direct therapeutic services are required. The southeastern and northeastern states have funding from national and state organizations for the management of heart diseases, thus fueling segment growth in the region.

The equipment segment is expected to witness lucrative growth over the forecast period owing to the increasing need for diagnostic and therapeutic surgical procedures. The preference for minimally invasive surgeries is resulting in the launch of new equipment in the market. For instance, in July 2021, Siemens Healthineers launched a new Artis Icono angiography system enabling high accuracy in diagnostics. The rising burden of expenditure on the cardiovascular sector in the U.S. is resulting in a requirement for cost-effective equipment enabling outpatient facilities to adopt advanced equipment to increase the quality of services. The trend of value-based services in the U.S. is resulting in higher adoption of new equipment by the cath labs.

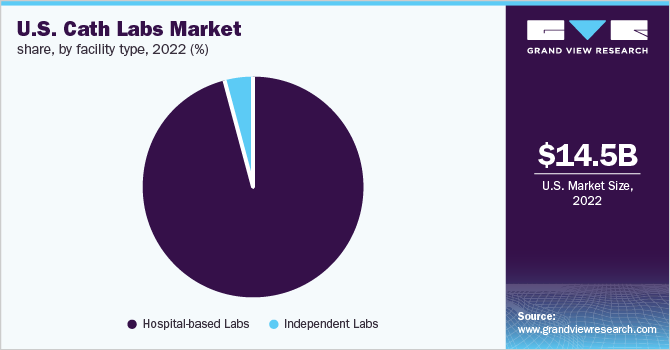

Facility Type Insights

In 2022, hospital-based labs dominated the market with a revenue share of over 95.0%. This can be attributed to the increasing number of corporate hospital-based cath labs, favorable reimbursement, and the accessibility of top-quality care and equipment in hospital-based settings. Based on facility type, the market is categorized into hospital-based labs and independent labs.

The regulations favored hospitals and provide better reimbursement for hospital inpatient settings. In addition, the hospital-based cath labs unit is among the top cath labs in the nation. In New York, The Mount Sinai hospital cath labs have been rated as the best cath lab in the state. The adoption of the latest technology for safe and effective diagnosis and treatment is resulting in a higher preference for such settings. For instance, in Aug 2019, Jackson memorial hospital-based cath lab became the first in the state of Florida to adopt Alphenix Core+, a catheterization imaging technology developed by Cannon Medical System.

Freestanding cath labs are witnessing lucrative growth owing to the lower cost of services and less time-consuming treatment. In addition, during the COVID-19 pandemic, the patients preferred independent labs due to the risk of infection in hospital-based settings and inefficiency in hospital-based services due to the COVID-19 burden. Moreover, the patients prefer independent cath labs due to the non-requirement of admission post-surgery resulting in quick recovery. The ambulatory catheterization centers facilitate better personalized patient care, which is not often possible in a hospital-based setting. However, the removal of various procedures from the Medicare reimbursement list in 2022 is limiting the segment growth.

Key Companies & Market Share Insights

The market is fragmented with the presence of several small and large players. In response to the COVID-19 pandemic and the high need for cath lab services in the U.S., key market players are taking up strategies such as new equipment launches, mergers & acquisitions, joint ventures, partnerships, and collaborations. These initiatives are enabling the companies in achieving and maintaining their market position in the U.S. Aside from that, several players are increasing their focus on expanding their product portfolio. For instance, in June 2022, Shimadzu Medical Systems launched a new AI-based angiography system requiring a 40% lower X-ray dose while maintaining high imaging quality. Some prominent players in the U.S. cath labs market include:

-

Koninklijke Philips N.V.

-

Shimadzu Corporation

-

GE Healthcare

-

Johnson & Johnson

-

B. Braun Melsungen AG

-

Siemens Healthineers

-

Medtronic

-

Cardinal Health, Inc.

-

Boston Scientific Corporation

-

Abbott Laboratories

U.S. Cath Labs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.2 billion

Revenue forecast in 2030

USD 21.9 billion

Growth rate

CAGR of 5.34% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, facility type

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; Shimadzu Corporation; GE Healthcare; Johnson & Johnson; B. Braun Melsungen AG; Siemens Healthineers; Medtronic; Cardinal Health, Inc.; Boston Scientific Corporation; Abbott Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cath Labs Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cath labs market report on the basis of component and facility type:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Services

-

Therapeutic

-

Angioplasty

-

Stent Placement

-

Rotational Atherectomy

-

Thrombectomy

-

Cardioversion

-

Transcatheter Aortic Valve Replacement (TAVR)

-

Others

-

-

Diagnostic

-

Angiography

-

Coronary Intravascular Ultrasound

-

Cardiac Catheterization

-

ECG/EKG

-

Fractional Flow Reserve (FFR)

-

Others

-

-

-

Equipment

-

-

Facility Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Independent Labs

-

Hospital-based Labs

-

Frequently Asked Questions About This Report

b. The U.S. cath labs market size was estimated at USD 14.5 billion in 2022 and is expected to reach USD 15.2 billion in 2023.

b. The U.S. cath labs market is expected to grow at a compound annual growth rate of 5.34% from 2023 to 2030 to reach USD 21.9 billion by 2030.

b. The services segment dominated the U.S. cath labs market in 2022. This is attributable to the rising prevalence of cardiac disorders and increase awareness regarding importance of early diagnostics.

b. Some key players operating in the U.S. cath labs market include Koninklijke Philips N.V.; Shimadzu Corporation; GE Healthcare; Johnson & Johnson; B. Braun Melsungen AG; Siemens Healthineers; Medtronic; Cardinal Health, Inc; Boston Scientific Corporation; Abbott Laboratories

b. Key factors that are driving the U.S. cath labs market growth include high incidence of cardiovascular diseases, technological advancements in diagnostic techniques, increasing number federal initiatives taken by the government to reduce healthcare expenditure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.