- Home

- »

- Advanced Interior Materials

- »

-

U.S. Ceiling Tiles Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Ceiling Tiles Market Size, Share & Trends Report]()

U.S. Ceiling Tiles Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Residential, Non-Residential, Industrial), By Material (Mineral Wool, Metal, Gypsum, Wood Wool), And Segment Forecasts

- Report ID: GVR-3-68038-026-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ceiling Tiles Market Summary

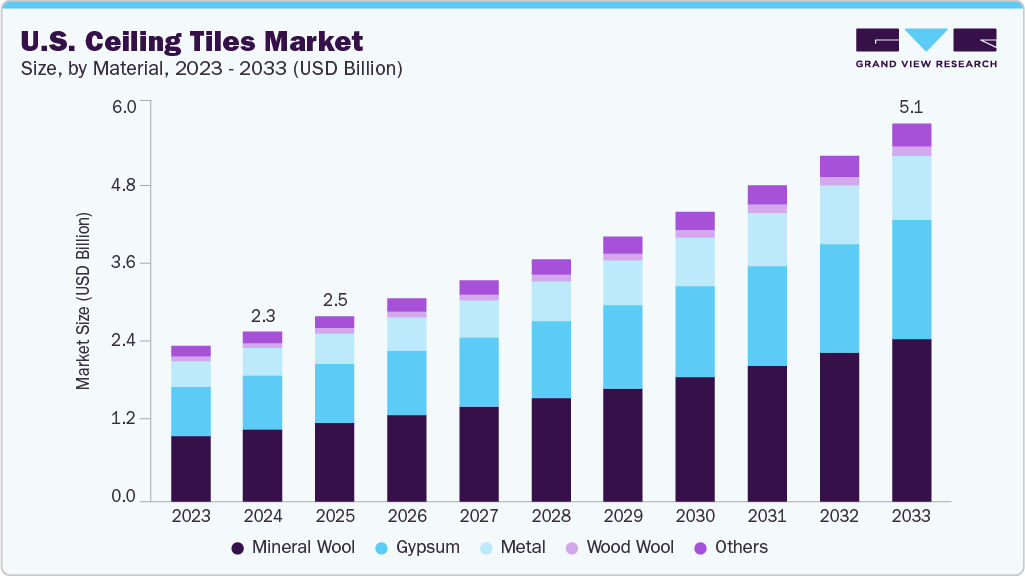

The U.S. ceiling tiles market size was estimated at USD 2.27 billion in 2024 and is projected to reach USD 5.07 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033, driven by sustained growth in commercial construction, particularly across office buildings, corporate workspaces, educational institutions, and healthcare facilities. Developers are prioritizing ceiling systems that offer acoustic performance, design flexibility, and rapid installation to support modern building standards.

Key Market Trends & Insights

- By material, the metal segment is expected to grow significantly at a CAGR of 9.7% over the forecast period.

- By application, the residential segment is expected to grow at the fastest CAGR of 9.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.27 Billion

- 2033 Projected Market Size: USD 5.07 Billion

- CAGR (2025-2033): 9.3%

The continued expansion of the services sector, coupled with renovations of aging commercial infrastructure, is increasing demand for high-performance ceiling solutions. In addition, post-pandemic refurbishments aimed at improving indoor environments are reinforcing market momentum. The rising emphasis on enhanced acoustic comfort is another major driver in the U.S. market, as noise control has become essential for productivity, patient well-being, and learning environments. Ceiling tiles with advanced sound absorption and noise reduction properties are increasingly incorporated into open-plan offices, schools, and medical buildings. The adoption of acoustical performance standards in construction codes and industry guidelines is further supporting growth. As tenants and building owners prioritize occupant experience, the need for premium acoustic ceiling systems continues to expand.

Sustainability initiatives are also accelerating market demand, with manufacturers and project developers shifting toward eco-friendly ceiling materials. The increasing adoption of recycled-content tiles, bio-based alternatives, and low-VOC finishes aligns with green building certifications, such as LEED and WELL. Government regulations promoting energy-efficient and environmentally responsible building materials foster greater acceptance of sustainable ceiling systems. These trends are encouraging manufacturers to introduce innovative, low-impact ceiling tiles tailored to U.S. environmental standards.

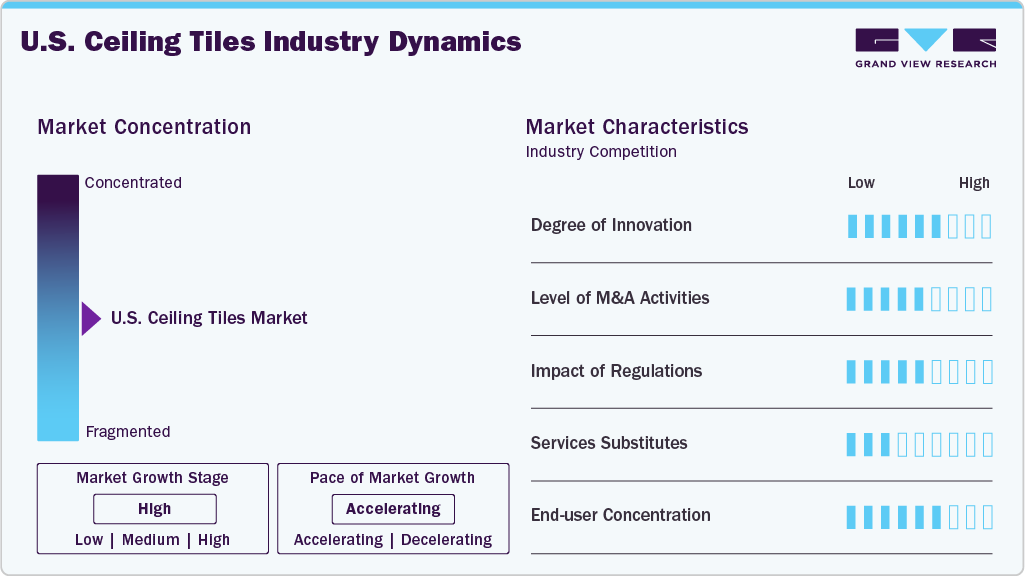

Market Concentration & Characteristics

The U.S. ceiling tiles industry exhibits moderate-to-high market concentration, characterized by the presence of several established manufacturers with strong distribution networks and long-standing industry relationships. The degree of innovation is steadily rising as companies invest in advanced acoustic technologies, sustainable materials, humidity-resistant formulations, and integrated design solutions to meet evolving performance standards. Regulatory frameworks related to fire safety, indoor air quality, and environmental compliance significantly influence product development, pushing manufacturers toward low-VOC, recyclable, and energy-efficient ceiling systems. At the same time, mergers and acquisitions continue to shape the competitive landscape, with larger players acquiring niche innovators to expand product portfolios, technological capabilities, and regional reach.

Service substitutes such as exposed ceilings, drywall systems, and modular wall panels also impact competitive intensity, though ceiling tiles maintain a strong position due to superior acoustic benefits and design flexibility. End user concentration is diverse, spanning commercial offices, education, healthcare, hospitality, and residential renovation markets, helping balance demand across cycles. However, commercial end users dominate due to higher adoption of acoustical and performance-driven ceiling systems in offices and institutional buildings. The interplay of innovation, strict regulatory standards, competitive consolidation, and varied end-user requirements collectively shapes the dynamic structure and characteristics of the U.S. ceiling tiles industry.

Material Insights

The mineral wool segment led the market and accounted for the largest revenue share of 42.3% in 2024, driven by its superior acoustic performance, fire resistance, and thermal insulation capabilities, making it a preferred choice for safety- and comfort-focused buildings. Increasing adoption in offices, schools, and healthcare facilities supports demand as developers seek materials that meet stringent building codes and indoor-environment standards. Its compatibility with modern suspension systems allows for flexible installation in both new construction and renovation projects.

The metal segment is expected to grow at the fastest CAGR of 9.7% over the forecast period, driven by rising interest in durable, aesthetically refined ceiling systems that offer long service life and design versatility. Metal tiles provide enhanced moisture resistance, dimensional stability, and easy maintenance, making them suitable for airports, hospitality spaces, and high-traffic commercial interiors. Their compatibility with integrated lighting, HVAC components, and smart-building systems increases adoption among architects seeking multifunctionality. Growth in modern architectural trends that favor exposed grids, clean lines, and reflective finishes also support segment expansion.

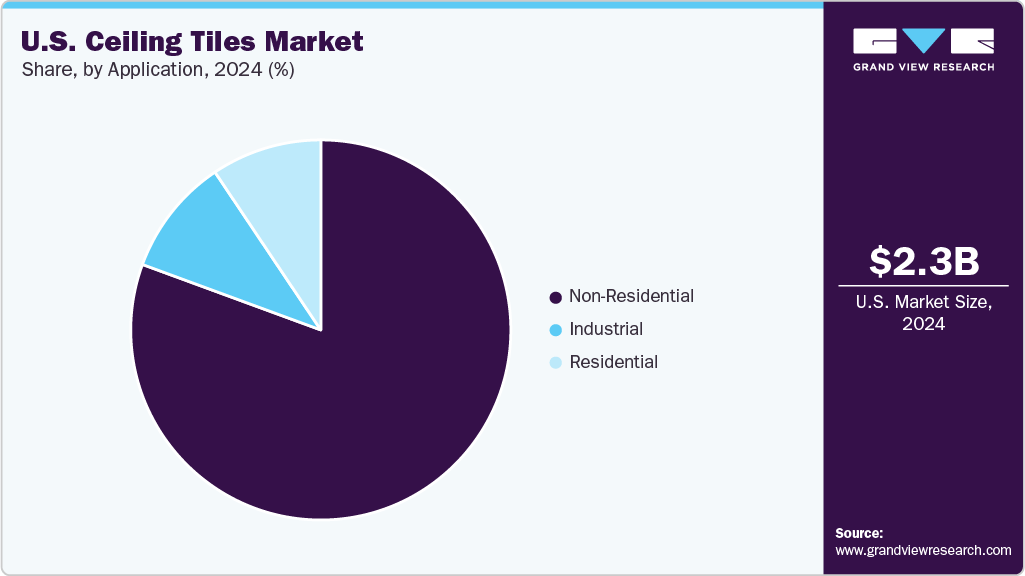

Application Insights

The non-residential segment dominated the market and accounted for the largest revenue share of 80.6% in 2024, driven by strong construction and renovation activity across offices, corporate campuses, educational institutions, and healthcare facilities. Rising emphasis on acoustic control, occupant comfort, and interior aesthetics fuels the need for performance-oriented ceiling systems. Updated building regulations related to fire safety, indoor air quality, and energy efficiency further encourage the use of advanced ceiling tiles. Expanding investments in healthcare and education infrastructure across the U.S. contribute to consistent demand.

The residential segment is expected to grow at the fastest CAGR of 9.9% over the forecast period, driven by steady growth in remodeling and home improvement activities, particularly in basements, home offices, and multifunctional living spaces. Homeowners increasingly adopt ceiling tiles to enhance sound insulation and improve interior appearance with cost-effective solutions. DIY-friendly installation and availability through large retail channels support broader uptake. Rising adoption of moisture-resistant and easy-clean ceiling options contributes to demand in humid or utility areas of homes.

Key U.S. Ceiling Tiles Company Insights

Some of the key players operating in the market include Armstrong World Industries, USG Corporation, among others.

-

Armstrong World Industries is a leading U.S.-based manufacturer that specializes in ceiling and wall solutions. Their portfolio includes mineral-fiber ceiling tiles, metal panels, and acoustical systems such as the “Ultima” and “Optima” lines, and they also develop energy-saving ceiling systems like the Templok series.

-

USG Corporation (United States Gypsum) is a major building-materials company known for gypsum products and dropped ceiling systems. Their ceiling business includes acoustical ceiling panels, fire-rated tiles, and grid systems under brands such as AURATONE, ACOUSTONE, and DONN grid

CertainTeed and Rockfon (ROCKWOOL) are some of the emerging market participants in the market.

-

CertainTeed, a subsidiary of Saint-Gobain, manufactures a wide variety of building materials, including ceiling tiles for both residential and commercial use. Their ceiling product range includes acoustical panels, gypsum ceilings, and modular suspension systems, with a focus on sustainability and design flexibility.

-

Rockfon, part of the ROCKWOOL Group, is known for its stone wool-based ceiling products in the U.S. Their ceiling tiles offer high acoustic performance, fire resistance, and moisture durability, suited for offices, healthcare, and educational environments.

Key U.S. Ceiling Tiles Companies:

- Armstrong World Industries

- USG Corporation

- CertainTeed

- Rockfon (ROCKWOOL)

- Chicago Metallic Corporation

- OWA Ceiling Systems

- SAS International

- Gordon Incorporated

- Ceilume (Empire West)

U.S. Ceiling Tiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.49 billion

Revenue forecast in 2033

USD 5.07 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Million Square Meters, Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, material

Country scope

U.S.

Key companies profiled

Armstrong World Industries; USG Corporation; CertainTeed; Rockfon (ROCKWOOL); Chicago Metallic Corporation; OWA Ceiling Systems; SAS International; Gordon Incorporated; Ceilume

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ceiling Tiles Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. ceiling tiles market report based on application and material:

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-Residential

-

Industrial

-

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Mineral Wool

-

Metal

-

Gypsum

-

Wood Wool

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. ceiling tiles market size was estimated at USD 2.27 billion in 2024 and is expected to reach USD 2.49 billion in 2025.

b. The U.S. ceiling tiles market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2033 to reach USD 5.07 billion by 2033.

b. Mineral wool segment led the market and accounted for the largest revenue share of 42.3% in 2024, driven by its superior acoustic performance, fire resistance, and thermal insulation capabilities, making it a preferred choice for safety- and comfort-focused buildings.

b. Some of the prominent companies in the ceiling tiles market include Armstrong World Industries, USG Corporation, CertainTeed, Rockfon (ROCKWOOL), Chicago Metallic Corporation, OWA Ceiling Systems, SAS International, Gordon Incorporated, Ceilume.

b. Key factors driving the U.S. ceiling tiles market include rising commercial construction activity, increasing demand for acoustic and aesthetic interior solutions, growing focus on energy-efficient and sustainable building materials, ongoing renovation of aging infrastructure, and advancements in lightweight, high-performance ceiling technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.