- Home

- »

- Advanced Interior Materials

- »

-

Ceiling Tiles Market Size & Share, Industry Report, 2030GVR Report cover

![Ceiling Tiles Market Size, Share & Trends Report]()

Ceiling Tiles Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Mineral Wool, Metal, Gypsum), By Application (Non-residential, Residential, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-890-9

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceiling Tiles Market Size & Trends

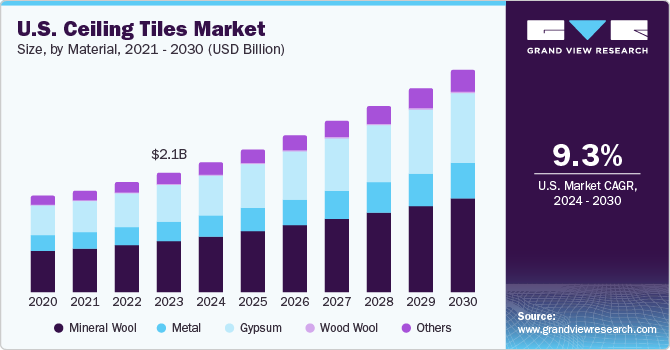

The global ceiling tiles market size was estimated at USD 6.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The growth is expected to be driven by rising commercial construction activities like office complexes, institutional buildings, and healthcare facilities across the world. The market is likely to grow substantially with increasing disposable income in emerging economies, increasing demand for thermal and acoustic insulation, and changing consumer behavior toward the aesthetics of office and home buildings. In addition, the usage of innovative and sustainable construction solutions involving eco-friendly materials for floors, ceilings, and walls, is expected to benefit the market dynamics over the forecast period. The ceiling tiles are manufactured using various raw materials such as metals, mineral fiber, fiberglass, gypsum, wood, and plastic. Some of them have harmful effects on the environment which acts as a restraint in the growth of the ceiling tiles industry. For instance, fiberglass is mainly produced using formaldehyde binders. These formaldehyde binders lead to health hazards when microfibers fall while removing installations of fiberglass ceiling tiles.

The recovery of the construction industry in the U.S. has a positive impact on product demand with increasing commercial construction projects in the country. In addition, changing consumer behavior along with increasing alternatives for soundproof and decorative interiors in commercial complexes is expected to promote the growth of the mineral wool segment in the country.

The market illustrates the strong presence of various raw material suppliers that are engaged in offering metals, mineral fiber, fiberglass, gypsum, wood, and plastics. In addition, there exists a significant level of backward integration where the manufacturers are the prominent raw material producers thereby lowering the bargaining power of the suppliers.

The rising adoption of environmentally friendly tiles that are certified as per the green building standards for emitting low VOCs is expected to influence the use of conventional products over the forecast period. Prominent producers of the product are enhancing their product portfolio by launching low-VOC emitting and asbestos-free product lines in the market.

The rising awareness regarding the use of eco-friendly building materials is estimated to propel the green retrofit or renovation activities of existing constructions in developed economies from North America and Europe. In addition, the increasing adoption of recyclable and reusable technologies by major players in the region is expected to drive market growth over the forecast period.

The ceiling tiles industry is dynamic and competitive in nature. Investments, new product development, and regional expansion are the key strategies adopted by various players to strengthen their presence in the market. However, fluctuations in raw material prices are expected to emerge as a key concern for the market players.

Product Insights

The mineral wool product segment led the market and accounted for 42.4% of the revenue share in 2022. The superior performance attributes of the products such as thermal and acoustic insulation, lightweight, and recyclability have resulted in increased penetration of the product in the application industries.

Gypsum, as a material for ceiling tiles, accounted for the second largest revenue share in 2022 and is expected to drive the market at a CAGR of 9.4% over the forecast period. These tiles provide numerous benefits such as reduced weight on the structure, ease of installation, and ease in maintenance and repair. It is majorly used in modern offices across the U.S. to enhance aesthetics by installing colored gypsum boards.

Steel, aluminum, and tin are the majorly used metals in the manufacturing of the product. They offer clean, crisp, and high-tech displays of interiors and are available in a wide variety of colors. Furthermore, tough finishing along with resistance to corrosion is offered by powder-coated metal ceilings, thereby driving the product demand from application industries.

Rising demand for varieties of ceiling tiles is expected to increase pressure on raw materials such as mineral wool, gypsum, and metals. Other ceiling tiles including wood, polycarbonate, PVC, and composite materials are anticipated to witness stabilized growth during the forecast period from 2023 to 2030 owing to the increasing utilization of mineral fiber, fiberglass, and metal ceiling tiles.

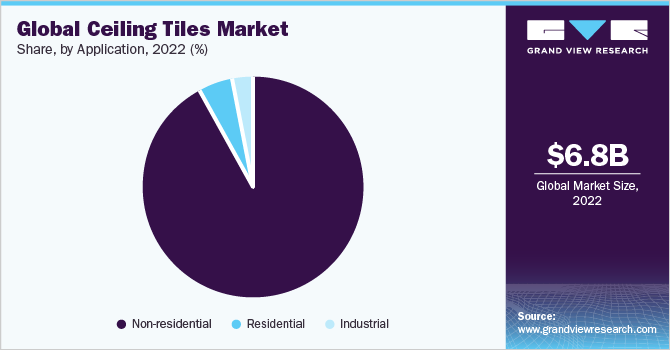

Application Insights

The non-residential applications segment led the market and accounted for 92.2% of the revenue share in 2022. Strong growth in commercial building construction activity across the globe with the revival of the non-residential construction sector in the U.S. is expected to boost the consumption of building materials thereby driving market growth.

Ceiling tiles are majorly used in various commercial spaces such as in retail, hospitality, and healthcare industries as well as in corridors, medical hallways, operation theatres, clinics, and diagnostic centers. These materials are used for highlighting the overall aesthetics and interiors of non-residential buildings as well as to offer improved acoustic and thermal insulation.

Residential applications are likely to provide a significant scope of growth for the ceiling tiles industry owing to the rising construction spending on renovation and repair in the housing sector. Strong growth in residential building construction activity across the globe, with rural-to-urban migration in developing economies, is expected to stimulate demand for ceiling tiles over the projected period.

The rise in the construction of green buildings in the developed economies of North America and Europe is expected to aid the consumption of eco-friendly and lightweight ceiling tiles. Furthermore, the usage of low VOC ceiling tiles is expected to increase in application industries over the projected periodon account of stringent VOC policies and regulations over building materials.

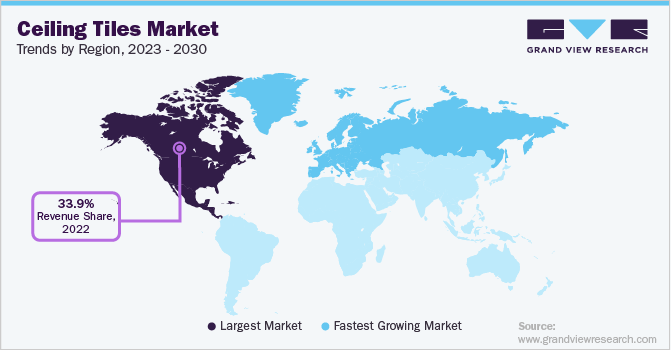

Regional Insights

The North America ceiling tiles market accounted for 33.9% of the global revenue share in 2022, due to the increased adoption of products from application industries. Technological breakthroughs in this area as well as the need for acoustic insulation have played a vital role in the increased adoption of ceiling tiles in the region.

The U.S. accounted for the major revenue share in the global market in 2022 owing to high consumer disposable income and changing consumer behavior along with increasing alternatives for soundproof and decorative interiors in commercial complexes. Residential growth, in terms of single-family housing, is a crucial factor driving the industry growth over the forecast period.

Europe accounted for a significant revenue share of the global market in 2022. The rise in the product demand in the region is due to the availability of innovative and sustainable construction solutions, easy installation techniques, the presence of a well-established construction industry, and strict regulations over particulate emissions thereby driving the market growth.

Asia Pacific region is expected to emerge as the market leader growing at a CAGR of 10.9% on account of rapid industrialization and a rise in consumer disposable income. Furthermore, population growth, urbanization, and a rise in renovation activities in Southeast Asia are expected to increase demand for the product from application segments from 2023 to 2030.

Key Companies & Market Share Insights

The industry exhibits a large number of players providing a range of product varieties leading to high competitive rivalry in the industry. The key players include USG Corporation; Hunter Douglas, Inc.; Saint-Gobain S.A.; Armstrong World Industries, Inc.; and Rockwool International A/S with their strong distribution network.

Major players have a strong presence in developed economies like North America, Europe, and some parts of the Asia Pacific region including Australia. The high degree of forward and backward integration of dominant players persists in the global market which has intensified the rivalry and competition thus making the entry for new players difficult. Some prominent players in the global ceiling tiles market include:

-

AWI Licensing LLC

-

USG Corporation

-

Knauf Gips KG

-

ROCKWOOL International A/S

-

Odenwald Faserplattenwerk GmbH

-

Saint-Gobain Gyproc

-

SAS International

-

BYUCKSAN

-

HIL Limited

-

Hunter Douglas

-

KET Ceilings

Ceiling Tiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.42 billion

Revenue forecast in 2030

USD 14.01 billion

Growth Rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Austria; Poland; Belgium; Switzerland; China; India; Japan; Indonesia; South Korea; Brazil

Key companies profiled

AWI Licensing LLC; USG Corporation; Knauf Gips KG; ROCKWOOL International A/S; Odenwald Faserplattenwerk GmbH; Saint-Gobain Gyproc; SAS International; BYUCKSAN, HIL Limited; Hunter Douglas; KET Ceilings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceiling Tiles Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceiling tiles market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Mineral Wool

-

Metal

-

Gypsum

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Non-residential

-

Residential

-

Industrial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Spain

-

Italy

-

Austria

-

Poland

-

Belgium

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ceiling tiles market size was estimated at USD 6.82 billion in 2022 and is expected to reach USD 7.42 billion in 2023.

b. The ceiling tiles market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 14.01 billion by 2030.

b. Mineral wool dominated the ceiling tiles market with a share of 42.4% in 2022. This is attributed to the superior characteristics such as less weight, acoustic insulation, recyclability, and thermal insulation, leading to increase in product usage in several end-use industries

b. Some of the key players operating in the ceiling tiles market include AWI Licensing LLC, USG Corporation, Knauf Gips KG, ROCKWOOL International A/S, Odenwald Faserplattenwerk GmbH, Saint-Gobain Gyproc, SAS International, BYUCKSAN, HIL Limited, Hunter Douglas, KET Ceilings

b. The key factors that are driving the ceiling market include rapidly rising construction activities of commercial buildings around the globe. In addition, investments in several developing countries such as India, Brazil, and South Korea towards development of the non-residential construction industry, is expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.