- Home

- »

- Medical Devices

- »

-

U.S. Cellulite Treatment Market Size, Industry Report, 2033GVR Report cover

![U.S. Cellulite Treatment Market Size, Share & Trends Report]()

U.S. Cellulite Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure (Non-Invasive Treatment, Minimally Invasive Treatment), By Cellulite (Soft Cellulite, Hard Cellulite, Edematous Cellulite), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-627-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cellulite Treatment Market Trends

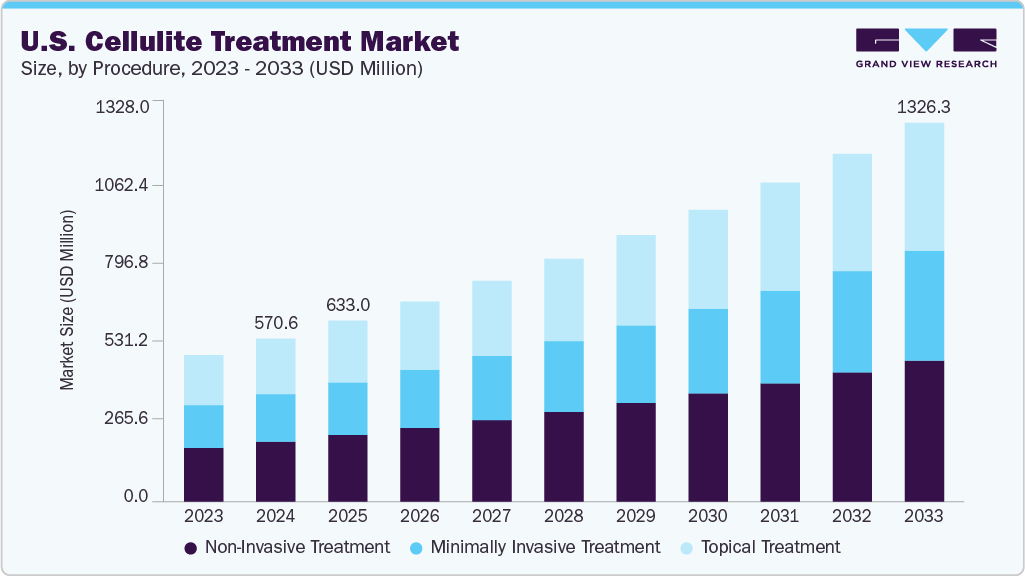

The U.S. cellulite treatment market size was estimated at USD 570.64 million in 2024 and is expected to grow at a CAGR of 9.7% from 2025 to 2033. The growing preference for cosmetic and aesthetic treatments, along with a surge in obesity rates, is propelling market expansion. Social and psychological challenges linked to obesity such as stigma, weight-based prejudice, emotional distress, and reduced self-confidence are emerging as key drivers. Individuals with obesity frequently encounter bullying, social exclusion, and limited access to educational and employment opportunities. For example, a publication by Novo Nordisk highlights that people with obesity are often discriminated against in professional and academic settings. These societal pressures are significantly contributing to the rising demand for cellulite treatment solutions in the U.S.

Minimally invasive surgeries are rapidly replacing invasive surgeries. For instance, according to American Society of Plastic Surgeons, 25.4 million cosmetic minimally-invasive procedures were carried out in 2023, out of which 0.74 million were Non-invasive fat reduction procedures. Thus, increasing adoption of minimally invasive surgeries, coupled with availability of a wide range of minimally invasive treatment options, is driving the growth of the U.S. cellulite treatment market.

A surge in sedentary lifestyles and obesity has significantly increased the prevalence of cellulite. According to the CDC, nearly 42% of U.S. adults were obese, with many states showing obesity rates exceeding 35%. Excess adipose tissue contributes to the development of cellulite, prompting more individuals to seek cosmetic treatments. This trend is further reinforced by growing health consciousness and a desire for self-care, translating into increased demand for solutions that offer smoother, more toned skin even in the absence of invasive surgery.

Recent years have seen rapid innovation in non-invasive and minimally invasive technologies such as radiofrequency, laser, ultrasound, cryolipolysis, and subcision techniques such as Cellfina offering effective results with minimal downtime. Consumers increasingly favor outpatient procedures and topical/home treatment options that align with busy schedules and ease of access. These technologies, supported by rising disposable incomes and direct-to-consumer education, have made cellulite treatments more mainstream and affordable, significantly driving market expansion.

Procedure Insights

The non-invasive treatment segment held the largest share of 36.8% in 2024 owing to rising preference for procedures that offer visible results without surgery, scarring, or extended recovery time. Consumers increasingly seek aesthetic enhancements that are safe, quick, and require little to no downtime, particularly working professionals and millennials. This demand aligns with the growth of outpatient medspas and dermatology clinics offering radiofrequency, laser-based, ultrasound, and cryolipolysis procedures that effectively target cellulite. Moreover, the growing obesity rate and aesthetic concerns related to aging have led more individuals to pursue non-surgical body contouring options, making non-invasive treatments the preferred modality for cellulite management.

Technological innovation continues to push the non-invasive segment forward, with companies developing next-generation devices that offer multi-modal capabilities, combining energy-based treatments with mechanical massage, lymphatic stimulation, or vacuum-assisted technology. The popularity of FDA-cleared treatments such as Cellulaze, Cellfina, and Qwo (collagenase clostridium histolyticum-aaes) has also contributed to increasing trust in non-invasive approaches.

Cellulite Insights

The soft cellulite segment held the largest share of 46.4% in 2024 owing to primarily driven by its high prevalence among aging and post-menopausal women. Soft cellulite typically appears more visibly when the skin loses elasticity and collagen, which is common with age and hormonal changes. This has increased demand for aesthetic treatments targeting skin laxity and fat accumulation. The rise in awareness about body aesthetics, especially among women aged 35–60, has fueled the growth of non-invasive solutions tailored to soft cellulite. Moreover, soft cellulite is easier to treat with topical agents, energy-based devices, and massage therapies, making it more commercially accessible than fibrous or edematous types.

Manufacturers are also launching targeted products such as anti-cellulite creams with retinol, caffeine, and peptides many of which are marketed specifically for soft cellulite. Coupled with lifestyle-focused marketing and increased social media influence, these factors have solidified soft cellulite’s dominance in the treatment market.

End Use Insights

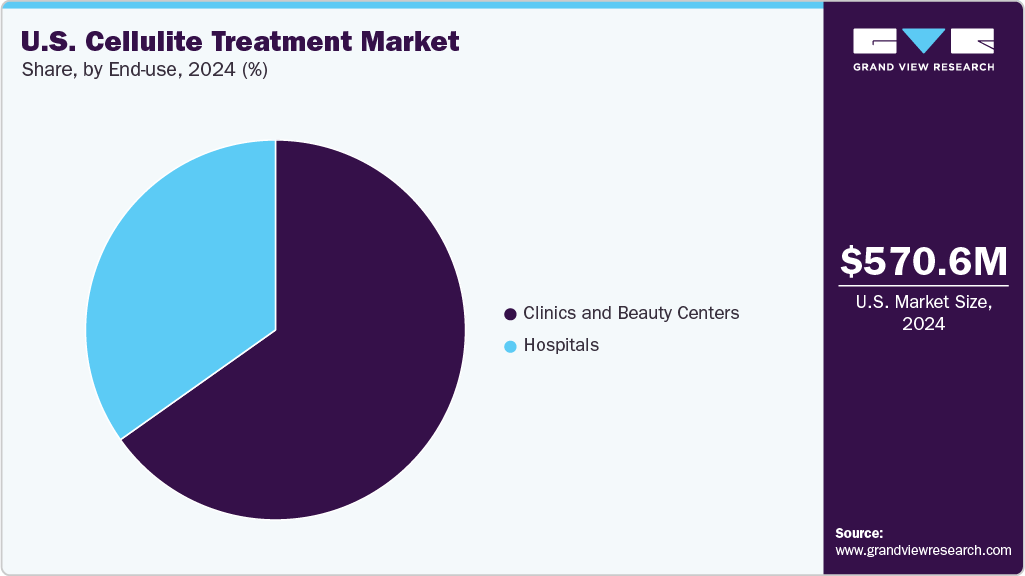

The clinics and beauty centers segment held the largest share of 65.2% in 2024. Cellulite development is commonly seen in women aged 20 and above and is primarily regarded as a cosmetic concern. As a result, many individuals seek treatment through aesthetic centers. Both beauty clinics and hospitals offer effective solutions for cellulite, but the growing prevalence of cellulite and other aesthetic issues has led to increased demand for specialized beauty centers and clinics. In many cases, hospitals refer patients to these facilities for focused cosmetic treatments, further driving growth and expanding the role of aesthetic clinics in the cellulite treatment landscape.

In addition, while some individuals opt for home-based solutions such as over-the-counter (OTC) creams to manage cellulite, many prefer professional treatments at clinics and beauty spas, where skilled staff and certified practitioners help minimize the risk of complications. The global growth of clinics and medical spas is further supported by relatively relaxed regulatory requirements for non-surgical cosmetic procedures, which continues to drive market expansion.

Key U.S. Cellulite Treatment Companies:

- Merz Pharma

- Hologic, Inc. (Cynosure)

- Syneron Medical

- Zimmer Aesthetics

- Alma Lasers

- Cymedics

- Nubway

- AbbVie

- Cutera

Recent Developments

-

In May 2023, Syneron Medical introduced a laser-based aesthetic platform with potential cellulite reduction applications alongside other skin treatments.

-

In April 2023, Zimmer Aesthetics launched this RF-vacuum hybrid platform designed for body contouring and cellulite reduction.

U.S. Cellulite Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 633.0 million

Revenue forecast in 2033

USD 1,326.3 million

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, cellulite, end use

Country scope

U.S.

Key companies profiled

Merz Pharma; Hologic Inc. (Cynosure); Syneron Medical; Zimmer Aesthetics; Alma Lasers; Cymedics; Nubway; AbbVie; Cutera

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cellulite Treatment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cellulite treatment market report on the basis of procedure, cellulite, and end use:

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-Invasive Treatment

-

Minimally Invasive Treatment

-

Topical Treatment

-

-

Cellulite Outlook (Revenue, USD Million, 2021 - 2033)

-

Soft Cellulite

-

Hard Cellulite

-

Edematous Cellulite

-

-

End UseOutlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinics and Beauty Centers

-

Frequently Asked Questions About This Report

b. The U.S. cellulite treatment market size was estimated at USD 570.6 million in 2024 and is expected to reach USD 633.0 billion in 2025.

b. The U.S. cellulite treatment market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 1.3 billion by 2033.

b. The non-invasive treatment segment held the largest share of 36.8% in 2024 owing to rising preference for procedures that offer visible results without surgery, scarring, or extended recovery time.

b. Some of the players operating in this market are Merz Pharma, Hologic Inc. (Cynosure), Syneron Medical, Zimmer Aesthetics, Alma Lasers, Cymedics, Nubway, AbbVie, Cutera.

b. Key factors that are driving the U.S. cellulite treatment market growth include the growing preference for cosmetic and aesthetic treatments, along with a surge in obesity rates, is propelling market expansion. Social and psychological challenges linked to obesity such as stigma, weight-based prejudice, emotional distress, and reduced self-confidence are emerging as key drivers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.