- Home

- »

- Advanced Interior Materials

- »

-

U.S. Ceramic Tiles Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Ceramic Tiles Market Size, Share & Trends Report]()

U.S. Ceramic Tiles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, Other Tiles), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-224-3

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ceramic Tiles Market Size & Trends

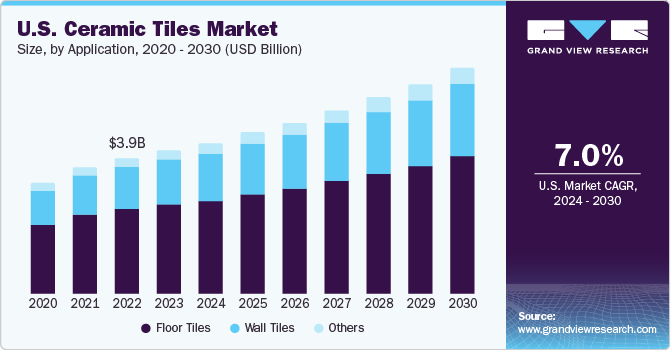

The U.S. ceramic tiles market size was estimated at USD 4.22 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. Ceramic tiles are being widely used in construction and interior activities, including kitchen and bathroom flooring, and wall treatments. The emerging trend of innovative structural designs is expected to further fuel ceramic adoption in the construction industry. Presently, the construction sector faces challenges such as widespread infrastructural decay and the availability of cheap materials, which is attributed to the exhaustion of the structural integrity of many concrete structures.

The rise in the number of nuclear family households is driving the demand for ceramic tiles for wall and flooring applications. According to a June 2023 U.S. Census Bureau report, the number of one-person households has tripled from 1940 to 2020. The majority of the one-person households are concentrated in Minnesota, North Dakota, Nebraska, Alabama, and Mississippi. Furthermore, high rehabilitation costs have fuelled the demand for durable and long-lasting flooring solutions.

Ceramic tiles are primarily made from ball clay, nepheline syenite, and talc, which produce acid gases, particulate matter, and mercury as toxic by-products. The market is governed by standard specifications by American National Standard Specifications - ANSI A137.1:2022 for manufacturers, specifiers, and installers. Furthermore, clay ceramic tile manufacturers have to comply with National Emission Standards for Hazardous Air Pollutants (NESHAP) for a sustainable production process.

Market Characteristics & Concentration

The market growth is medium and is accelerating at a significant pace owing to a moderately fragmented market. U.S. ceramic tiles manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, innovation, and production expansion, among others.

The market is driven by innovations and technological advancements. Digital technology has positively affected the ceramic tiles market over the past few years. For instance, digital inkjet printing technology for ceramic tiles has diversified product offerings of tiles with a variety of colors, designs, and appearances. Inkjet technology allows high-quality and high-speed printing with a speed of around 50- meters per minute.

Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the American National Standard Specifications have passed numerous initiatives intended to restrict carbon gas emissions. EPA has established national emission standards for hazardous air pollutants (NESHAP) for the production of brick, structural clay, and clay ceramic products.

The threat of substitutes is moderately high. Glass and rubber tiles are some of the commonly used alternate products for ceramic tiles. Glass tiles are majorly used in kitchens, spas, and bathrooms. High rigidity and plasticity are the key properties that differentiate glass tiles from their ceramic counterparts. Other alternatives also include bamboo, FSC-certified and reclaimed wood, and cork flooring. The growing adoption of substitutes can restrain the market for ceramic tiles.

Application Insights

Floor tiles dominated the market, accounting for a revenue share of 62.2% in 2023 owing to the shifting preference from stone and marble tiles to ceramic tiles. Ceramic tiles are highly durable and stain-resistant. Furthermore, the adoption of micro-crystal technology and digital printing processes are offering nanometer-grade and high-resolution prints, thereby facilitating product diversification.

Wall tiles is projected to experience the fastest growth during the forecast period. The home décor industry has massively evolved in the past few decades; a shift from mid-century to contemporary designs. Wall treatment has emerged as a trend in contemporary designs over the past decade. The redevelopment of old residential infrastructures, office spaces, and hotels has fueled the adoption of wall tiles as a design statement.

Product Insights

Porcelain tiles accounted for the highest revenue share of 14.16% in 2023. Porcelain tiles are extremely durable as they are made from denser clay, and fired at extreme temperatures. They are stain and chemical-resistant, which is driving their adoption in commercial spaces including institutional buildings, hotels, shopping malls, and others.

The scratch-free tiles segment is expected to expand at a significant CAGR from 2024 to 2030. It is primarily used for heavy-duty applications and high-traffic public spaces such as pathways, parking, and shop floors. They are also used in residential spaces where there is movement of heavy furniture. The high functionality and durability of scratch-free tiles are propelling the segment growth.

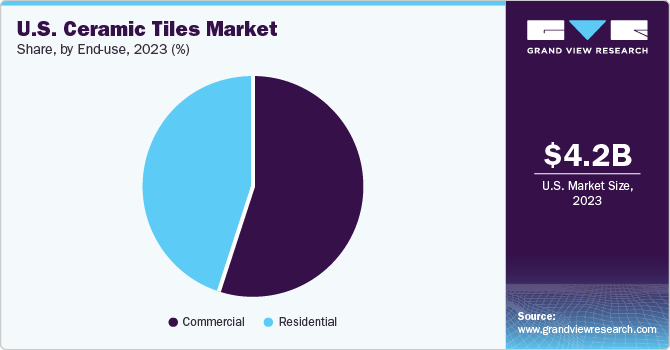

End-use Insights

The commercial segment accounted for a revenue share of 55.3% in 2023. Ceramic floorings are cost-effective and sustainable alternatives to marble and stone tiles. The segment has several end use applications including healthcare, corporate office, retail stores, and other commercial areas. Factors such as ease of cleaning, anti-bacterial properties, and slip and water resistance offered by ceramic tiles are expected to promote their applications in hospital wardrooms and clinics.

The residential segment is projected to register the highest CAGR from 2024 to 2030. Ceramic tile are easy to clean, moisture resistant, and durable, making it an ideal choice for homeowners. The growth in the number of single-family houses in developing economies and the rising disposable income of consumers are among the various factors projected to drive product demand in the residential application sector. Government regulations including the ANSI standards are established to uphold quality production and installations, although wage disparity in the industry persists.

Key U.S. Ceramic Tiles Company Insights

Market players have been adopting various strategies such as new product developments, partnerships, agreements, contracts, joint ventures, and collaborations to maximize their market penetration and to cater to the changing technological requirements of end use industries. For instance, in June 2022, Mohawk Industries, Inc. acquired Vitromex ceramic tilefrom Grupo Industrial Saltillo (for USD 293 million. This strategic acquisition was aimed at expanding Mohawk’s Mexican operations, manufacturing efficiencies, strengthening customer base, and logistical capabilities.

Key U.S. Ceramic Tiles Companies:

- Shaw Industries Group, Inc.

- Roca Tile USA

- Daltile

- Florim Ceramiche S.P.A.

- Crossville Inc.

- Marazzi

- Mirage Granito Ceramico USA Inc.

- Grupo Lamosa

- Mohawk Industries Inc.

- Ceramica del Conca Spa

- Interceramic

- Vitromex USA, Inc.

Recent Development

- In October 2023, Du-Co Ceramics Company launched the hermetically sealed ceramic terminals, metalized steatite bushings, and ceramic to metal assemblies. This has diversified Du-Co Ceramic’s product line.

U.S. Ceramic Tiles Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.63 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use,

Country scope

U.S.

Key companies profiled

Shaw Industries Group, Inc.; Roca Tile USA; Daltile; Florim Ceramiche S.P.A.; Crossville Inc.; Marazzi; Mirage Granito Ceramico USA Inc.; Grupo Lamosa; Mohawk Industries Inc.; Ceramica del Conca Spa; Interceramic; Vitromex USA, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ceramic Tiles Market Report SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ceramic tiles market report based on product, application, and end-use:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Glazed Ceramic Tiles

-

Porcelain Tiles

-

Scratch Free Ceramic Tiles

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Wall Tiles

-

Floor Tiles

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. ceramic tiles market size was estimated at USD 4.22 billion in 2023 and is expected to reach USD 4.42 billion in 2024.

b. The U.S. ceramic tiles market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 6.63 billion by 2030.

b. Porcelain tiles led the market and accounted for about 14% share of the revenue in 2023, which can be attributed to the impervious porcelain tiles offering mold and bacteria resistance thereby enhancing its long-term value in the floor covering

b. Some of the key players operating in the ceramic tiles market include Mohawk Industries, Inc.; Shaw Industries Group, Inc., Roca Tile USA, Daltile, Florim Ceramiche S.P.A., Crossville Inc.

b. Key factors driving the ceramic tiles market growth include the growth in the construction of office spaces, shopping malls, lodging spaces, and other utility spaces across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.