- Home

- »

- Healthcare IT

- »

-

U.S. Chatbot-based Mental Health Apps Market Report, 2033GVR Report cover

![U.S. Chatbot-based Mental Health Apps Market Size, Share & Trends Report]()

U.S. Chatbot-based Mental Health Apps Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Meditation Management, Stress Management), By Platform, By Technology, By Device, And Segment Forecasts

- Report ID: GVR-4-68040-625-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

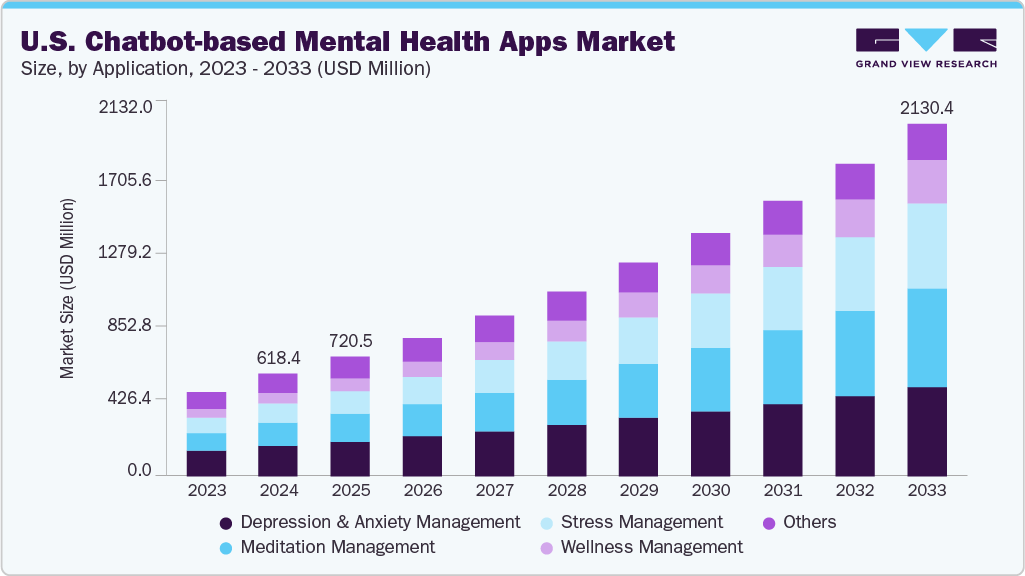

The U.S. chatbot-based mental health apps market size was estimated at USD 618.36 million in 2024 and is growing at a CAGR of 14.51% from 2025 to 2033. The growing adoption of chatbot-based mental health apps is driven by their benefits in improving treatment outcomes, enhancing lifestyles, and increasing mental health awareness. In addition, these apps promote overall well-being and boost individuals' productivity, particularly among professionals in the workforce.

For instance, Woebot, an AI-powered mental health chatbot developed by Woebot Health, utilizes interpersonal psychotherapy (IPT), dialectical behavior therapy (DBT), and cognitive behavioral therapy (CBT) to help users manage stress, anxiety, and depression through structured conversations and coping strategies.

AI-Powered Chatbots in Mental Health Care

The market for chatbot-based mental health applications is experiencing significant growth, driven by increasing interest in the clinical validation of AI-powered therapy chatbots. A growing number of clinical trials are being conducted to assess the safety and effectiveness of these tools in treating a range of mental health conditions, including anxiety, depression, stress, and other psychological disorders.

A notable example is a clinical trial conducted by researchers at Dartmouth in March 2025. This study evaluated the therapeutic potential of an AI-powered therapy chatbot named Therabot. The trial included 106 participants from across the U.S., each diagnosed with generalized anxiety disorder, an eating disorder, or major depressive disorder.

Participants engaged with Therabot through a smartphone app, either responding to prompts about their emotional state or initiating conversations whenever they needed support. The results showed positive trends:

-

Depression: Individuals with major depressive disorder experienced an average symptom reduction of 51%, resulting in clinically significant improvements in mood and overall well-being.

- Generalized Anxiety: Participants with generalized anxiety disorder saw a 31% average reduction in symptoms, with many moving from moderate to mild anxiety levels or even falling below the clinical threshold for diagnosis.

These findings underscore the potential of AI therapy chatbots such as Therabot to complement traditional mental health care by providing effective, scalable, and user-friendly support for those in need.

Growth Drivers

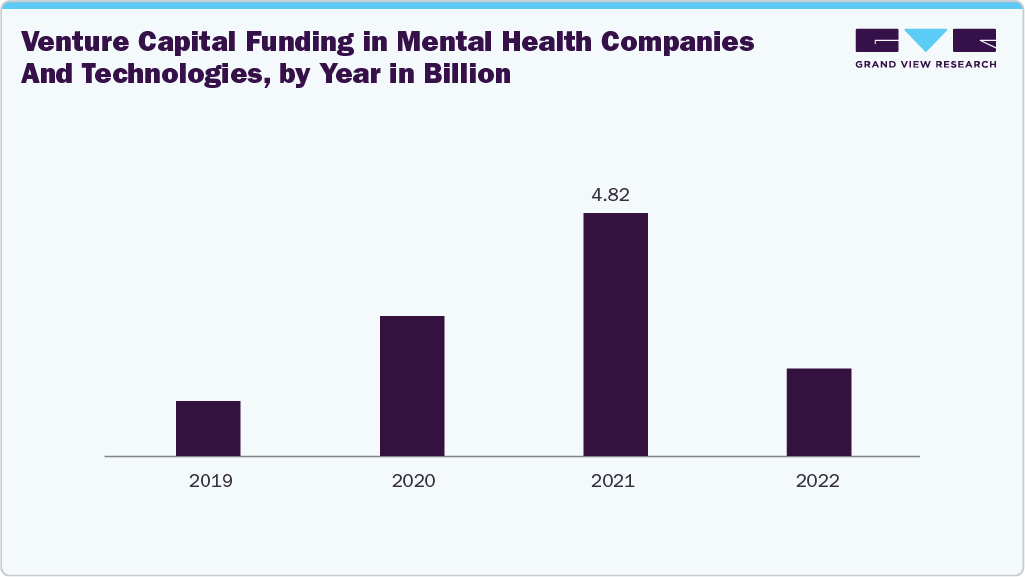

Increased Funding and Investment

The growing investment in mental health technologies is further accelerating market expansion. According to the American Psychological Association, recent funding has been directed toward mental health solutions specifically designed for children and teenagers, as well as platforms that incorporate coaching and AI-driven interventions. This influx of capital indicates strong market potential and continued innovation in chatbot-based mental health applications.

Shift Toward Personalized, Patient-Centric Care

The transition from traditional mental health care models to more personalized and patient-centric approaches drives the adoption of digital mental health tools, including chatbot-based apps. These apps, targeting meditation, stress relief, anxiety and depression management, and general wellness, empower individuals to take control of their mental well-being, encouraging healthier lifestyles and reducing psychological distress.

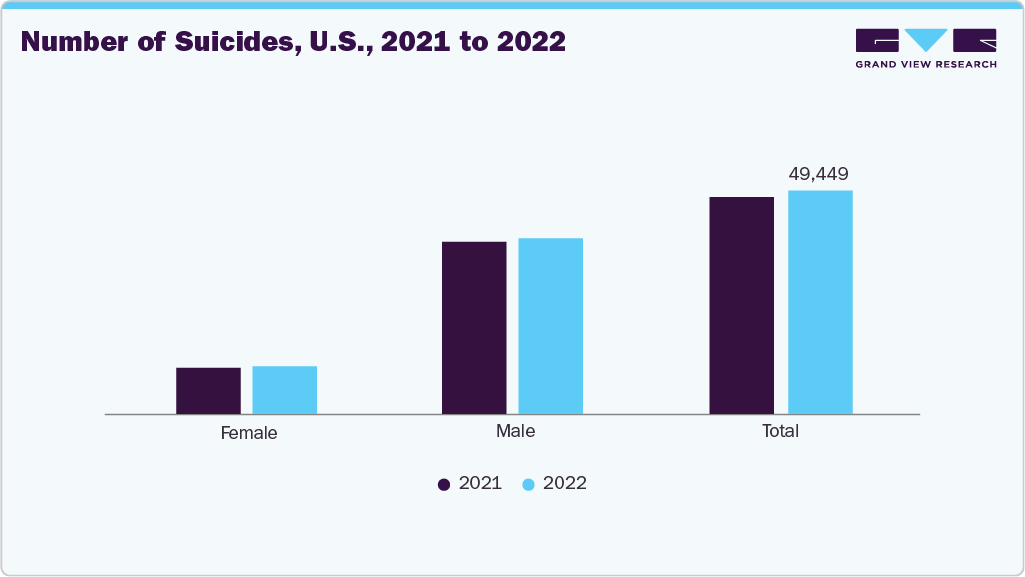

Rising Mental Health Concerns and Suicide Rates

The alarming increase in suicide rates globally has highlighted the urgent need for accessible mental health support. Chatbot-based apps are uniquely positioned to meet this demand by providing immediate, private, and stigma-free assistance. These tools often include early intervention features like self-assessment, mood tracking, and anonymous conversations, which can be life-saving for individuals dealing with suicidal ideation or other mental health issues.

Market Restraint

Data Privacy and Ethical Concerns

User concerns about data privacy and ethical AI use pose a key restraint in the U.S. market. Many apps fall outside HIPAA protections, leading to fears about data misuse, lack of transparency, and the impersonal nature of AI interactions. These concerns can limit user trust and engagement.

To address this, developers must prioritize strong privacy practices, ethical AI design, and clear communication about data use. Without these safeguards, adoption may slow despite growing demand.

Market Opportunities

Expanding Access in Underserved and Rural Areas

There is strong potential to reach underserved and rural populations in the U.S., where mental health services are limited. AI-powered chatbots can provide affordable, 24/7, and private mental health support, helping bridge care gaps in these communities.

Integration with Employer and Insurance Wellness Programs

U.S. employers and health insurers increasingly incorporate mental health apps into wellness benefits to improve employee well-being and reduce healthcare costs. Integrating AI chatbots into these programs can enhance engagement and provide scalable mental health support for working adults.

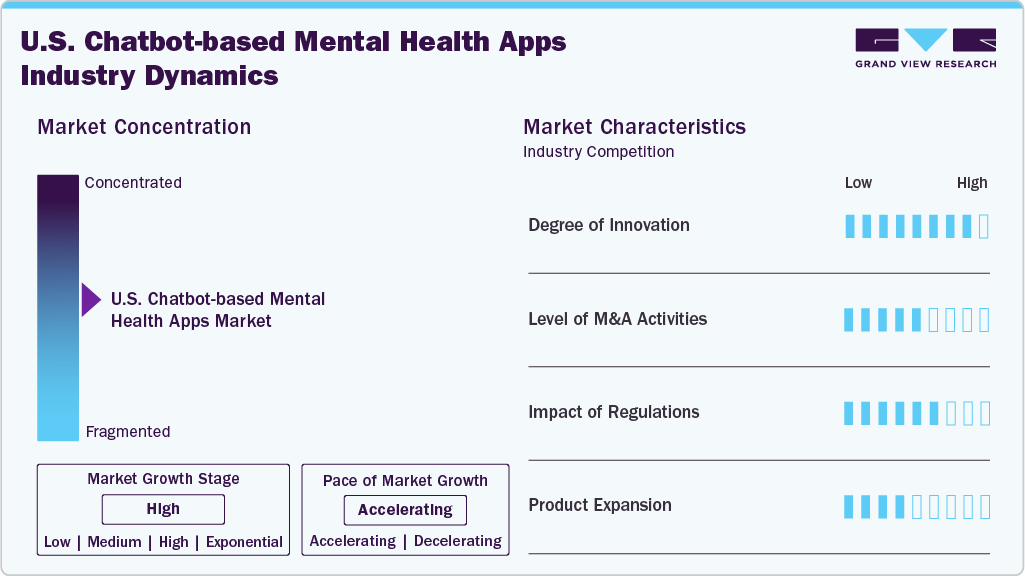

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaboration activities, degree of innovation, and regional expansion. For instance, the U.S. market is moderately concentrated, with a mix of established medical device manufacturers and emerging technology startups competing actively. The degree of innovation, level of partnerships & collaboration, and regulatory impact are high, while product expansion is experiencing rapid growth.

The U.S. market is characterized by a high degree of innovation. The innovation is due to increasing technological advancements, integrating AI/ML with mental health apps, and more. For instance, the Matellio, an AI Chatbot for mental health, delivers 24x7 emotional support, enhances patient care, and transforms engagement with intelligent solutions. Moreover, the Woebot app is an AI-driven chatbot that offers mental health assistance based on cognitive behavioral therapy principles.

The U.S. market is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary expertise, technologies, and distribution channels to capture a larger market share. For instance, in March 2025, Wysa, which provides an AI-powered mental health chatbot, merged with April Health, which incorporates virtual behavioral health services into primary care. Wysa's chatbot assists users in navigating cognitive behavioral therapy for issues such as low mood, stress, and anxiety. Moreover, the company's offerings for employers feature a self-care library filled with exercises aimed at enhancing self-esteem, sleep, and mindfulness, along with the option to connect with human coaches from Wysa.

Mental health app companies must comply with regulations prioritizing patient and data safety. Furthermore, several regulatory organizations are working on initiatives to simplify the regulations related to digital health applications. For example, in December 2022, the Federal Trade Commission (FTC) collaborated with OCR, the HHS Office of the National Coordinator for Health Information Technology (ONC), and the Food and Drug Administration (FDA) to update the widely utilized Mobile Health Apps Interactive Tool. This tool is developed to assist developers of health-focused mobile apps, including those governed by HIPAA, understand the federal laws and regulations pertinent to their activities.

Several market players are expanding their business by launching new solutions to expand their product portfolio. For instance, in August 2021, Life Clips, Inc. introduced Aiki, an AI-powered interactive assistant that simplifies measuring, understanding, and enhancing employees' mental health. Aiki aims to take advantage of the growing trend of employers using AI platforms to promote awareness of their employees' mental health.

Application Insights

By type, the depression and anxiety management segment dominated the market with the largest revenue share of 29.78% in 2024. The growing prevalence of anxiety and depression disorders and increasing awareness about mental health apps for the treatment of these conditions are some of the major factors supporting the segment's growth. For instance, according to the Anxiety and Depression Association of America (ADAA), Generalized Anxiety Disorder (GAD) impacts 3.1% of adults, which is about 6.8 million in the U.S. population. However, only 43.2% of those affected are currently receiving treatment. Women are twice as likely to be diagnosed with GAD compared to men, and it frequently occurs alongside major depression.

The stress management segment is anticipated to witness the fastest CAGR growth over the forecast period. The rising prevalence of stress and related disorders and the increasing adoption of applications beneficial for stress reduction and management are pioneering factors fueling the segment's growth during the forecast period. For instance, according to the American Psychiatric Association, the prevalence of PTSD in the U.S. is estimated to be approximately 4% of U.S. adults and 8% of U.S. adolescents aged 13-18. The lifetime prevalence in the U.S. is estimated to be 6%.

Platform Insights

By platform, the iOS segment dominated the market with the largest revenue share of 50.15% in 2024. The high adoption of iOS devices is one of the major factors propelling growth and is expected to continue to boost the segment over the forecast period. For instance, according to the Demandsage report, as of 2023, there are 153 million iPhone users in the U.S. In addition, according to the Backlinko report. Moreover, in June 2023, Apple introduced upgraded health features in iPadOS 17 and iOS 17, broadening its focus on vision and mental health and providing innovative tools and experiences across its platforms. The updated mental health options allow users to track their immediate feelings and daily moods, and easily access assessments and resources.

The Android segment is anticipated to witness the fastest CAGR growth over the forecast period. Major factors contributing to the segment's development include the rising usage rate of Android-based smartphones and their cost-effectiveness. A growing number of Android users is anticipated to boost the market growth, signifying a higher growth rate. Furthermore, the Android operating system has undergone continuous improvements. These include enhanced features, Application Programming Interface (API) integrations, and machine learning capabilities. These enhancements strengthen the functionality and accuracy of chatbot-based mental health apps.

Technology Insights

By technology, the machine learning and deep learning segment dominated the market with the largest revenue share of 46.49% in 2024 and is anticipated to witness the fastest CAGR growth over the forecast period. Machine learning and deep learning, which can process vast amounts of unstructured data such as text and speech, enable continuous learning and improvement of chatbot systems. These technologies identify behavioral trends, detect early warning signs of mental health conditions such as depression or anxiety, and provide proactive interventions. As a result, chatbot applications powered by advanced AI models offer more reliable, comprehensive, and timely support, which is increasingly important in a world facing a growing mental health crisis and a shortage of human therapists. For example, Wysa is an AI chatbot that combines cognitive behavioral therapy (CBT) techniques with conversational AI. It provides users with evidence-based coping strategies and emotional support. The chatbot is designed to engage users in a supportive and non-judgmental manner, making mental health support more accessible.

The natural language processing segment is anticipated to witness significant CAGR growth over the forecast period. Modern NLP-powered chatbots can remember previous exchanges, understand complex emotional states, and deliver personalized responses that more closely mimic human dialogue than ever before. These improvements make NLP-equipped chatbots more effective at guiding users through cognitive behavioral therapy (CBT) exercises, mindfulness routines, or stress-reduction techniques, boosting their market.

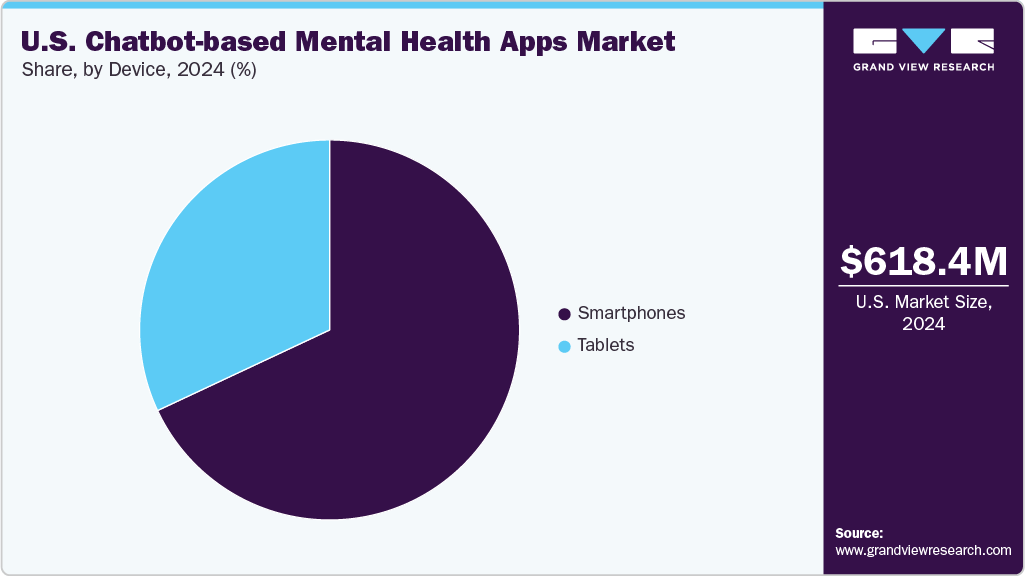

Device Insights

By device, the smartphones segment dominated the market with a share of 68.03% in 2024. Growth in the segment is attributed to the increasing penetration of smartphones. According to data from GSMA Intelligence, the number of cellular mobile connections in the U.S. was 396.0 million at the beginning of 2024. The figures from GSMA Intelligence suggest that mobile connections in the USA represented 116.2% of the total population in January 2024. Between the start of 2023 and the beginning of 2024, the number of mobile connections in the U.S. grew by 9.5 million, an increase of 2.5%.

The tablets segment is anticipated to witness the fastest CAGR growth over the forecast period. Tablets are being increasingly adopted in institutional settings such as hospitals, mental health clinics, and care facilities. These environments often deploy tablets for patient engagement and monitoring, making them ideal platforms for hosting AI-driven mental health support apps. The ease of sharing devices among patients in such settings and the integration capabilities with other health systems further support their use. Thus, such factors are expected to boost the market growth over the forecast period.

Key U.S. Chatbot-based Mental Health Apps Company Insights

Key players in the U.S. market focus on developing innovative business growth strategies through product portfolio expansions, partnerships and collaborations, mergers and acquisitions, and business footprint expansions.

Key U.S. Chatbot-based Mental Health Apps Companies:

- Woebot Health

- Wysa Ltd

- Matellio

- Headspace Health

- Earkick

- Marigold Health

- Life Clips, Inc.

- Biobeat

- Cognoa, Inc.

- Lyra Health, Inc.

Recent Developments

-

In March 2025, Wysa, which provides an AI-powered mental health chatbot, merged with April Health, which incorporates virtual behavioral health services into primary care.

-

In August 2024, Akron Children’s Hospital, located in Ohio, collaborated with Woebot Health to provide access to Woebot for Adolescents for patients aged 13-17 through clinician referrals. This tool, designed to complement therapy, is an evidence-based, AI-driven mental health support resource.

U.S. Chatbot-based Mental Health Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 720.47 million

Revenue forecast in 2033

USD 2.13 billion

Growth rate

CAGR of 14.51% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, platform, device

Country Scope

U.S.

Key companies profiled

Woebot Health; Wysa Ltd.; Matellio; Headspace Health; Earkick; Marigold Health; Life Clips, Inc.; Biobeat; Cognoa, Inc.; Lyra Health, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Chatbot-based Mental Health Apps Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. chatbot-based mental health apps market report based on application, technology, platform, and device:

-

Application Outlook (Revenue USD Million, 2021 - 2033)

-

Depression and Anxiety Management

-

Meditation Management

-

Stress Management

-

Wellness Management

-

Others

-

-

Technology Outlook (Revenue USD Million, 2021 - 2033)

-

Machine learning and Deep learning

-

Natural Language Processing

-

Others

-

-

Platform Outlook (Revenue USD Million, 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

Device Outlook (Revenue USD Million, 2021 - 2033)

-

Smartphones

-

Tablets

-

Frequently Asked Questions About This Report

b. The global U.S. chatbot-based mental health apps market size was estimated at USD 618.36 million in 2024 and is expected to reach USD 720.47 million in 2025.

b. The global U.S. chatbot-based mental health apps market is expected to grow at a compound annual growth rate of 14.51% from 2025 to 2033 to reach USD 2.13 billion by 2033.

b. By type, the depression and anxiety management segment dominated the market with the largest revenue share of 29.78% in 2024. The growing prevalence of anxiety and depression disorders and increasing awareness about mental health apps for the treatment of these conditions are some of the major factors supporting the segment's growth.

b. Some key players operating in the U.S. chatbot-based mental health apps market include Woebot Health, Wysa Ltd, Matellio, Headspace Health, Earkick, Marigold Health, Life Clips, Inc., Biobeat, Cognoa, Inc., and Lyra Health, Inc.

b. The growing adoption of chatbot-based mental health apps is driven by their benefits in improving treatment outcomes, enhancing lifestyles, and increasing awareness of mental health as a significant health concern, a major factor contributing to market growth. In addition, these apps promote overall well-being and boost individuals' productivity, particularly among professionals in the workforce.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.