- Home

- »

- Medical Devices

- »

-

U.S. Child Care Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Child Care Market Size, Share & Trends Report]()

U.S. Child Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Early Care, Early Education & Daycare, Backup Care), By Delivery Type, By Age Group, By States, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-205-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Child Care Market Summary

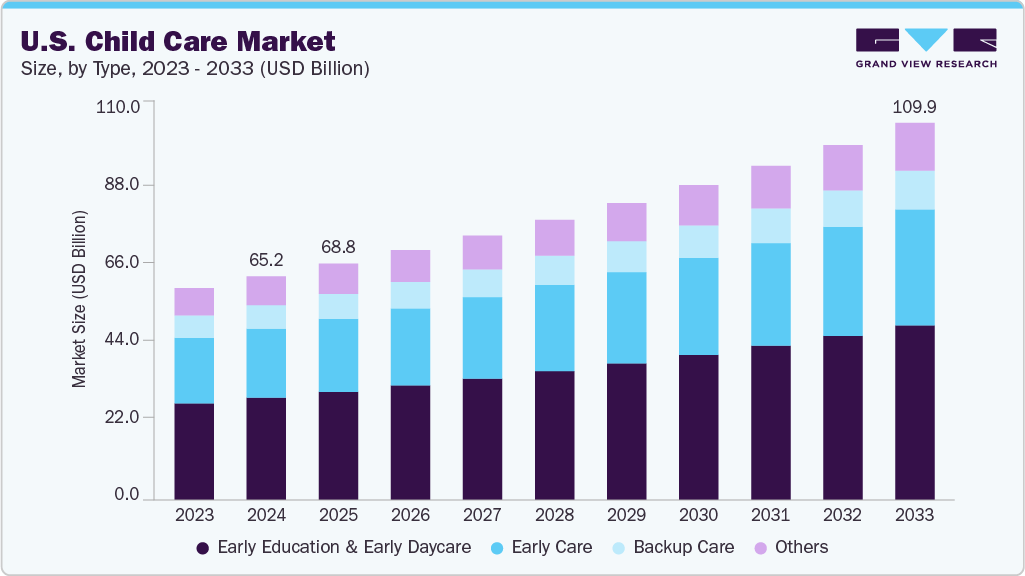

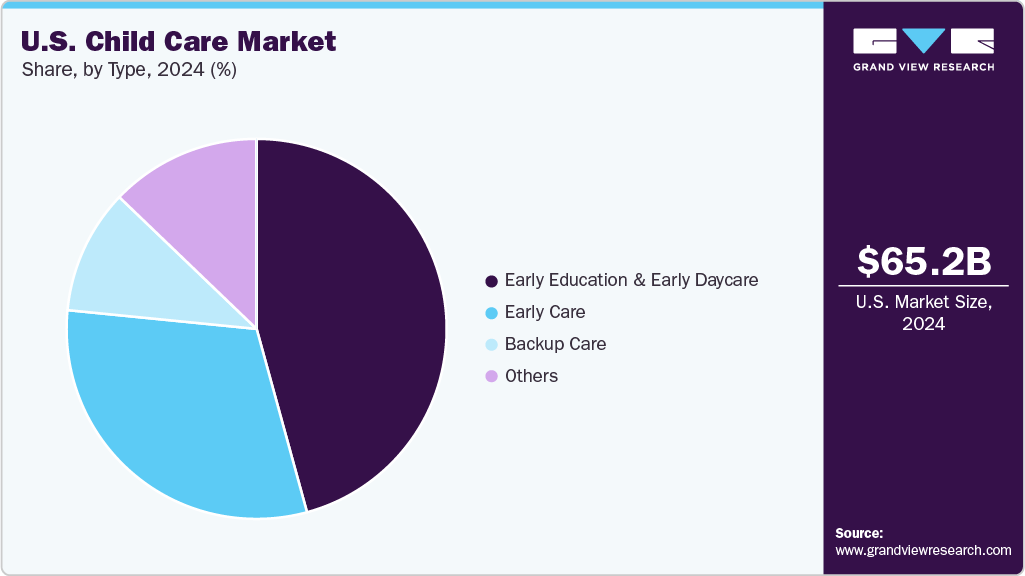

The U.S. child care market size was estimated at USD 65.15 billion in 2024 and is expected to reach USD 109.88 billion by 2033, growing at a CAGR of 6.02% from 2025 to 2033. This growth is driven by the increased demand due to more parents returning to offices, advancements in learning technologies, and government fundings, specifically for single and working mothers. In addition, the shift in family structures, such as single-parent households, and the growing recognition of early childhood education’s role in cognitive and social development are further propelling market growth.

Increasing Number of Single-Parent & Dual-Income Households

The increasing number of single-parent and dual-income households is a significantly drives the market. These family structures often require reliable external care options due to work commitments. In single-parent households, the sole caregiver is typically employed full-time or part-time, creating a steady demand for daycare centers, preschools, and after-school programs. Similarly, in dual-income households, both parents are busy with their careers, which limits their ability to provide full-time in-home care. This trend is further amplified by rising living costs that compel more parents to enter the workforce, as well as the growing recognition of the importance of early childhood education for cognitive and social development.

Impact of Rising Single-Parent & Dual-Income Households on the Market

Instance

Description

Higher enrollment in daycare centers

Working parents increasingly choose licensed daycare facilities to provide structured care during work hours.

Growth in after-school care programs

Single parents rely on after-school services to cover the gap between school dismissal and workday completion.

Expansion of employer-sponsored child care

Companies offer on-site or subsidized child care as part of employee benefits to retain working parents.

Increase in part-time and flexible care options

Families with nontraditional or shift-based schedules opt for flexible hourly or part-time child care services.

Rising demand for early learning academies

Parents choose preschool programs that combine child care with early skill and social development.

Source: Grand View Research

Rising Demand for Early Education & Adoption of Digital Learning Tools

Parents increasingly view early learning as critical to their children’s long-term academic and social success. As awareness grows regarding the importance of cognitive, emotional, and language development during preschool, families seek child care centers that provide structured educational programs instead of merely basic supervision. In addition, integrating digital learning platforms such as interactive e-learning apps, virtual classrooms, and AI-powered progress tracking has transformed early education delivery. These tools enhance personalized learning and allow educators to monitor developmental milestones and engage children through gamified content, making child care services more appealing to tech-savvy parents.

Early Education Demand & Digital Learning Integration Tools

Instance

Description

Interactive E-Learning Apps

Use of platforms such as ABCmouse or Khan Academy Kids to build early literacy, numeracy, and problem-solving skills.

Virtual Classrooms

Live-streamed lessons and activities that allow remote participation in early education programs.

AI-Powered Progress Tracking

Tools that analyze each child’s learning patterns and provide personalized activity recommendations.

Gamified Learning Modules

Educational games and activities that make learning engaging while developing cognitive skills.

Digital Parent Updates

Apps such as Brightwheel or HiMama provide parents with real-time updates on lessons, activities, and milestones.

Source: Grand View Research

Expansion of Onsite Employer-Sponsored Centers

As more companies recognize that providing convenient, high-quality child care directly at or near the workplace improves employee satisfaction, retention, and productivity. These centers reduce commuting stress for working parents, allow for flexible scheduling, and support work-life balance critical in industries facing talent shortages. In addition, many organizations use this benefit as a competitive advantage to attract skilled workers, particularly women returning to the workforce after parental leave. The trend is further supported by tax incentives, public-private partnerships, and increasing awareness of the link between reliable child care and economic output. As employers compete for talent in a tight labor market, investment in such facilities is expected to continue rising.

Onsite Employer-Sponsored Child Care Centers

Employer

Location

Child Care Provider Partner

Key Features

Patagonia

Ventura, California

In-house

Offers subsidized tuition, outdoor play areas, and bilingual staff

Google

Mountain View, California

Bright Horizons

Multiple centers with STEM-based curriculum and extended hours

Toyota Motor Manufacturing

Georgetown, Kentucky

In-house

Serves infants to preschool, flexible scheduling for shift workers

JPMorgan Chase

Columbus, Ohio

Bright Horizons

Includes backup care services and early learning programs

Cisco Systems

San Jose, California

In-house

Emphasis on technology-aided learning and healthy meals

Source: Grand View Research

Government Subsidies & Tax-Credit Programmes for Child Care

Government subsidies and tax-credit programs act as a primary driver market by making early childhood education and care services more affordable for families, thereby increasing demand. These programs, such as the Child Care and Development Fund (CCDF), the Child and Dependent Care Tax Credit (CDCTC), and state-level subsidies, help low- and middle-income families cover the cost of licensed child care providers. By reducing out-of-pocket expenses, they encourage higher enrollment in child care centers and home-based care services, supporting both the growth of the industry and workforce participation, particularly among working parents. In addition, expanded funding initiatives under federal acts, such as the American Rescue Plan, have provided temporary boosts to stabilize the sector post-pandemic, further fueling market growth.

Key U.S. Government Subsidy and Tax-Credit Programs

Program / Initiative

Type

Key Features

Impact on Market

Child Care and Development Fund (CCDF)

Federal subsidy program

Provides funding to states for child care assistance to low-income families

Increases access to affordable care and boosts licensed provider demand

Child and Dependent Care Tax Credit (CDCTC)

Federal tax credit

Allows working parents to claim a portion of child care expenses as a tax credit

Reduces financial burden, encouraging use of formal child care services

Head Start & Early Head Start

Federal early education program

Offers free early learning, health, and nutrition services for low-income children

Increases preschool enrollment and supports holistic child development

State Child Care Subsidies (e.g., California Alternative Payment Program)

State-level subsidy

State-administered assistance to eligible families for licensed and home-based providers

Expands reach in underserved communities

American Rescue Plan Act Child Care Stabilization Grants

Temporary federal funding

Provided $39 billion to stabilize child care providers post-COVID

Prevented closures, maintained capacity, and supported workforce retention

The Rising Demand for Early Care and Education

The rising demand for early care and education in states such as Massachusetts, driven by the growth of skilled service sectors such as business and healthcare, is a significant driver for the industry. As these industries expand, the need for quality and accessible child care becomes critical to ensure that skilled workers with young children can remain active in the labor force. Reliable child care services not only support parents in maintaining their careers but also enable them to pursue higher education and specialized training, thereby enhancing their skills and contributing to a more competitive workforce. This, in turn, sustains economic productivity, reduces employee turnover, and fosters long-term workforce stability, making child care infrastructure an essential component of labor market growth and competitiveness.

Rising Demand for Child Care Services

Rising demand for child care services in states such as New Jersey is a significant driver for the U.S. child care market, fueled by increasing workforce participation among parents and demographic shifts. As more parents enter or remain in the labor force, the need for reliable, accessible, and affordable early education programs grows, making public funding and support critical to meeting this demand. According to a Rutgers University report, every county in New Jersey is projected to see an increase in the need for child care, with Ocean, Somerset, Morris, and Burlington counties expecting notable growth in the population of young children between 2019 and 2034. This anticipated population surge underscores the importance of expanding child care infrastructure, ensuring affordability, and enhancing program availability to support economic productivity while fostering early childhood development.

Market Concentration & Characteristics

The market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, and the level of partnerships & collaborations activities is medium. The impact of regulations on the market is high, and service expansion of players is medium.

Digital innovation is transforming the way providers operate, communicate, and deliver services. Childcare management software solutions have become increasingly popular in the U.S. These platforms streamline administrative tasks such as enrollment, attendance tracking, billing, and communication with parents. Providers can use these digital tools to manage schedules, track children's activities, and maintain compliance with licensing requirements.

The market players are leveraging strategies such as collaborations, partnerships, and acquisitions, to promote the reach of their offerings and increase their services capabilities. In February 2023, Cadence Education acquired the Montessori Teacher Education Institute (MTEI) and Suzuki School in Atlanta, Georgia. The acquisition aims to strengthen and boost the growth of Cadence Education’s presence in the Southeast, with the addition of three new campus locations in the Northside Drive, Ponce City Market, and Buckhead neighborhoods of Atlanta to its portfolio.

Regulations play a crucial role in the market, dictating operational standards and care delivery. All child care programs, including small group & school-age, large group & school-age child care, and family child care, are subject to certain requirements. Specific regulations for families can be found at 606 CMR 7.03(5), while additional requirements for small group & school-age are outlined in 606 CMR 7.03(6). Large groups & school-age child care have their specific requirements detailed at 606 CMR 7.03(6) and (7).

Market players utilize a strategy of service expansion to increase their service capabilities and promote the reach of their service offerings. For instance, in March 2023, Bright Horizons Family Solutions opened two new Bright Spaces for children at Newton Police Department Headquarters, Newton, Massachusetts. The program aims to promote healing, offers nurturing & stimulating activities, and provides an enriching and stable environment for children in centers.

The level of regional expansion is significant in the U.S. due to various government programs and initiatives. For instance, in December 2023, Goddard Systems partnered with Staples, Inc. to open the Childhood Education Center in Framingham. This center aims to provide care and education for approximately 200 children aged from 6 weeks to 6 years old.

Age Group Insights

The school-aged children segment dominated the market with a revenue share of 41.21% in 2024. Population growth, urbanization, and demographic shifts influence demand for services in communities across the U.S. As communities grow and evolve, there is an increasing need for service providers to accommodate the needs of school-aged children and their families. Moreover, many parents of school-aged children require child care before and after school due to their work schedules. The programs that offer before- and after-school care provide a solution for parents who need supervision and engagement for their children during these hours. Child care programs for school-aged children focus on providing engaging learning and recreational experiences that support children's development and help them thrive outside of school.

The infants segment is anticipated to grow at the fastest CAGR during the forecast period. The growing demand for infant care is due to a rise in labor participation. According to a survey by Move.org., in September 2023, infant care is estimated to be more expensive than older kids. Furthermore, the rise in the number of home-based centers, revenue limitations for providers, low teacher compensation, social & economic factors such as poverty, and a shortage of licensed child care options for infants & toddlers are expected to drive the segment growth.

Delivery Type Insights

The organized care facilities segment held the dominant revenue share of 71.91% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This growth of the segment is driven by the increasing number of working parents, technological advancements, and funding for quality early education. In addition, organizations that facilitate daycare are collaborating to provide large-scale daycare services. For instance, South Carolina First Steps 4K has collaborated with private non-profit and for-profit organizations, faith-based institutions, independent schools, and other eligible providers to expand 4-year-old kindergarten programs in the 2023-2024 school year. The program is expected to prioritize developmental and learning support for children to prepare them for school, incorporating research-based practices, ongoing assessment, and parenting education.

The home-based settings are expected to witness lucrative growth during the forecast period. These settings are highly recommended for families with younger children or irregular schedules. Around 7 million children under 5 receive care in a home-based setting, offering benefits such as personalized care, lower costs, and a home-like environment. This is expected to fuel segment growth during the forecast period.

Type Insights

The early education & early daycare segment dominated the market with the largest revenue share of 45.73% in 2024 and is expected to grow the fastest from 2025 to 2033. The demand for services is driven by several factors, including the increasing number of working parents who require care for their young children and growing recognition of the importance of early childhood education in supporting children's development. In addition, various state-level institutions are undertaking the initiative to develop early education and care systems. For instance, in November 2023, the American College of Education (ACE) announced a strategic alliance with Learning Care Group, Inc. The alliance aims to initiate an educational pathway for early childhood professionals through three-course packs as part of the company expansion of professional development and educational training.

The early care segment is expected to have substantial growth over the forecast period. It is emerging as an essential aspect for parents and the government since it provides a safe and nurturing environment for them to grow & learn. High-quality early care can have long-lasting positive effects on children's cognitive, social, and emotional development, and can even lead to better outcomes in adulthood.

State Insights

Texas held the largest market share of 45.60% in 2024. The primary factor driving the market growth in Texas includes stringent regulation and licensing processes in services. Child care centers and facilities in Texas are regulated and licensed by the Texas Department of Family and Protective Services (DFPS) through the Child Care Licensing (CCL) Division. The CCL ensures that child-placing agencies and operations meet the minimum standards set by the state. There is an increase in dual-income households, where both parents work outside the home. As a result, there is a greater need for reliable and affordable options for children of working parents, including infants, toddlers, preschoolers, and school-aged children. In addition, Texas has its own set of policies and regulations governing child care facilities, licensing requirements, and health and safety standards. These state-level policies influence the operation and oversight of providers and contribute to the overall quality and accessibility of services in Texas.

South Carolina is expected to grow at the fastest growth rate during the forecast period. The growing need for ensuring the health and well-being of children are factors driving South Carolina's child care system. The state focuses on ensuring that providers meet health & safety standards and provides resources for families to find safe options. The DSS works to increase the quality of care for all children in the state.

Regional Insights

Southeast region dominated the market with a revenue share of 28.49% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. The Southeast region is experiencing significant population growth, driven by factors such as migration from other parts of the country, natural population increase, and economic opportunities. As the population grows, the demand for these services increases, particularly in urban and suburban areas. Economic conditions vary across the Southeast region, with some states experiencing robust economic growth while others face challenges such as poverty and unemployment. Economic factors influence families' ability to afford services and impact the demand for subsidized care programs and financial assistance. Collaboration among community organizations, nonprofits, and government agencies is essential for addressing the diverse needs of children and families in the Southeast region. Community partnerships can help expand access to services, provide support for low-income families, and promote early childhood development initiatives.

The Midwest region is expected to witness substantial growth over the forecast period. The growing initiatives and increased investments by the government are expected to boost the growth of the region. In addition, State and local governments utilized State and Local Fiscal Recovery Funds (SLFRF) from the American Rescue Plan Act (ARPA) to support working families and close the care gap, enabling the country's economic recovery. For instance, in September 2023, Franklin County, Ohio launched the Franklin County RISE program, which allocates USD 22.5 million to improve child care support in the county. This includes early learning scholarships of up to USD 10,000 for eligible families, rental assistance for child care workers, and incentive payments for licensed providers.

Key U.S. Child Care Company Insights

Key companies in the U.S. child care market include large national operators such as Bright Horizons Family Solutions, KinderCare Education, and Learning Care Group, alongside regional providers such as Goddard Systems, Primrose Schools, and Childtime Learning Centers. These players operate through a mix of corporate-owned centers, franchised models, and employer-sponsored programs, catering to the rising demand for early education and full-day care. Their competitive strength lies in offering structured curricula, technology integration for parent engagement, and adherence to safety and regulatory standards. In addition, many are expanding through acquisitions and partnerships with employers to address growing workforce needs for reliable and high-quality services.

Key U.S. Child Care Companies:

- Bright Horizons Family Solutions

- KinderCare Learning Centers LLC.

- Learning Care Group, Inc.

- Spring Education Group

- Cadence Education

- The Learning Experience

- Childcare Network

- Kids 'R' Kids

- Primrose Schools

- Goddard Systems

- BrightPath Kids

- Winnie, Inc.

- New Horizon Academy

- Care.com

- NeighborSchools, Inc.

- SitterTree., LLC

Recent Developments

-

In January 2025, The Department of Defense (DOD) launched a comprehensive Child Care Expansion Initiative to enhance access and affordability of child care for military and civilian families serving the armed forces. Recognizing that on-base child development centers alone cannot meet demand particularly for geographically dispersed service members, the initiative broadens care options through partnerships with nonprofit organizations to open new centers in high-demand areas, such as Norfolk, Virginia with additional facilities planned in Northern Virginia and Virginia Beach each accommodating about 200 children.

-

In March 2024, Wonderschool operation of child care and early learning businesses acquired EarlyDay, a Miami-based early childhood educator career marketplace, in a strategic move to tackle the pressing staffing shortages across the U.S. child care sector. EarlyDay's AI-powered platform employs proprietary matching algorithms and technology to efficiently connect pre-screened early educators with child care providers, streamlining hiring and reducing administrative burdens.

-

In December 2023, Goddard Systems partnered with Staples, Inc. to open the Childhood Education Center in Framingham. This center aims to provide care and education to approximately 200 children aged from 6 weeks to 6 years old.

-

In November 2023, the American College of Education (ACE) announced a strategic alliance with Learning Care Group, Inc. The alliance aims to initiate an educational pathway for early childhood professionals through three-course packs as part of Learning Care Group, Inc.’s expansion of professional development and educational training.

U.S. Child Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 68.83 billion

Revenue forecast in 2033

USD 109.88 billion

Growth rate

CAGR of 6.02% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, delivery type, age group, states, region

Country scope

U.S.

Key companies profiled

Bright Horizons Family Solutions; KinderCare Learning Centers LLC.; Learning Care Group, Inc.; Spring Education Group; Cadence Education; The Learning Experience; Childcare Network; Kids 'R' Kids; Primrose Schools; Goddard Systems; BrightPath Kids; Winnie, Inc.; New Horizon Academy; Care.com; NeighborSchools, Inc.; SitterTree., LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Child Care Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 For this study, Grand View Research has segmented the U.S. child care market report based on type, age group, delivery type, states, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Early Care

-

Early Education & Early Daycare

-

Backup Care

-

Others

-

-

Delivery Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Organized Care Facilities

-

Home-based Settings

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infants

-

Toddlers

-

Preschoolers

-

School-aged Children

-

-

State Outlook (Revenue, USD Billion, 2021 - 2033)

-

Massachusetts

-

New Jersey

-

Connecticut

-

Texas

-

South Carolina

-

Georgia

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. child care market size was estimated at USD 65.15 billion in 2024 and is expected to reach USD 68.83 billion in 2025.

b. The U.S. child care market is expected to grow at a compound annual growth rate of 6.02% from 2025 to 2033 to reach USD 109.88 billion by 2033.

b. Some key players operating in the U.S. child care market include BBright Horizons Family Solutions; KinderCare Learning Centers LLC.; Learning Care Group, Inc.; Spring Education Group; Cadence Education; The Learning Experience; Childcare Network; Kids 'R' Kids; Primrose Schools; Goddard Systems; BrightPath Kids; Winnie, Inc.; New Horizon Academy; Care.com; NeighborSchools, Inc.; SitterTree., LLC

b. Key factors that are driving the U.S. child care market growth include growing demand for early daycare & education services with more parents returning to working in offices, advancements in learning technologies for children, the rising number of single & working mothers, and government funding.

b. School-aged children segment dominated market in 2024 with market share of 41.21%. Population growth, urbanization, and demographic shifts influence demand for child care services in communities across U.S. As communities grow and evolve, there is an increasing need for child care providers to accommodate the needs of school-aged children and their families.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.