- Home

- »

- Pharmaceuticals

- »

-

U.S. Chiropractic Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. Chiropractic Market Size, Share & Trends Report]()

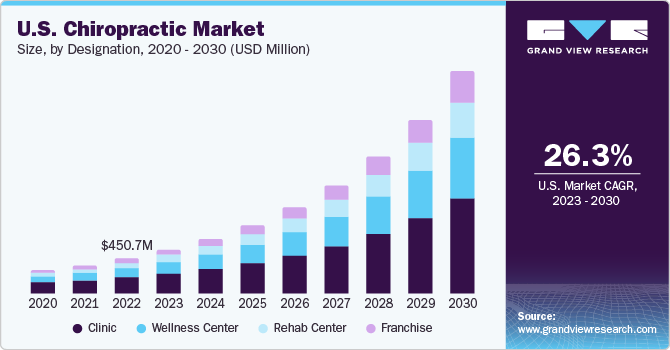

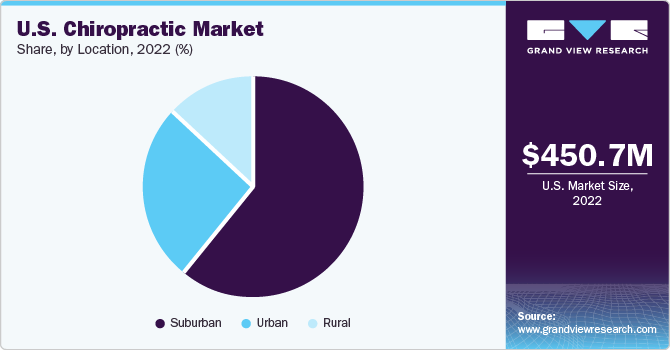

U.S. Chiropractic Market (2023 - 2030) Size, Share & Trends Analysis Report By Designation (Clinic, Wellness Center, Rehab Center, Franchise), By Location (Urban, Suburban, Rural), And Segment Forecasts

- Report ID: GVR-2-68038-673-8

- Number of Report Pages: 30

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Chiropractic Market Size & Trends

The U.S. chiropractic market size was valued at USD 450.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 26.3% from 2023 to 2030. As a complementary treatment to pharmaceutical drugs, chiropractic care has seen a substantial increase in popularity. The acceptance of treatments by patients who choose non-invasive treatment for chronic pains is a key factor driving the market's growth. One of the main causes of the market's expansion is the rising overuse of prescription painkillers and knowledge of this treatment. According to the American Chiropractic Association, chiropractors provide treatment to over 35 million Americans every year.

The most common visitors to chiropractors are women and individuals aged between 45 and 64 years of age. Surprisingly, 60% of the patients seeking chiropractic care are female, while a significant majority of chiropractors (77%) are male. Efforts are being made to encourage more women to join the chiropractic profession. Regarding children, those aged between 12 and 17 are more likely to seek chiropractic care.

One of the key factors driving demand is chiropractic treatments being relatively lower in cost than traditional treatments that use drugs and surgeries. According to the National Center for Biotechnology Information (NCBI), chiropractic procedures such as manual spinal manipulation are reimbursed for those with Medicare Part B coverage. Although the FDA does not approve most of the techniques in chiropractic treatment, it is the most preferred method as it is more affordable than prescription medicine and does not involve any dependence on harmful drug substances.

Efforts undertaken by the FDA to produce and provide clinical support for chiropractic treatment are anticipated to drive market growth in the coming years. Most patients taking up chiropractic treatment opt for long-term treatment and consult a chiropractor for chronic pains such as Degenerative Disc Disease (DDD), whiplash, and headache. According to an article published by the National Library of Medicine, globally, back pain and neck pain together account for more than 10% of all years spent with a disability. Chiropractic care offers a safe and effective choice to manage many of these patients.

Recent years have seen a surge in the presence of clinics, spas, and rehab centers that are supported by well-established firms and smaller individual setups. There are several chiropractic studios and clinics in the country, including solo and group entities at multiple franchises and chain clinics. According to national estimates by the Bureau of Labor Statistics, there are around 38,000 chiropractors currently employed in the U.S.

It is seemingly a direct result of the rise in patient visits to chiropractors due to long-term and enhanced outcomes. According to the NCBI, the prevalence, incidence, and years lived with a disability (YLD) of neck pain were age-standardized rates of 2,696.5 per 100,000 individuals worldwide in 2019. Chiropractors treat over 35 million patients each year in the U.S., which has made the U.S. chiropractic industry a significant one and is likely to boost market growth.

The COVID-19 pandemic has significantly impacted chiropractic clinics, as many facilities were closed for patients due to safety regulations. However, chiropractors continued by diversifying services according to changing needs of the patients through virtual consultations. For instance, in 2021, the U.S. Department of Health and Human Services (HHS) announced a USD 9 billion assistance for healthcare providers facing financial difficulties due to the COVID-19 pandemic.

The plan was made available in September and healthcare providers had the opportunity to apply for it. Over 69,000 providers across all 50 states of the country, Washington, D.C., and eight territories would receive these payments. The funds were aimed at supporting healthcare providers during this challenging period.

Location Insights

The suburban segment dominated the market and accounted for the largest revenue share of around 62.0% in 2022. Chiropractic care has grown more rapidly in the U.S. suburbs than urban regions. The suburban population, frequently made up of families and people with established lives, show a larger propensity for holistic medical treatments.

In suburban locations, where space is more readily available, chiropractors can open larger clinics with plenty of parking, which might be difficult in highly populated metropolitan settings. In addition, the strong sense of community and close-knit relationships that may be found in suburban neighborhoods contribute significantly to the expansion of chiropractic clinics through word-of-mouth referrals and recommendations.

The rural segment is expected to advance at the fastest CAGR of 27.2% during the forecast period. The segment is projected to witness a significant increase in healthcare expenditure. The availability of limited healthcare facilities and the need for non-invasive treatments are the key factors driving market growth in this segment. In addition, chiropractic care is more affordable than other types of healthcare, which appeals to people with limited financial resources.

According to the U.S. Bureau of Labor Statistics, the average cost of a chiropractic visit in the U.S. is relatively affordable at USD 65, making it an attractive option for people seeking healthcare services. This lower cost compared to other medical procedures allows individuals to access chiropractic care more easily, leading to its popularity as a preferred choice for managing musculoskeletal issues and promoting overall health and wellness.

Designation Insights

The clinic segment accounted for the largest revenue share of around 45% in 2022. In comparison to wellness centers, chiropractic clinics have grown significantly. They provide specialized treatments for musculoskeletal diseases, especially those connected to spine-related diagnosis, treatment, and prevention. Patients are seeking out these clinics due to growing public knowledge of the advantages of chiropractic treatment. Additionally, the ease of direct access flexible scheduling, and the integration of chiropractic care with conventional healthcare systems, all contribute to their expansion.

However, wellness centers, which provide a wider range of holistic treatments, are not necessarily on the decline because chiropractic clinics are growing. In the U.S., there are approximately 95,438 licensed chiropractic businesses. Among the states, California and Florida have the highest number of chiropractor clinics, with each state having over 10,000 establishments offering chiropractic services. Chiropractic care is a popular form of complementary and alternative medicine, and these clinics cater to a diverse range of patients seeking relief from musculoskeletal issues and improve overall well-being.

The franchise segment is expected to expand at the fastest CAGR of 28.5% over the forecast period in the U.S. chiropractic market. The franchise segment offers a tested business structure that enables chiropractors to launch their practices with the backing of a well-known name. Franchises with a proven track record get more clients due to their credibility and reputation, accelerating segment growth.

Franchise systems support marketing and advertising, providing efficient service promotion both locally and nationally. The reputation of the clinics is improved through training programs that keep the level of services uniform across all franchise sites. Chiropractic professionals open new clinics at a faster pace due to the expansion strategies of franchise systems and financial aid availability.

Key Companies & Market Share Insights

Companies focus on research and development to introduce technologically advanced products and gain a competitive edge. They are also engaging in acquisitions, mergers, and partnerships to increase their manufacturing capacities & strengthen product portfolio, as well as provide competitive differentiation. For instance, in April 2022, FV Hospital announced the acquisition of American Chiropractic Clinic (ACC). The acquisition enabled FV Hospital to enhance its medical treatment and services and chiropractic services.

Key U.S. Chiropractic Companies:

- Magen David Community Center, Inc.

- The Joint Corp.

- Lbi Starbucks DC 3

- Allied Health of Wisconsin, S.C.

- Sherman College of Chiropractic

- Chiropractic Strategies Group, Inc.

- Chiro One Wellness Centers, LLC

- Landmark Healthcare Services, Inc.

- Parsons Gregory V Advanced Chiropractic Clinic

- Silverman Chiropractic Center, DC PCA

- Emergency Chiropractic

- Multi-Specialty Healthcare Group, LLC

U.S. Chiropractic Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2,871.8 million

Growth Rate

CAGR of 26.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Designation, location

Country scope

U.S.

Key companies profiled

Magen David Community Center, Inc.; The Joint Corp.; Lbi Starbucks DC 3; Allied Health of Wisconsin, S.C.; Sherman College of Chiropractic; Chiropractic Strategies Group, Inc.; Chiro One Wellness Centers, LLC; Landmark Healthcare Services, Inc.; Parsons Gregory V Advanced Chiropractic Clinic; Silverman Chiropractic Center, DC PCA; Emergency Chiropractic; Multi-Specialty Healthcare Group, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Chiropractic Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. chiropractic market report on the basis of designation and location:

-

Designation Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinic

-

Wellness Center

-

Rehab Center

-

Franchise

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Urban

-

Suburban

-

Rural

-

Frequently Asked Questions About This Report

b. The U.S. chiropractic market size was estimated at USD 450.7 million in 2022 and is expected to reach USD 561.54 million in 2023.

b. The U.S. chiropractic market is expected to grow at a compound annual growth rate of 26.3% from 2023 to 2030 to reach USD 2,871.8 million by 2030.

b. Clinic segment dominated the U.S. chiropractic market with a share of 44.6% in 2022. This is attributable to rising healthcare awareness coupled with increasing adoption of chiropractic practices in clinics.

b. Some key players operating in the U.S. chiropractic market include Magen David Community Center, Inc.; The Joint Corp.; Lbi Starbucks DC 3; Allied Health of Wisconsin, S.C., P.C.; Sherman College of Straight Chiropractic, Inc.; Chiropractic Strategies Group, Inc.; Chiro One Wellness Centers, LLC; Landmark Healthcare Services, Inc.; Parsons Gregory V Advanced Chiropractic Clinic; Silverman Chiropractic Center, DC PCA; Emergency Chiropractic PC; and Multi-Specialty Healthcare Group, LLC.

b. Key factors driving the U.S. chiropractic market growth include increasing prescription pain drug abuse, increasing awareness regarding chiropractic treatment, and growing acceptance of chiropractic therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.