- Home

- »

- Automotive & Transportation

- »

-

U.S. Cold Storage Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Cold Storage Market Size, Share & Trends Report]()

U.S. Cold Storage Market (2025 - 2033) Size, Share & Trends Analysis Report By Storage (Facilities/Services, Equipment), By Temperature Range (Chilled (0°C to 15°C), Frozen (-18°C to -25°C)), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-451-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cold Storage Market Summary

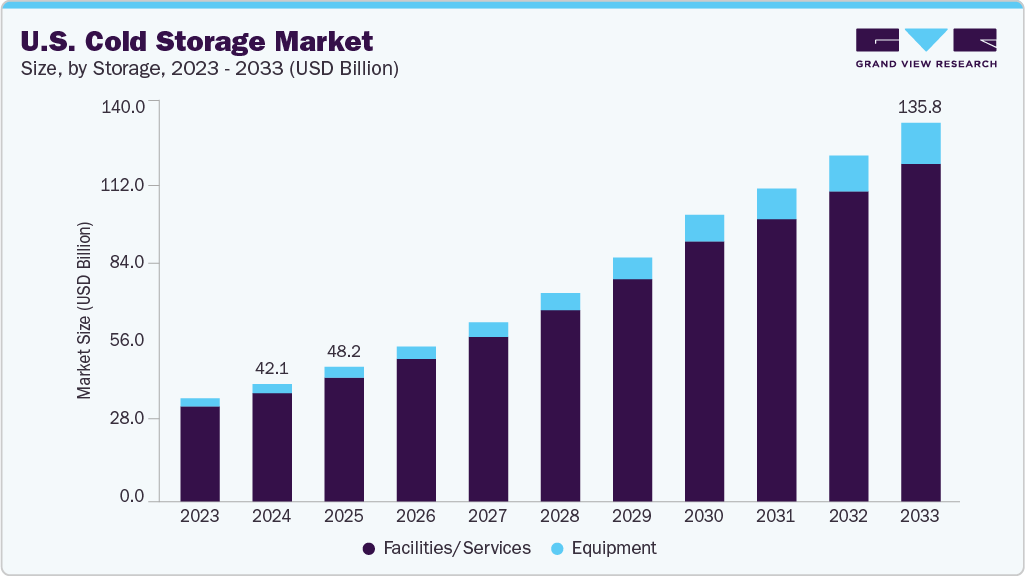

The U.S. cold storage market size was estimated at USD 42.09 billion in 2024 and is projected to reach USD 135.83 billion by 2033, growing at a CAGR of 13.8% from 2025 to 2033. The growth can be attributed to several critical factors, such as technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items.

Key Market Trends & Insights

- By storage, the facilities/services segment accounted for the largest share of 92.3% in 2024.

- By storage, the equipment segment is expected to grow at a significant CAGR during the forecast period.

- By temperature, the frozen (-18°C to -25°C) segment held the largest market share in 2024.

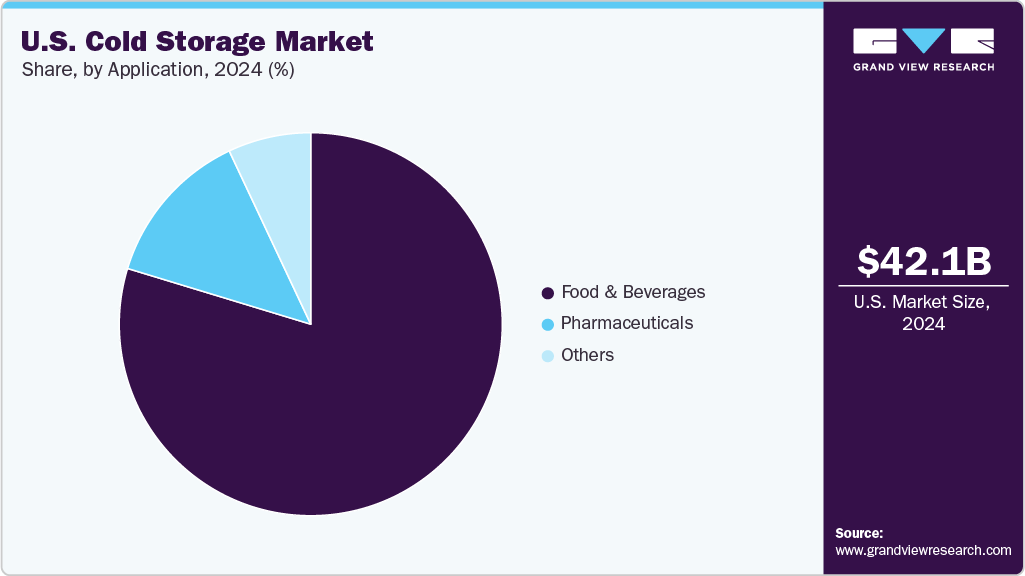

- By application, the food & beverages segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.09 Billion

- 2033 Projected Market Size: USD 135.84 Billion

- CAGR (2025-2033): 13.8%

The market has also benefited significantly from the stringent government regulation of the production and supply of temperature-sensitive products. The industry is poised for unprecedented growth in the next seven years owing to growing organized retail sectors in the emerging economies, which will create opportunities for the service providers over the forecast period.Growing demand for connected trucks, high-cube refrigerated trailers, and vehicles that facilitate cross-product transportation is likely to drive demand for cold chain services. The ever-increasing health consciousness among consumers has inspired healthier eating habits and led to a rising demand for high-quality food packaging and storage solutions. Outsourcing services have been gaining popularity among businesses owing to factors such as increasing competition, a rapid rise in operational costs, and stringent quality standards. Numerous benefits of outsourcing these services, such as reduced operational costs, improved flexibility, higher efficiency, and expertise, have also encouraged its widespread adoption.

Service providers in the U.S. cold storage industry have enhanced their efforts to protect temperature-controlled products from potential tampering or malicious actions. Securing the facility encompasses not only refrigerated warehouses but also employees and visitors as well. This has resulted in increasing demand for the adoption of monitoring components such as telematics and telemetry devices, sensors, data loggers, and networking devices. Such components significantly improve the performance and efficiency of refrigerated storage and transportation.

Industry players are relying on RFID and Automatic Identification and Data Capture (AIDC) for enhancing the efficiency of the order fulfillment process. The growing penetration of Bluetooth technology and RFID sensors, across the logistics industry, is expected to spur the adoption of AIDC technology. Furthermore, cold storage operators focus on maximizing their throughput and order accuracy by using robotics applications, high-speed conveyor systems, and automated materials handling equipment. These technological advancements are in turn expected to boost the growth of the market over the forecast period.

Storage Insights

The facilities/services segment accounted for the largest share of 92.3% in 2024. The facilities and services segment continues to dominate the U.S. market, driven by rising demand for end-to-end temperature-controlled logistics, increasing complexity in food supply chains, and the rapid expansion of e-commerce grocery fulfillment. Operators are investing heavily in automation, high-density racking systems, and multi-temperature zones to improve throughput and reduce operating costs. In addition, stringent food safety regulations and the growing need for third-party storage solutions by retailers and food processors are reinforcing the reliance on large, professionally managed cold storage facilities.

The equipment segment is expected to grow at a significant CAGR during the forecast period. The equipment segment is emerging as a high-growth category, supported by continuous innovation in refrigeration technologies, energy-efficient cooling systems, and IoT-enabled monitoring devices. Rising electricity costs and sustainability requirements are pushing operators to adopt advanced compressors, smart sensors, and low-GWP refrigerants. In addition, the shift toward modular and portable cold storage units, especially for pharmaceuticals, meal kits, and last-mile logistics, is accelerating the adoption of next-generation cold storage equipment across the market.

Temperature Range Insights

The frozen (-18°C to -25°C) segment accounted for the largest share in 2024, supported by sustained demand for long-shelf-life products such as frozen meat, seafood, bakery items, and ready-to-eat meals. The rise of bulk purchasing behavior, growth of frozen food penetration among U.S. households, and strong requirements from foodservice operators continue to drive capacity expansion in frozen storage. In addition, manufacturers and retailers are increasingly relying on frozen storage to reduce waste, maintain product quality during long-haul transportation, and efficiently manage seasonal inventory fluctuations, reinforcing the dominance of this segment.

The chilled (0°C to 15°C) segment is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by rising demand for fresh produce, dairy, beverages, and high-value perishables that require controlled short-term storage. The expansion of fresh meal kits, rapid grocery delivery services, and premium organic food categories is creating a strong need for modern, energy-efficient chilled storage capacity. Moreover, consumers’ growing preference for minimally processed, fresh foods and the emphasis on shorter supply chain cycles are encouraging retailers and distributors to scale up chilled storage investments, positioning this segment for strong future growth.

Application Insights

The food & beverages segment dominated the market in 2024, primarily driven by the rising demand for temperature-controlled storage of meat, seafood, dairy, bakery products, and ready-to-eat meals. Growth in e-commerce grocery, increasing consumer preference for frozen and fresh convenience foods, and the expansion of nationwide distribution networks continue to strengthen demand. Food processors and retailers are also investing in modern cold chain infrastructure to reduce spoilage, maintain compliance with food safety regulations, and support year-round product availability, further reinforcing the segment’s dominance.

The pharmaceuticals segment is anticipated to witness strong growth over the forecast period, due to the increasing need for precise temperature management for vaccines, biologics, specialty drugs, and clinical trial materials. The rise in biopharmaceutical production, expansion of temperature-sensitive therapeutics, and stringent regulatory requirements from bodies like the FDA are accelerating investments in advanced cold storage capabilities. In addition, the growth of mail-order pharmacies and decentralized healthcare delivery models is driving demand for high-reliability storage systems with continuous monitoring, positioning pharmaceuticals as one of the fastest-growing segments in the market.

Key U.S. Cold Storage Company Insights

Some of the key companies in the U.S. cold storage industry include Lineage Logistics Holdings, LLC, Americold Logistics, Inc., United States Cold Storage, Inc., and others. Organizations in the U.S. market are increasingly focused on expanding their customer base to strengthen their competitive position. To achieve this, leading players are actively pursuing strategic initiatives such as mergers and acquisitions, capacity expansion, and partnerships with major food producers, retailers, and logistics providers. These initiatives enable companies to scale their nationwide footprint, enhance service capabilities, and integrate advanced technologies, ultimately positioning them to meet rising demand for temperature-controlled logistics across diverse end-use industries.

-

Lineage Logistics Holdings, LLC is a global leader in temperature-controlled warehousing and logistics, operating one of the world’s largest cold storage networks. The company leverages advanced automation, data-driven optimization, and proprietary warehouse management technologies to enhance efficiency and product integrity across frozen and chilled supply chains. Lineage’s high-density automated storage systems, energy-efficient refrigeration solutions, and integrated transportation offerings enable seamless end-to-end cold chain operations.

-

Americold Logistics, Inc. is a major temperature-controlled logistics provider specializing in refrigerated warehousing, value-added services, and integrated supply chain solutions. With a large, strategically located network of facilities, Americold uses advanced thermal management systems, multi-temperature storage environments, and real-time digital monitoring platforms to ensure product safety and reduce operational inefficiencies. The company’s innovative i-3PL technology suite enhances visibility and coordination across transportation and storage, enabling customers to optimize inventory flow.

Key U.S. Cold Storage Companies:

- AmericoldLogistics, Inc.

- AGRO Merchants Group North America

- Burris Logistics

- Henningsen Cold Storage Co.

- Lineage Logistics Holdings, LLC

- Nordic Logistics

- Preferred Freezer Services

- VersaCold Logistics Services

- United States Cold Storage

- Wabash National Corporation

Recent Developments

-

In September 2025, Americold’s automated Russellville, Arkansas facility was named Refrigerated & Frozen Foods Magazine’s inaugural Cold Storage Facility of the Year, recognizing leadership in construction, automation, sustainability, and customer satisfaction. Completed in 2023, the 136,000-square-foot facility features 13 million cubic feet of temperature-controlled space, 42,000 pallet positions, 64 dock doors, and a fully integrated Automated Storage and Retrieval System (ASRS) with automated trailer unloading and high-speed barcode scanning. The site incorporates sustainable design elements, including energy-efficient ammonia refrigeration, insulated panels, electric yard tractors, and autonomous fleet integration, achieving a 25% reduction in water use. The facility provides services such as distribution, inventory management, cross-docking, transloading, and value-added supply chain support, and ramped up to full operations four months ahead of schedule.

-

In May 2024, CJ Logistics America announced the opening of a new 291,000-square-foot cold storage warehouse in New Century, Kansas, located 30 miles from Kansas City. The facility was developed through a joint venture with Yukon Real Estate Partners and BGO, and featured Alta EXPERT refrigeration along with rail access for efficient logistics. It was connected to Upfield’s New Century production plant via an above-ground conveyor bridge, allowing direct delivery of finished products into the warehouse. The warehouse provided additional space for other customers and was strategically located near major highways and a transcontinental rail line to optimize shipping efficiency and reduce environmental impact.

U.S. Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.23 billion

Revenue forecast in 2033

USD 135.84 billion

Growth rate

CAGR of 13.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report frequency

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Storage, temperature range, application

Key companies profiled

AmericoldLogistics, Inc.; AGRO Merchants Group North America; Burris Logistics; Henningsen Cold Storage Co.; Lineage Logistics Holdings, LLC; Nordic Logistics; Preferred Freezer Services; VersaCold Logistics Services; United States Cold Storage; Wabash National Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cold Storage Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cold storage market report based on storage, temperature range, and application.

-

Storage Outlook (Revenue, USD Million, 2021 - 2033)

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cold storage market size was estimated at USD 42.09 billion in 2024 and is expected to reach USD 48.23 billion in 2025.

b. The U.S. cold storage market is expected to grow at a compound annual growth rate of 13.8% from 2025 to 2033 to reach USD 135.84 billion by 2033.

b. The facilities/services segment accounted for the largest share of 92.3% in 2024. The facilities and services segment continues to dominate the U.S. cold storage market, driven by rising demand for end-to-end temperature-controlled logistics, increasing complexity in food supply chains, and the rapid expansion of e-commerce grocery fulfillment

b. Some key players operating in the U.S. cold storage market include Americold Logistics, LLC; AGRO Merchants Group North America, Burris Logistics, Cloverleaf Cold Storage, Henningsen Cold Storage Co., Lineage Logistics Holdings, LLC.

b. Key factors that are driving the U.S. cold storage market growth include technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.