- Home

- »

- Beauty & Personal Care

- »

-

U.S. Color Cosmetics Market Size, Industry Report, 2030GVR Report cover

![U.S. Color Cosmetics Market Size, Share & Trends Report]()

U.S. Color Cosmetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Face Products, Lip Products, Eye Products, Nail Color Cosmetics), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-564-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Color Cosmetics Market Size & Trends

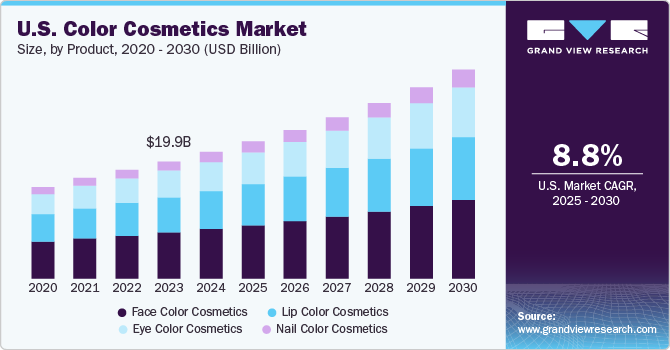

The U.S. color cosmetics market size was estimated to be estimated at USD 21.52 billion in 2024 and is expected to expand at a CAGR of 8.8% in the forecast period from 2025 to 2030. The growth of e-commerce platforms and advancements in technology have greatly reshaped the color cosmetics industry. Consumers now enjoy easier access to a diverse selection of products, while brands can connect with a wider audience through digital channels. Innovations such as augmented reality (AR) virtual try-ons have elevated the online shopping experience by enabling users to preview products before buying. This digital transformation has enhanced both convenience and personalization, playing a key role in driving market expansion.

Social media platforms such as Instagram, YouTube, and TikTok have become crucial in shaping beauty trends and influencing consumer preferences. Beauty influencers and makeup artists use these platforms to share tutorials, product reviews, and new techniques, which greatly affect purchasing decisions. Brands are increasingly turning to social media to launch products, engage with their audiences, and create viral trends that boost sales and foster brand loyalty. In 2024, the men's grooming and skincare market is rapidly growing, driven by shifting societal norms and the influence of platforms such as TikTok, where hashtags like #mensskincare have gone viral. More men are embracing skincare and beauty routines, prompting brands to expand product lines tailored to male consumers. This trend reflects changing attitudes toward masculinity and highlights how social media is shaping both consumer behavior and marketing strategies in the beauty industry.

Alongside this digital influence, there is a rising consumer demand for natural and organic color cosmetics. Shoppers prioritize products made with natural ingredients, cruelty-free practices, and eco-friendly packaging. This shift toward sustainability is encouraging many brands to reformulate their offerings and adopt more transparent and responsible supply chains to meet consumer expectations. a recent Nosto report highlights that 68% of consumers look for products labeled as “clean,” and 59% are influenced by products advertised as “natural and organic.” This trend reflects a growing awareness of the impact of synthetic chemicals on health and the environment.

Modern consumers seek beauty solutions that enhance appearance and contribute positively to skin health. This demand has led to the development of hybrid products that combine makeup's aesthetic qualities with skincare's nourishing properties. Products infused with ingredients such as hyaluronic acid, peptides, niacinamide, foundations with SPF protection, or hydrating lipsticks, aligning with the wellness-driven approach of modern consumers are becoming increasingly popular. These components offer benefits such as hydration, anti-aging effects, and improved skin texture, making them appealing to consumers who desire both cosmetic enhancement and skincare advantages. This trend reflects a broader shift towards 'skinification,' where makeup products are formulated to support skin health, thereby blurring the lines between skincare and cosmetics. As consumers become more informed and health-conscious, the demand for products that offer dual benefits continues to rise, driving the growth of the color cosmetics market in the U.S.

The growing emphasis on inclusivity and diversity in the U.S. color cosmetics market significantly influences its expansion. Consumers increasingly expect beauty brands to offer products that cater to a wide range of skin tones and reflect diverse identities. This shift is not merely a trend but a response to a long-standing demand for representation and equity in the beauty industry. Brands that prioritize inclusivity are seeing positive consumer responses. For instance, offering a broad spectrum of foundation shades allows individuals to find products that match their unique skin tones, fostering a sense of belonging and validation. This approach not only meets the practical needs of consumers but also builds brand loyalty and trust.Moreover, inclusivity extends beyond product offerings to encompass marketing strategies. Brands that feature diverse models and authentic narratives in their advertising resonate more deeply with a wide audience. Such representation ensures that all consumers feel seen and valued, which can enhance a brand's reputation and consumer engagement.

Consumer Insights & Surveys

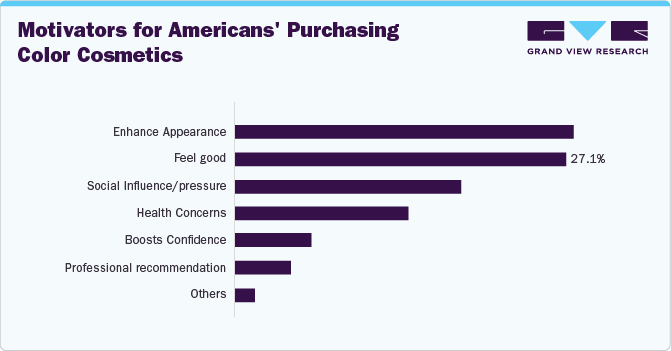

According to the survey conducted by Grand View Research of over 500 Americans, the findings show that Beauty and confidence are key motivators behind the purchase of skincare and cosmetics, though several other factors also influence consumer choices.

A majority of respondents-56%-identified the desire to enhance their appearance as the main reason for buying these products. Close behind, 55.6% said they make such purchases to feel better about themselves. In addition, 37% of participants reported that they use skincare and cosmetics to boost their self-confidence, underscoring the empowering effect these products can have on their self-esteem.

The frequency of color cosmetics purchases in the U.S. reveals that beauty shopping forms a regular part of the monthly routine for 23.4% of Americans, who may prioritize beauty as part of their lifestyle or profession. In comparison, 26% opt to refresh their beauty collections every few months to stay updated. Among more dedicated beauty enthusiasts, 22% engage in weekly purchases, often to keep up with the latest trends and product launches. Interestingly, 19.9% of respondents reported never purchasing color cosmetics, pointing to a notable segment either uninterested in or not using these products-potentially due to personal preference, demographic differences, or lifestyle choices. Only 8.7% of consumers make such purchases annually, reflecting that cosmetics are generally viewed as more routine than one-off buys.

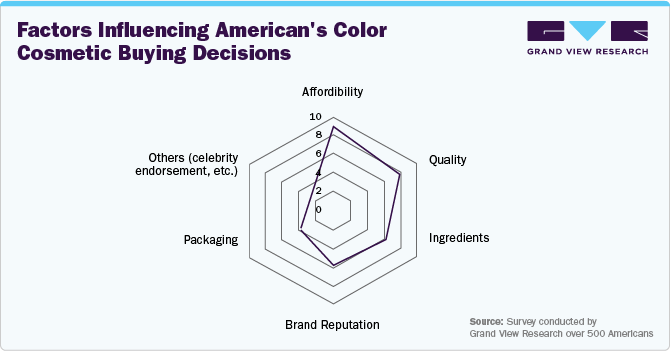

When selecting skincare and cosmetic products, a vast majority of Americans-around 90%-prioritize affordability, closely followed by quality, which is important to roughly 80% of consumers. These two factors stand out as the most influential in driving purchase decisions. Ingredients are also a key consideration for about 60% of buyers, highlighting a strong consumer preference for products made with natural and effective components. Though brand reputation still matters to approximately 50% of consumers. Meanwhile, packaging appeals to about 30%, showing that aesthetic presentation plays a moderate role in product appeal. Celebrity endorsements, however, have minimal impact-only about 10% of respondents consider them influential in their decision-making process. This suggests that authenticity and value outweigh star power in beauty purchases.

Product Insights

Facial color cosmetics accounted for a share of about 39.03% of the U.S. color cosmetics market in 2024 due to its essential role in daily beauty routines and the wide variety of products it encompasses. Items such as foundations, concealers, blushes, primers, and setting powders are fundamental for creating a flawless base, making them indispensable for many consumers. This segment's dominance is further reinforced by the growing consumer demand for products that enhance appearance and offer skincare benefits, reflecting a trend toward multifunctional beauty solutions. India-based beauty brand Ibaeuty expanded its gender-neutral product offerings with the launch of 'Gulabo' in May 2024. Designed for brown skin tones, Gulabo is a hybrid product that combines skincare and makeup, providing a pink tint while addressing skin concerns such as inflammation and breakouts. The product is marketed as gender-neutral, aligning with Ibaeuty's philosophy of inclusivity and breaking conventional beauty standards.

Demand for nail color cosmetics is projected to rise at a CAGR of 10.0% from 2025 to 2030. The rising demand for nail color cosmetics in the U.S. is largely fueled by the growing popularity of do-it-yourself (DIY) beauty routines and significant advancements in product formulations. Brands like Olive & June have tapped into this trend by offering comprehensive at-home gel systems, allowing consumers to achieve salon-quality manicures conveniently and affordably. At the same time, innovations such as gel-based, breathable, and non-toxic nail polishes have appealed to health-conscious consumers. These products, often labeled as "3-free," "5-free," or even "10-free," eliminate harmful chemicals without compromising on quality or durability, highlighting the industry's commitment to safer, more consumer-friendly solutions.

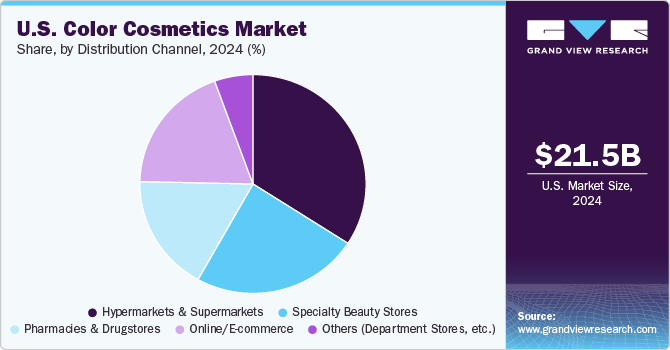

Distribution Channel Insights

Sales through hypermarkets and supermarkets accounted for a share of about 34.14% of the overall U.S. color cosmetics market in 2024 the retail formats offer unparalleled convenience and accessibility. Consumers can purchase cosmetics alongside their regular grocery shopping, streamlining their shopping experience. This one-stop-shop approach caters to time-conscious shoppers who prefer to consolidate their purchases in a single location. Moreover, the physical presence of products allows customers to examine items firsthand, fostering immediate purchasing decisions and enhancing customer satisfaction.

In response to tightening profit margins in traditional grocery sectors, supermarkets are diversifying their product offerings to include higher-margin items such as beauty products. By expanding their beauty aisles, retailers aim to increase overall profitability and attract a wider customer base interested in affordable yet quality cosmetics. Retailers are increasingly partnering with popular and emerging beauty brands to offer trendy, affordable products that resonate with consumers. For instance, Kroger's collaboration with MCoBeauty introduces over 250 new beauty products, providing customers with access to fashionable cosmetics at accessible price points.

The online distribution channel is projected to grow at a CAGR of 10.5% from 2025-2030. Online channels have revolutionized the U.S. color cosmetics market, enabling brands to transcend effortlessly. This expands market penetration and enhances brand visibility and accessibility to a diverse consumer base presented in the U.S. Moreover, advanced algorithms and sophisticated customer data analytics empower brands to deliver personalized shopping experiences. By analyzing consumer preferences and behavior, brands can offer tailored product recommendations, targeted promotions, and customized marketing campaigns. This personalized approach fosters more robust customer engagement and increases satisfaction and loyalty, driving growth in the competitive landscape of color cosmetics.

Key U.S. Color Cosmetics Company Insights

The dominance of major color cosmetics companies such as L’Oréal USA, The Estée Lauder Companies Inc., e.l.f. Beauty, Huda Beauty continues to define the upper tier of the competitive spectrum.

-

L'Oréal S.A, beauty products manufacturing company offers a wide range of products catering to diverse consumer needs, including foundations, concealers, lipsticks, eyeshadows, mascaras, and nail polishes. Their color cosmetics brands, such as L'Oréal Paris, Maybelline New York, Lancôme, and NYX Professional Makeup, are well-regarded for their innovative formulations, vibrant color palettes, and trendsetting products.

-

The Estée Lauder Companies Inc., established in 1946 by Estée and Joseph Lauder, is recognized as one of the world’s top manufacturers, marketers, and sellers of high-quality skincare, makeup, fragrance, and hair care products. It is widely acknowledged for managing a portfolio of luxury and prestige brands. The company operates globally, with its products available in around 150 countries and territories under several renowned brand names such as Estée Lauder, Clinique, Origins, M·A·C, Bobbi Brown Cosmetics, La Mer, Aveda, Jo Malone London, TOM FORD, Too Faced, Dr.Jart+, and The Ordinary.

Key U.S. Color Cosmetics Companies:

- L’Oréal USA

- The Estée Lauder Companies Inc.

- Coty Inc.

- e.l.f. Beauty

- Revlon

- Shiseido Americas

- LVMH Moët Hennessy Louis Vuitton SE

- Fenty Beauty

- Huda Beauty

- Haus Labs by Lady Gaga

Recent Developments

-

In February 2025, L’Oréal USA marked a significant milestone with the grand opening of its new North America Research & Innovation (R&I) Center in Clark, New Jersey. This $160 million investment represents the company's largest R&I facility outside of France, spanning approximately 250,000 square feet. The state-of-the-art center is designed to bolster L’Oréal's capabilities in developing innovative, high-quality, and safe beauty products tailored to the diverse needs of consumers. Housing over 600 scientists, engineers, and researchers, the facility underscores L’Oréal's commitment to scientific advancement and its strategic focus on the U.S. market. This development not only enhances the company's research endeavors but also contributes to local economic growth and employment opportunities.

-

In October 2024, e.l.f. Beauty has made significant strides in sustainability, inclusivity, and product innovation. In its report, the company highlighted that over 85% of its products are manufactured in Fair Trade Certified™ facilities, and more than 2,500 ingredients are excluded from its formulations, surpassing FDA and EU restrictions. Notably, e.l.f. Beauty stands out as the only publicly traded U.S. company with a board comprising over 78% women and 44% diverse members. The company also launched the "Dupe That!" campaign, encouraging consumers and other businesses to embrace affordable, high-quality beauty alternatives and to join in making positive impacts on people, products, and the planet.

-

In December 2024, Coty entered a long-term partnership with Swarovski to rejuvenate Swarovski's fragrance division. This collaboration aims to leverage Coty's expertise to reintroduce Swarovski's fragrances, with the first new release scheduled for 2026. The partnership aligns with Coty's strategy of acquiring licenses with multi-category potential to boost growth.

U.S. Color Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.30 billion

Revenue forecast in 2030

USD 35.52 billion

Growth rate (Revenue)

CAGR of 8.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

L’Oréal USA; The Estée Lauder Companies Inc.; Coty Inc.; e.l.f. Beauty; Revlon; Shiseido Americas; LVMH Moët Hennessy Louis Vuitton SE; Fenty Beauty; Huda Beauty; Haus Labs by Lady Gaga

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Color Cosmetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. color cosmetics market report by product and distribution channel.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Face Color Cosmetics

-

Foundation

-

Concealer

-

Blush and Bronzer

-

Powder

-

Others (Highlighter, etc.)

-

-

Lip Color Cosmetics

-

Lipstick

-

Lip Liner

-

Lip Gloss

-

Lip Tint

-

Others (Lip Powder, Plummer, etc.)

-

-

Eye Color Cosmetics

-

Eye Shadow

-

Eye Liner

-

Mascara

-

Eye Pencil

-

False Eyelashes

-

Others (Eye Primer, etc.)

-

-

Nail Color Cosmetics

-

-

Distribution Channel (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Beauty Stores

-

Pharmacies & Drugstores

-

Online/ E-commerce

-

Others (Department stores, etc.)

-

Frequently Asked Questions About This Report

b. The U.S. color cosmetics market was estimated at USD 21.52 billion in 2024 and is expected to reach USD 23.30 billion in 2025.

b. The U.S. color cosmetics market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 35.52 billion by 2030.

b. The facial color cosmetics market dominated, with a share of 39.03% in 2024. They enhance appearance and offer other skincare benefits, making them a multifunctional beauty solution.

b. Some of the key players in the U.S color cosmetics market include L’Oréal USA, The Estée Lauder Companies Inc., Coty Inc., e.l.f. Beauty, Revlon, Shiseido Americas, LVMH Moët Hennessy Louis Vuitton SE, Fenty Beauty, Huda Beauty, and Haus Labs by Lady Gaga.

b. The growth of e-commerce platforms and advancements in technology have greatly reshaped the color cosmetics industry. Consumers now enjoy easier access to a diverse selection of products, while brands can connect with a wider audience through digital channels. Innovations like augmented reality (AR) virtual try-ons have elevated the online shopping experience by enabling users to preview products before buying.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.