- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Heating Equipment Market Report, 2030GVR Report cover

![U.S. Commercial Heating Equipment Market Size, Share & Trends Report]()

U.S. Commercial Heating Equipment Market Size, Share & Trends Analysis Report By Product (Heat Pump, Furnace), By Building Floorspace, By End-use (Hospitality, Offices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-051-8

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

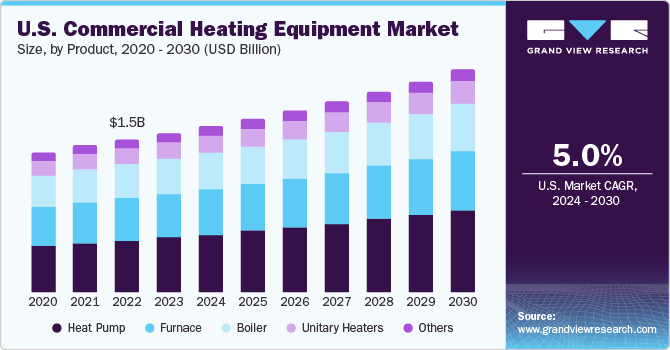

The U.S. commercial heating equipment market size was estimated at USD 1.52 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2030. Increasing commercial construction spending along with growing demand for highly energy-efficient heating solutions is projected to drive the demand for heating equipment in the U.S. Furthermore, favorable government initiatives such as rebates and incentives for installation of highly energy-efficient heating products such as heat pumps are projected to have a positive impact on the market.

As reported by the U.S. Census Bureau, construction expenditures in the U.S. amounted to USD 22.2 billion in 2022, exhibiting a growth from USD 19.8 billion in the preceding year. Growing construction spending coupled with increasing repair & replacement activities are predicted to boost heating solutions growth. The construction sector in the U.S. is focused on developing sustainable and energy-efficient structures. The Leadership in Energy & Environmental Design (LEED) is a recognized green building certification program that is established by the U.S. Green Building Council (USGBC).

LEED focuses on reducing energy consumption by designing and developing energy-efficient projects. HVAC systems must comply with the requirements outlined by New Buildings Institute, Inc.’s publication titled “Advanced Buildings: Energy Benchmark for High-Performance Buildings.” Such policies have further enabled the development and installation of environmentally sustainable solutions.

Commercial heating is an essential factor in the transition of establishments equipped with fossil fuel-based systems in the U.S. to buildings incorporated with renewable energy-based systems since it accounts for a considerable share of the energy consumption of the country. For instance, the Governor of Maine has proposed the installation of 100,000 high-performance heat pumps in homes and businesses in the state by 2025. Moreover, Maine is also making significant headway by having installed over 28,000 high-efficiency heat pumps just one year after making the commitment. These factors are expected to drive the demand for commercial heating equipment in the U.S. over the forecast period.

Moreover, the replacement of existing commercial heating equipment with energy-saving solutions is expected to be one of the major factors influencing the growth of the market in the country. Surging space heating requirements in the U.S. are projected to propel the demand for energy-efficient heating solutions, thereby increasing the demand for certified commercial heating equipment in the country.

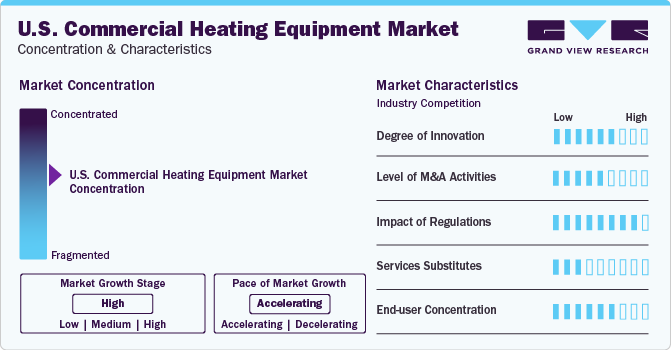

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. U.S. commercial heating equipment market is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include Ingersoll Rand; Lennox International Inc.; Burnham Holdings, Inc.; Johnson Controls; Robert Bosch GmbH; Honeywell International Inc.; Daikin Comfort Technologies North America, Inc.; Emerson Electric Co.; Rheem Manufacturing Company; American Heating

The market is significantly influenced by a complex regulatory landscape, encompassing energy efficiency standards, environmental regulations, and building codes. Stringent energy efficiency mandates, such as those set by the Department of Energy (DOE), have a profound impact, driving innovation in HVAC technologies to meet or exceed efficiency requirements. Additionally, environmental regulations targeting refrigerants, such as the phasedown of hydrofluorocarbons (HFCs) outlined in the Kigali Amendment to the Montreal Protocol, are reshaping the market towards more sustainable and eco-friendly refrigerant solutions.

The market is influenced by a diverse range of sectors, including commercial real estate, hospitality, healthcare, manufacturing, and other commercial establishments. The concentration of end-users in specific industries or geographical regions can have a significant effect on the demand for heating equipment, as economic conditions, regulatory requirements, and industry trends vary across sectors. For instance, fluctuations in the construction and real estate sectors directly impact demand for commercial heating solutions. Changes in consumer preferences, such as a growing focus on energy efficiency and sustainability, can also influence purchasing decisions among end-users. Additionally, regional variations in climate and building practices contribute to diverse heating needs, affecting the concentration of demand in specific areas.

The market is experiencing a significant degree of innovation driven by a confluence of factors. Technological advancements, coupled with a heightened focus on energy efficiency and sustainability, are propelling manufacturers to develop cutting-edge solutions. The industry is witnessing a surge in smart technologies, including IoT integration and advanced controls, enabling remote monitoring and optimization of heating systems.

Product Insights

The heat pump product segment dominated the market and accounted for 34.5% in 2023. Heat pumps are used for temperatures with moderate warming and cooling requirements. It can provide equivalent area conditioning at one-fourth the operating cost than conventional HVAC systems. With a growing emphasis on energy efficiency and sustainability, heat pumps have gained popularity due to their high energy efficiency ratings. Government regulations and incentives promoting energy-efficient technologies have also encouraged the adoption of heat pumps.

The boiler segment is expected to grow at a significant CAGR over the forecast period. Boilers are used for various applications such as water heaters, power generation, cooking, central heaters, and sanitation. They are extensively preferred in the commercial, institutional, industrial, as well as the educational sector. Boilers are further segmented into two broad categories namely, water boilers and steam boilers. Hot water remains essential to daily requirements in kitchens and laundries. The increasing population & rapid development of housing projects are expected to augment the growth of water boilers over the coming years.

Building Floorspace Insights

The up to 5,000 sq. ft. building floorspace segment held the largest share of the U.S. revenue in 2023. Increasing commercial building floor space of up to 5,000 square feet will demand more commercial construction which will further propel the demand for heating equipment as they assist in reducing energy waste while lowering operating costs and improving comfort.

In the U.S., there are 5.6 million commercial buildings with 51 billion square feet to 87 billion square feet of floor space. One of the major issues that must be addressed when it comes to commercial buildings is the need to decarbonize the operations in the construction of commercial buildings between 5,001 square feet to 10,000 square feet. As a result, commercial heating equipment such as the rooftop units is widely used in the commercial space.

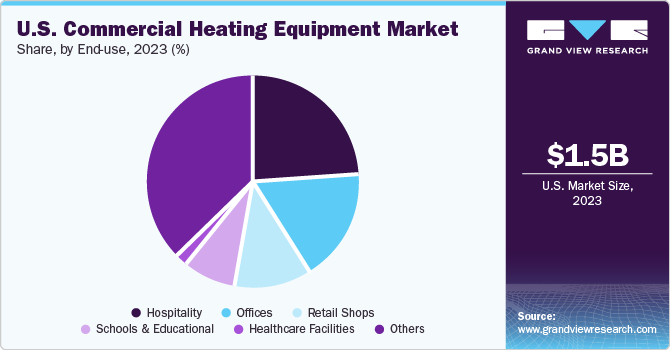

End-use Insights

The demand for U.S. commercial heating equipment in the hospitality end-use sector is anticipated to dominate the market in 2023 owing to its distinctive heating applications. The continuous expansion of the hospitality sector, coupled with a heightened focus on sustainability, drives the innovation and customization of heating systems, solidifying its pivotal role in the commercial heating equipment market.

Schools and educational institutions represent a significant segment of the market due to their diverse heating requirements. These facilities necessitate efficient heating solutions for classrooms, auditoriums, gyms, and administrative spaces to create optimal learning environments. The emphasis on student well-being and productivity underscores the need for reliable and controllable heating systems, often integrating technologies such as programmable thermostats and energy-efficient HVAC units. With a growing focus on sustainability in educational settings, there is an increasing demand for eco-friendly heating technologies, including geothermal and solar solutions, driving innovation in the commercial heating sector for this crucial end-use segment.

Regional Insights

The market in the Southeast region of the country accounted for the maximum revenue share of 23.0% in 2023. The increasing population of the Southeastern part of the U.S. is expected to drive the requirement for commercial spaces. This is anticipated to further fuel the demand for commercial heating equipment over the forecast period as this equipment creates healthy, comfortable, and safe environments for users while minimizing energy consumption.

The Northeastern region is expected to register the fastest CAGR over the forecast period. The growing population in the Northeastern part of the U.S. is expected to fuel the requirement for commercial spaces such as malls, stores, offices, and hotels wherein commercial heating equipment are installed to reduce energy wastage and improve comfort for end-users. This, in turn, is anticipated to surge the demand for commercial heating equipment in the Northeastern U.S. over the forecast period.

Key Companies & Market Share Insights

Some of the key players operating in the market include Carrier Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Ingersoll-Rand Plc, Daikin Industries, Ltd.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to retail, commercial, transport, and food service sectors. It was acquired by United Technologies Corporation in 1979, however, it was separated into a separate business in April 2020.

-

Mitsubishi Electric Corporation is engaged in designing, manufacturing, and selling electrical and electronic equipment. It operates through six business segments, namely Energy & Electric Systems, Industrial Automation Systems, Information & Communication Systems, Electronic Devices, Home Appliances, and Others. The company markets and sells its products through distributors, retailers, and dealers. It offers its solutions to various industries including education, healthcare, manufacturing, government, hospitality, and pharmaceuticals.

Rheem Manufacturing, Lennox International, Viessmann Groupare some of the emerging market participants in the U.S. commercial heating equipment market.

-

Rheem Manufacturing manufactures products for water heating, heating & cooling, pool & spa heating, commercial refrigeration, and home enhancement. It is one of the largest manufacturers of water heating products in North America. The company makes water-heating products for commercial and residential applications. It sells its products through various brands including Rheem, Ruud, Richmond, Raypak, HTPG, Eemax, Ecomsmart, and IBC. The company has a presence in North America, South & Central America, Asia Pacific, Middle East & Africa and Latin America. It offers a line of cooling, heating, and water heating products with a 50% reduction in greenhouse gas footprint by 2025.

-

Lennox International operates through three business segments, namely residential heating & cooling, refrigeration, and commercial heating & cooling. The company offers furnaces, heat pumps, air conditioners, indoor air quality equipment, packaged heating and cooling systems, comfort control products, and replacement parts.

Key U.S. Commercial Heating Equipment Companies:

- Carrier Corporation

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Ingersoll-Rand Plc

- Daikin Industries, Ltd.

- Rheem Manufacturing

- Lennox International

- Johnson Controls, Inc.

- Robert Bosch GmbH

- Viessmann Group

Recent Developments

-

In July 2023, Rheem Manufacturing Company acquired DEJONG from Nordian Capital, a manufacturer and supplier of stainless steel hot water tanks.

-

In June 2023, Automated Logic Corporation, a part of Carrier, announced that it had signed an agreement for the acquisition of Standard Plumbing Heating Controls (SPHC), a Washington-based independent Automated Logic Dealer. SPHC provides HVAC and building automation services for various establishments, including colleges, schools, commercial buildings, universities, and healthcare facilities.

U.S. Commercial Heating Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.13 billion

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, building floorspace, end-use, region

Country scope

U.S.

Region Scope

Northeast; Southeast; Midwest; Southwest; West

Key companies profiled

Carrier Corporation; Mitsubishi Electric Corporation; Emerson Electric Co.; Ingersoll-Rand Plc; Daikin Industries, Ltd.; Rheem Manufacturing; Lennox International; Johnson Controls, Inc.; Robert Bosch GmbH; Viessmann Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Heating Equipment Market Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. commercial heating equipment market report based on product, building floorspace, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heat Pump

-

By Capacity

-

Up to 75,000

-

75,001 - 120,000

-

120,001 - 240,000

-

240,001 -360,000

-

above 360,000

-

-

By Type

-

Water-Borne Heat Pump

-

up to 35 °C

-

35 to 45 °C

-

46 to 60 °C

-

61 to 80 °C

-

above 80 °C

-

-

Air-Borne Heat Pump

-

-

-

Furnace

-

By Capacity

-

upto 350,000

-

350,001 to 550,000

-

550,001 to 750,000

-

750,001 to 950,000

-

above 950,000

-

-

-

Boiler

-

By Capacity

-

up to 10 MMBtu/hr

-

10-50 MMBtu/hr

-

50-100 MMBtu/hr

-

100-250 MMBtu/hr

-

above 250 MMBtu/hr

-

-

By Type

-

Condensing

-

Non-condensing

-

-

-

Unitary Heaters

-

By Capacity

-

up to100,000

-

100,001 - 250,000

-

250,001 - 500,000

-

above 500,000

-

-

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Shops

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational

-

Others

-

-

Building Floorspace Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 5,000 sq. ft.

-

5,001 to 10,000 sq. ft

-

10,001 to 25,000 sq. ft

-

25,001 to 50,000 sq. ft

-

50,001 to 100,000 sq. ft

-

above 100,000 sq. ft

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Southeast

-

Midwest

-

Southwest

-

West

-

Frequently Asked Questions About This Report

b. U.S. commercial heating equipment market size was estimated at USD 1.52 billion in 2023 and is expected to be USD 1.59 billion in 2024.

b. The U.S. commercial heating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 2.13 billion by 2030.

b. Southeast region dominated the market in 2023 by accounting for a share of 23.0% of the market. The increasing population of the Southeastern part of the U.S. is expected to drive the requirement for commercial spaces. This is anticipated to further fuel the demand for commercial heating equipment over the forecast period.

b. Some of the key players operating in the U.S. commercial heating equipment market include Carrier Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Ingersoll-Rand Plc, Daikin Industries, Ltd., Rheem Manufacturing, Lennox International, Johnson Controls, Inc., Robert Bosch GmbH, Viessmann Group.

b. Growing preference for energy-efficient certified products is anticipated to be one of the major factors influencing growth over the forecast period. Moreover, rising energy consumption in the industrial and residential sectors is projected to drive the preference for solutions that reduce overall operational costs and improve energy savings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."