- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Paving Slabs Market Size Report, 2030GVR Report cover

![U.S. Commercial Paving Slabs Market Size, Share & Trends Report]()

U.S. Commercial Paving Slabs Market (2022 - 2030) Size, Share & Trends Analysis Report By Material (Concrete, Stone, Clay, Crushed Stone), And Segment Forecasts

- Report ID: GVR-1-68038-788-9

- Number of Report Pages: 61

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

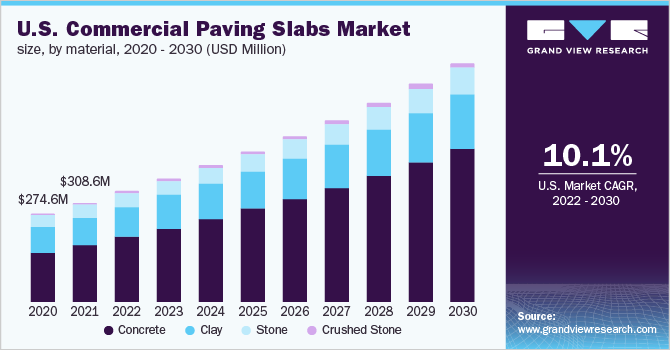

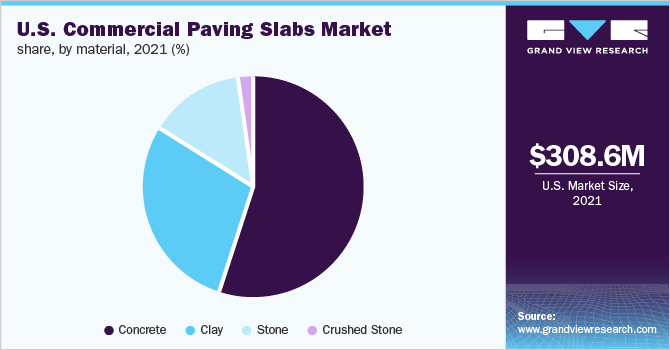

The U.S. commercial paving slabs market size was valued at USD 308.6 million in 2021 and is expected to exhibit a compounded annual growth rate (CAGR) of 10.1% during the forecast period. Increasing construction activities across the country with a focus on strong, durable, and aesthetically pleasing flooring solutions is expected to drive market growth throughout the forecast period.

The market witnessed a slight decline in growth, due to the lack of demand from the construction sector. Restrictions imposed due to the pandemic caused a temporary closure of the construction activities, resulting in a shortage of demand for the paving slabs in new and re-development construction activities, which reduced the demand for the product. However, the early lifting of the restrictions on construction activities and the relief work for COVID-19 within the region have helped in regaining the market with minimal losses.

The market is expected to be driven by an increase in commercial construction activities to account for the improving economic health. The rise in the growth of commercial sectors like food and consumer goods has led to an increase in office and storage space requirements. This has contributed significantly to the construction industry and the need for durable and aesthetic floorings in the form of paving slabs. The improving standard of living in households has caused an increase in awareness about the benefits of using paving for flooring in construction. This increased level of income has led to a rise in the use of paving slabs for flooring due to their aesthetic and useful properties. While conventional alternatives like tiles are still preferred by some, the performance, maintenance, and cost properties have given rise to a higher rate of adaptation of paving slabs.

Product manufacturers have a highly integrated supply chain with a majority of the players engaged in the production of raw materials, used in the manufacture of paving slabs. The majority of the players have an extensive direct distribution network that helps in a smooth flow of the products and helps them to create a larger product portfolio with multiple customization options, which is a key factor in purchase decisions. The presence of multiple players having higher quality products and competitive prices with slight product differentiation has induced lower switching costs for the customer thereby increasing the bargaining power of the buyers. Simultaneously, the rising popularity of the product because of its combined properties of strength, maintenance, and beauty has kept the threat of substitutes to the minimum.

Material Insights

Concrete paving slabs led the market and accounted for over 57.0% share of the revenue in 2021. A rise in expenditure on landscaping and focus on higher performance at a lower price is expected to drive the market during the forecast period. The use of concrete pavers is also expected to rise with the development of permeable pavers, which allow for water run-off, making it more environmentally viable. The market for stone pavers is restricted by their high prices as the raw materials required to manufacture stone pavers are imported, which increases its production cost. The market for stone pavers is mainly limited to premium commercial installation and their interior décor uses due to a higher degree of customizability along with superior strength.

The market for clay pavers is expected to witness steady growth in demand due to its popularity among the smaller to medium commercial establishments. These users focus on lower purchase and maintenance costs, both of which are fulfilled by the clay pavers along with their characteristics like fire and stain resistance. Crushed stone is primarily used by architects in abstract interior décor due to its low strength and high maintenance factors. The high customization possibilities in design and color according to the client's requirements are the major factor in the buyer’s choice. However, low penetration and higher cost are the major factors for the restricted growth of the market.

Key Companies & Market Share Insights

Key industry participants operate integrated supply chains and extensive self and third-party distribution networks to maintain a higher profit margin. Most of the players are privately held companies, focusing on their product portfolios and extensive product customizations in terms of size, color, and texture. Key players in the industry are expected to maintain their position in the market by introducing innovative products that have properties such as recyclability and using eco-friendly products. The development of products such as permeable paving options and ADA compliant paving are likely to help the companies to strengthen their market position. Some prominent players in the U.S. commercial paving slabs market include:

-

Hanover Architectural Products

-

Unilock Ltd

-

Artistic Paver Manufacturing, Inc.

-

Pavestone, LLC.

-

Abbotsford Concrete Products Ltd.

-

Westile Roofing Products

-

Sunny Brook Pressed Concrete, Co.

-

Mutual Materials Company

-

Techo-Bloc, Inc.

-

Concrete Collaborative

-

Tile Tech, Inc.

-

Wausau Tile, Inc.

U.S. Commercial Paving Slabs Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 344.8 million

Revenue forecast in 2030

USD 735.8 million

Growth Rate

CAGR of 10.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million square feet, revenue in USD million, CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Material

Country scope

U.S.

Key companies profiled

Hanover Architectural Products; Unilock Ltd; Artistic Paver Manufacturing Inc.; Pavestone, LLC.; Abbotsford Concrete Products Ltd.; Westile Roofing Products; Sunny Brook Pressed Concrete, Co.; Mutual Materials Company; Techo-Bloc, Inc.; Concrete Collaborative; Tile Tech, Inc.; Wausau Tile, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth and provides an analysis of the industry trends in the sub-segments from 2022 to 2030. For this study, Grand View Research has segmented the U.S. Commercial Paving Slabs market report based on the product:

-

U.S. Commercial Paving Slabs Market Material Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2030)

-

Concrete

-

Clay

-

Stone

-

Crushed Stone

-

Frequently Asked Questions About This Report

b. The U.S. Commercial Paving Slabs market size was estimated at USD 308.6 million in 2021 and is expected to reach USD 344.8 million in 2022.

b. The U.S. Commercial Paving Slabs market is expected to grow at a compound annual growth rate of 10.1% from 2022 to 2030 to reach USD 735.8 million by 2030.

b. Concrete paving slabs led the market and accounted for about 57% share of the revenue in 2021, which can be attributed to the increase in commercial construction focusing on durable, high performance, and aesthetically superior flooring solutions.

b. Some of the key players operating in the U.S. Commercial Paving Slabs market include Hanover Architectural Products, Unilock Ltd, Artistic Paver Manufacturing, Inc., Pavestone, LLC., Abbotsford Concrete Products Ltd., Westile Roofing Products, Sunny Brook Pressed Concrete, Co., Mutual Materials Company, Techo-Bloc, Inc., Concrete Collaborative, Tile Tech, Inc., and Wausau Tile, Inc.

b. The key factors that are driving the U.S. Commercial Paving Slabs market include growing commercial construction activities in the U.S. and increasing demand for aesthetically pleasing, and at the same time strong and durable, flooring landscape.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.