- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Restoration Waterproofing Membranes Market Report, 2021-2028GVR Report cover

![U.S. Commercial Restoration Waterproofing Membranes Market Size, Share & Trends Report]()

U.S. Commercial Restoration Waterproofing Membranes Market Size, Share & Trends Analysis Report By Product (Liquid Applied, Sheet), By Application (Roofing, Building Structures), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-309-6

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

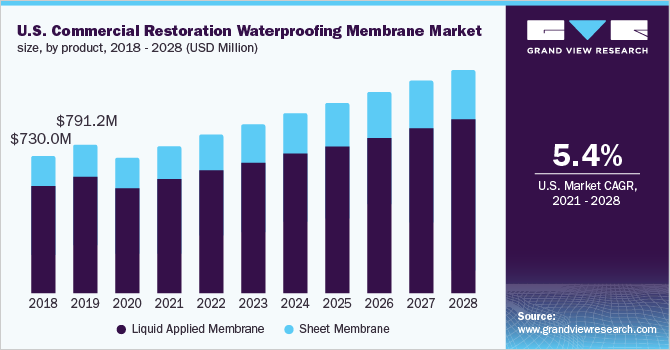

The U.S. commercial restoration waterproofing membranes market size was estimated at USD 715.8 million in 2020 and is expected to expand at a compounded annual growth rate (CAGR) of 5.4% from 2021 to 2028. Rising emphasis on disaster management plans in government and private offices to minimize economic losses during calamities is expected to drive the market growth. The U.S. is one of the major countries which witnessed a severe impact due to the outbreak of COVID-19 pandemic in 2020. The lockdown strategies and social distancing norms in the U.S. restricted the building and construction activities, thus postponing the commercial restoration projects and negatively impacting the demand for waterproofing membranes.

The pandemic also led to imposition of lockdown regulations in the countries engaged in production of precursor materials for waterproofing solutions. These regulations also led to transport restrictions, thus disrupting the global supply chain. This in turns further impacted production of waterproofing membranes in the U.S.

The use of waterproofing membranes helps in increasing the life of building structure, as they avoid the corrosions of TMT bars and other structural instruments due to issues such as water leakage, which may cause problems like lowering of structural strength. Thus, companies in the U.S. tend to invest a large sum of money over repair and maintenance of buildings to keep up operations and avoid losses due to them.

The U.S. is witnessing an emerging trend of disaster management insurance schemes at the time of construction of buildings. Various agencies are involved in providing such schemes via long-term agreements with customer companies, which involves making disaster management plans, repair works at the time of occurrence, training of employees, and risk analysis of the building locations from various disasters.

New waterproofing systems, when compared to traditional systems, offer advantages in terms of cost reduction, better planning, and overall concrete protection. Technological innovations aimed for the development of new materials for waterproofing by companies such as Sika AG and BASF SE are expected to remain critical success factors for market growth over the forecast period.

Product Insights

Liquid applied membranes products led the U.S. commercial restoration waterproofing membranes market and accounted for about 78% share of the global revenue in 2020. In addition, these membranes are expected to witness the highest growth over the forecast period on account of increasing infrastructural investment, along with the growing awareness about the product and its cost-effectiveness.

Polyurethane liquid membranes offer advantages over traditional waterproofing solutions owing to their high functionality in geometrically complicated connections and low energy usage. In addition, these products offer aesthetically and structurally seamless solutions, thus exhibiting high growth potential over the forecast period.

Sheet membrane products are expected to expand at a CAGR of 5.5% over the forecast period, on account of their high functionality in underground structures. These products offer high strength, durability, and tear resistance properties, thus are suitable for utilization in suitable structures such as swimming pools and tunnels.

Bituminous segment dominated the U.S. commercial restoration sheet membranes demand and accounted for a notable market revenue share in 2020. Bituminous sheets have been used traditionally in roofing applications. However, the black color of the product is considered to absorb heat which is expected to restrain the market growth over the forecast period

Application Insights

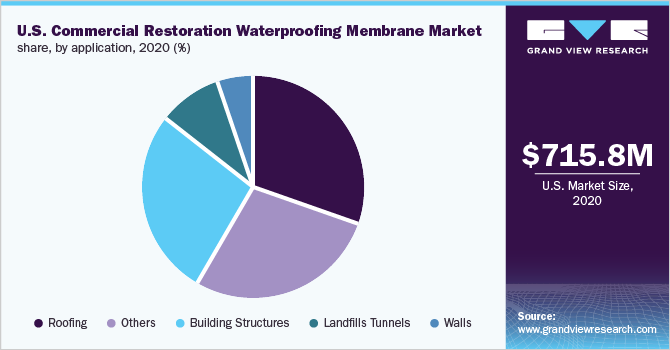

Roofing application led the market and accounted for about 30% share of the revenue in 2020, as this being a preferred option for protection against rainwater and environmental moisture. In addition, the membranes also offer high thermal resistance and strength properties to roofing materials to withhold foot traffic.

In case of large area, generally sheet products are preferred, whereas in case of smaller areas, liquid applied membranes are preferred. Sheet products are preferred over liquid applied membranes, in large areas on account of their ability to cover gaps and bridge over cracks with higher effectiveness.

Building structures also emerged as one of the largest end-use segments for commercial restoration waterproofing membranes, as they are applied to improve the shelf life of the building and protect the structure from varying temperatures. Liquid applied membranes are highly preferred for building structures as they provide high level of protection to the initial paint coat.

Sheet membranes are primarily used in flooring applications, to reduce the risk of accidents. With growing number of infrastructural projects such as renewable power generation, water treatment systems, and others, the demand for waterproofing membranes, particularly liquid applied solutions is likely to grow over the next eight years.

Key Companies & Market Share Insights

The U.S. commercial restoration waterproofing membranes industry is highly fragmented in nature owing to the presence of several key players such as Sika AG, Coverstro AG and BASF SE. The major players in the industry are employing efforts to extend their operations across the value chain through backward or forward integration strategies.

The manufacturers are entering into raw material manufacturing as it leads to uninterrupted supply of raw materials and low production costs. For Instance, companies such as BASF, which are engaged in manufacturing of precursor materials such as polymers and bitumen incur low raw materials through captive consumption. Some of the prominent players operating in the U.S. commercial restoration waterproofing membranes market are:

-

Sika AG

-

BASF SE

-

Kemper System America, Inc.

-

DuPont de Nemours, Inc.

-

GAF Materials Corporation

-

Johns Manville

-

Alchimica

-

Saint-Gobain Weber GmbH

-

Isomat S.A.

-

Covestro AG

U.S. Commercial Restoration Waterproofing Membranes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 774.4 million

Revenue forecast in 2028

USD 1.19 billion

Growth Rate

CAGR of 5.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in Million Square Meters, Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Volume Forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Sika AG; BASF SE; Kemper System America, Inc.; DuPont de Nemours, Inc.; GAF Materials Corporation; Johns Manville

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the U.S. commercial restoration waterproofing membranes market report based on product and application:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2028)

-

Liquid Applied Membranes

-

Cementitious

-

Bituminous

-

Polyurethane

-

Acrylic

-

Others

-

-

Sheet Membranes

-

Bituminous

-

PVC

-

EPDM

-

Others

-

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2028)

-

Roofing

-

Walls

-

Building Structures

-

Landfills & Tunnels

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. commercial restoration waterproofing membranes market size was estimated at USD 715.8 million in 2020 and is expected to reach USD 774.4 million in 2021.

b. The U.S. commercial restoration waterproofing membranes market is expected to grow at a compound annual growth rate of 5.4% from 2021 to 2028 to reach USD 1.19 billion by 2028.

b. Liquid applied membranes dominated the U.S. commercial restoration waterproofing membranes market with a share of 78 % in 2020. This is attributed to the high-cost effectiveness along with superior functionality in geometrically complicated connections and low energy usage.

b. Some of the key players operating in the U.S. commercial restoration waterproofing membranes market include Sika AG, BASF SE, Kemper System America, Inc., DuPont de Nemours, Inc., GAF Materials Corporation, Johns Manville.

b. The key factors that are driving the U.S. commercial restoration waterproofing membranes market include growing emphasis on disaster management plans to minimize economic loss during calamities and rising awareness regarding the application of membrane solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."