- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Windows Market, Industry Report, 2033GVR Report cover

![U.S. Commercial Windows Market Size, Share & Trends Report]()

U.S. Commercial Windows Market (2026 - 2033) Size, Share & Trends Analysis Report By Mechanism (Sliding, Swing), By Frame Material, By End Use, By Region (New York, Pennsylvania, Massachusetts, Michigan, Virginia, Illinois, Wisconsin, New Jersey), And Segment Forecasts

- Report ID: GVR-4-68039-229-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Commercial Windows Market Summary

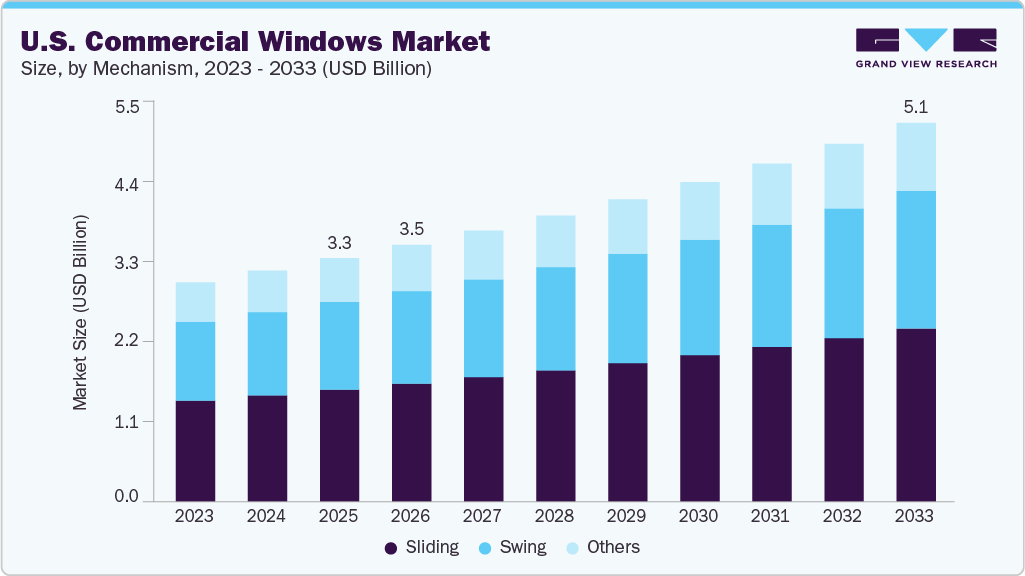

The U.S. commercial windows market size was estimated at USD 3.27 billion in 2025 and is projected to reach USD 5.09 billion by 2033, growing at a CAGR of 5.7% from 2026 to 2033. Demand for commercial windows in the U.S. is increasing due to sustained growth in non-residential construction, particularly across offices, healthcare facilities, educational institutions, and retail spaces.

Key Market Trends & Insights

- New York dominated the U.S. commercial windows market with the largest revenue share of 10.3% in 2025.

- By mechanism, the swing segment is expected to grow at the fastest CAGR of 5.8% over the forecast period.

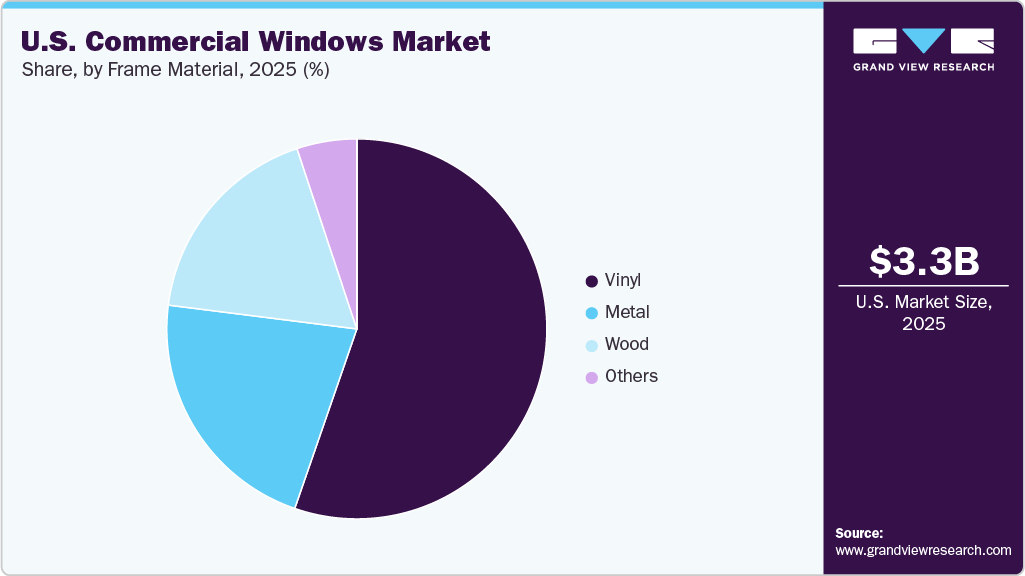

- By frame material, the vinyl segment is expected to grow at the fastest CAGR of 6.0% over the forecast period.

- By end use, the new commercial segment is expected to grow at the fastest CAGR of 5.8% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 3.27 Billion

- 2033 Projected Market Size: USD 5.09 Billion

- CAGR (2026-2033): 5.7%

- New York: Largest market in 2025

- Massachusetts: Fastest growing market

Aging commercial infrastructure is driving replacement demand, especially in older office buildings and public facilities that require energy-efficient retrofits. Rising investments in smart buildings and green-certified commercial properties are accelerating window upgrades. Urban redevelopment and mixed-use projects are also contributing to higher demand. Increased emphasis on occupant comfort, daylight optimization, and aesthetics in commercial architecture further supports adoption. Post-pandemic workplace redesigns focusing on ventilation and natural light have reinforced demand.

Key drivers include stricter building energy performance requirements, rising electricity costs, and growing adoption of energy-efficient glazing solutions. Developers increasingly prefer high-performance windows that reduce HVAC loads and improve insulation. Corporate sustainability goals are pushing demand for low-emissivity, insulated, and solar-control windows. Advancements in façade design and demand for larger glass surfaces in commercial buildings also act as strong demand drivers. Safety and security requirements in institutional buildings are boosting demand for impact-resistant and laminated glass windows. Noise reduction requirements in urban commercial zones further support adoption. In addition, higher lifecycle cost awareness among commercial property owners favors durable and low-maintenance window systems.

Technological innovations such as triple glazing, dynamic glazing, and electrochromic windows are transforming the commercial windows market. Smart window integration with building management systems is gaining traction in premium commercial projects. Lightweight yet high-strength frame materials are improving performance while reducing installation complexity. Enhanced thermal break technologies are becoming standard across aluminum window systems. Customizable façade solutions tailored to commercial architectural requirements are trending. Manufacturers are focusing on sustainable materials and recyclability to meet ESG goals. Digital design tools and prefabricated window systems are also improving project efficiency and precision.

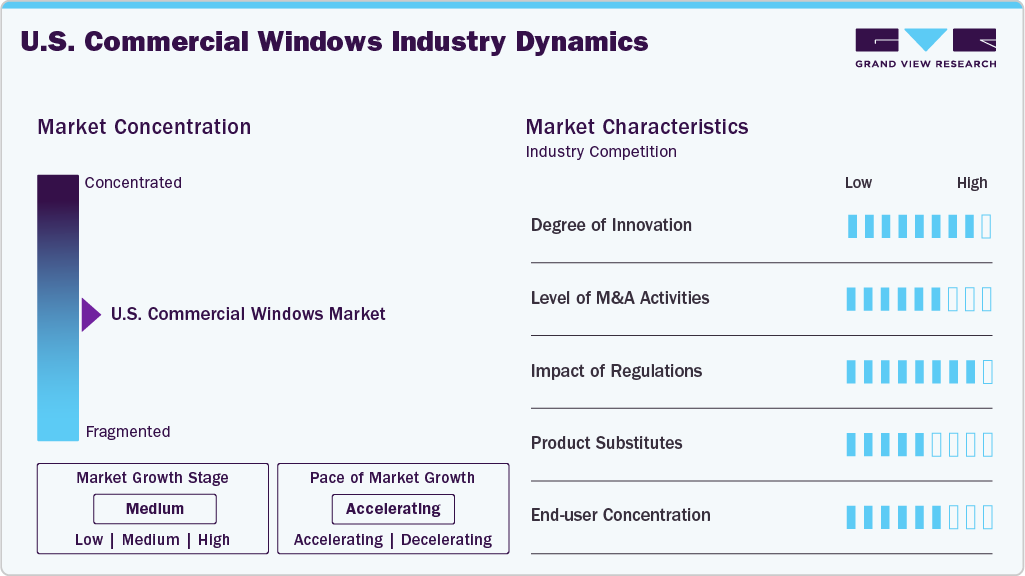

Market Concentration & Characteristics

The U.S. commercial windows market is moderately consolidated, with a mix of large multinational manufacturers and strong regional players. Leading companies dominate large-scale commercial and institutional projects through established contractor networks and brand trust. However, regional manufacturers remain competitive in localized construction and retrofit markets. Product differentiation through performance, customization, and service quality plays a key role in competition. Entry barriers are moderate due to certification requirements and technical expertise. Pricing competition exists, but performance compliance remains a decisive factor.

The threat of substitutes is moderate, as alternative façade materials such as curtain walls and glass walls overlap with commercial window applications. However, windows remain essential for ventilation, energy regulation, and design flexibility. Curtain wall systems often complement rather than replace commercial windows in many buildings. Skylights and façade glazing solutions provide partial substitution but do not eliminate window demand. Cost and installation complexity limit substitution in retrofit projects. Regulatory requirements often mandate specific window performance standards, reducing substitution risk. As a result, commercial windows maintain a strong functional position in building design.

Mechanism Insights

The sliding segment held the highest revenue market share of 46.1% in 2025, due to its wide adoption across offices, retail spaces, hospitality buildings, and institutional facilities. Sliding windows are preferred for their space-saving design, ease of operation, and ability to accommodate large glass panels. Their compatibility with modern architectural layouts and façade designs supports extensive use in commercial construction and refurbishment projects. Sliding systems also offer good ventilation and daylight access while maintaining structural simplicity. Lower maintenance requirements and efficient installation further contribute to their revenue dominance.

The swing segment is expected to grow significantly at a CAGR of 5.8% over the forecast period, owing to increasing demand for improved ventilation, safety, and design flexibility in commercial buildings. Swing windows are widely used in healthcare, educational, and institutional facilities where controlled airflow and accessibility are critical. Advancements in hardware and sealing technologies have enhanced durability and energy performance. Growing emphasis on user comfort and building safety standards supports adoption. Swing systems also allow better cleaning and maintenance access in multi-story buildings. These factors collectively drive strong growth potential for the swing segment.

Frame Material Insights

The vinyl segment held the highest revenue market share of 55.3% in 2025, due to its cost efficiency, low maintenance requirements, and strong thermal insulation properties. Vinyl windows are widely adopted across office buildings, educational institutions, and healthcare facilities, particularly in refurbishment and replacement projects. Their resistance to moisture, corrosion, and weather-related degradation makes them suitable for long-term commercial use. Ease of installation and compatibility with energy-efficient glazing systems further support adoption. Commercial property owners prefer vinyl windows for achieving regulatory compliance at lower lifecycle costs. As a result, vinyl continues to dominate overall revenue generation.

The metal segment is expected to grow significantly at a CAGR of 5.8% over the forecast period, owing to rising demand for durable, high-strength window systems in modern commercial construction. Aluminum and steel frames are increasingly used in high-rise buildings, large façades, and architecturally complex projects. Advancements in thermal break technologies have improved the energy performance of metal windows, addressing earlier efficiency limitations. Growing preference for contemporary designs with larger glass areas further supports metal adoption. Metal windows also offer superior structural stability and design flexibility. These factors collectively drive strong growth prospects for the metal segment.

End Use Insights

The new construction segment held the highest revenue market share of 79.4% in 2025, driven by new office developments, institutional buildings, mixed-use complexes, and large commercial infrastructure projects. Growing urbanization and the expansion of business districts are increasing the number of installations in newly built structures. Developers prefer high-performance commercial window systems that comply with modern energy efficiency and safety standards. Large glass façades and contemporary architectural designs are supporting higher adoption of aluminum and advanced glazing solutions. Integration of windows with modern building envelopes is becoming standard in new projects.

The refurbishment segment is expected to grow significantly at a CAGR of 5.5% over the forecast period, due to the need to upgrade aging buildings to meet current energy efficiency and safety requirements. Replacement of older windows with insulated and high-performance systems helps reduce energy costs and improve indoor comfort. Urban centers with mature commercial infrastructure are witnessing strong retrofit activity. Property owners increasingly prioritize lifecycle cost savings and regulatory compliance. Refurbishment projects typically favor minimally disruptive installation solutions. As sustainability goals and renovation investments increase, refurbishment continues to emerge as a key growth driver.

Regional Insights

New York Commercial Windows Market Trends

The New York commercial windows market dominated with the highest revenue share of 10.3% in 2025, driven by large-scale office towers, institutional buildings, and dense mixed-use developments, particularly in metropolitan areas. Continuous refurbishment of aging commercial infrastructure drives strong replacement demand for high-performance and noise-reducing window systems. Stringent energy efficiency standards and sustainability requirements push adoption of advanced glazing and thermally efficient window technologies. High-rise construction favors aluminum-framed commercial windows with enhanced structural strength. Demand from healthcare, education, and transportation facilities further supports market dominance.

Pennsylvania Commercial Windows Market Trends

Pennsylvania’s commercial windows market is primarily driven by retrofit and replacement activities across offices, manufacturing facilities, healthcare buildings, and educational institutions. The presence of older commercial properties supports consistent demand for durable and energy-efficient window systems. Climate variability increases preference for insulated and weather-resistant windows. Cost efficiency and long service life are major purchasing considerations among commercial property owners. Public sector infrastructure investments contribute to steady installation volumes. The market shows stable growth with a strong focus on modernization.

Massachusetts Commercial Windows Market Trends

The Massachusetts commercial windows market is shaped by strict energy efficiency standards and strong adoption of sustainability-focused construction practices. Demand is high across office buildings, research facilities, healthcare centers, and academic institutions. Retrofit projects dominate due to aging infrastructure and regulatory compliance needs. High-performance glazing and advanced insulation systems are widely preferred. Architectural design quality also influences material selection in urban developments. The market favors premium, energy-efficient commercial window solutions.

Michigan Commercial Windows Market Trends

Michigan’s commercial windows market is supported by industrial facilities, logistics hubs, offices, and institutional buildings. Replacement demand is significant due to exposure to extreme seasonal temperatures, driving adoption of thermally efficient window systems. Durability and cost effectiveness remain key purchasing criteria. Manufacturing-linked commercial construction supports steady demand. Public infrastructure upgrades contribute to consistent procurement. Overall, the market exhibits moderate growth with emphasis on performance and reliability.

Key U.S. Commercial Windows Company Insights

Key companies in the U.S. commercial windows industry include PGT Innovation, Inc., Cornerstone Building Brands, Starline Windows, and others. These companies adopt various strategies to enhance their competitive edge. New product launches focus on innovative designs and energy-efficient technologies, catering to evolving consumer preferences. Strategic collaborations with suppliers and industry partners aim to streamline operations and expand market reach. Mergers and acquisitions consolidate resources, diversify product offerings, and enhance distribution networks. Furthermore, companies invest in research and development to improve product quality and sustainability, ensuring they meet regulatory standards and customer demands effectively.

-

Pella Corporation specializes in designing and producing high-quality windows and doors for residential and commercial applications. The company offers a diverse range of products, including wood, fiberglass, vinyl windows, patio doors, and entry doors.

-

PGT Innovations, Inc. specializes in producing high-performance fenestration products designed to withstand severe weather conditions while providing superior energy efficiency and security. The company offers various products, including sliding glass doors and fixed windows, serving various segments such as commercial buildings, hospitality, and residential markets.

Key U.S. Commercial Windows Companies:

- Andersen Corporation

- Jeld-Wen Inc.

- The Pella Corporation

- Profine International Group

- PGT Innovation, Inc.

- Cornerstone Building Brands

- Velux Group

- Harvey Building Products

- MI Windows and doors

- Starline Windows

Recent Developments

-

In January 2024, MITER Brands announced its acquisition of PGT Innovations, a manufacturer of premium windows and doors, in a deal valued at approximately USD 3.1 billion. This merger is expected to enhance MITER's portfolio in the commercial windows sector, as both companies aim to provide high-quality products and services.

-

In November 2023, PGT Innovations launched Triple Diamond Glass, a company dedicated to providing advanced glass solutions for commercial windows and door manufacturing. Located in Prince George's County, Virginia, the facility will produce Tri-Ultra thin triple-insulated glass units and Diamond Glass laminated units, focusing on energy efficiency and security.

U.S. Commercial Windows Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.45 billion

Revenue forecast in 2033

USD 5.09 billion

Growth rate

CAGR of 5.7% from 2026 to 2033

Base year for estimation

2025

Actual estimates/Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mechanism, frame material, end use, and region

Regional scope

New York, Pennsylvania, Massachusetts, Michigan, Virginia, Illinois, Wisconsin, New Jersey, Washington, Indiana, Minnesota, Maryland, Connecticut, Rhode Island, Delaware, Maine, Vermont, New Hampshire

Key companies profiled

Andersen Corporation, Jeld-Wen Inc., The Pella Corporation, Profine International Group, PGT Innovation, Inc., Cornerstone Building Brands, Velux Group, Harvey Building Products, MI Windows and doors, Starline Windows

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Windows Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. commercial windows market on the basis of product type, frame material, end use, and region:

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Sliding

-

Swing

-

Others

-

-

Frame Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Vinyl

-

Metal

-

Wood

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

New Commercial

-

Refurbishment

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

New York

-

Pennsylvania

-

Massachusetts

-

Michigan

-

Virginia

-

Illinois

-

Wisconsin

-

New Jersey

-

Washington

-

Indiana

-

Minnesota

-

Maryland

-

Connecticut

-

Rhode Island

-

Delaware

-

Maine

-

Vermont

-

New Hampshire

-

Frequently Asked Questions About This Report

b. The U.S. commercial windows market size was estimated at USD 3.27 billion in 2025 and is expected to reach USD 3.45 billion in 2026.

b. The U.S. commercial windows market is expected to grow at a compound annual growth rate of 5.7% from 2026 to 2033 to reach USD 5.09 billion by 2033.

b. The new construction segment held the highest revenue market share of 79.4% in 2025, driven by new office developments, institutional buildings, mixed-use complexes, and large commercial infrastructure projects.

b. Some of the key players operating in the market include Andersen Corporation, Jeld-Wen Inc., The Pella Corporation, Profine International Group, PGT Innovation, Inc., Cornerstone Building Brands, Velux Group, Harvey Building Products, MI Windows and doors, and Starline Windows.

b. The U.S. commercial windows market is driven by rising non-residential construction, growing refurbishment of aging buildings, stringent energy efficiency regulations, and increasing adoption of high-performance glazing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.