- Home

- »

- Animal Health

- »

-

U.S. Companion Animal Health Market, Industry Report, 2030GVR Report cover

![U.S. Companion Animal Health Market Size, Share & Trends Report]()

U.S. Companion Animal Health Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Equine), By Product (Vaccines, Pharmaceuticals, Supplements), By Distribution Channel, By End Use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-960-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

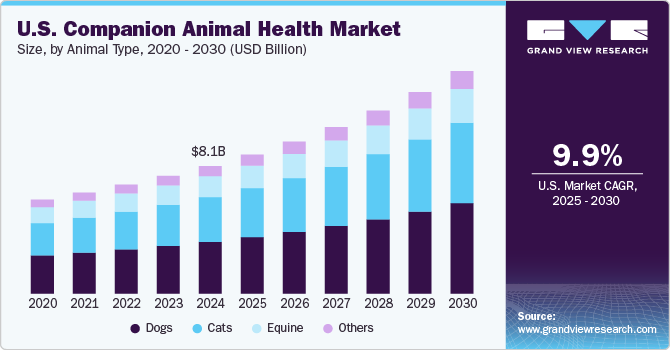

The U.S. companion animal health market size was estimated at USD 8.01 billion in 2024 and is projected to grow at a CAGR of 9.87% from 2025 to 2030. The market is primarily driven by the increasing pet humanization & pet expenditure, increasing medicalization rate, rising prevalence of pet diseases, and rising government initiatives. Pharmaceutical companies are increasingly investing in research and development to create new & improved treatments, address emerging diseases & unmet needs, and combat antimicrobial resistance. For instance, Librela by Zoetis was first launched by the company in 2021 as the only monoclonal antibody (mAb) for dogs with osteoarthritis pain. Since 2022, Librela has joined Zoetis’ lineup of blockbuster products, with revenues crossing USD 100 million.

Advancements in veterinary medicines lead to the development of more effective and targeted treatments for various diseases and health conditions in animals. New drugs and therapies offer improved efficacy, reduced adverse effects, and better outcomes for animals, driving demand for innovative veterinary medications. Increasing product approvals, rising focus on precision medicine, increasing uptake of pet insurance, growing animal health expenditure, the emergence of regenerative medicine techniques, and rising demand for advanced animal care are expected to drive advancements in veterinary medicine in the near future.

In addition, in January 2024, Zoetis, Inc. introduced an expansion to its Vetscan Imagyst diagnostics platform, incorporating AI urine sediment analysis, enabling swift and precise in-clinic analysis for veterinarians to expedite treatment decisions, enhancing care for canine & feline patients. Furthermore, in October 2023, Zoetis' Basepaws, known for feline DNA testing, introduced an extensive DNA test for dogs, providing insights into health risks and breed characteristics using advanced NGS technology. Hence, such advancements are anticipated to drive the market growth.

Many regions have seen a notable increase in the pet population over time. The majority of typical pet animals, such as dogs and cats, are valued for giving people better company. Because of their many advantages, including psychological comfort, lowering adult stress and sadness, and assisting people in overcoming anxiety, pets have become a permanent fixture in every home. In several countries, these factors have led to an increase in pet ownership and pet humanization.

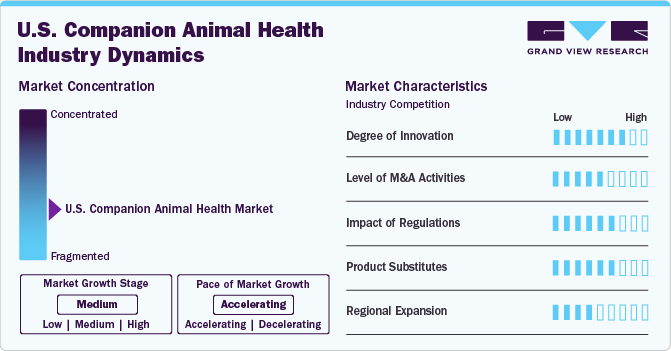

Market Concentration & Characteristics

The market exhibits a moderate market concentration. The market growth stage is medium, and the pace of the market growth is accelerating. One major factor propelling the market growth is rising Government initiatives. These initiatives are aimed at enhancing animal welfare and preventing the spread of diseases. Governments establish regulations and standards for the approval, manufacturing, distribution, and use of veterinary pharmaceuticals, vaccines, & feed additives. Regulatory agencies ensure that products meet safety, efficacy, and quality standards. In the U.S., the FDA regulates animal health along with other bodies, such as the United States Department of Agriculture (USDA). In March 2024, the FDA approved Dechra’s DuOtic under the New Animal Drug Applications for the treatment of otitis externa in dogs.

U.S. Companion Animal Health Industry Characteristics

Degree of innovation in the market is high, driven by technological advancements, research, and consumer demand for more effective and convenient solutions for their pets. For instance, in November 2023, IDEXX introduced the SNAP Leish 4Dx Test, a thorough screening for vector-borne illnesses that substitutes leishmaniosis, a more common disease in particular regions, for Lyme detection. The test makes use of IDEXX's SNAP 4Dx Plus platform to facilitate the diagnosis of vector-borne diseases worldwide.

Level of merger and acquisition activities in the market is moderate, with companies strategically acquiring or merging with others to expand their product portfolios, enhance their market presence, and gain competitive advantages. For instance, in July 2023, EQT, a Swedish investment firm, acquired Dechra Pharmaceuticals, a manufacturer of veterinary drugs.

Since strict laws control the creation, production, marketing, and distribution of veterinary products, regulations have a significant impact on the market. Animal drug approvals are supervised by regulatory agencies like the FDA to guarantee that safety and efficacy requirements are satisfied before goods are released onto the market. For example, in order to address antimicrobial resistance, legislative reforms such as the Veterinary Feed Directive (VFD) in February 2024 have affected the usage of antibiotics in animal agriculture.

Level of product substitute in the market is moderate to high. Substitutes for pharmaceutical drugs, such as herbal supplements, CBD-based treatments, and homeopathic remedies, are gaining popularity for managing pain, anxiety, or inflammation in pets. Moreover, health-monitoring devices, such as smart collars or trackers, offer preventive care by detecting early signs of health problems, reducing the need for frequent vet visits or medications.

Regional expansion in the market is moderate as companies seek opportunities to broaden their geographical footprint through strategic partnerships, collaborations, or establishing subsidiaries abroad. For instance, in November 2023, Antech, a subsidiary of Mars Petcare's Science & Diagnostics division, opened a new veterinary diagnostics facility in Warwick, UK, to expand its existing network.

Animal Type Insights

Based on animal type, the dogs segment led the market with the largest revenue share of 40.57% in 2024. Dogs are one of the most popular pets in the U.S. The percentage of Americans who stated they had a dog in their home in 2023 was 56%, which is a considerable increase over previous years. Due to their susceptibility to a variety of health problems, including infections, traumas, hereditary diseases, and age-related illnesses, dogs frequently need more regular veterinarian care than other types of pets. The American Veterinary Medical Association (AVMA) released data in December 2023 indicating that the respiratory disease that is affecting dogs in the United States is still prevalent.

Moreover, according to the National Pet Owners Survey 2023-2024 conducted by the American Pet Products Association, 86.9 million households (around 66%) in the U.S. owned dogs. For decades, dogs have gained greater importance and popularity in North America, where owners frequently treat them as devoted family members. To a degree where one-third of the U.S. population loves their dogs more than their partners.

The cat segment is expected to grow at the fastest CAGR over the forecast period. Cats are often thought of being low-maintenance pets because they don't require specialized training for basic hygiene and self-cleaning. The leading players are investing heavily in feline-related R&D due to the rapidly increasing cat adoption rate and the growing need for feline-specific medications. For example, the FDA approved Zoetis's first-ever breakthrough monoclonal antibody injection for feline species in January 2022. The Solensia Mab injectable is now meant to alleviate osteoarthritis pain in the cat population.

Product Insights

The pharmaceutical segment led the market with the largest revenue share of 44.45 % in 2024. Advancements in pet medicine, including new drugs and treatments, provide more options to manage health conditions and are expected to drive pharmaceutical demand. Positive FDA assessments for drugs that prolong pet lifespans-like a new treatment that prolongs the lifespan of dogs are probably going to increase demand as owners try to increase the lifespan and general well-being of their animals. For example, the FDA gave biotech company Loyal encouraging input in December 2023 regarding LOY-001, a medication intended to increase the longevity of large dog breeds. By 2026, the reasonably priced medication that is administered by veterinarians may become accessible via a conditional approval procedure.

The diagnostic segment is anticipated to grow at the fatsest CAGR over the forecast period. Advanced diagnostic methods and technologies are in high demand due to the increasing prevalence of many diseases and health conditions in companion animals, including but not limited to cancer, cardiovascular diseases, infectious diseases like parvovirus and heartworm, and metabolic disorders. In order to identify problems early and administer the proper care, pet owners are becoming more proactive in keeping an eye on their animals' health and are prepared to spend money on thorough diagnostic services. For example, in June 2023, IDEXX Laboratories introduced the first veterinary diagnostic test for identifying kidney damage in dogs and cats. The test attempts to meet the increasing demand for thorough diagnostic capabilities on the market.

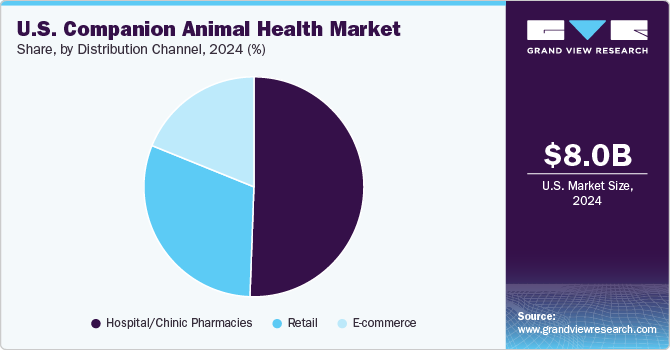

Distribution Channel Insights

Based on distribution channel, the hospital/ clinic segment led the market with the largest revenue share of 50.68% in 2024. This segment represents the revenue generated by veterinary hospitals & clinics, which directly provide medications, vaccines, customized therapies, and diagnostic test kits to pet owners. The U.S. market is anticipated to increase as a result of significant companies expanding their networks of vet pharmacies, as demonstrated by Vets Pets' endeavor in North Carolina. For example, to improve pharmacy-related patient care and client support for their more than 100 veterinarians, Vets Pets, a cooperative network of veterinary facilities in North Carolina, launched its pharmacy program in February 2024, headed by young pharmacists.

The e-commerce segment is expected to register at the fastest CAGR over the forecast period. The growth can be ascribed to the ease of acquiring prescriptions online, the vast range of items accessible, the opportunity to compare prices, and the competitive pricing techniques used by e-commerce platforms. For example, Giant Eagle Inc. and Allivet, a digital pet pharmacy, collaborated in May 2023 to include Allivet's PetRx platform in the grocery store's online offerings. This allows customers to take advantage of speedy delivery, discounts on pet healthcare items, and an AutoShip service for scheduled pet owner deliveries.

End Use Insights

Based on end use, the hospitals & clinics segment led the market with the largest revenue share of 50.68% in 2024. Veterinary hospitals and clinics encourage pet owners to seek out effective treatments by educating them on the value of diagnostics and medication for their pet's health. Developments in companion animal medicine, such as improved methods of diagnosis and treatment, have led to veterinary clinics becoming more sophisticated and growing. For instance, in March 2023, Zoetis upgraded its Vetscan Imagyst platform to include AI-powered dermatology diagnostics and equine fecal egg count evaluation. These new tests offer full in-clinic diagnostics linked to cloud-based AI capabilities, complementing the current AI tools for digital cytology, blood smear analysis, and fecal analysis.

The point-of-care segment testing in veterinary medicine involves using various products to conduct preventive or diagnostic tests at the site where the pet receives care, such as a veterinary clinic or a pet’s home. Point-of-care testing allows tests to be performed at the site where the pet receives care, eliminating the need to visit a separate laboratory or clinic. For instance, in July 2023, Veterinary fast diagnostic tests for home usage were introduced by the Vetster platform in partnership with MySimplePetLab. By establishing a continuous spectrum of veterinarian treatment, particularly for non-urgent illnesses, this strategic action seeks to lessen the anxiety of in-clinic visits.

Key U.S. Companion Animal Health Company Insight

The key players undertake extensive mergers and acquisitions, product portfolios, geographical expansions, and collaborative research initiatives. For instance, in June 2023, Heska was acquired by Mars Petcare, which then incorporated it into its Science & Diagnostics division. In line with Mars' commitment to enhancing the lives of pets, this initiative intends to improve diagnostic capabilities, speed up research and development, and increase global access to pet healthcare products.

Key U.S. Companion Animal Health Companies:

- Merck & Co., Inc.

- Elanco

- Boehringer Ingelheim GmbH

- Ceva Santé Animale

- Zoetis

- Virbac

- IDEXX Laboratories, Inc.

- Mars Inc.

- Dechra Pharmaceuticals Plc (EQT)

- Vetoquinol S.A.

View a comprehensive list of companies in the U.S. Companion Animal Health Market

Recent Developments:

-

In January 2024, IDEXX Laboratories' Fecal Dx antigen testing platform now includes Cystoisospora, a common intestinal parasite found in young dogs and cats. Along with other common parasites, this offers early and accurate detection.

-

In January 2024, Leading biotechnology company Scout Bio, which specializes in advanced pet medicines, acquired by Ceva Santé Animale. With this acquisition, Ceva will have more access to ground-breaking therapies including gene therapy and monoclonal antibodies that target chronic pet illnesses.

-

In November 2023, Antech launched innovative diagnostic devices like KeyScreen and AIS RapidRead to improve the results of pet healthcare for veterinarians.

U.S. Companion Animal Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.73 billion

Revenue forecast in 2030

USD 13.97 billion

Growth rate

CAGR of 9.87% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, distribution channel, end use

Country scope

U.S.

Key companies profiled

Merck & Co., Inc.; Elanco; Boehringer Ingelheim International GmbH; Ceva Santé Animale; Zoetis; Virbac; IDEXX Laboratories, Inc.; Mars Inc.; Dechra Pharmaceuticals Plc (EQT); Vetoquinol S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Companion Animal Health Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. companion animal health market report based on animal type, product, distribution channel, end use.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Equine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Supplements

-

Diagnostics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospital/ Clinic Pharmacies

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Point-of-Care

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. companion animal health market size was estimated at USD 8.01 billion in 2024 and is expected to reach USD 8.7 billion in 2025.

b. The U.S. companion animal health market is expected to grow at a compound annual growth rate of 9.87% from 2025 to 2030 to reach USD 13.97 billion by 2030.

b. Some key players operating in the U.S. companion animal health market include Merck & Co., Inc. , Elanco , Boehringer Ingelheim International GmbH, Ceva Santé Animale, Zoetis, Virbac, IDEXX Laboratories, Inc., Mars Inc., Dechra Pharmaceuticals Plc, Vetoquinol S.A.

b. Dogs dominated the U.S. companion animal health market with a share of 40.57% in 2024. This is attributable to the rising adoption of the dogs as a pet.

b. Key factors that are driving the U.S. companion animal health market growth include the increasing pet humanization and pet expenditure, increasing medicalization rate, rising prevalence of pet diseases, and rising government initiatives

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."