- Home

- »

- Medical Devices

- »

-

U.S. Compression Therapy Market, Industry Report, 2030GVR Report cover

![U.S. Compression Therapy Market Size, Share & Trends Report]()

U.S. Compression Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report, By Technology (Static Compression Therapy, Dynamic Compression Therapy), By End Use (Hospitals), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-426-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Compression Therapy Market Trends

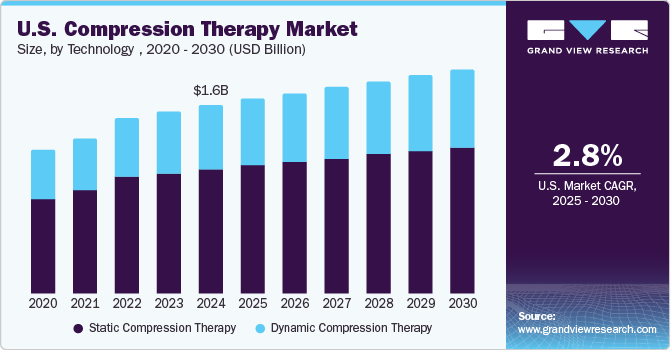

The U.S. compression therapy market size was estimated at USD 1.58 billion in 2024 and is projected to grow at a CAGR of 2.82% from 2025 to 2030. Growing awareness about venous disorders such as chronic venous insufficiency (CVI) and deep vein thrombosis (DVT) is driving demand for compression therapy products. Educational campaigns and health initiatives are highlighting the benefits of compression therapy in managing these conditions. The increasing prevalence of chronic conditions such as diabetes, obesity, and hypertension are contributing to a higher incidence of venous and lymphatic disorders, which in turn drives the demand for compression therapy. According to the CDC, 38.4 million individuals of all ages, or 11.6% of the U.S. population, had diabetes.

The growing incidence of chronic venous insufficiency (CVI) is significantly driving the U.S. compression therapy market. According to an NLM article published in February 2024, an estimated 10% to 35% of adults in the U.S. are affected by CVI, with 4% of adults aged 65 and older developing venous ulcers. Patients are generally prescribed compression stockings with a strength of 20–30 mmHg to treat CVI. Thus, the rising patient population suffering from venous disorders is increasing the demand for compression therapy products and propelling market growth.

The rise in the number of orthopedic procedures is another factor causing an increased demand for compression therapy. The major factors causing the rise in these procedures are attributed to the increased geriatric population, sport-related injuries, and advancements in surgical techniques giving rise to orthopedic surgeries, such as joint replacements (knee or hip replacements), fracture repairs, ligament reconstruction, and arthroscopic surgeries. For instance, the data published by the American College of Rheumatology in February 2024 reported that about 790,000 knee replacement surgeries and 544,000 hip replacement procedures are being conducted annually in the U.S., and the number continues to increase owing to the rise in the geriatric population.

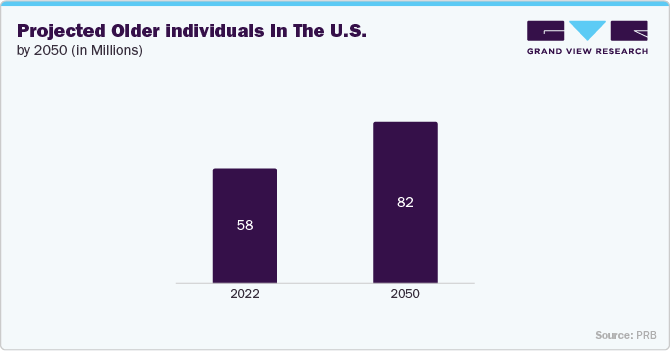

As the global population grows older, the demand for healthcare services and infrastructure is rising to meet the distinct and changing needs of older adults. The U.S. has a rapidly growing elderly population associated with increased healthcare spending. According to the PRB fact sheet updated in January 2024, approximately 58 million adults aged 65 and above currently reside in the U.S., constituting around 17.3% of the nation's population. Projections indicate that 2050 this proportion is anticipated to grow to 23%. This demographic is more prone to circulatory issues, varicose veins, and edema, all of which are treated with compression therapy. As a result, the demand for compression products is rising, fueled by healthcare spending on geriatric care.

Healthcare spending in the U.S. is directed toward managing chronic conditions such as venous disorders, diabetes, and lymphedema, which are prevalent among the aging population. According to CMS data, by December 2024, U.S. healthcare spending grew by 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person. Compression therapy is a standard treatment for these conditions, leading to increased demand for compression garments, stockings, and bandages. With rising healthcare costs, there is a growing emphasis on preventive care to manage chronic conditions early. Compression therapy is recommended as a preventive measure for conditions like deep vein thrombosis (DVT), driving market growth.

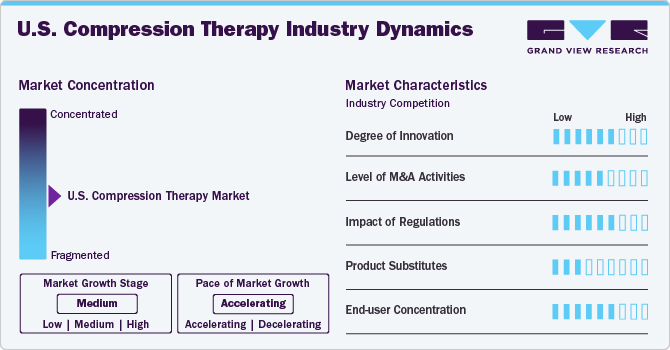

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. compression therapy market is characterized by growth owing to the rising prevalence of chronic diseases and rising geriatric population coupled with increasing novel product launch.

The U.S. compression therapy market is characterized by a high degree of innovation, driven by advancements in materials, technology integration, patient-centric design, and personalized treatment solutions. Companies are launching novel products. For instance, in June 2022, Hyperice launched Normatec 3, featuring dynamic air compression, improved design, longer battery life, and app connectivity. These enhancements support faster recovery and better performance, contributing to ongoing innovation in the compression therapy industry.

In the U.S., compression therapy products, such as compression stockings, sleeves, and bandages, are classified as medical devices by the Food and Drug Administration (FDA). Depending on their intended use, these products can be categorized under Class I, II, or III devices, with varying levels of regulatory scrutiny. For example, Class I devices typically have lower risk and are subject to general controls. In contrast, Class II devices may require additional regulatory requirements, such as premarket notification (510(k)), to demonstrate substantial equivalence to an existing device.

The U.S. compression therapy market has seen a moderate level of mergers and acquisitions (M&A) activity in recent years. This trend is driven by several factors, including the growing demand for compression therapy products, the need for companies to expand their product portfolios, and the desire to enhance market presence and technological capabilities.

The market is highly fragmented, featuring a mix of established medical device companies such as Cardinal Health, 3M, and SIGVARIS GROUP, alongside emerging startups focusing on innovative, patient-centric solutions. This diversity fosters intense competition and continuous innovation, leading to advancements in materials, technology integration, and personalized treatment options.

Technology Insights

The static compression therapy segment led the market in 2024, accounting for a revenue share of 66.07%. This growth is largely driven by the technology’s convenience, user-friendly design, and widespread accessibility for treating conditions such as edema and sports-related injuries, providing effective pain and pressure relief. The launch of new products has further strengthened this segment’s performance in the U.S. compression therapy market. Static compression therapy, encompassing products such as compression stockings, bandages, and garments, remains vital for managing chronic venous insufficiency, lymphedema, and post-surgical recovery. For example, in October 2023, Medi GmbH & Co. introduced the Medi Rehab one compression stocking, available in both thigh and calf versions with open or closed-toe options. The calf stocking with an open toe is specifically designed to make it easier and more comfortable for patients to put on and remove, particularly during conservative or postoperative treatment of ankle joint injuries or Achilles tendon ruptures.

Dynamic compression therapy technology is emerging as one of the fastest-growing segments in the U.S. compression therapy market, offering enhanced therapeutic benefits for conditions such as deep vein thrombosis (DVT), lymphedema, and chronic venous insufficiency. Dynamic compression, recognized for enhancing blood flow, minimizing edema, and speeding up healing, offers a more effective treatment than static compression, fueling its adoption in both clinical and home settings. Reflecting this growth, in September 2023, AIROS Medical launched the AIROS 6P Pneumatic Compression Device and Truncal Garment System, expanding advanced treatment options for patients across the U.S.

End Use Insights

The hospital end-use segment dominated the market in 2024 with share of the 31.14%. Compression therapy is integrated into hospital protocols for managing conditions such as venous disorders, wound care, and post-surgical recovery. The use of compression garments, bandages, and devices is often mandated as part of treatment guidelines, ensuring consistent demand within hospitals. In many hospitals, compression stockings or pneumatic compression devices are automatically prescribed for bedridden or limited mobility patients to prevent DVT, making these products a staple in hospital care.

The home healthcare segment is anticipated to grow significantly over the forecast period. Innovations in compression therapy devices designed specifically for home use, such as portable pneumatic compression pumps and easy-to-use compression garments, are driving growth in this segment. These products are designed to be user-friendly and require minimal assistance. Patients increasingly prefer receiving care in the comfort of their own homes rather than in clinical settings. Home-based compression therapy allows for greater convenience and personal comfort, leading to higher patient satisfaction and adherence.

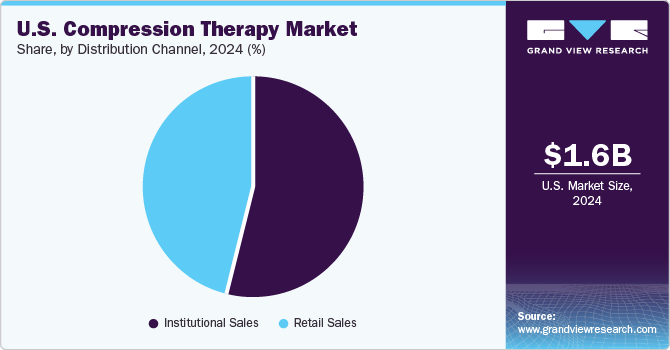

Distribution Channel Insights

The institutional sales segment held the largest market share in 2024. Due to their high patient volume, institutions such as hospitals and large clinics procure compression therapy products in bulk, which drives significant sales through institutional channels. Compression therapy is a key component of standard treatment protocols for a range of conditions, such as venous disorders, lymphedema, and post-surgical recovery. This integration ensures these products are regularly used and purchased through institutional channels. Institutions have the resources to invest in advanced compression therapy technologies, such as high-end pneumatic compression devices and specialized compression garments. These technologies are more complex and expensive, making them more commonly purchased through institutional channels.

The retail sales distribution channel is anticipated to grow at the fastest CAGR in the U.S. compression therapy market. There is a rising awareness among consumers about the benefits of compression therapy for managing conditions such as varicose veins, chronic venous insufficiency, and lymphedema. This heightened awareness drives increased consumer interest and demand for compression products available through retail channels. The growth of e-commerce has made it easier for consumers to access compression therapy products from the comfort of their homes. Online retailers such as Advantage Medical, Performance Health, offer a wide range of compression products, including stockings, sleeves, and bandages, with convenient delivery options. Retail channels, including pharmacies, medical supply stores, and specialty retailers, have expanded their product offerings to include compression therapy items. This increased availability makes it easier for consumers to purchase these products without needing a prescription or visiting a healthcare facility.

Clinical Trials for Compression Therapy in the U.S.

Study Name

Intervention/ Treatment

Conditions

Enrollment

Sponsor

Study Completion

Effects of Intermittent Pneumatic Compression Therapy on Tissue Volume, Pain, and Quality of Life in Lipedema

DEVICE: Intermittent pneumatic compression therapy

Lipedema

46

Lympha Press

16/11/2023

Utility of Intermittent Cryo-Compression Versus Traditional Icing Following Arthroscopic Rotator Cuff Repair

DEVICE: Cryo-compression|OTHER: Cryo-therapy

Rotator Cuff Injuries|Cryotherapy Effect

100

Allina Health System

2025-06

Early Intervention

DEVICE: Juzo Compression Sleeve and Glove|DEVICE: Compression Sleeve Sensor

Breast Cancer|Breast Cancer Treatment Related Lymphedema

40

Massachusetts General Hospital

2026-06-30

The ROle of Compression StocKings in Heart Failure Patients

DEVICE: low grade compression stockings (10-15 mmHg)|DEVICE: high grade compression stockings (20-30 mmHg)

Heart Failure,Congestive|Leg Edema|Venous Insufficiency|Venous Ulcers

50

University of Maryland, Baltimore

2026-01-01

Source: ClinicalTrials.gov

Government organizations and academic institutions, including the University of Maryland, Baltimore, are actively conducting clinical trials to evaluate compression therapy for various applications, such as cardiac disorders, post-surgery recovery, and sports. The positive results from these studies are anticipated to lead to the introduction of innovative compression therapy products, significantly improving treatment options. This advancement enhances patient care and stimulates growth in the compression therapy industry as new technologies emerge.

Key U.S. Compression Therapy Company Insights

Cardinal Health, 3M, SIGVARIS GROUP, Essity, Julius Zorn, Inc., HARTMANN USA, Inc., Bauerfeind USA Inc., medi USA, BIOCOMPRESSION SYSTEMS, and Gottfried Medical, Inc. are some of the major players in the U.S. compression therapy market. These companies are expanding their portfolios in this sector and acquiring smaller firms to strengthen their competitive edge in the rapidly growing industry. Moreover, industry players are launching advanced products to meet the increasing demand.

Key U.S. Compression Therapy Companies:

- Cardinal Health

- 3M

- SIGVARIS GROUP

- Essity

- Julius Zorn, Inc.

- HARTMANN USA, Inc

- Bauerfeind USA Inc.

- medi USA

- BIOCOMPRESSION SYSTEMS

- Gottfried Medical, Inc.

Recent Developments

-

In November 2024, Cardinal Health launched the Kendall SCD SmartFlow Compression System in the U.S., offering advanced, customized pneumatic compression to help prevent VTE and improve blood circulation. This next-generation device strengthens innovation in the U.S. compression therapy market.

-

In September 2024, Tactile Systems Technology, Inc. announced positive clinical trial results, showing their advanced pneumatic compression device significantly improved outcomes in lymphedema patients. This marks a key innovation in the growing U.S. compression therapy market.

-

In October 2023, 3M and MediWound announced a strategic partnership to support EscharEx’s Phase III clinical trial, strengthening their collaboration in the medical sector. 3M Health Care supplied its market-leading Coban 2 and Coban 2 Lite compression systems for the study.

U.S. Compression Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.63 billion

Revenue forecast in 2030

USD 1.87 billion

Growth rate

CAGR of 2.82% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, distribution channel

Country scope

U.S.

Key companies profiled

Cardinal Health; 3M; SIGVARIS GROUP; Essity; Julius Zorn, Inc.; HARTMANN USA, Inc; Bauerfeind USA Inc.; medi USA; BIOCOMPRESSION SYSTEMS; Gottfried Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Compression Therapy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. compression therapy market report based on technology, end use, and distribution channel:

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Static Compression Therapy

-

Compression bandages

-

Compression stockings

-

Compression tape

-

Others compression garments

-

-

Dynamic Compression Therapy

-

Compression Pumps

-

Compression Sleeves

-

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

Frequently Asked Questions About This Report

b. The U.S. compression therapy market size was estimated at USD 1.58 billion in 2024 and is expected to reach USD 1.63 billion in 2025.

b. The U.S. compression therapy market is expected to grow at a compound annual growth rate of 2.82% from 2025 to 2030 to reach USD 1.87 billion by 2030.

Which segment accounted for the largest U.S. compression therapy market share in technology segment?b. The static compression therapy segment dominated the U.S. compression therapy market. This is attributable to established clinical effectiveness, a wide range of product offerings, ease of use, cost-effectiveness, strong clinical and regulatory support, and high demand driven by chronic conditions.

b. Some of the key market players include Cardinal Health, 3M, SIGVARIS GROUP, Essity, Julius Zorn, Inc., HARTMANN USA, Inc., Bauerfeind USA Inc., medi USA, BIOCOMPRESSION SYSTEMS, and Gottfried Medical, Inc.

b. The increasing incidence of chronic venous disorders, such as chronic venous insufficiency (CVI), deep vein thrombosis (DVT), and varicose veins, drives demand for compression therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.