- Home

- »

- Advanced Interior Materials

- »

-

U.S. Connected Thermostat Market, Industry Report, 2033GVR Report cover

![U.S. Connected Thermostat Market Size, Share & Trends Report]()

U.S. Connected Thermostat Market (2025 - 2033) Size, Share & Trends Analysis Report By Connectivity Technology (Wi-Fi Enabled, Bluetooth Thermostats), By End Use (Commercial, Residential, Industrial), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-670-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Connected Thermostat Market Summary

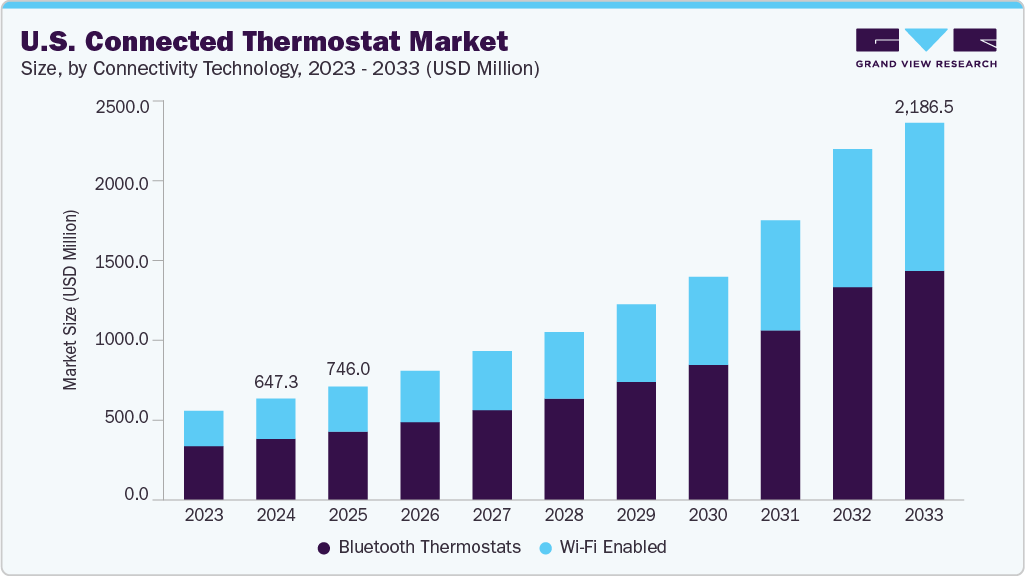

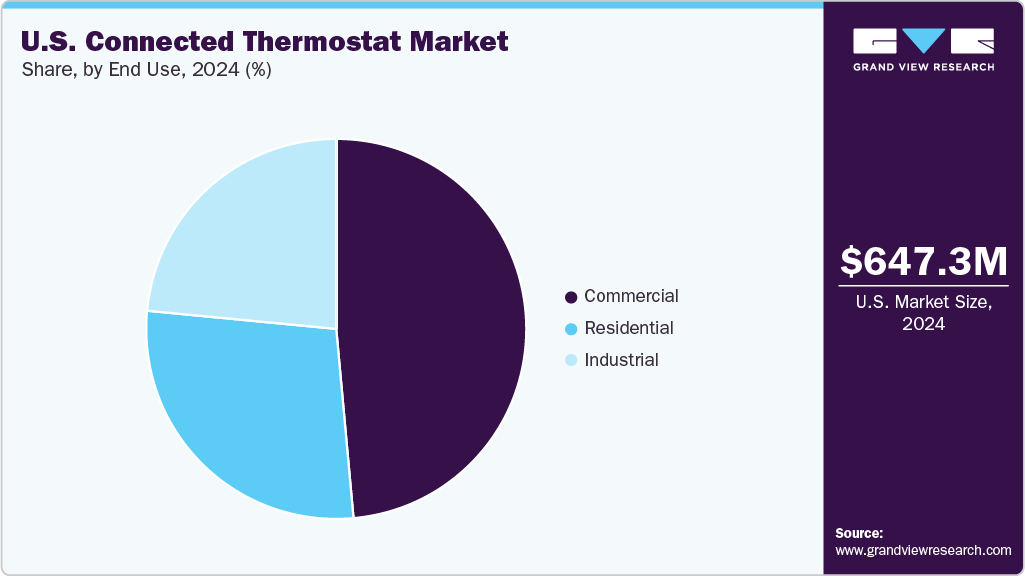

The U.S. connected thermostat market size was estimated at USD 647.3 million in 2024 and is expected to reach USD 2,186.5 million by 2033, growing at a CAGR of 14.4% from 2025 to 2033. The market is witnessing significant growth due to increasing adoption of smart home technologies, demand for energy efficiency, and rising awareness about environmental sustainability.

Key Market Trends & Insights

- By connected technology, the bluetooth thermostats segment is projected to expand at a rapid CAGR of 14.5% from 2025 to 2033.

- By distribution channel, the online segment is expected to grow at a significant CAGR of 15.2% from 2025 to 2033.

- By application, the new construction segment is expected to grow at a fast-paced CAGR of 14.4% from 2025 to 2033.

- By end use, the industrial segment is expected to grow at a rapid CAGR of 15.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 647.3 Million

- 2033 Projected Market Size: USD 2,186.5 Million

- CAGR (2025-2033):14.4%

Connected thermostats offer real-time remote control, learning capabilities, and automation that enhance user convenience and reduce energy consumption. The adoption of connected thermostats is gaining momentum across the U.S. residential, commercial, and industrial sectors as users seek data-driven climate control solutions. Additionally, utility companies in the U.S. are increasingly integrating connected thermostats into demand response programs to enhance grid efficiency, further propelling market expansion.

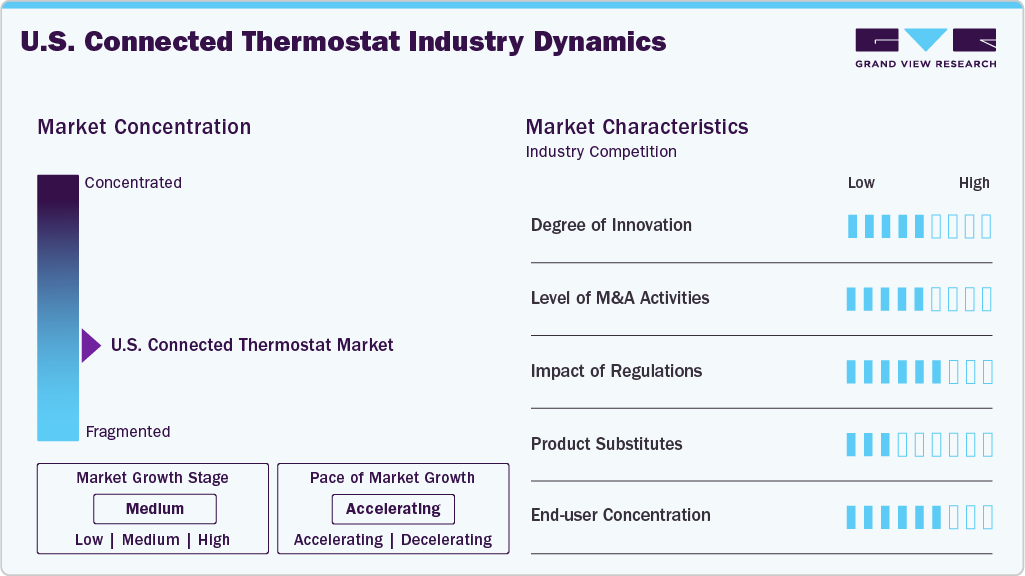

Market Concentration & Characteristics

The U.S. connected thermostat market is moderately consolidated, featuring several prominent domestic and multinational corporations such as Honeywell International Inc., Emerson Electric Co., and ecobee, along with a growing base of specialized startups and regional competitors. These firms primarily compete on the basis of technological advancement, connectivity features, system interoperability, and seamless integration within smart home ecosystems.

Established players command significant market share due to their strong brand recognition, expansive distribution channels, and integration with comprehensive home automation platforms. Meanwhile, newer entrants are disrupting the landscape with nimble product development, differentiated software capabilities, and cost-effective offerings. These challengers often target niche use cases or offer superior user interfaces, contributing to a competitive and evolving market dynamic.

R&D efforts in the U.S. market are heavily focused on enhancing functionalities such as self-learning capabilities, geofencing, voice control compatibility, and predictive maintenance. Cloud connectivity, remote updates, and app-based control have become standard expectations, reflecting consumer demand for convenience and centralized control.

Partnerships continue to shape the competitive terrain, with thermostat manufacturers increasingly aligning with HVAC OEMs, utility firms for demand response programs, and IoT platform vendors to build integrated and responsive climate control systems. White-label solutions are also gaining traction, especially among utility providers and retailers seeking to offer branded smart energy products to their customer base.

Drivers, Opportunities & Restraints

The U.S. connected thermostat market is being driven by a combination of macro and micro-level factors. A key growth driver is the rapid domestic adoption of smart home technologies, with consumers increasingly embracing automated living solutions that prioritize energy efficiency, remote accessibility, and personalized comfort. Connected thermostats play a pivotal role in this shift by offering intelligent temperature control based on user routines, occupancy, and environmental conditions.

The market presents significant opportunities across the U.S. landscape. Utility companies and HVAC OEMs are exploring bundled service models that pair connected thermostats with energy management or maintenance plans. Demand is expanding beyond residential use, with growing adoption in small commercial spaces, hospitality, education, and healthcare sectors where operators value centralized control and energy monitoring. Additionally, the transition from premium to more accessible offerings is widening retail penetration across urban and suburban markets.

However, certain barriers persist. Compatibility challenges with outdated HVAC systems may necessitate additional equipment or professional intervention. Data security and privacy are ongoing concerns as devices gather behavioral and geolocation data. Regulatory inconsistencies across states on smart device usage and energy compliance also create hurdles for nationwide deployment strategies.

Connectivity Technology Insights

Bluetooth thermostats accounted for the largest revenue share of 60.2% in 2024 due to their ease of installation, lower cost, and compatibility with a wide range of HVAC systems. These devices are particularly popular in smaller homes and retrofit projects where Wi-Fi coverage is limited. Their ability to operate without an internet connection makes them suitable for basic automation needs while still offering app-based control.

Wi-Fi enabled thermostats support remote access, voice assistant integration, and advanced scheduling, making them particularly attractive to tech-savvy U.S. consumers. Rising demand for real-time temperature control and seamless interoperability with wider smart home ecosystems is fueling the growth of this segment across both residential and light commercial applications.

Distribution Channel Insights

The retail stores segment accounted for the highest revenue share of 48.1% in 2024 due to wide connectivity technology availability, in-store promotions, and brand visibility. Consumers benefit from hands-on demonstrations, staff assistance, and bundled offers with other smart home connectivity technologies. Retail chains and electronics outlets continue to be primary sales channels for connected thermostats, especially in mature markets with established smart home ecosystems.

E-commerce platforms offer consumers a broad selection, competitive pricing, and doorstep delivery, making them an increasingly preferred channel for connected thermostat purchases. The growth of digital retail is further supported by rising smartphone usage, online payment adoption, and promotional campaigns by manufacturers targeting tech-savvy users.

Application Insights

The retrofit & renovation application segment accounted for 56.2% of the revenue share in 2024. Homeowners and commercial property managers are increasingly upgrading traditional thermostats with smart alternatives to reduce energy bills, improve HVAC control, and integrate with broader home automation systems. This segment benefits from the large installed base of legacy thermostats across the country, especially in older homes and buildings undergoing energy-efficiency upgrades. Utility rebate programs and federal tax incentives further support adoption in retrofit scenarios.

In the U.S. connected thermostats market, the new construction segment is experiencing strong growth driven by evolving building codes, energy efficiency mandates, and growing adoption of smart home technologies. Connected thermostats are increasingly being integrated as standard features in newly built residential and commercial buildings, particularly in high-end and energy-efficient developments. Builders and developers are leveraging these devices to meet ENERGY STAR and LEED certification requirements, while also enhancing property value and appeal to tech-savvy buyers.

End Use Insights

The commercial segment accounted for the largest revenue share of 48.6% in 2024, driven by growing adoption in office buildings, retail outlets, hospitality, and healthcare facilities. Businesses are leveraging connected thermostats to optimize energy usage, reduce operating costs, and meet sustainability goals. Integration with building management systems and centralized HVAC networks further supports large-scale implementation. Rising focus on occupant comfort and remote facility management is also contributing to continued market dominance.

Manufacturing plants, warehouses, and data centers are increasingly adopting connected thermostats to manage thermal environments and reduce energy consumption. These systems help operators monitor, control, and automate HVAC operations across large, complex facilities. The push toward operational efficiency, energy benchmarking, and compliance with environmental regulations is driving growth in this segment.

U.S. Connected Thermostat Company Insights

Some key players operating in the market include Honeywell International Inc. and Carrier.

-

Honeywell International Inc. is a global technology company with decades of experience in home automation and climate control. The company’s connectivity technology is widely used in both residential and commercial settings, offering features like geofencing, multi-room sensors, and energy-saving automation.

-

Carrier is a prominent company involved in the larger HVAC industry and a leading provider of heating, cooling, and smart control systems. The company’s connected thermostats are recognized for energy efficiency, advanced diagnostics, and seamless compatibility with home HVAC systems. The company has a strong global presence with operations and sales in several nations.

Key U.S. Connected Thermostat Companies:

- Honeywell International Inc.

- Trane

- Carrier

- ecobee

- Copeland LP

- EME Delaware Inc.

- Robert Bosch GmbH

- DAIKIN INDUSTRIES, LTD

- Rheem Manufacturing Company

- Lennox International Inc.

Recent Developments

-

In February 2024, Carrier introduced a new Smart Thermostat aimed at residential new construction builders and homeowners, offering improved connectivity at an affordable price. This 24V thermostat features a modern design, supports accessories, integrates with smart home systems, and offers warranty options of up to 5 years when connected.

-

In October 2024,Ecobee launched the ecobee Smart Thermostat Lite, a new pro-exclusive model designed for professional installers. It is easy to install, durable, and hardwired, eliminating the need for charging or secondary power sources. Compatible with most HVAC systems-including multi-stage heating and cooling, radiant heating, and dual-fuel systems-it supports accessories like humidifiers and ventilators.

U.S. Connected Thermostat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 746.0 million

Revenue forecast in 2033

USD 2,186.5 million

Growth rate

CAGR of 14.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Connectivity technology, distribution channel, application, and end use

Country Scope

U.S.

Key companies profiled

Honeywell International Inc.; Trane; Carrier; ecobee; Copeland LP; EME Delaware Inc.; Robert Bosch GmbH; DAIKIN INDUSTRIES, LTD; Rheem Manufacturing Company; Lennox International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Connected Thermostat Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. connected thermostat market report based on connectivity technology, distribution channel, application, and end use.

-

Connectivity Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Residential

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Wi-Fi Enabled

-

Bluetooth Thermostats

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

New Construction

-

Retrofit & Renovation

-

Frequently Asked Questions About This Report

b. The U.S. connected thermostat market size was estimated at USD 647.3 million in 2024 and is expected to reach USD 746.0 million in 2025.

b. The U.S. connected thermostat market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2033 to reach USD 2,186.5 million by 2033.

b. The bluetooth thermostats segment led the market in 2024, capturing 60.2% of the share, driven by their user-friendly design, ability to function without internet connectivity, and strong fit for basic residential use. Their affordability and straightforward installation made them especially appealing in cost-conscious and retrofit-heavy markets.

b. Some of the key players operating in the U.S. connected thermostat market include Honeywell International Inc., Trane, Carrier, ecobee, Copeland LP, LUX Connectivity Technologys Pro Solutions (EME Delaware Inc), Robert Bosch GmbH, DAIKIN INDUSTRIES, LTD), Rheem Manufacturing Company, and Lennox International Inc.

b. The U.S. connected thermostat market is being propelled by increasing demand for energy-efficient HVAC systems and the expanding adoption of smart home technologies. Innovations such as remote control capabilities, AI-driven scheduling, and compatibility with voice assistants are further boosting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.