- Home

- »

- IT Services & Applications

- »

-

U.S. Construction And Design Software Market, Industry Report, 2030GVR Report cover

![U.S. Construction And Design Software Market Size, Share & Trends Report]()

U.S. Construction And Design Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Function (Safety & Reporting, Project Management & Scheduling, Project Design), By Deployment (Cloud, On-premise), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-251-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

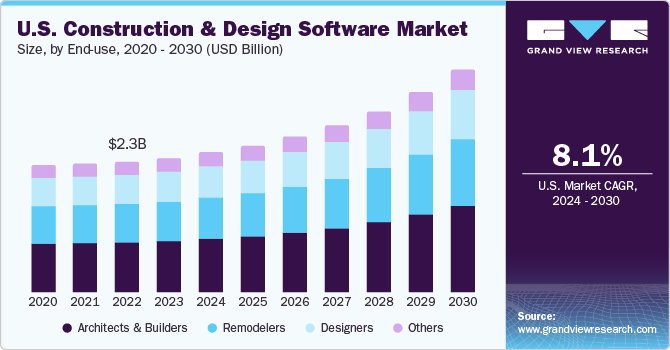

The U.S. construction and design software market size was valued at USD 2,388.1 million in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. The U.S. accounted for 22.9% of the global construction and design software market. AI, cloud computing, and IoT, among other digital technologies, have contributed to the market's growth. The U.S. market players are aggressively introducing innovative software tools that help end-users reduce time, minimize errors, and limit resources. This technological advancement is expected to play a crucial role in driving the growth of the market.

The U.S. market is witnessing a constant technological transformation in the construction industry and civil engineering, including architectural verticals. The software assists designers in designing complex layouts, assessing the potential risks, and planning & conceptualizing designs. In addition, the growing adoption of these latest software tools is helping organizations enhance practical visualization, and make complex designs with practical approaches, and execute construction & design plans more efficiently. The extensive use of construction software solutions based on data analytics, AI, and ML also plays a decisive role in addressing, predicting, classifying, and solving complex mathematical problems associated with complex construction projects.

U.S. based architects and builders recognize the potential of construction and design software in reducing their reliance on paperwork, documentation, and manual designing. Using integrated tools, such as construction estimating, project management, safety, and reporting, allows construction companies to ensure well-organized work sites, well-developed designs, and overall safety and success of their construction projects. Construction and design software enables architects and builders to ensure the success of their construction projects. As a result, software advancements and innovations are expected to drive its demand among architects and builders.

Furthermore, the rising number of construction projects undertaken in the U.S. is becoming challenging due to these projects becoming increasingly complex, and safety and regulatory concerns are also growing. Therefore, construction companies in the U.S. are deploying construction and design software solutions to track various project processes, deadlines, and compliance status in real-time. These software solutions give construction companies deeper insights into future spending, helping create purchase and exchange orders, estimate project costs, and ensure effective team communication, enhancing efficiency and scaling the business in the long-term.

However, the increased adoption of the software in the U.S. is witnessing high initial costs of the software, and evolving digital threats such as phishing, Distributed Denial of Service (DDoS), ransomware, and viruses are the two key factors expected to hamper the growth of the market over the forecast period. In addition, the construction and design software development process is costly as the provider needs to hire expert software engineers and implement advanced software testing and assessment tools. Furthermore, if any company develops an innovative feature and integrates it into the software, it increases the project's overall costs.

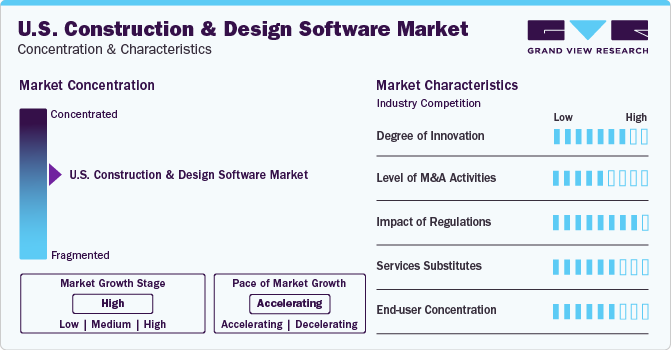

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. construction and design software market is fairly concentrated. Rapid urbanization and population growth are increasing the demand for infrastructure development and construction projects in the United States, which is fueling growth and creating ample opportunities for the growth of the construction & design software market growth.

The U.S. market players are aggressively integrating construction and design software to reduce time, minimize human errors, and use the maximum resources. However, the market is expecting more innovations in these tools. There is an enormous scope for innovation in designing and making the software more cost-effective for end-users.

Software-making companies in the U.S. construction industry must comply with strict regulations. American companies always seek to enhance their end-user experience and outperform competitors, but construction and design software developers need to ensure data privacy where copying design incidents won't happen. Stringent laws are needed in the U.S. construction industry to ensure streamlined project management, cost estimation, field service management, labor safety, bid management, and project design.

However, the market experiences a few service substitutes due to the growing complexity of U.S. construction industry regulations, including data security. Therefore, new startups are less likely to enter this market. Still, the market has opportunities in the long run, and it is anticipated that new entrants will propel the U.S. construction & design software market growth in the forecasted period.

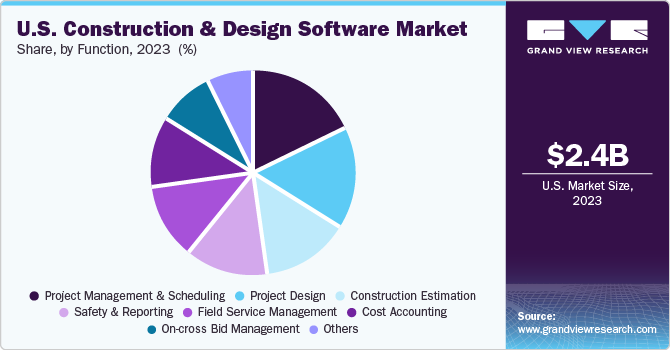

Function Insights

Project management & scheduling segment dominated the market and accounted for the highest revenue share of 18.4% in 2023.Construction projects are often complex, involving multiple teams coordinating and working together. In the U.S., construction companies use construction and design software for project management and scheduling to keep projects on track and meet project deadlines. The software enables the management of construction projects typically involving residential, commercial, and institutional construction, renovations, and other engineering projects. Similarly, it provides a wide range of expertise to manage these projects effectively with appropriate planning, leadership, and resources.

On-cross bid management segment is anticipated to witness a significant CAGR of 9.6% from 2024 to 2030 in the U.S. construction and design software market. On-cross bid management is one of the essential processes carried out by construction companies to hire contractors willing to execute different tasks associated with a construction project. The bidding process involves the determination of the scope of work, time of completion, pre-qualification details, and penalties for delays and non-compliance associated with the execution of the project. Thus, a significant amount of data is shared between clients and contractors. To manage all the information related to this process, many U.S.-based construction companies integrate the software to manage the targets and assist contractors in collecting and sharing data to streamline the overall process.

Deployment Insights

Cloud segment led the market and accounted highest revenue share of 54.0% in 2023. Cloud deployment ensures cost-efficiency while increasing productivity by allowing the use of data to streamline processes. Cloud-based construction and design software provides on-demand self-service for provisioning servers on a flexible, pay-as-you-go basis. AI-powered cloud computing allows companies to become more strategic, efficient, and insight-driven. Several large enterprises are introducing innovative cloud software in the market. As a result, the cloud deployment segment is anticipated to foster market share in the forecasted period.

On-premise segment is anticipated to witness a nominal CAGR of 6.1% from 2024 to 2030 in the market. On-premise construction and design software is installed in the organization, typically on the servers and computers owned by clients. On-premise software offers greater control over data security, as sensitive project data remains within the organizations' infrastructure. Similarly, it allows flexibility to scale software usage by adding more computational power, storage capacity, and software licenses while ensuring secure data storage and greater control over the operational process.

End-use Insights

Architects & builders segment accounted for the largest market revenue share of 38.6% in 2023. The increasing demand for design skills to enhance the potential of the project and the growing concerns over obtaining the necessary approvals are expected to drive the segment's growth. Architects and builders can tailor drawings to customers' budgets, provide construction information to reduce costs and ensure projects are completed on time. With the help of construction and design software, U.S. businesses, as well as professionals such as engineers and architects, can create a detailed floor plan that includes accurate measurements of walls, windows, and doors, among others. Thus, architects and builders segment is expected to grow significantly over the forecast period.

Designers segment is expected to register the fastest CAGR of 8.7% during the forecast period.U.S. End users are increasingly opting for construction designing software for better interior design and decoration. Many designer professionals use construction software extensively to create more detailed designs and manipulate them virtually to improve productivity, automate design drafting, and work on effective design development, optimization, and alteration. Furthermore, Building Information Modeling (BIM) and Computer Aided Design (CAD) solutions facilitate remote teams' collaboration. As a result, this segment is driving the growth of the U.S. construction and design software market.

Key U.S. Construction And Design Company Insights

Some of the key companies operating in U.S. construction and design market are Microsoft Corporation, Autodesk Inc., Oracle corporation, and among others.

-

Autodesk Inc. is an application software company offering software and services for the 3D design, engineering, and entertainment industries. The company provides BIM 360, a cloud-based construction management software, AutoCAD, a software for professional designing, formulating, outlining, and visualization and AutoCAD LT, a drafting and detailing software

-

Oracle, a multinational technology company, offers a wide range of solutions for businesses to build, manage, and optimize its IT infrastructure. From cloud services (IaaS, PaaS, and SaaS) to construction management software, Oracle empowers companies to innovate, expand, and gain valuable insights. Its offerings include cutting-edge software, hardware, and consulting services, all designed to improve performance, security, and cost-effectiveness across the entire IT ecosystem

Houzz Inc., Vectorworks, Inc., Trimble Inc., and among others are some of the emerging companies operating in the U.S. construction and design software market.

-

Houzz is a one-stop shop for home improvement. The company offers a website and online community for design inspiration, professional connection, and product discovery. It features a massive image database for browsing and saving ideas, along with a free platform for professionals and homeowners to connect

-

Vectorworks, Inc. creates software for architects, engineers, landscapers, and entertainment professionals. Its software extends beyond simple 2D and 3D drawing, offering features such as report generation, custom programming, and industry-specific tools. It also offers modules for specialized tasks such as lighting design

Key U.S. Construction And Design Software Companies:

- Autodesk Inc.

- Bentley Systems

- Buildertrend

- CMiC

- ConstructConnect

- Dassault Systemes

- Houzz Inc.

- Microsoft Corporation

- Oracle Corporation

- Procore Technologies Inc.

- RIB Software

- Trimble Inc.

- Vectorworks Inc.

Recent Developments

-

In November 2023, SmartPM collaborating with Autodesk Construction Cloud, a comprehensive suite offering construction teams advanced technology, industry connections, and future-oriented insights. This new integration streamlines project assessment for stakeholders, enabling them to identify crucial project drivers and dedicate more time to proactive management and risk reduction

-

In August 2023, Generac, a leading provider of residential energy solutions, partnered with Buildertrend, a popular construction management software platform. This collaboration brought Generac's entire suite of products, including standby generators, solar and battery storage systems, and smart home devices, directly into Buildertrend. This integration streamlined the process for builders and homeowners to seamlessly incorporate backup power and energy management solutions into the early stages of design and construction, potentially saving thousands of dollars on installation costs

-

In June 2023, PMI, a leading company in project management, and Oracle Construction and Engineering partnering to develop resources specifically for construction and related industries. This collaboration leveraged PMI's expertise and Oracle's tools to offer, best practices, and practical solutions to help professionals in these sectors deliver projects successfully

U.S. Construction And Design Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,479.0 million

Revenue forecast in 2030

USD 3,958.0 million

Growth rate

CAGR of 8.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, end-use

Country scope

U.S.

Key companies profiled

Autodesk Inc.; Bentley Systems; Buildertrend; ConstructConnect; CMiC; Dassault Systemes; Houzz Inc.; Microsoft Corporation; Procore Technologies Inc.; RIB Software; Oracle Corporation; Trimble Inc.; Vectorworks Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Construction And Design Software Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. construction and design software market report based on function, deployment, and end-use.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety & Reporting

-

Project Management & Scheduling

-

Project Design

-

Field Service Management

-

Cost Accounting

-

Construction Estimation

-

On-cross Bid Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Architects & Builders

-

Remodelers

-

Designers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. construction and design software market size was estimated at USD 2,388.1 million 2023 and is expected to reach USD 2,479.0 million in 2024

b. The U.S. construction and design software market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 3,958.0 million in 2030.

b. Cloud segment led the market and accounted highest revenue share of 54.0% in 2023. Cloud deployment ensures cost-efficiency while increasing productivity by allowing the use of data to streamline processes.

b. Some key players operating in the U.S. construction and design software market are Autodesk Inc.; Bentley Systems; Buildertrend; ConstructConnect; CMiC; Dassault Systemes; Houzz Inc.; Microsoft Corporation; Procore Technologies Inc.; RIB Software; Oracle Corporation; Trimble Inc.; and Vectorworks Inc. among others.

b. The U.S. market players are aggressively introducing innovative software tools that help end-users reduce time, minimize errors, and limit resources. This technological advancement is expected to play a crucial role in driving the growth of the U.S. construction and design software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.