- Home

- »

- Medical Devices

- »

-

U.S. Contraceptive Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Contraceptive Market Size, Share & Trends Report]()

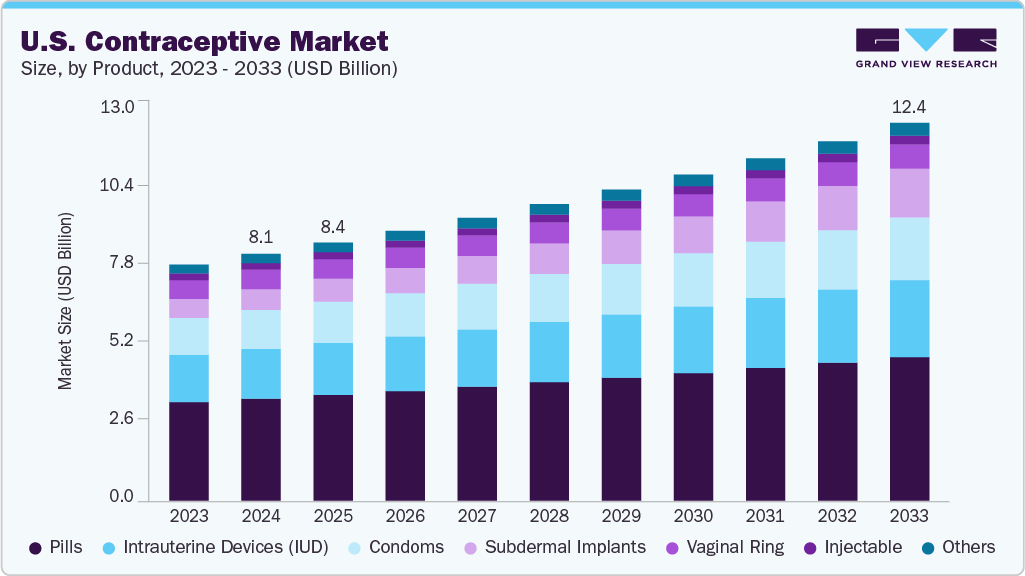

U.S. Contraceptive Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Pills, Intrauterine Devices, Condoms, Vaginal Ring, Subdermal Implants, Injectable), By Region (West, Southeast, Southwest, Northeast, Midwest), And Segment Forecasts

- Report ID: GVR-2-68038-702-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Contraceptive Market Summary

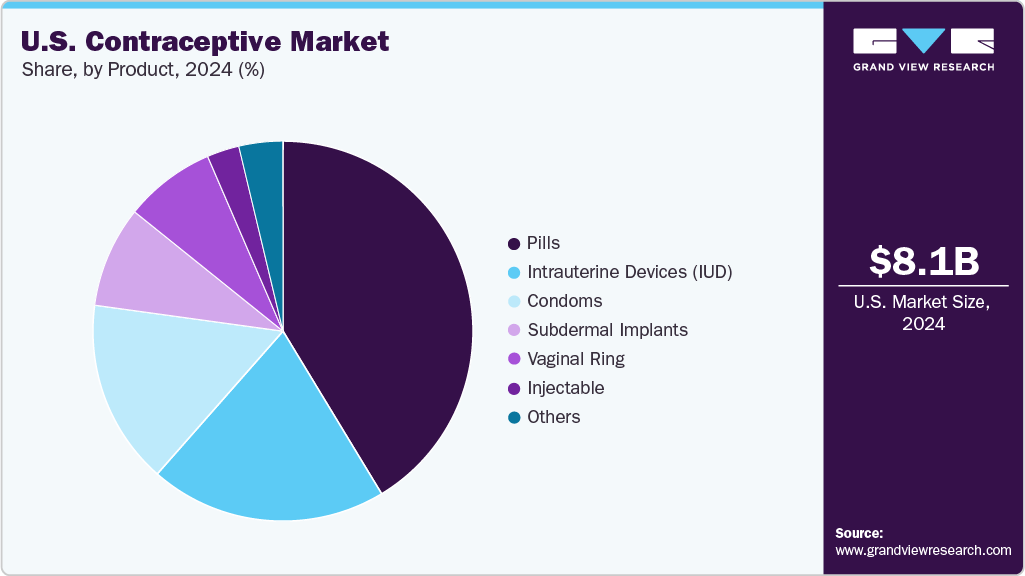

The U.S. contraceptive market size was valued at USD 8.4 billion in 2025 and is expected to reach USD 12.4 billion by 2033, growing at a CAGR of 4.9% from 2026 to 2033. The increase in the use of modern contraceptives and the rise in awareness among adolescents and young people about sexual health and family planning are key factors driving the U.S. market growth.

Key Market Trends & Insights

- Based on product, the pills segment dominated the market, accounting for the largest share of 41.0% in 2025.

- Based on region, the Southeast U.S. dominated the market with the largest share in 2025.

- The Southwest region is anticipated to grow at a significant CAGR during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 8.4 Billion

- 2033 Projected Market Size: USD 12.4 Billion

- CAGR (2026-2033): 4.9%

Moreover, government programs have led to an increase in access to contraceptives that help prevent unwanted pregnancies in teenagers. The section below outlines key market factors such as research and development and trends shaping the women’s contraceptive health market. It highlights recent product launches, regulatory approvals, public health initiatives, and technological innovations that are expanding contraceptive choices, improving accessibility, and driving market growth in the U.S.

Market Drivers

Continued Innovation in Women’s Contraceptive Health:

With the increasing demand, awareness, and preference for reliable alternatives, companies are looking forward to offering safe, effective, and long-term contraceptive options to meet the evolving needs of women worldwide, leading to notable advancements and product launches.

EnilloRing: Expanding Contraceptive Choices

In October 2023, Xiromed LLC introduced EnilloRing (etonogestrel/ethinyl estradiol vaginal ring), a generic alternative to NuvaRing. This product offers long-lasting contraceptive protection and marks an important expansion of Xiromed’s extensive range of women's health medications, which also feature oral contraceptives and transdermal gels.

Rob Spina, CEO of Xiromed, highlighted the impact of this launch:

"The launch of EnilloRing is an exciting milestone in Xiromed’s journey to becoming a leading generic provider of women’s healthcare products in the United States. We are committed to broadening and growing the availability of contraceptive options for U.S. patients."

Increasing Initiatives by Social Organizations to Improve Access to Condoms

Government initiatives such as the Title X family planning program, aimed at offering family planning services to low-income individuals, have played a crucial role in enhancing condom access in various communities across the U.S. The NYC Condom Availability Program has distributed over 30 million free safer sex products, including internal condoms (FC2) and standard condoms, each year at more than 3,500 locations throughout the city. These efforts are essential for boosting condom usage, which consequently raises the demand for contraceptive products and contributes to the overall expansion of the U.S. market.

Rising Publicly Funded Family Planning Services:

In the U.S., each year, approximately 45% of pregnancies are estimated to be unwanted pregnancies. Furthermore, over the past decade, rising publicly funded family planning services have continued to grow through federal, state, and local initiatives, reinforcing their importance as a key market driver for contraceptive usage. According to the Kaiser Family Foundation (KFF) article published in March 2022, more than 6.4 million women received publicly funded contraceptive care through Title X clinics, Medicaid, and other state programs as of 2022. Title X, the only federal program dedicated solely to providing family planning and related preventive services, remains the backbone of this effort.

Technological Innovations in Contraceptive Methods:

Development, approval, and commercialization of new, more effective, and long-acting reversible contraceptive methods are expected to drive the market during the forecast period. For instance, in August 2020, the U.S. FDA approved Phexxi, a nonhormonal form of birth control for women, which helped regulate vaginal pH levels. Launch of generic and low-cost drugs and devices has led to an increase in the demand for contraceptives by teenagers as well. In April 2022, Reckitt Benckiser launched a new condom category, Durex Intense, targeted at the female consumer pool by claiming that it enhanced stimulation and pleasure.

Moreover, new methods such as the NuvaRing, a combined hormonal vaginal ring, and the development of non-hormonal birth control methods are also helping to meet diverse consumer preferences. The introduction of non-hormonal options appeals to those who are sensitive to hormones or wish to avoid their potential side effects. In addition, advances in digital health, such as smartphone apps to track fertility and ovulation cycles, offer women more personalized ways to manage their reproductive health.

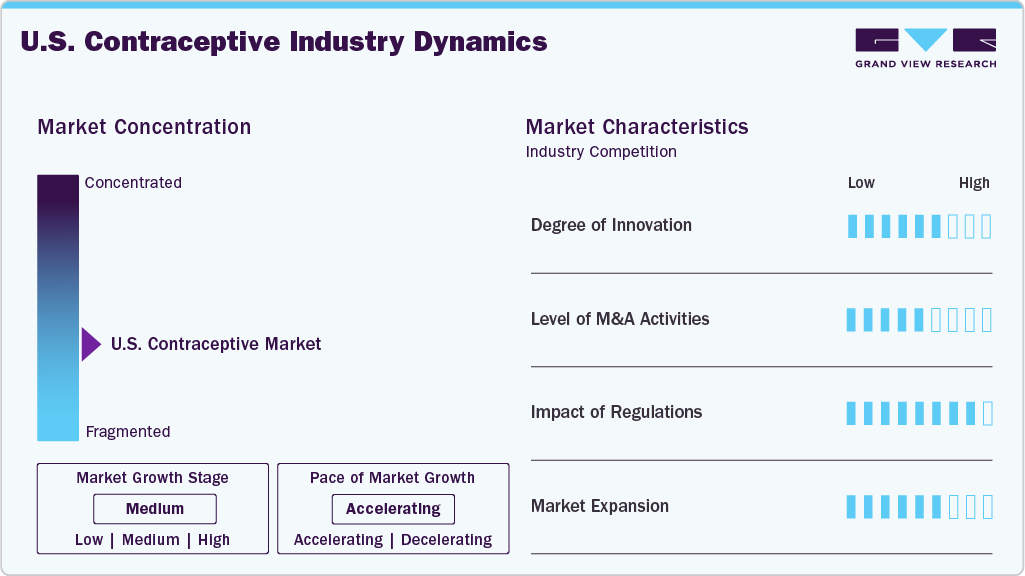

Market Concentration & Characteristics

The market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, and the level of partnerships & collaborationactivities is medium. The impact of regulations on the market is high, and the market expansion of players is medium.

Innovations include the innovations in contraceptive methods that manage unmet needs for safer, more effective, and user-friendly options. In October 2023, ONE Condoms introduced graphene-enhanced condoms. Graphene, known for its strength, thinness, and thermal conductivity, has been incorporated into condom manufacturing to create thinner, stronger, and more heat-conductive products. The innovation aims to improve user comfort and sexual experience without compromising safety, addressing common user complaints about traditional latex condoms.

The industry saw notable consolidations as larger companies aimed to expand their reach and capabilities. For instance, in August 2024, Agile Therapeutics, Inc. merged with Insud Pharma, S.L., a global pharmaceutical organization based in Spain that operates in over 50 countries. This merger will combine Agile Therapeutics with Exeltis, Insud Pharma's U.S. subsidiary, enhancing its previously extensive portfolio in women's health and contraceptive products.

The impact of regulations on the use of contraceptives in the U.S. is significant. The U.S. FDA is the regulatory authority that reviews pharmaceutical & biological products intended for sale and marketing in the U.S. To commercialize a hormonal product, a New Drug Application (NDA) under the Food, Drug, and Cosmetic (FD&C) Act, which is under the Public Health Service (PHS) Act, must be submitted to the FDA for filing and premarket review. The FDA approval process for new contraceptive devices-such as diaphragms and inert intrauterine devices-is similar to that for drugs. The U.S. FDA regulates condoms under Class II medical devices.

The industry is experiencing significant geographical expansion, driven by various factors, including increasing awareness, changing consumer preferences, and technological advancements. For instance, in February 2024, Bayer and Daré Bioscience collaborated to develop Ovaprene, an investigational hormone-free monthly contraceptive. This device is designed as an intravaginal ring that provides contraception for three weeks without requiring any action from the user at the time of intercourse.

Product Insights

The pills segment dominated the market, accounting for the largest share of 41.0% in 2025. This growth is due to the popularity of pills among young women in the U.S., which can be attributed to safety and ease of administration. Moreover, contraceptive pills are also one of the most cost-effective methods of contraception, with around 93% effectiveness. These medicines are available only via a gynecologist’s prescription and can be used for other conditions as well, such as dysmenorrhea, amenorrhea, hypermenorrhea, endometriosis, and others. Oral contraceptives have been in the U.S. market for a long time, and their availability has led to women’s economic empowerment.

The subdermal implants segment is anticipated to grow at the significant CAGR during the forecast period. Contraceptive implants are flexible and small plastic rods that are placed under the skin of the upper arm, which release progestogen in the bloodstream to prevent pregnancy. Subdermal implants are more than 99% effective in preventing pregnancy and are a cost-effective method as they protect for up to 3 years.

Regional Insights

The Southeast region dominated the market with the largest share in 2025. This growth is due to the rising awareness of reproductive health, increasing demand for modern family planning methods, and expanding access through public and private healthcare initiatives. Rapid urbanization, improving female education levels, and greater workforce participation among women have strengthened the preference for reliable and long-acting contraceptive solutions. Support from global health organizations such as the United Nations Population Fund and programs backed by USAID have improved distribution networks and affordability across Southeast Asian countries.

The Southwest region is anticipated to grow at a significant CAGR during the forecast period. This is driven by high population growth, a relatively younger demographic profile, and increasing awareness of reproductive health. The region has a large proportion of women of reproductive age, including significant Hispanic and rural populations, which sustains demand for affordable and accessible contraceptive solutions.

Key U.S. Contraceptive Companies Insights:

Key players operating in the U.S. contraceptive market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Contraceptive Companies:

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group Plc

- Organon Group of Companies

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- The Cooper Companies, Inc.

- Mayer Laboratories Inc

- Agile Therapeutics

- Mayne Pharma Group Limited.

- Bayer AG

- Afaxys, Inc.

- AbbVie

- Gedeon Richter

Recent Developments

- In April 2025, NEXT Life Sciences announced the successful completion of a clinical trial in Australia for its Plan A male contraceptive delivery device, achieving a 100% success rate. This milestone builds upon earlier trials conducted in Canada and positions Plan A as a promising non-hormonal, long-acting, reversible male contraceptive option.

“Plan A has the potential to be a game-changer for men and couples as they traverse their lives and careers, giving them an on-demand reversible contraception option,” said Founder and Executive Chairman. “This is one of the reproductive health innovations NEXT Life Sciences plans to bring to market to revolutionize a critical area of health.”

- In February 2025, Daré Bioscience and Theramex announced a partnership for the co-development and licensing of Casea S, a potential biodegradable contraceptive implant, as a Phase 1 study, supported by a foundation, assessing its potential.

“We are excited to partner with Daré to develop Casea S, a potential first-in-category contraceptive candidate for women,” said CEO of Theramex. “A biodegradable implant for contraception resonates with what we hear from women as does the idea that she can make that choice every 18-24 months as to whether it is right for her. With its innovative design, Casea S would only require a single surgery visit, offering a more convenient, reversible alternative to existing long-acting contraceptive methods that would enable women to take control of their reproductive health with confidence.”

- In February 2025, FDA approved MIUDELLA, a copper intrauterine system (IUS) developed by Sebela Women's Health Inc., marking the first hormone-free IUD approved in the U.S. in over 40 years. This approval represents a significant advancement in long-acting reversible contraception (LARC) options available to individuals seeking hormone-free birth control methods.

"Considering it has been four decades since we've been able to offer women a new hormone-free IUD option, I find the clinical data supporting MIUDELLA efficacy and safety to be very exciting," said MD, MPH, Professor, Department of Obstetrics and Gynecology, University of Utah. "This innovative intrauterine device may allow for improvements in discontinuation rates due to pain and bleeding and in expulsion rates. This would be very meaningful for women looking for hormone-free options."

U.S. Contraceptive Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.8 billion

Revenue forecast in 2033

USD 12.4 billion

Growth rate

CAGR of 4.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Country scope

U.S.

Key companies profiled

Church & Dwight Co., Inc.; Reckitt Benckiser Group Plc; Organon Group of Companies; Pfizer, Inc.; Teva Pharmaceutical Industries Ltd.; The Cooper Companies, Inc.; Mayer Laboratories Inc.; Agile Therapeutics; Mayne Pharma Group Limited; Bayer AG; Afaxys, Inc.; AbbVie; Gedeon Richter

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Contraceptive Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. contraceptive market report based on product and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pills

-

Intrauterine Devices (IUD)

-

Hormonal IUD

-

Nonhormonal IUD

-

-

Condoms

-

Male Condoms

-

Female Condoms

-

-

Vaginal Ring

-

Subdermal Implants

-

Injectable

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Northeast

-

Midwest

-

Frequently Asked Questions About This Report

b. The U.S. contraceptive market size was valued at USD 8.4 billion in 2025.

b. Some key players operating in the U.S. contraceptive market include Merck & Co. Inc.; Bayer AG; Allergan; Afaxys, Inc.; Mayer Laboratories, Inc.; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; TherapeuticsMD Inc.; Reckitt Benckiser Plc.; Pfizer, Inc.; Cooper Surgical; Church & Dwight Co., Inc.; and Mithra Pharmaceuticals.

b. Key factors that are driving the U.S. contraceptive market growth include the increase in the use of modern contraceptives and the rise in awareness among adolescents and young people about sexual health and family planning.

b. The U.S. contraceptive market size was valued at USD 8.4 billion in 2025 and is expected to reach USD 12.4 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033.

b. The pills segment dominated the market, accounting for the largest share of 41.0% in 2025. This segment growth is due to the popularity of pills among young women in the U.S., which can be attributed to safety and ease of administration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.