- Home

- »

- Medical Devices

- »

-

U.S. Contraceptive Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Contraceptive Market Size, Share & Trends Report]()

U.S. Contraceptive Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Pills, Nonhormonal Intrauterine Devices, Hormonal Intrauterine Devices, Male Condoms, Female Condoms, Vaginal Ring, Subdermal Implants, Injectable), And Segment Forecasts

- Report ID: GVR-2-68038-702-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Contraceptive Market Size & Trends

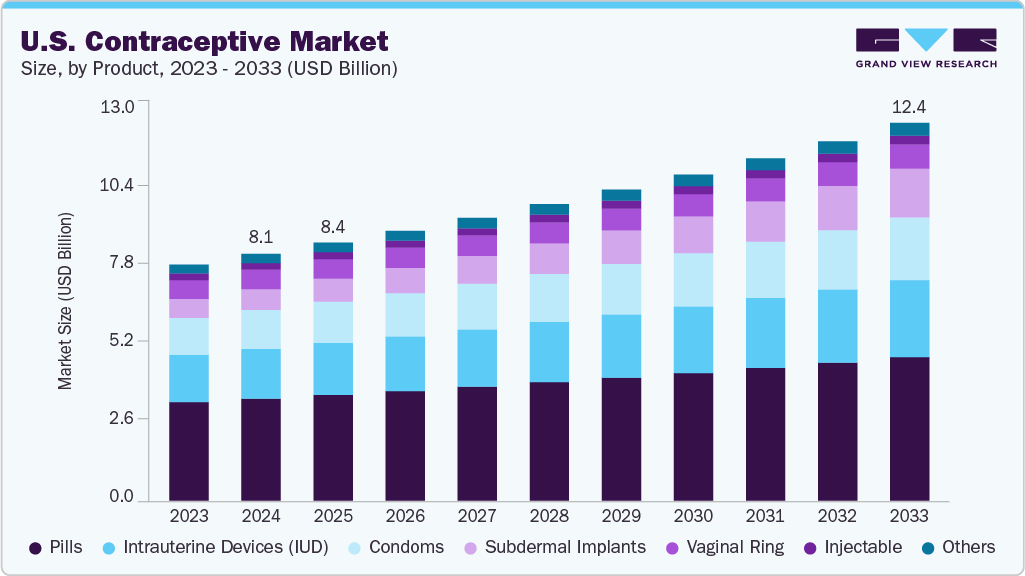

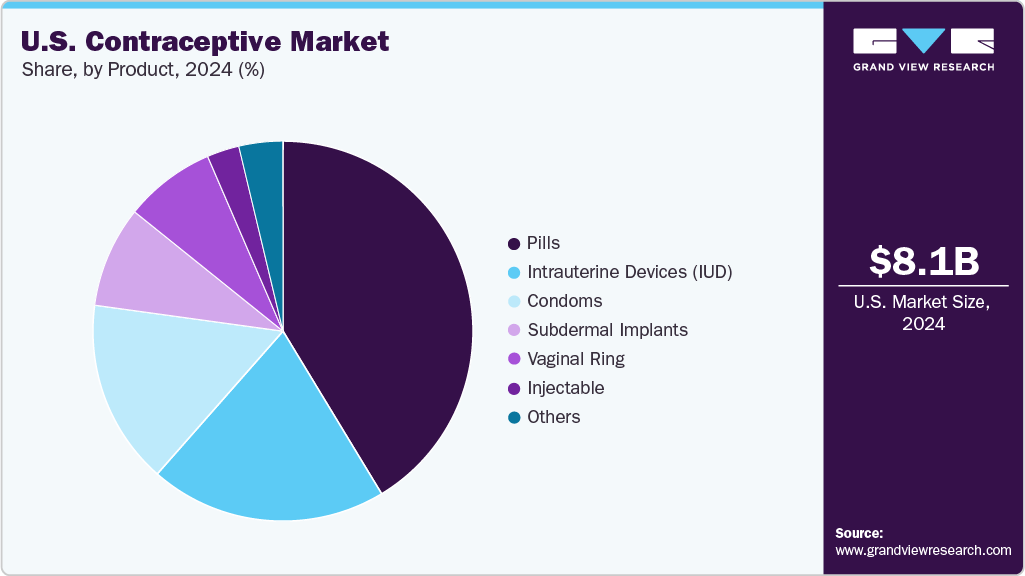

The U.S. contraceptive market size was valued at USD 8.08 billion in 2024 and is expected to reach USD 12.37 billion by 2033, growing at a CAGR of 4.88% from 2025 to 2033. The increase in the use of modern contraceptives and the rise in awareness among adolescents and young people about sexual health and family planning are key factors driving growth. Moreover, government programs have led to an increase in access to contraceptives that help prevent unwanted pregnancies in teenagers.

Continued Innovation in Women’s Contraceptive Health

With the increasing demand, awareness, and preference for reliable alternatives, companies are looking forward to offering safe, effective, and long-term contraceptive options to meet the evolving needs of women worldwide, leading to notable advancements and product launches.

EnilloRing: Expanding Contraceptive Choices

In October 2023, Xiromed LLC introduced EnilloRing (etonogestrel/ethinyl estradiol vaginal ring), a generic alternative to NuvaRing. This product offers long-lasting contraceptive protection and marks an important expansion of Xiromed’s extensive range of women's health medications, which also feature oral contraceptives and transdermal gels.

Rob Spina, CEO of Xiromed, highlighted the impact of this launch:

"The launch of EnilloRing is an exciting milestone in Xiromed’s journey to becoming a leading generic provider of women’s healthcare products in the United States. We are committed to broadening and growing the availability of contraceptive options for U.S. patients."

Manufactured at Laboratorios Leon Pharma SAU in Leon, Spain, EnilloRing underscores Xiromed’s dedication to leveraging cutting-edge technologies as part of Insud Pharma’s commitment to advancing women’s health solutions.

Increasing Initiatives by Social Organizations to Improve Access to Condoms

Non-profit organizations and public health initiatives have concentrated on providing free or affordable condoms to at-risk groups, such as teenagers, low-income communities, and other vulnerable populations. For instance, Planned Parenthood delivers a variety of contraceptive options, including condoms, at its health centers, through outreach efforts, and via online resources. Their initiatives to educate people about safe sex and distribute condoms at no cost in schools, clinics, and community events have significantly increased access for individuals who may encounter obstacles due to financial constraints or insufficient information.

Moreover, government initiatives such as the Title X family planning program, aimed at offering family planning services to low-income individuals, have played a crucial role in enhancing condom access in various communities across the U.S. The NYC Condom Availability Program has distributed over 30 million free safer sex products, including internal condoms (FC2) and standard condoms, each year at more than 3,500 locations throughout the city. These efforts are essential for boosting condom usage, which consequently raises the demand for contraceptive products and contributes to the overall expansion of the U.S. market.

Rising Publicly Funded Family Planning Services

In the U.S., each year, approximately 45% of pregnancies are estimated to be unwanted pregnancies. Despite advancements in contraceptive technology and an increase in R&D spending on contraceptives, the rate of unplanned pregnancies in the U.S. has remained unchanged for decades. This has increased the economic burden on low-income families that do not have easy access to modern and more effective methods of contraception. Publicly funded family planning services play a critical role in expanding access to contraceptives across the U.S., particularly among low-income and underserved populations.

Furthermore, over the past decade, rising publicly funded family planning services have continued to grow through federal, state, and local initiatives, reinforcing their importance as a key market driver for contraceptive usage. According to the Kaiser Family Foundation (KFF) article published in March 2022, more than 6.4 million women received publicly funded contraceptive care through Title X clinics, Medicaid, and other state programs as of 2022. Title X, the only federal program dedicated solely to providing family planning and related preventive services, remains the backbone of this effort. Beyond federal programs, several states have proactively expanded state-level family planning services. For instance, California's Family PACT (Planning, Access, Care, and Treatment) program continues to serve over 1 million low-income residents annually, offering free contraceptives and reproductive health services to eligible individuals.

Technological Innovations in Contraceptive Methods

Development, approval, and commercialization of new, more effective, and long-acting reversible contraceptive methods are expected to drive the market during the forecast period. For instance, in August 2020, the U.S. FDA approved Phexxi, a nonhormonal form of birth control for women, which helped regulate vaginal pH levels. Launch of generic and low-cost drugs and devices has led to an increase in the demand for contraceptives by teenagers as well. In April 2022, Reckitt Benckiser launched a new condom category, Durex Intense, targeted at the female consumer pool by claiming that it enhanced stimulation and pleasure.

Furthermore, the demand for nonhormonal contraceptives in the U.S. is increasing, as they eliminate the risk of adverse effects associated with hormonal imbalance in the body. Companies operating in the contraceptive market have a significant opportunity to introduce advanced versions of nonhormonal contraceptive products. For instance, DARÉ BIOSCIENCE, INC.’s Ovaprene, which is a hormone-free, intravaginal ring that releases spermicides and a polymer barrier in the form of a mesh, preventing entry of sperm into the cervical canal, is in the development stage.

Moreover, new methods such as the NuvaRing, a combined hormonal vaginal ring, and the development of non-hormonal birth control methods are also helping to meet diverse consumer preferences. The introduction of non-hormonal options appeals to those who are sensitive to hormones or wish to avoid their potential side effects. In addition, advances in digital health, such as smartphone apps to track fertility and ovulation cycles, offer women more personalized ways to manage their reproductive health.

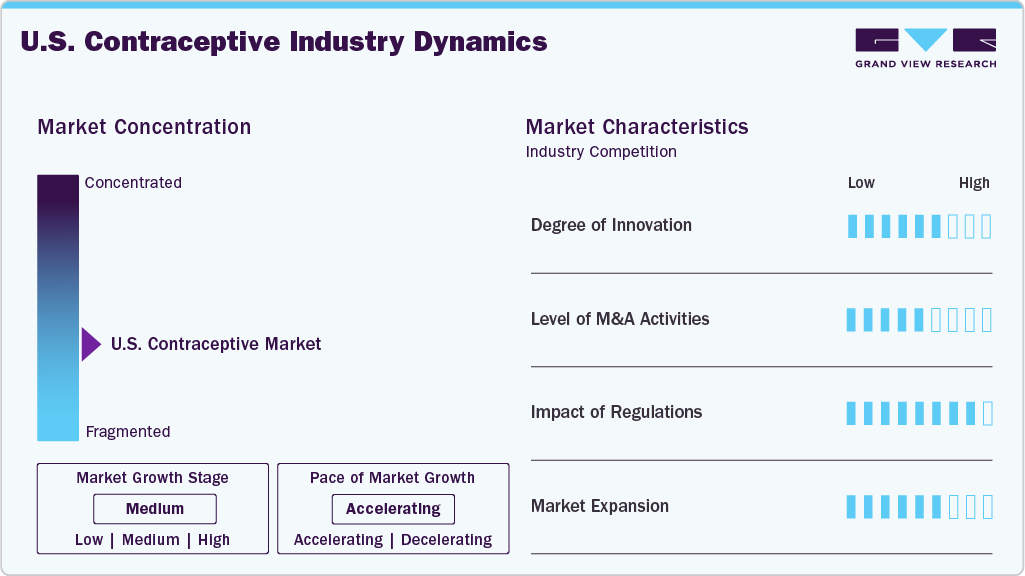

Market Concentration & Characteristics

The industry is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, and the level of partnerships & collaborationactivities is medium. The impact of regulations on the market is high, and the market expansion of players is medium.

Innovations include the innovations in contraceptive methods manage unmet needs for safer, more effective, and user-friendly options. In October 2023, ONE Condoms introduced graphene-enhanced condoms. Graphene, a Nobel Prize-winning material known for its strength, thinness, and thermal conductivity, has been incorporated into condom manufacturing to create thinner, stronger, and more heat-conductive products. The innovation aims to improve user comfort and sexual experience without compromising safety, addressing common user complaints about traditional latex condoms.

The industry saw notable consolidations as larger companies aimed to expand their reach and capabilities. For instance, in August 2024, Agile Therapeutics, Inc. merged with Insud Pharma, S.L., a global pharmaceutical organization based in Spain that operates in over 50 countries. This merger will combine Agile Therapeutics with Exeltis, Insud Pharma's U.S. subsidiary, enhancing its previously extensive portfolio in women's health and contraceptive products.

The impact of regulations on the use of contraceptives in the U.S. is significant. The U.S. FDA is the regulatory authority that reviews pharmaceutical & biological products intended for sale and marketing in the U.S. To commercialize a hormonal product, a New Drug Application (NDA) under the Food, Drug, and Cosmetic (FD&C) Act, which is under the Public Health Service (PHS) Act, must be submitted to the FDA for filing and premarket review. The FDA approval process for new contraceptive devices-such as diaphragms and inert intrauterine devices-is similar to that for drugs. The U.S. FDA regulates condoms under Class II medical devices.

The industry is experiencing significant geographical expansion, driven by various factors, including increasing awareness, changing consumer preferences, and technological advancements. For instance, in February 2024, Bayer and Daré Bioscience collaborated to develop Ovaprene, an investigational hormone-free monthly contraceptive. This device is designed as an intravaginal ring that provides contraception for three weeks without requiring any action from the user at the time of intercourse.

Product Insights

The pills segment dominated the market, accounting for the largest share of 41.32% in 2024. This segment growth is due to the popularity of pills among young women in the U.S., which can be attributed to safety and ease of administration. Moreover, contraceptive pills are also one of the most cost-effective methods of contraception, with around 93% effectiveness. These medicines are available only via a gynecologist’s prescription and can be used for other conditions as well, such as dysmenorrhea, amenorrhea, hypermenorrhea, endometriosis, and others. Oral contraceptives have been in the U.S. market for a long and their availability has led to women’s economic empowerment. Furthermore, the availability of advanced and generic versions of oral contraceptive pills is expected to boost the growth of the pills market in the U.S. Several international pharmaceutical companies have launched generic versions of oral contraceptives, which have significantly increased access to pills in low-income areas of the country.

The subdermal implants segment is anticipated to grow at the significant CAGR during the forecast period. Contraceptive implants are flexible and small plastic rods that are placed under the skin of the upper arm, which release progestogen in the bloodstream to prevent pregnancy. Subdermal implants are more than 99% effective in preventing pregnancy and are a cost-effective method as they protect for up to 3 years. Moreover, women have also reported experiencing the natural return of fertility after the removal of the subdermal implants. Hence, the subdural implants are gaining popularity in the U.S. market.

Key U.S.Contraceptive Company Insights

Key players in the U.S. contraceptive market include companies like Reckitt Benckiser, Pfizer, Bayer, and AbbVie. They offer various contraceptive options, such as oral pills, IUDs, injectables, and patches. These companies leverage strong R&D, distribution networks, and brand recognition in women's health, focusing on innovative products, including hormone-free and long-acting options. In addition, they participate in public health initiatives and partnerships to enhance access and education in family planning, while investing in next-generation contraceptive technologies to address unmet reproductive health needs.

Key U.S. Contraceptive Companies:

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group Plc

- Organon Group of Companies

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- The Cooper Companies, Inc.

- Mayer Laboratories Inc

- Agile Therapeutics

- Mayne Pharma Group Limited.

- Bayer AG

- Afaxys, Inc.

- AbbVie

- Gedeon Richter

Recent Developments

-

In April 2025, NEXT Life Sciences announced the successful completion of a clinical trial in Australia for its Plan A male contraceptive delivery device, achieving a 100% success rate. This milestone builds upon earlier trials conducted in Canada and positions Plan A as a promising non-hormonal, long-acting, reversible male contraceptive option.

“Plan A has the potential to be a game-changer for men and couples as they traverse their lives and careers, giving them an on-demand reversible contraception option,” said Founder and Executive Chairman. “This is one of the reproductive health innovations NEXT Life Sciences plans to bring to market to revolutionize a critical area of health.”

-

In February 2025, Daré Bioscience and Theramex announced a partnership for the co-development and licensing of Casea S, a potential biodegradable contraceptive implant, as a Phase 1 study, supported by a foundation, assessing its potential.

“We are excited to partner with Daré to develop Casea S, a potential first-in-category contraceptive candidate for women,” said the CEO of Theramex. “A biodegradable implant for contraception resonates with what we hear from women, as does the idea that she can make that choice every 18-24 months as to whether it is right for her. With its innovative design, Casea S would only require a single surgery visit, offering a more convenient, reversible alternative to existing long-acting contraceptive methods that would enable women to take control of their reproductive health with confidence.”

-

In February 2025, the FDA approved MIUDELLA, a copper intrauterine system (IUS) developed by Sebela Women's Health Inc., marking the first hormone-free IUD approved in the U.S. in over 40 years. This approval represents a significant advancement in long-acting reversible contraception (LARC) options available to individuals seeking hormone-free birth control methods.

"Considering it has been four decades since we've been able to offer women a new hormone-free IUD option, I find the clinical data supporting MIUDELLA efficacy and safety to be very exciting," said MD, MPH, Professor, Department of Obstetrics and Gynecology, University of Utah. "This innovative intrauterine device may allow for improvements in discontinuation rates due to pain and bleeding, and in expulsion rates. This would be very meaningful for women looking for hormone-free options."

-

In February 2024, Bayer and Daré Bioscience partnered to create a hormone-free monthly contraceptive. The device, a vaginal ring, offers three weeks of contraception without requiring user action during intercourse, expanding current contraceptive options.

“As a recognized leader in Women’s Health, the collaboration with Daré Bioscience represents an excellent strategic fit with our vision to continue to offer differentiated contraceptive choices to women,” said Member of the Executive Committee and EVP, Head of Business Development & Licensing, Pharmaceuticals Division of Bayer AG

U.S. Contraceptive Market Report Scope

Report Attribute

Details

Market size in 2025

USD 8.45 billion

Revenue forecast in 2033

USD 12.37 billion

Growth rate

CAGR of 4.88% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

Church & Dwight Co., Inc.; Reckitt Benckiser Group Plc; Organon Group of Companies; Pfizer, Inc.; Teva Pharmaceutical Industries Ltd.; The Cooper Companies, Inc.; Mayer Laboratories Inc.; Agile Therapeutics; Mayne Pharma Group Limited; Bayer AG; Afaxys, Inc.; AbbVie; Gedeon Richter

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Contraceptive Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. contraceptive market report based on product.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pills

-

Intrauterine Devices (IUD)

-

Hormonal IUD

-

Nonhormonal IUD

-

-

Condoms

-

Male Condoms

-

Female Condoms

-

-

Vaginal Ring

-

Subdermal Implants

-

Injectable

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.