- Home

- »

- Medical Devices

- »

-

U.S. Contrast Media Injectors Market, Industry Report, 2030GVR Report cover

![U.S. Contrast Media Injectors Market Size, Share & Trends Report]()

U.S. Contrast Media Injectors Market Size, Share & Trends Analysis Report By Product (Injector Systems, Consumables), By Type (Single Head Injectors, Dual Head Injectors), By Application (Radiology, Interventional Cardiology), By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-231-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Contrast Media Injectors Market Trends

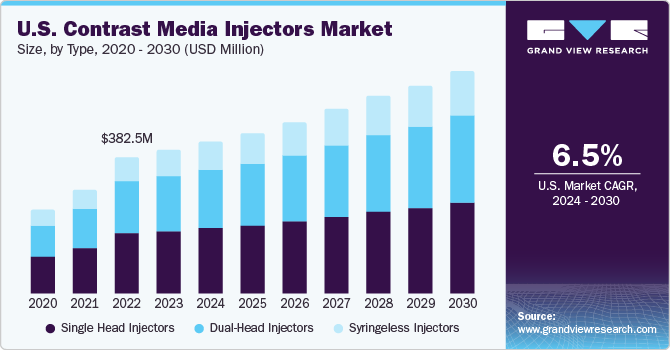

The U.S. contrast media injectors market size was valued at USD 401.8 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The market growth is attributed to the increasing prevalence of chronic disorders, technological advancements, along with growing demand for minimally invasive surgical procedures.

Chronic diseases are the primary cause of death, and a large number of people are affected by complicated morbidities which is expected to spur the market growth. Further, the number of diagnostic imaging tests such as X-rays, ultrasounds, and advanced imaging equipment such as CT scans, MRIs, and others has increased with growing prevalence of long-term diseases and complex comorbidities. In addition, according to a report by Centers for Disease Control and Prevention, incidence of heart failure is increasing in the U.S., and it is one of the leading causes of death. Moreover, by 2030, the number of people with heart diseases is estimated to increase by 46%. In most cases, deaths due to cardiac conditions can be avoided if diagnosed at an early stage. Hence, increasing prevalence of long-term diseases and complex comorbidities is one of the major drivers as it is leading to an increase in demand for contrast media injectors.

In 2023, U.S. contrast media injectors market accounted for a market share of over 32% in the global contrast media injectors market. Rapid technological advancements, rise in healthcare expenditure, and improvement in quality of patient care are some of the major factors contributing to the increase in demand for minimally invasive surgeries. Contrast media injectors can assist surgeons in accurately inserting a contrast agent to reduce human errors and increase accuracy & efficiency of surgical procedures. Contrast media injectors play a crucial role in intraoperative interventional radiology and interventional cardiology. Availability of advanced injector systems for diagnosis and intraoperative imaging is likely to propel their adoption.

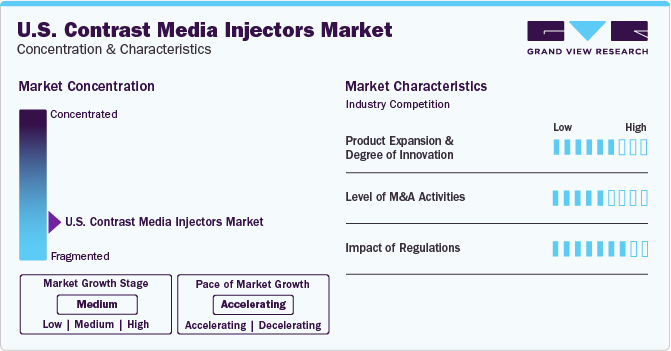

Market Concentration & Characteristics

The industry growth stage is high (CAGR: >10%) and the pace of the growth is accelerating due to numerous initiatives undertaken by key players.

Several U.S. contrast media injectors companies are focusing on undertaking extensive R&D activities to develop new products and advanced technologies. Technological advancements such as IT-enabled solutions for injectors, syringeless injectors, duel-head injectors, and automated injectors have led to incremental changes in medical imaging. Syringeless injectors are more user-friendly, efficient, and minimize contrast agent wastage as well as provide contrast enhancement quality during imaging. Furthermore, the availability of advanced IT-enabled solutions for injectors in data management, which provide data to analyze imaging optimization, workflow efficiencies, and patient safety is opportunistic for the product demand.

The industry is characterized by a moderate level of merger and acquisition (M&A) and collaboration activities. This is due to several factors, including the need to gain a competitive advantage in the industry and to consolidate in a rapidly growing industry. Major industry participants are collaborating with firms operating across the industry. For instance, in December 2022, Ulrich Medical announced a co-operative agreement with GE Healthcare to market a multi-dose branded contrast media injector in the U.S.

The FDA and other authorities have established a regulatory framework to assure product safety, effectiveness, and quality standards. Contrast media injectors are classified under class I medical devices. As per U.S. FDA regulations, most of the class I devices are exempt from 510(k) notification, while manufacturers of some of these devices are required to submit the notification. For every device with 510(k) notification, manufacturers must receive an order of clearance before distributing the device. Stringent regulations can create challenges for innovators, manufacturers, and exporters to receive approval for market distribution from the U.S. to developing economies.

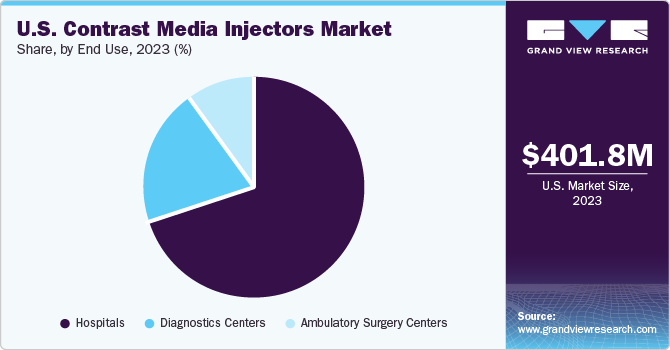

End-use Insights

Hospitals led the market and accounted for a share of 67.8% in 2023 and expected to witness the fastest growth over the forecast period. This growth is attributable to the increasing admissions of patients suffering from cardiovascular diseases, cancer, and neurological disorders. Hospitals are primary end-users of contrast media injectors, owing to their wide range of applications in radiology, interventional radiology, and interventional cardiology. In addition, increasing focus on development of healthcare infrastructure is expected to propel the segment growth.

The diagnostics centers segment is one of the fastest growing segments. The rising number of private imaging centers owing to the increased demand for early diagnosis, and shortage of imaging modalities in small and mid-scale hospitals are significant factors driving the segment growth. The demand for angiography operations, which are utilized for diagnosis, treatment planning, and prevention of chronic illnesses, is expected to increase as people become more aware of these conditions.

Product Insights

Injector systems led the market and accounted for a share of 60.3% in 2023.Contrast agents are delivered into the bloodstream of patients during CT, MRI, and angiography, enabling enhanced visualization of contrast of fluids within the body. Types of injector systems include CT injector systems, MRI injector systems, and cardiovascular/angiography injector systems. Among these, CT injector systems accounted for the largest share in terms of revenue. This is due to its increasing use in the diagnosis and treatment of cancer, vascular disease, and orthopedic injuries & disorders.

The consumables segment is expected to grow at the fastest CAGR during the forecast period. Segment growth is attributable to the increasing need for consumables to ensure safety and hygienic conditions during diagnostic procedures. Further, surge in adoption of contrast media injectors consumables, paired with increasing prevalence of chronic disorders is expected to spur the segment growth.

Type Insights

Single head injectors led the market and accounted for more than 43.4% share in 2023.The market dominance of these injectors is attributable to the increasing application areas and low average selling price. Single head injectors are the most widely used injectors for angiography, CT, and MRI. These injectors involve the use of a single syringe to deliver contrast media.

The syringeless injectors segment is anticipated to grow at the fastest CAGR during the forecast period.Syringeless power injectors have become popular presently to limit contrast media waste. It is estimated that syringeless injectors offer a cost savings of over $8 per patient, which is projected to drive the segment growth. Several manufacturers are concentrating their efforts on the introduction and development of syringeless injectors, which is expected to boost the market.

Application Insights

Radiology led the market and accounted for more than 46.6% share in 2023. Radiology involves the use of noninvasive imaging technologies such as CT and MRI scanning for delivering highly comprehensive images. Contrast media injectors are used with CT and MRI to diagnose a wide range of health conditions such as heart diseases, breast cancer, gastrointestinal conditions, broken bones, colon cancer, and blood clots. In addition, this segment is projected to grow at a lucrative rate owing to increasing demand for these non-invasive techniques and rise in prevalence of chronic diseases.

Interventional cardiology is anticipated to witness at the fastest growth over the forecast period owing to the rising prevalence of cardiac conditions such as coronary artery disease, heart valve disease, and peripheral vascular disease among others. Additionally, increasing technological advancements along with rising hospital admissions coupled with increasing adoption of interventional cardiology for treatment of acute myocardial infarction will further drive the segment growth.

Key U.S. Contrast Media Injectors Company Insights

Some of the key companies include Bracco Group, Bayer HealthCare LLC, Medtron AG, and Ulrich Medical, among others. They provide a broad range of advanced injector solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launch, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies to expand their businesses and market presence. For instance, In December 2021, Guerbet announced that it had signed a global agreement with Bracco Imaging for Gadopiclenol, a next-generation MRI contrast agent.

Key U.S. Contrast Media Injectors Companies:

- Bayer HealthCare LLC

- Bracco Group

- Ulrich Medical

- Guerbet Group

- Medtron AG

- Nemoto Kyorindo Co., Ltd.

- Hong Kong Medi Co Limited

Recent Developments

-

In November 2023, Bracco announced long term partnership with Ulrich Medical. This deal was aimed at establishing an exclusive private label arrangement to bring a Bracco-branded flagship MR injector to the U.S.

-

In November 2022, GE Healthcare announced an investment of USD 80 million to expand the capacity of contrast media production. The company also planned to manufacture 30 million more doses of contrast media every year.

U.S. Contrast Media Injectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 423.4 million

Revenue forecast in 2030

USD 622.5 million

Growth Rate

CAGR of 6.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use

Country scope

U.S.

Key companies profiled

Bayer AG; Bracco Imaging S.p.A.; Ulrich medical; Guerbet; MEDTRON AG; Nemoto Kyorindo Co., Ltd.; Hong Kong Medi Co Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Contrast Media Injectors Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. contrast media injectors market report on the basis of product, type, application, and end use:

-

Product Outlook (Revenue USD Million; 2018 - 2030)

-

Injector Systems

-

CT injector systems

-

MRI injector systems

-

Cardiovascular/angiography injector systems

-

-

Consumables

-

Tubing

-

Syringe

-

Others

-

-

-

Type Outlook (Revenue USD Million; 2018 - 2030)

-

Single Head Injectors

-

Dual-Head Injectors

-

Syringeless Injectors

-

-

Application Outlook (Revenue USD Million; 2018 - 2030)

-

Radiology

-

Interventional Cardiology

-

Interventional Radiology

-

-

End Use Outlook (Revenue USD Million; 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The U.S. contrast media injectors market size was estimated at USD 401.8 million in 2023 and is expected to reach USD 423.4 million in 2024.

b. The U.S. contrast media injectors market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 622.5 million by 2030.

b. Injector systems led the market and accounted for a share of 60.3% in 2023. Contrast agents are delivered into the bloodstream of patients during CT, MRI, and angiography, enabling enhanced visualization of contrast of fluids within the body.

b. Some prominent players in the U.S. contrast media injectors market include Bayer AG; Bracco Imaging S.p.A.; Ulrich medical; Guerbet; MEDTRON AG; Nemoto Kyorindo Co., Ltd.; Hong Kong Medi Co Limited.

b. The growth of the market is attributed to the increasing prevalence of chronic disorders, technological advancements, along with growing demand for minimally invasive surgical procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."