- Home

- »

- Medical Devices

- »

-

U.S. Corporate Wellness Market Size Report, 2022-2030GVR Report cover

![U.S. Corporate Wellness Market Size, Share & Trends Report]()

U.S. Corporate Wellness Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Health Risk Assessment, Fitness), By End Use, By Category, By Delivery Model (Onsite, Offsite), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-233-5

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

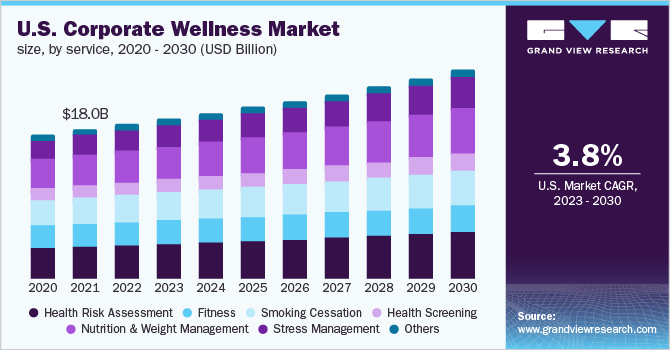

The U.S. corporate wellness market size was valued at USD 18.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.87% from 2023 to 2030. The reduction in the overall healthcare costs of the employee and the increasing onset of chronic diseases are expected to boost the market growth. Employee well-being has proved to be an essential feature of the modern-day business world. Employees are likely to perform more diligently for employers that make them feel loved. Around 60% of employees approve that corporate wellness programs have made them opt for a healthy lifestyle outside of the office as well.

Stress in the workplace is common among U.S.-based adults and is progressively increasing over the past few decades. The American Institute of Stress, in September 2019, reported that around 85% of employees in the U.S. suffer from work-related stress, which costs the employers around USD 300 billion annually. Moreover, according to SHRM, the cost of treating depression alone is approximately USD 110 billion annually, half of which is spent on treating employees.

There is an increasing awareness regarding employee health programs and their benefits in countering the various physical and mental disorders. This has resulted in increased adoption of programs by employers. According to a study published by the American Journal of Health Promotion, in 2017, almost half of the entire U.S. worksites offered some kind of health promotion program.

COVID-19 U.S. Corporate Wellness Market Impact: 10.7 % decrease from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The market contracted by 10.7% year on year in 2020, compared to 2019 due to the COVID-19 pandemic. According to the November 2020 Job Openings and Labor Turnover Summary, total separations grew to 5.4 million, including resignations, layoffs, and discharges.

The pandemic has heightened interest in creating stress-relieving office cultures that improve mental health and productivity. By providing digital technology that enables real-time access to healthcare resources, organizations can empower their employees to take control of their health. For instance, SilverCloud Health users report an improvement in anxiety and depression symptoms in up to 85% of cases, contributing to increased working satisfaction.

The growing sense of stress and isolation has also prompted wellness service providers to adopt virtual techniques for scheduling appointments with health coaches and psychologists. Additionally, various firms, like Salesforce, 3M, and SAP, have placed a high premium on several virtual wellness programs and activities during the pandemic.

As a result of the pandemic, integrating health initiatives into the workplace has become a higher priority, particularly as a way to keep staff engaged while working from home. Several of these corporate ideas include the use of Zoom to hold social gatherings and group workouts. This is likely to stimulate market growth.

The high return on investment (ROI) in corporate wellness services is also a factor that attracts employers to offer these services. Employers pay a substantial amount of healthcare premiums to insurance providers, especially, in large-scale organizations. The increasing number of unhealthy employees leads to an upsurge in the premium cost putting employers under an increased financial burden. This motivates employers to readily invest in programs for employees to reduce healthcare costs for the organization and increase productivity at work.

The government is taking initiatives to promote corporate well-being services. The Health Insurance Portability and Accountability Act (HIPAA) protects employee health information held by employers. Moreover, in May 2016, the U.S. Equal Employment Opportunity Commission (EEOC) passed a rule to implement Title II of the Genetic Information Nondiscrimination Act (GINA) associated with employer wellness programs. The final rule implies that employers may provide limited financial and other incentives in exchange for employee participation in wellness programs.

Most workplace wellness programs compensate for gym memberships. Businesses may need to provide alternatives to their employees because many individuals may not feel safe coming to gyms until there are fewer incidences of COVID-19. Providing access to online workout sessions is an easy substitute for gym memberships. The financial burden of the crisis has impacted people’s willingness to spend on well-being. Corporate wellbeing programs can help by giving reimbursements for employees who purchase yoga mats, resistance bands, and other basic gym equipment for at-home activities.

Service Insights

Based on service, the market is segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition & weight management, stress management, and others. The health risk assessment segment dominated the market in 2022 with a revenue share of 21.0%. The HRA analyzes information such as height, weight, level of physical activity, smoking habits, and stress level of the employees to derive the risk factors affecting the employees’ health. The segment growth is attributed to the growing trend to adopt health risk assessment as a service while offering employee wellness services.

The stress management segment is anticipated to witness a maximum CAGR of 5.33% during the forecast period. due to the increasing prevalence of stress in the workplace. The health screening segment is projected to witness growth owing to the increasing emphasis on preventing health. Wellness programs mainly comprise screening activities for the identification of probable health risks and the implementation of the required intervention strategies for promoting a healthy lifestyle.

Fitness programs are a pivotal part of any workplace health program. Many companies provided their employees with health wristbands, such as Fitbit, in the past to monitor their daily physical activity. Employers encourage their employees to be more active and special recognition is given to those who can reach their targets daily. Increasing adoption of remote patient monitoring devices is expected to drive the growth of the fitness segment. The increasing smoking population and rising awareness about side effects are major factors driving the growth of the smoking cessation segment.

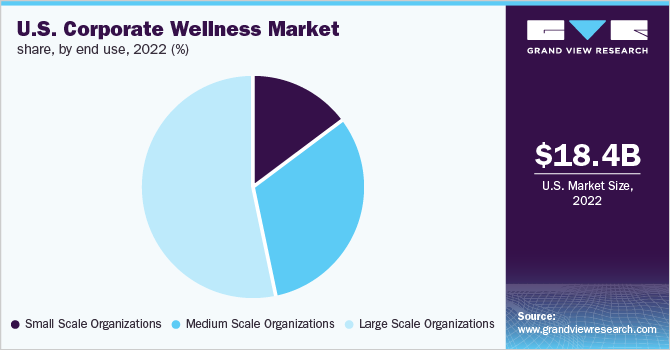

End-use Insights

The large-scale organizations with a share of 53.4% dominated the market in 2022. The segment growth is attributed to the availability of capital for investing in wellbeing services and sufficient space for providing onsite health services for employees. Large-scale organizations offer various services on their campuses, such as physicians, therapists, and chiropractors. This eventually saves employees time and also contributes to their productivity.

The implementation of corporate wellness programs helps in tracking various diseases. Health screening programs are conducted at regular intervals to keep a health check, promote preventive care, and reduce treatment costs. The focus on such conditions can reduce the disease burden and the overall cost of healthcare premiums paid by the employer to any insurance provider. Although lockdown and closure of offices have resulted in a large group of employees switching to work from home models, it remains vital to ensure that employees can access and continue to use health services at the workplace.

The medium-scale organizations segment is projected to register the highest CAGR of 4.30% during 2023-2030. The quick adoption of these services by medium-scale organizations is expected to contribute to the growth of the segment in the coming years. Rising awareness about employee health programs and increased absenteeism and attrition are anticipated to boost the growth of small and medium-scale organizations. These organizations can provide their employees with on-site services, such as yoga and meditation classes. This can be done bi-monthly or once a month.

Category Insights

In terms of category, the market is bifurcated into fitness & nutrition consultants, psychological therapists, and organizations/ employers. The organizations/ employers segment with 49.9% in 2022 accounted for the maximum portion of the market. The service providers offer in-house as well as outsourced health management services for large as well as small-scale corporations.

The trend of on-site fitness, which includes yoga and meditation, is becoming popular. Employers are significantly investing in offering healthy diets by providing catering options on campus and are hiring fitness coaches for their employees. Therefore, The fitness & nutrition consultants segment is expected to exhibit the fastest growth of 4.38% during the forecast period.

Employers often provide their employees with meditation and yoga sessions for releasing stress. Stressed employees tend to get angry frequently, which negatively impacts an organization. Thus, organizations provide art therapy, which is a unique technique for releasing stress. It is considered a form of expressive psychotherapy that uses art to improve a person’s emotional, physical, and mental well-being. Professionals also use this therapy on people suffering from emotional and mental disorders. Increasing demand for such therapy is propelling the growth of the psychological therapist segment.

Delivery Model Insights

The onsite segment held the maximum market share of 57.5% in 2022. The segment is anticipated to witness considerable growth over the forecast period. Onsite initiatives provide a personal touch to employee well-being, along with the facilities to exercise under the guidance of fitness consultants and coaches to meet their personal health needs.

Many organizations have restructured or added benefits and insurance plans to meet employees and their families health needs. Service providers are creating awareness among employees regarding unhealthy aspects related to working from home due to COVID-19. For instance, the pandemic has resulted in a shift from in-person meetings to virtual meetings. However, associated challenges such as the need to focus harder to process non-verbal cues such as body language and facial expressions, poor internet connections leading to disconnection from the meeting, and multitasking during meetings are causing more stress and exhaustion as compared to in-person meetings.

The offsite segment is projected to witness lucrative growth of 4.47% during the forecast period. Offsite programs include one-to-one interaction to improve employee health at different locations. Health services are constantly upgraded by the adoption of advanced technology. For instance, in January 2020, Virgin Pulse via the acquisition of a digital therapeutics provider Blue Mesa Health, Inc. is planning to leverage its Diabetes Prevention Program to promote diabetes prevention. This is driving the growth of the offsite segment.

Key Companies & Market Share Insights

The market is characterized by the increase in awareness regarding the benefits of corporate wellness and research and development leading to the launch of new products. For instance, in May 2019, Wellness Corporate Solutions launched an upgraded employee wellness portal to include client and participant feedback to make the screening, administering flu shots, and health coaching easier. Some prominent players in the U.S. corporate wellness market include:

-

ComPsych

-

Wellness Corporate Solutions

-

Virgin Pulse

-

EXOS

-

Marino Wellness

-

Privia Health

-

Vitality

-

Wellsource, Inc.

- Sonic Boom Wellness

U.S. Corporate Wellness Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.0 billion

Revenue forecast in 2030

USD 24.8 billion

Growth rate

CAGR of 3.87% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end use, category, delivery model

Country scope

U.S.

Key companies profiled

ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Sonic Boom Wellness

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

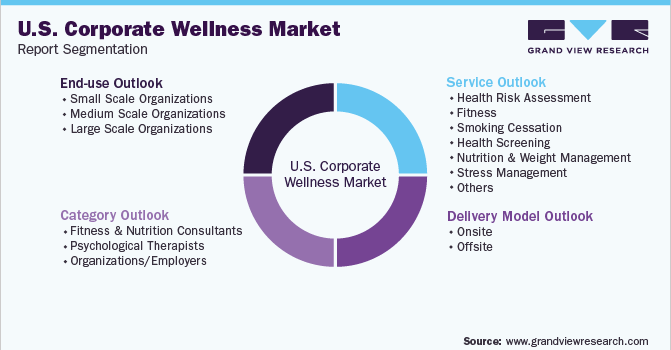

U.S. Corporate Wellness Market SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the U.S. corporate wellness market report based on service, end use, category, and delivery model:

-

Service Outlook (Revenue, USD Million, 2016 - 2030)

-

Health Risk Assessment

-

Fitness

-

Smoking Cessation

-

Health Screening

-

Nutrition & Weight Management

-

Stress Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Category Outlook (Revenue, USD Million, 2016 - 2030)

-

Fitness & Nutrition Consultants

-

Psychological Therapists

-

Organizations/Employers

-

-

Delivery Model Outlook (Revenue, USD Million, 2016 - 2030)

-

Onsite

-

Offsite

-

Frequently Asked Questions About This Report

b. The U.S. corporate wellness market size was estimated at USD18.4 billion in 2022 and is expected to reach USD 19.0 billion in 2023.

b. The U.S. corporate wellness market is expected to grow at a compound annual growth rate of 3.93% from 2023 to 2030 to reach USD 24.8 billion by 2030.

b. The health risk assessment segment dominated the U.S. corporate wellness market with the highest share in 2022. This is attributable to the trend to adopt health risk assessment as a service while offering employee wellness services.

b. Some key players operating in the U.S. corporate wellness market include ComPsych, Wellness Corporate Solutions (WCS), Virgin Pulse, EXOS, Marino Wellness, Privia Health, Vitality, Wellsource, Inc., and Sonic Boom Wellness.

b. Key factors that are driving the U.S. corporate wellness market growth include the reduction in overall healthcare costs of the employee and the increasing onset of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.