- Home

- »

- Homecare & Decor

- »

-

U.S. Countertops Market Size & Share, Industry Report 2033GVR Report cover

![U.S. Countertops Market Size, Share & Trends Report]()

U.S. Countertops Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Granite, Solid Surface, Engineered Quartz, Laminate, Marble), By Application (Kitchen, Bathroom), By End User (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-842-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Countertops Market Summary

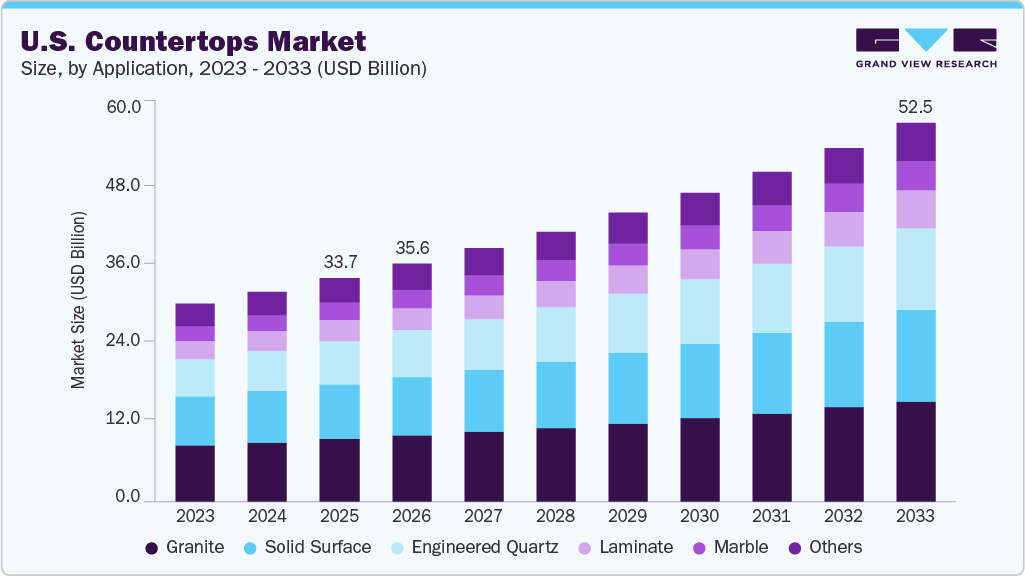

The U.S. countertops market size was estimated at USD 33.77 billion in 2025 and is expected to reach USD 52.48 billion by 2033, witnessing a CAGR of 5.7% from 2026 to 2033. Elevated mortgage rates and housing affordability constraints have reduced residential mobility, encouraging homeowners to invest in upgrading existing properties rather than relocating.

Key Market Trends & Insights

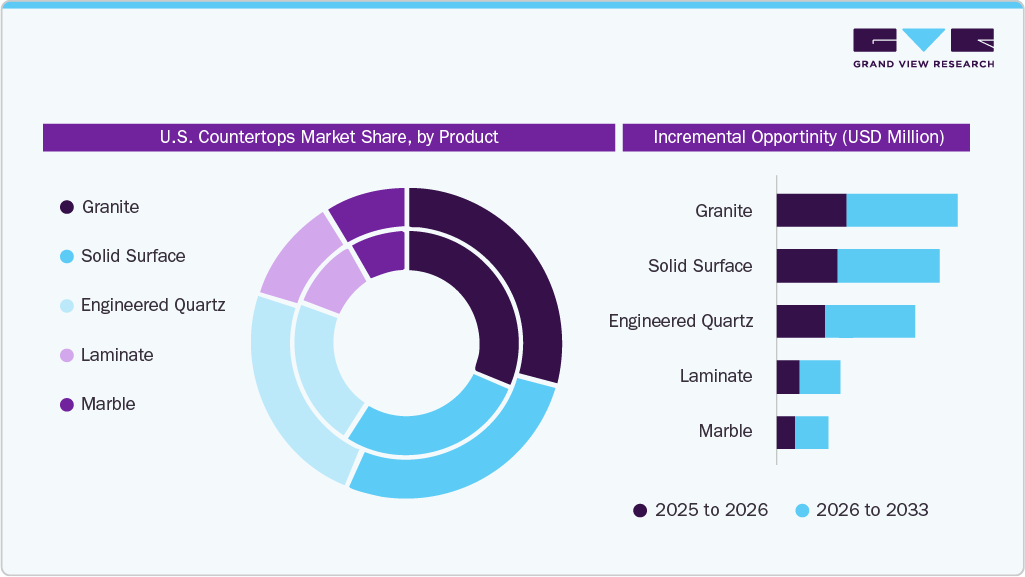

- By product, granite countertops led the market and accounted for a share of 27.9% in 2025.

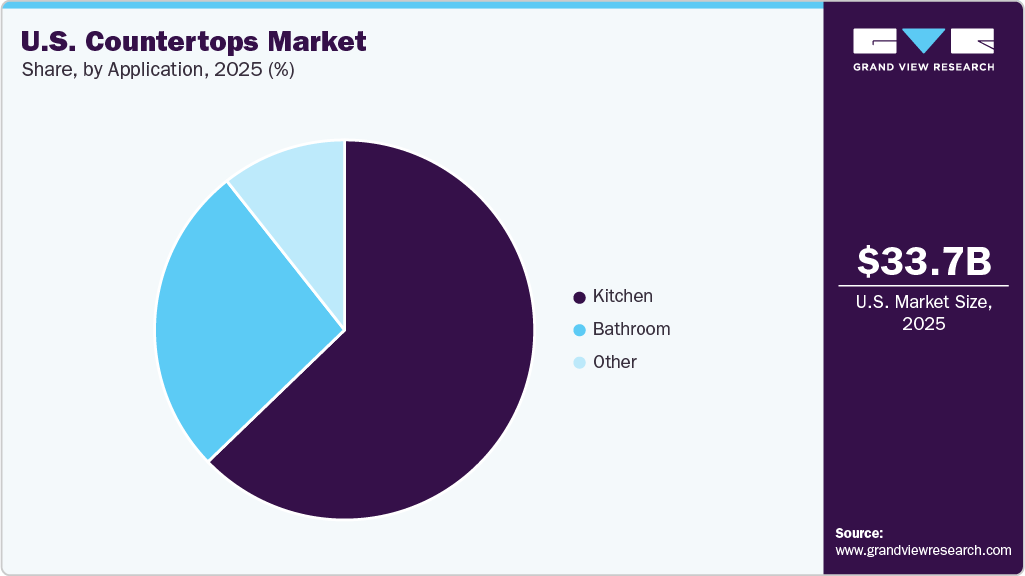

- By end user, kitchen led the market and accounted for a share of 60.6% in 2025.

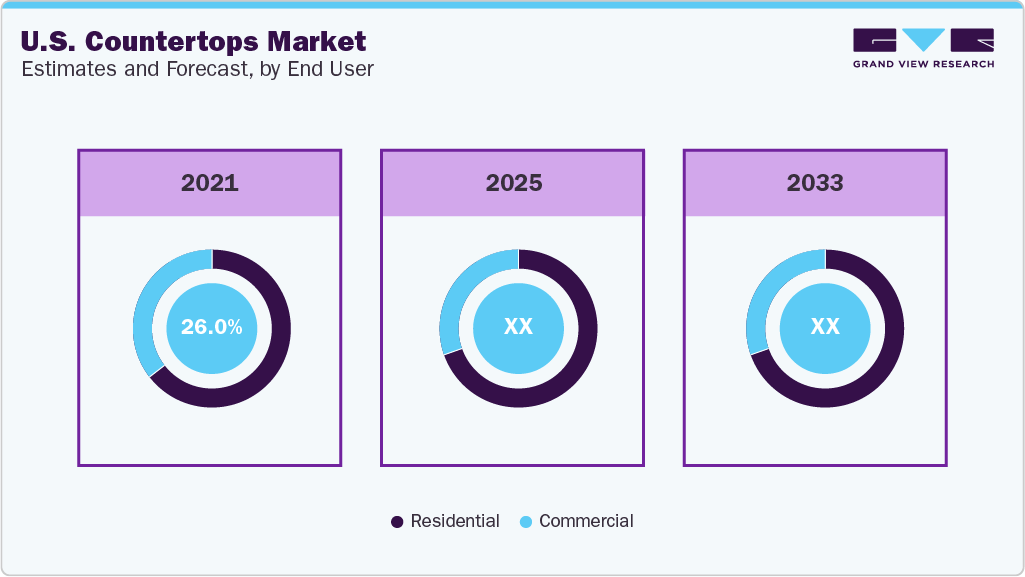

- By application, residential led the market and accounted for a share of 73.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 33.77 Billion

- 2033 Projected Market Size: USD 52.48 Billion

- CAGR (2026-2033): 5.7%

Kitchens remain one of the most prioritized renovation areas due to their central role in daily living and their strong impact on home value. Countertops, as a high-visibility and functional component of kitchen upgrades, benefit directly from this remodeling trend, particularly in projects involving layout reconfiguration, cabinet replacement, or appliance upgrades.In parallel, new construction activity continues to support baseline demand for countertops across residential and mixed-use developments. Housing completions rose sharply during the year, indicating a strong pipeline of projects entering final build-out stages where interior finishes such as countertops are installed. This momentum in completions, even amid moderated housing starts, has been especially supportive of near-term demand for interior surface materials.

Consumer preferences are also shifting toward durable, low-maintenance, and aesthetically distinctive countertop materials. Homeowners increasingly value surfaces that offer resistance to stains, scratches, and heat, alongside long-term durability and ease of cleaning. These functional priorities, combined with evolving design preferences for premium finishes, bold patterns, and integrated kitchen concepts, are driving replacement demand and higher average spending per project. As a result, countertops are increasingly viewed not merely as functional components but as design investments aligned with modern lifestyles.

In addition, broader home improvements in drivers such as energy efficiency upgrades, aging-in-place modifications, and overall home modernization are indirectly contributing to countertop demand. Many renovation projects initiated for functional or efficient reasons ultimately include kitchen updates, where countertop replacement becomes a natural extension of the investment. Supported by strong remodeling intent reported in homeowner surveys and stable construction expenditure levels, the U.S. countertop market is expected to remain resilient, underpinned by both replacement-driven demand and continued construction activity.

Product Insights

Granite countertops accounted for the largest market share of 27.9% in 2025. As a natural stone, granite offers unique patterns and color variations that enhance the visual character of kitchens and bathrooms, aligning well with consumer preferences for premium and customized home interiors. Its high resistance to heat, scratches, and everyday wear makes it particularly suitable for busy households, while its longevity supports the perception of granite as a cost-effective investment over the life of a home. In addition, granite countertops are often associated with higher resale value, reinforcing their appeal among homeowners undertaking renovations with both lifestyle and property value considerations in mind.

Engineered quartz countertops are expected to grow at a CAGR of 7.0% from 2026 to 2033. Engineered quartz countertops are gaining popularity among U.S. consumers due to their combination of durability, low maintenance, and design consistency. Unlike natural stone, quartz is non-porous, making it resistant to stains, bacteria, and moisture, attributes that strongly appeal to hygiene- and convenience-focused households. Consumers also value the wide range of colors and patterns that offer a uniform appearance suitable for modern and transitional kitchens. In addition, quartz countertops align well with long-term value considerations, as they require no sealing and maintain their aesthetic over time, supporting their adoption in both new residential construction and kitchen remodeling projects across the U.S.

Application Insights

Countertops for the kitchen accounted for the largest market revenue share of 60.6% 2025. Countertops for kitchens continue to gain strong traction among U.S. consumers as kitchens increasingly function as both functional workspaces and central lifestyle hubs. Rising home renovation and remodeling activity, driven by aging housing stock, hybrid work lifestyles, and higher time spent at home, has elevated demand for durable, low-maintenance, and visually appealing countertop materials such as quartz, granite, and engineered stone. Consumers are prioritizing surfaces that offer stain resistance, hygiene, and long-term value, while also aligning with contemporary design trends like neutral palettes, waterfall edges, and seamless integration with cabinetry.

Countertops for bathrooms are expected to grow at a CAGR of 6.5% from 2026 to 2033. U.S. consumers increasingly favor bathroom countertops as bathrooms evolve from purely functional spaces into comfort- and design-driven areas of the home. Consumers also prioritize hygiene and ease of maintenance, especially post-pandemic, making non-porous and stain-resistant surfaces more attractive. In addition, the growing influence of real estate resale value and lifestyle aesthetics driven by social media and home-improvement platforms has positioned upgraded bathroom countertops as a relatively affordable way to enhance both functionality and perceived home value.

End User Insights

Countertops for residential use held the largest revenue share, accounting for a share of 73.0% in 2025. Countertops for residential use are gaining increased attention among consumers as kitchens and bathrooms continue to be positioned as both functional and aesthetic focal points of the home. Rising home renovation and remodeling activity, supported by higher time spent at home and growing interest in interior personalization, has elevated demand for durable, visually appealing countertop materials such as quartz, granite, and engineered stone. Consumers increasingly prioritize low maintenance, longevity, and hygiene, especially in kitchen applications, which favors non-porous and stain-resistant surfaces.

Countertops for commercial use are expected to register a growth rate of 6.3% over the forecast period. Commercial consumers increasingly favor materials such as quartz, granite, solid surfaces, and stainless steel due to their resistance to wear, stains, heat, and microbial growth, which supports compliance with stringent health and safety standards. In addition, the growing emphasis on aesthetic branding and experiential design in restaurants, cafés, hotels, and retail outlets has elevated demand for visually consistent, customizable countertop solutions that enhance customer perception while maintaining functional performance. Rising renovation activity, standardized commercial kitchen layouts, and the expansion of quick-service and casual dining formats further reinforce steady demand for robust, low-maintenance commercial countertops.

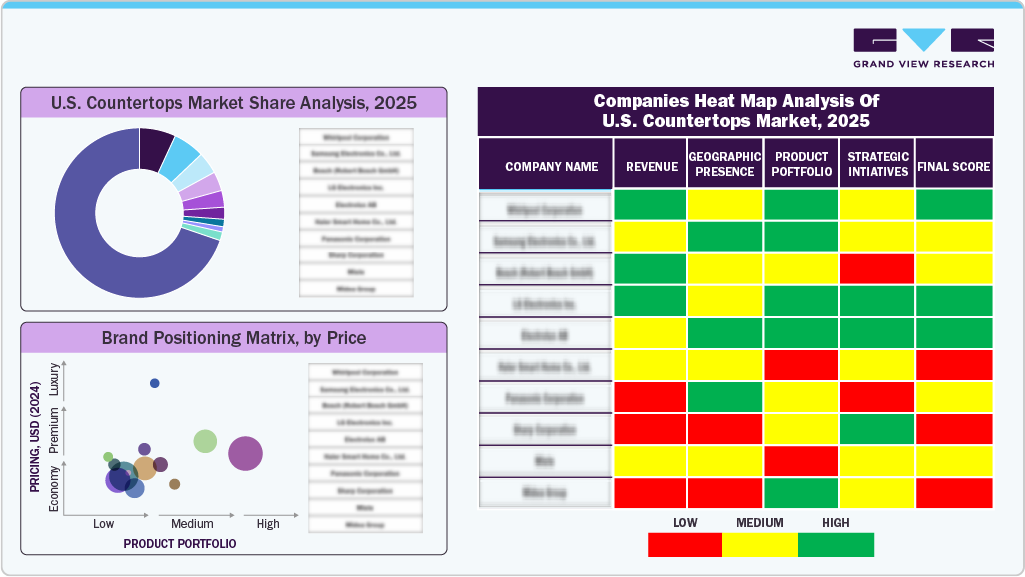

Key U.S. Countertops Company Insights

The U.S. market is highly fragmented with the presence of a large number of regional players. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

- In November 2025, Granite Expo in Sterling, VA, expanded its premium engineered quartz countertop collection for kitchens and bathrooms, offering more colors, patterns, and finishes designed for durability, low maintenance, and modern style. The non-porous quartz surfaces resist stains, moisture, and bacteria, support integrated sinks and backsplashes, and are professionally measured and installed to enhance both aesthetics and home resale value.

Key U.S. Countertops Companies:

- Cosentino

- Levantina

- LX Hausys

- Corian

- Cambria

- LG Hausys (Viatera)

- Wilsonart

- EGGER

- Polycor

- Antolini

U.S. Countertops Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 35.57 billion

Revenue forecast in 2033

USD 52.48 billion

Growth rate

CAGR of 5.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end user, region

Country scope

U.S.

Key companies profiled

Cosentino; Levantina; LX Hausys; Corian; Cambria; LG Hausys (Viatera); Wilsonart; EGGER; Polycor; Antolini

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Countertops Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. countertops market on the basis of product, application, end user, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Granite

-

Solid Surface

-

Engineered Quartz

-

Laminate

-

Marble

-

Other

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Kitchen

-

Bathroom

-

Other

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. countertops market was estimated at USD 33.77 billion in 2025 and is expected to reach USD 35.57 billion in 2026.

b. The U.S. countertops market is expected to grow at a compound annual growth rate of 5.7% from 2026 to 2033 to reach USD 52.48 billion by 2033.

b. Granite countertops accounted for the largest market share of 27.9% in 2025. As a natural stone, granite offers unique patterns and color variations that enhance the visual character of kitchens and bathrooms, aligning well with consumer preferences for premium and customized home interiors.

b. Some of the key players operating in the market include Cosentino, Levantina, LX Hausys, Corian, Cambria, LG Hausys (Viatera), and others

b. Key factors that are driving the U.S. countertops market growth include transition from natural stone craft to scalable engineered surfaces and sustained growth in residential remodeling and urban kitchen standardization

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.