- Home

- »

- Medical Devices

- »

-

U.S. Craniomaxillofacial Devices Market Size Report, 2030GVR Report cover

![U.S. Craniomaxillofacial Devices Market Size, Share & Trends Report]()

U.S. Craniomaxillofacial Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Material (Metal, Bio Absorbable Material, Ceramics), By Application (Neurosurgery, Plastic Surgery), And Segment Forecasts

- Report ID: GVR-2-68038-712-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

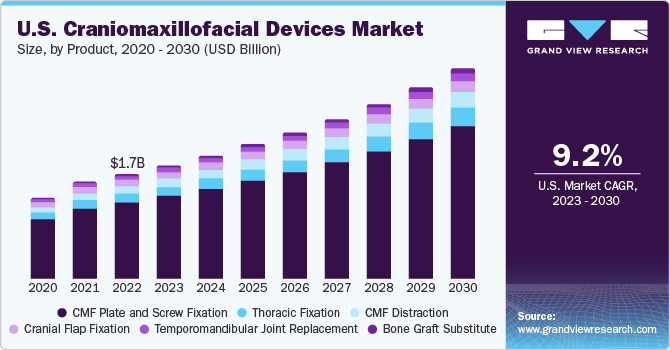

The U.S. craniomaxillofacial devices market size was valued at USD 1.07 billion in 2022 and is anticipated to grow at a CAGR of 9.2% over the forecast period from 2023 to 2030. The rising incidence of road accidents due to increased industrialization & urbanization, growing instances of drunk driving, not following safety rules, drowsy driving, speeding, distracted driving, and increasing occurrences of traumatic injuries, such as facial fractures resulting from accidents, sports-related incidents, and acts of violence are some of the factors responsible for the increasing demand for these solutions, driving the market growth. The growing demand for minimally invasive surgeries and the rising incidence of facial fractures are also expected to fuel the growth. According to the U.S. National Highway Traffic Safety Transport Administration, in 2022, there were 42,795 fatalities due to motor accidents in the U.S., and 42,939 fatalities in 2021

Factors such as the growing demand for minimally invasive surgeries and the rising incidence of facial fractures due to high-impact accidents, sports injuries, and falls, are estimated to fuel the demand for craniomaxillofacial (CMF) solutions in the coming years. According to John Hopkins Medicine, about 21% of all traumatic brain injuries among American youngsters are caused by sports and recreational activities.

The aging population is another crucial driver of the increasing demand for craniomaxillofacial technologies. As people age, they become more susceptible to age-related conditions like osteoporosis and facial bone degeneration. Consequently, there is a greater need for craniomaxillofacial procedures and implants to address these conditions. Additionally, advancements in medical technology have led to the development of innovative craniomaxillofacial products that offer enhanced surgical outcomes, reduced surgical time, and improved patient safety.

The market has benefited from young people's growing concerns about their physical and aesthetic attractiveness and the rising demand for cosmetic and aesthetic procedures, such as facial contouring and augmentation. Craniomaxillofacial devices play a crucial role in these procedures, facilitating the reshaping and reconstruction of facial bones and soft tissues. The market is expected to grow as a result of advantages related to these products, such as shorter hospital stays, painless procedures, reduced recovery times, safety, and efficacy. Moreover, increasing awareness of facial deformities, treatment options, and improved access to healthcare services are driving the growth of the craniomaxillofacial devices market.

The demand for craniomaxillofacial implants is also being driven by an increase in the frequency of facial abnormalities brought on by genetic diseases and trauma that require aesthetic operations. Increasing disposable income is also supporting people to opt for such surgeries. According to The American Society of Plastic Surgeons, around 15.6 million minimally invasive and cosmetic surgical procedures were performed in 2020. Craniomaxillofacial solutions are indispensable in reconstructive surgeries aimed at restoring the form and function of facial structures affected by congenital abnormalities, tumors, or accidents. The growing number of reconstructive and corrective procedures is further expected fuel the market demand. The demand for craniomaxillofacial products is anticipated to witness a rise in the upcoming years due to the general increase in CMF surgeries. Medicare and other helpful insurance programs that facilitate CMF surgeries are also projected to promote the expansion of the industry.

The COVID-19 pandemic negatively impacted the CMF devices market as the manufacturers of products for elective surgeries experienced a considerable decrease in sales, due to stoppage in production, reduced working hours, and layoffs. The neurological product line was most impacted by the pandemic. Orders were delayed and consumable sales were reduced due to non-essential surgeries being put on hold. Plastic surgeons were made to serve at COVID Care Centers and plastic surgeries were performed only in the case of emergencies.

However, many people opted for surgeries in this period because of working flexibilities but there was a decrease in the number of surgeries performed as compared to previous years. The sales revenue of many manufacturers was also affected, for instance, the annual report of Johnson and Johnson showed an 11.6% decrease in the sales revenue.

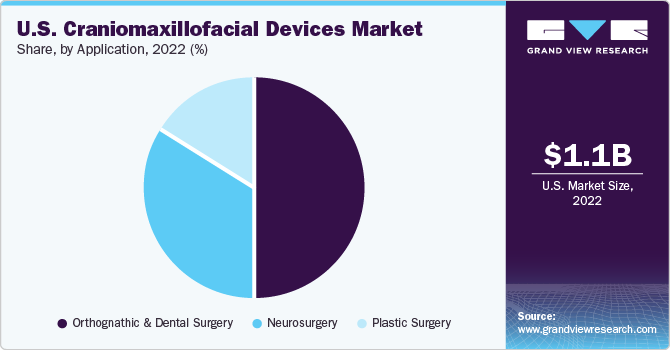

Application Insights

The orthognathic and dental surgery segment dominated the U.S. craniomaxillofacial devices market with the highest revenue share in 2022 owing to the increasing awareness of aesthetic consciousness and the increasing use of CMF procedures and devices for facial reconstruction. Additionally, factors such as improved surgical precision, stability of bone segments, facilitation of dental implant placement, treatment of TMJ disorders, advancements in surgical navigation, device design, and supporting surgical training and education are expected to boost the demand for CMF devices across orthognathic and dental surgery applications in the U.S.

The neurosurgery segment is expected to grow at the fastest CAGR over the forecast period from 2023 to 2030 owing to factors such as the increased adoption of CMF devices across neurosurgery applications such as surgical navigation, implantable neurostimulation, facial fracture repair, treatment of traumatic brain injuries, craniotomy fixation, and cranial reconstruction. Additionally, advancements in CMF device technology and the advantages of its use in neurosurgery applications are expected to boost the growth of the segment over the forecast period.

Product Insights

The CMF plate and screw fixation segment held the largest revenue share of over 70% in 2022 owing to its high adoption in numerous procedures, including cranial fixation, deformity correction, tumor removal, and orthognathic removal. The growing number of accidents, sports injuries, and violence-related incidents contributes to the rising incidence of facial fractures. CMF plate and screw fixation products are essential in the surgical management of these fractures, driving the demand for such products.

On the other hand, the temporomandibular joint replacement segment is expected to grow at the fastest CAGR over the forecast period owing to a surge in demand for face augmentation, cranial fractures, and sports injuries. Additionally, the increasing adoption of temporomandibular joint replacement products across applications such as arthritic disorders, degenerative joints, deformities, fractures, enhancing mouth opening ability, obstructing normal eating, and decreasing jaw discomfort are expected to boost the growth of the segment over the forecast period.

Material Insights

Metallic CMF implants held the largest revenue share of around 70% in 2022, owing to their advantages over ceramic and bioabsorbable materials, such as their minimal corrosiveness and hard characteristics. Metals such as copper, brass silver, chromium, vitallium, titanium, and stainless steel and frequently used for the internal stiff fixation of the face skeleton. Stainless steel alloys made of molybdenum, aluminum, cobalt, copper, chromium, and nickel are still widely adopted in facial surgical procedures.

On the other hand, the bioabsorbable materials segment is expected to grow at the fastest CAGR over the forecast period. The use of bioabsorbable materials in CMF devices in the U.S., provides benefits such as patient satisfaction, surgeon preference, material advancements, wide applicability, compatibility with imaging techniques, support for bone healing, and reduced risk of long-term complications. These factors all contribute to the market growth and growing acceptance of bioabsorbable CMF devices in the region.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in April 2022, 3D Systems, Inc., a provider of 3D printing devices, 3D scanners, 3D printing materials, and 3D printers, announced a partnership with Enhatch Inc., a provider of surgery enhancing platform through the adoption of artificial intelligence. The partnership will cater specifically to the demand for personalized and customized medical devices.

Key U.S. Craniomaxillofacial Devices Companies:

- Stryker Corporation

- Medtronic Plc

- KLS Martin L.P

- Medartis AG

- Johnson & Johnson

- W. L. Gore & Associates, Inc

- TMJ Concepts; Integra LifeSciences

- OsteoMed L.P.

- Aesculap Implant Systems, Inc

- Zimmer-Biomet Inc.

U.S. Craniomaxillofacial Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.15 billion

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application

Country scope

U.S.

Key companies profiled

Stryker Corporation; Medtronic Plc; KLS Martin L.P; Medartis AG; Johnson & Johnson; W. L. Gore & Associates, Inc; TMJ Concepts; Integra LifeSciences; OsteoMed L.P.; Aesculap Implant Systems, Inc; Zimmer-Biomet Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Craniomaxillofacial Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. craniomaxillofacial devicesmarket on the basis of product, material, and application:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Cranial Flap Fixation

-

CMF Distraction

-

Temporomandibular Joint Replacement

-

Thoracic Fixation

-

Bone Graft Substitute

-

CMF Plate and Screw Fixation

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Metal

-

Bioabsorbable material

-

Ceramics

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Neurosurgery

-

Orthognathic and Dental Surgery

-

Plastic surgery

-

Frequently Asked Questions About This Report

b. The U.S. craniomaxillofacial devices market size was estimated at USD 1.07 billion in 2022 and is expected to reach USD 1.17 billion in 2023.

b. The U.S. craniomaxillofacial devices market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 2.15 billion by 2030.

b. MF plate and screw fixation dominated the U.S. craniomaxillofacial devices market with a share of 73.02% in 2022. This is attributable to high adoption in different surgeries such as orthognathic, tumor removal, deformity correction, and cranial fixation.

b. Some key players operating in the U.S. craniomaxillofacial devices market include DePuy Synthes; Zimmer-Biomet Inc.; and Medtronic Inc, Medartis AG, Stryker Corporation.

b. Key factors that are driving the U.S. craniomaxillofacial devices market growth include increasing incidence of sports and facial fractures, rising demand for minimally invasive surgeries, and technological advancements in the management of craniomaxillofacial injuries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.