- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Creatine Supplements Market, Industry Report, 2030GVR Report cover

![U.S. Creatine Supplements Market Size, Share & Trends Report]()

U.S. Creatine Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report Form (Powder, Liquid, Capsules/Tablets, Others), By Distribution Channel (Hypermarkets, Pharmacy & Drug Stores, Online), And Segment Forecasts

- Report ID: GVR-4-68040-579-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Creatine Supplements Market Trends

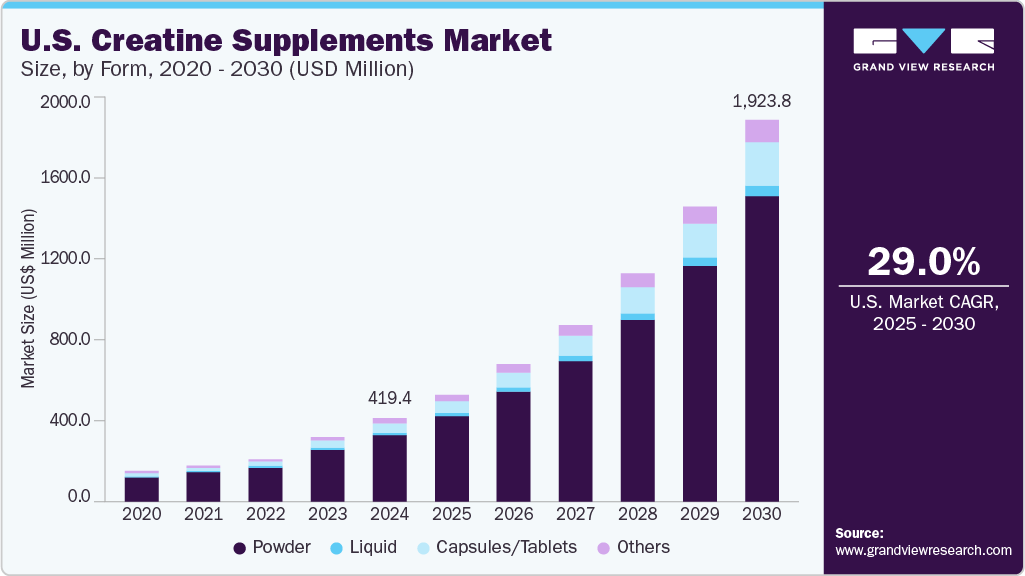

The U.S. creatine supplements market size was estimated at USD 419.4 million in 2024 and is projected to grow at a CAGR of 29.0% from 2025 to 2030. This growth is attributable to a combination of rising fitness awareness and the increasing adoption of performance-enhancing supplements.

The growing e-commerce sector has played a pivotal role in the market's rapid growth by improving product accessibility. Direct-to-consumer sales channels, supported by transparent labeling and third-party testing, have increased consumer trust and convenience. Major online platforms like Amazon and niche brands like Transparent Labs have capitalized on this trend by offering subscription models for high-quality creatine supplements. For instance, single-serving creatine powders available in convenience stores cater to on-the-go consumers, further driving impulse purchases.

Furthermore, regulatory developments have bolstered consumer confidence in the safety and efficacy of creatine supplements. The U.S. FDA's Dietary Supplement Ingredient Directory provides clear information on supplement ingredients, ensuring transparency and compliance with safety standards. This regulatory clarity has encouraged both established players and new entrants to innovate while maintaining quality assurance. For instance, collaborations between supplement brands and sports organizations have amplified marketing efforts, effectively reaching target audiences such as athletes and wellness enthusiasts

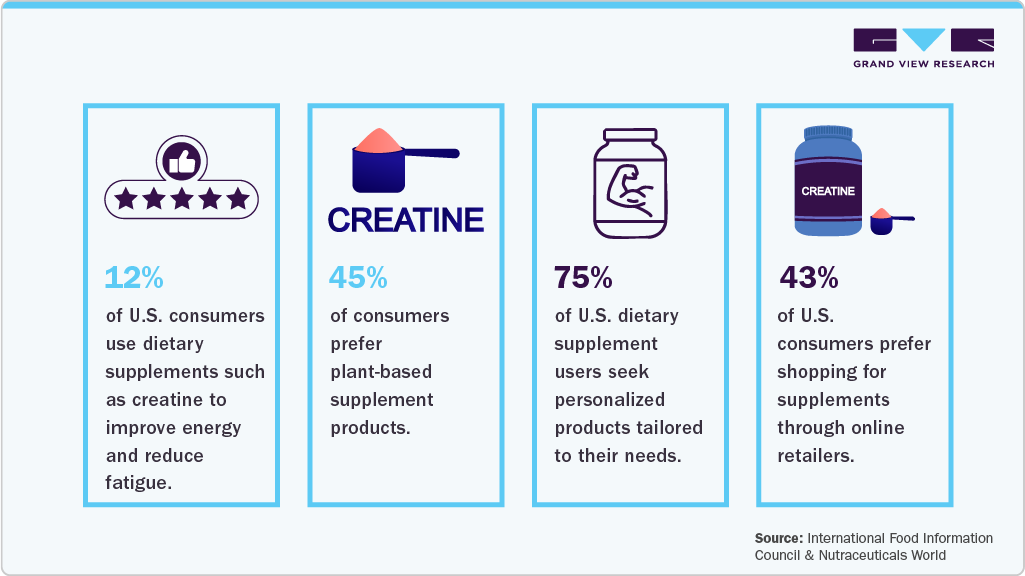

Consumer Insights for Creatine Supplements Products in the U.S.:

According to data published by Glanbia in April 2022, individuals focused on sports performance are the primary users of creatine supplements. Approximately 70% of these users engage in exercise for seven or more hours per week. They are significantly more inclined to participate in bodybuilding or competitive weightlifting compared to the general population (28% vs. 14%).

In addition, they are more likely to be involved in team sports such as football, basketball, hockey, and soccer (36% vs. 21%), as well as combat sports like martial arts, boxing, and wrestling (25% vs. 15%). While the primary objective is to enhance performance, some users also take creatine for its recovery benefits.

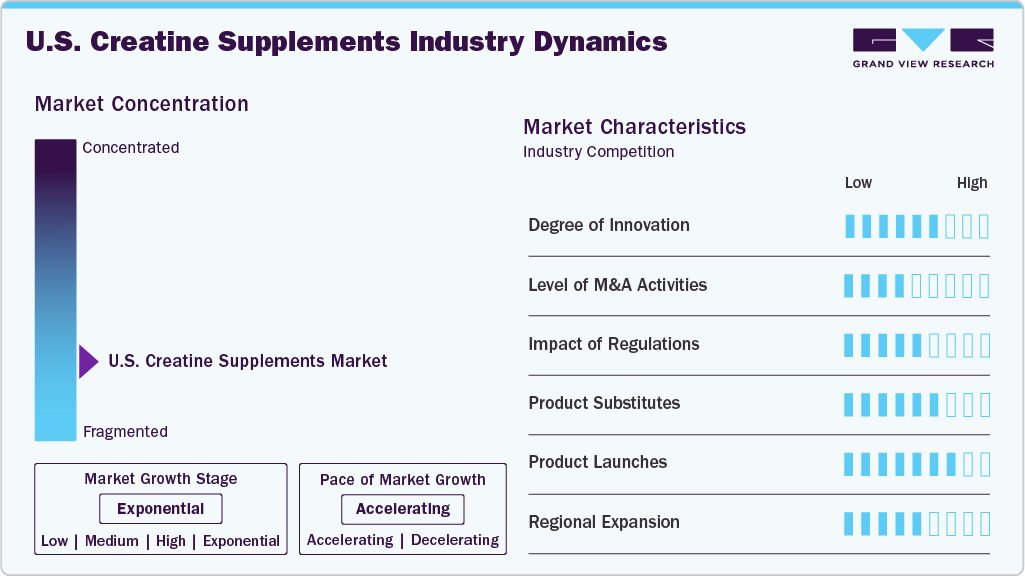

Market Concentration & Characteristics

Advancements in product formulation and growing consumer demand for performance-enhancing solutions in fitness and sports drive the U.S. creatine supplements industry. Companies are innovating with micronized and flavored creatine powders, as well as capsules, to improve solubility, taste, and convenience. These products cater to athletes and fitness enthusiasts seeking enhanced muscle recovery, strength, and endurance. In addition, sustainable practices, such as eco-friendly packaging and plant-based ingredients, are gaining traction to align with consumer preferences for clean-label sports nutrition.

The manufacturing of creatine supplements in the U.S. is influenced by key trends such as advancements in technology, shifting consumer preferences, and regulatory factors. A major trend is the emphasis on clean and transparent production processes, driven by consumer demand for safety and purity. Manufacturers increasingly adopt GMP-certified facilities, third-party testing for purity, and transparent labeling to ensure product integrity. For instance, state-of-the-art facilities compliant with GMP standards and certifications like FSSC 22000 are becoming industry benchmarks, ensuring consistent quality and building consumer trust.

Merger and acquisition (M&A) activities have accelerated in the U.S. creatine supplements industry as companies aim to expand their portfolios and strengthen market positioning. Key players are acquiring niche brands specializing in advanced formulations or targeting specific demographics, such as vegan athletes. This strategic consolidation enables companies to meet diverse consumer needs while driving innovation in the competitive sports nutrition industry.

The U.S. Food and Drug Administration (FDA) regulates dietary supplements, including creatine supplements, under the Dietary Supplement Health and Education Act (DSHEA) of 1994. This legislation places certain limitations on what claims can be made about the cognitive benefits of nootropic products.

The U.S. creatine supplements industry faces competition from alternative performance-enhancing products such as whey protein, branched-chain amino acids (BCAAs), and pre-workout formulas. However, creatine remains a preferred choice due to its proven effectiveness in boosting athletic performance and muscle growth. Rising awareness of fitness benefits among consumers continues to drive demand for creatine supplements across various formats.

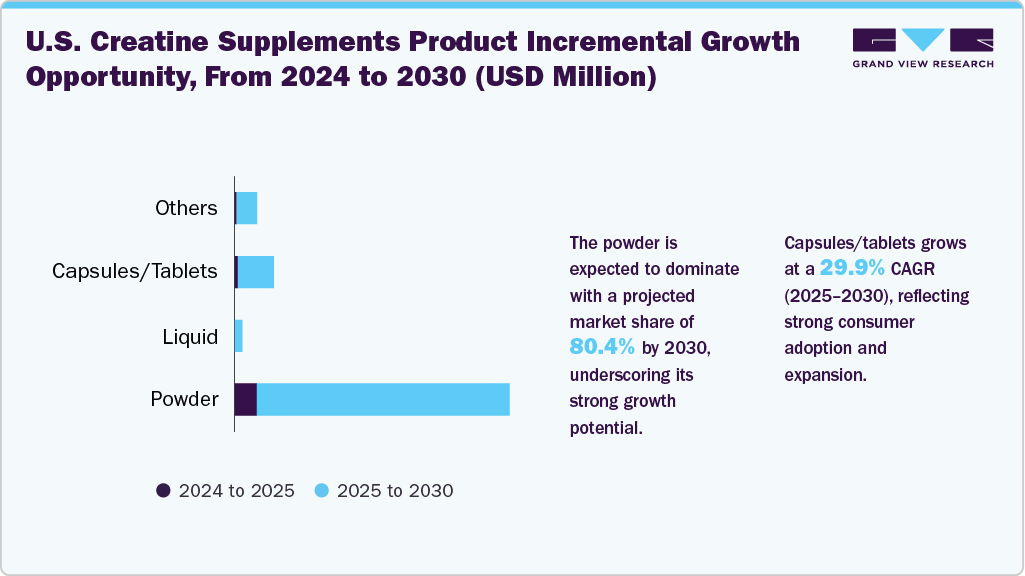

Form Insights

The powder form segment led the market with the largest revenue share of 80.4% in 2024, The primary driver for creatine powder is its flexibility in dosage, allowing the users to tailor their intake more precisely. In addition, the creatine powder can be mixed with various beverages, including water, protein shakes, smoothies, or other pre-workout drinks.

In addition, powders tend to be more cost-effective, which appeals to the large segment of price-sensitive consumers who use creatine regularly, such as bodybuilders and athletes. Consumers who are committed to a long-term fitness regime often prefer powdered creatine due to the bulk purchasing options available, which lowers the cost per serving.

The capsules/tablets segment is projected to grow at the fastest CAGR of 29.9% from 2025 to 2030. Capsules and tablets provide a compact and portable way to consume creatine, which appeals to users who prioritize convenience. This form is particularly attractive to individuals who do not want to deal with the mess of powder or the extra step of mixing it with liquid. Capsules are easy to swallow and can be taken on the go, making them a popular choice for people with hectic schedules who need to ensure consistent creatine intake without any preparation time. Furthermore, the pre-measured servings in capsules or tablets eliminate the risk of incorrect dosages, which can sometimes occur when measuring out powders.

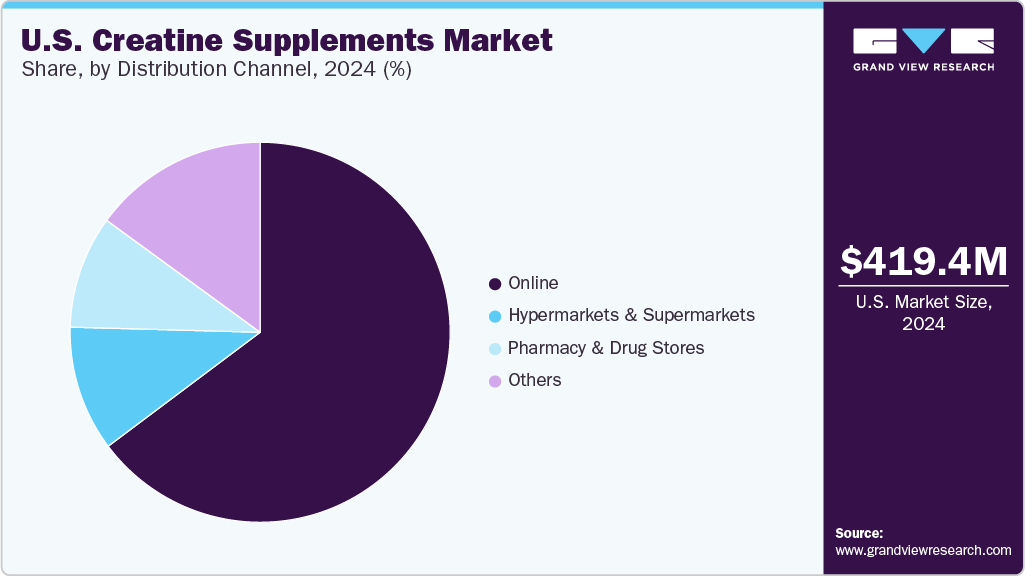

Distribution Channel Insights

The online segment led the market with the largest revenue share of 64.8% in 2024. The online channel has seen exponential growth in the distribution of creatine and creatine supplements, driven by the increasing preference for e-commerce. The convenience of shopping from home, coupled with the ability to compare different brands, prices, and user reviews, makes online platforms an attractive option for consumers.

E-commerce giants such as Amazon, alongside specialized fitness and supplement websites, offer a vast array of creatine products catering to a global audience. The ease of accessing detailed product information, customer feedback, and recommendations further enhance the appeal of purchasing supplements online. Online shopping also allows for easy subscription services, price comparisons, and access to a wider range of niche products, often unavailable in physical stores.

The hypermarkets & supermarkets segment is projected to grow at the fastest CAGR of 34.4% from 2025 to 2030. Hypermarkets and supermarkets play a significant role in the distribution of creatine and creatine supplements due to their wide reach and accessibility. These retail outlets provide a convenient shopping experience for consumers who prefer to purchase health supplements in person. The presence of well-established global and regional chains, such as Walmart, Carrefour, and Tesco, ensures a vast selection of creatine products, allowing consumers to choose from multiple brands and formulations. The growth of the fitness and wellness industry has led to an increase in the availability of health supplements in mainstream grocery stores, making it easier for individuals to incorporate creatine into their fitness routines.

Key U.S. Creatine Supplements Company Insights

In the U.S. creatine supplements industry key companies employ diverse strategies to sustain competitive advantage, including launching scientifically validated and innovative formulations such as instantized and micronized creatine for enhanced absorption and effectiveness. They emphasize expanding distribution through e-commerce and subscription models to improve consumer accessibility and convenience. Sustainability is gaining focus, with some players exploring plant-based creatine options and eco-friendly packaging to meet rising consumer demand for clean-label and ethical products. Strategic collaborations and influencer partnerships further support market penetration and brand visibility.

Key U.S. Creatine Supplements Companies:

- NutraBio

- Allmax Nutrition

- Nutrex Research, Inc.

- Glanbia PLC

- Weider Global Nutrition

- MuscleTech

- Weider Global Nutrition

- GNC Holdings

- Ajinomoto Co Inc

- THG PLC Ordinary Share

Recent Developments

-

In October 2024, Reebok announced a strategic partnership with wellness company Generation Joy to launch a new line of sports nutrition and performance supplements, aiming to enhance endurance and recovery for a broad audience ranging from committed gym-goers to wellness enthusiasts. The product range included protein, collagen, vitamins, pre- and post-workout supplements, and hydration products, designed to simplify and support customers’ fitness journeys. Generation Joy took charge of distributing the Reebok-branded supplements across the U.S. and Canada through key department stores, specialty retailers, and online platforms, marking Reebok’s significant expansion into the wellness and nutritional supplement market.

U.S. Creatine Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 538.0 million

Revenue forecast in 2030

USD 1,923.8 million

Growth rate

CAGR of 29.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel

Country scope

U.S.

Key companies profiled

NutraBio; Allmax Nutrition; Nutrex Research, Inc.; Glanbia PLC; Weider Global Nutrition; MuscleTech Weider Global Nutrition; GNC Holdings; Ajinomoto Co Inc; THG PLC Ordinary Share

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Creatine Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. creatine supplements market report based on form, and distribution channel:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Capsules/Tablets

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. creatine supplements market size was estimated at USD 419.2 million in 2024 and is expected to reach USD 538.0 million in 2025.

b. The U.S. creatine supplements market is expected to grow at a compounded growth rate of 29.0% from 2025 to 2030 to reach USD 1,923.8 million by 2030.

b. The powder form accounted for a share of 80.4% of the revenue in 2024, The primary driver for creatine powder is its flexibility in dosage, allowing the users to tailor their intake more precisely.

b. Some key players operating in the U.S. creatine supplements market include NutraBio; Allmax Nutrition; Nutrex Research, Inc.; Glanbia PLC; Weider Global Nutrition; MuscleTech Weider Global Nutrition; GNC Holdings; Ajinomoto Co Inc and others

b. Key factors that are driving the market growth include the rising fitness awareness and the increasing adoption of performance-enhancing supplements. As more individuals prioritize health and physical activity, creatine has gained popularity due to its proven benefits in improving strength, muscle mass, and recovery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.