- Home

- »

- Healthcare IT

- »

-

U.S. Credentialing Software And Services In Healthcare Market Report, 2033GVR Report cover

![U.S. Credentialing Software And Services In Healthcare Market Size, Share & Trends Report]()

U.S. Credentialing Software And Services In Healthcare Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Functionality, By Deployment Type, By End Use (Hospitals And Clinics, Healthcare Payers), And Segment Forecasts

- Report ID: GVR-4-68040-707-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Credentialing Software And Services In Healthcare Market Summary

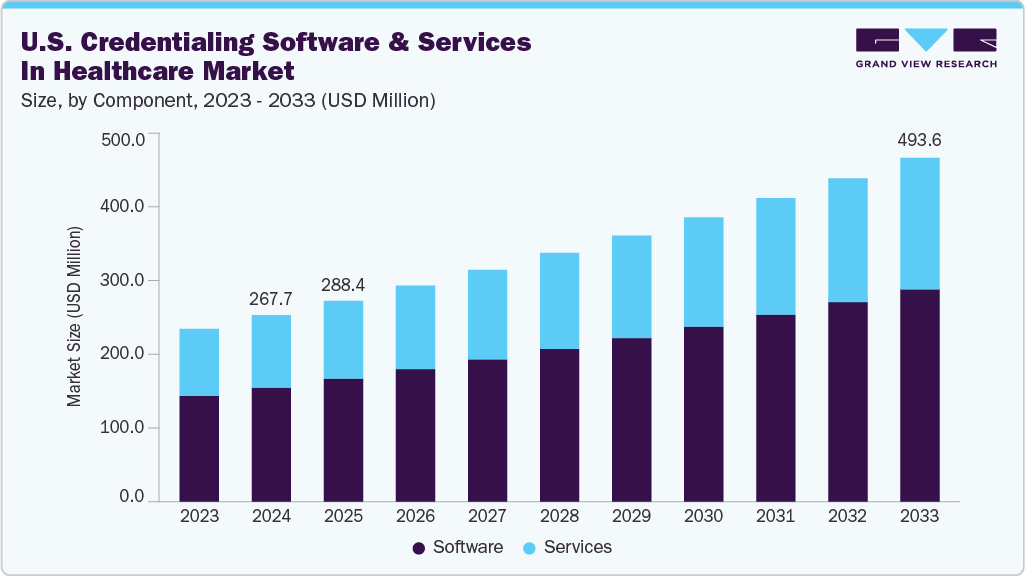

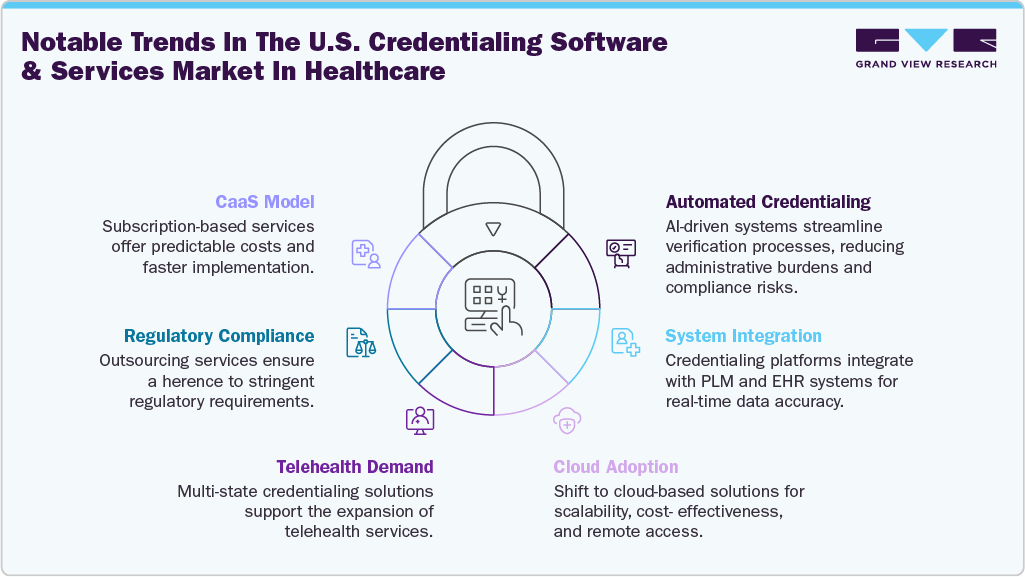

The U.S. credentialing software and services in healthcare market size was estimated at USD 267.72 million in 2024 and is expected to grow at a CAGR of 6.95% from 2025 to 2033. The growth is attributed to the growing demand for efficient, automated verification of healthcare provider qualifications to ensure regulatory compliance and patient safety. Increasing complexity of payer-provider networks, coupled with stringent accreditation requirements from bodies like NCQA and The Joint Commission, is accelerating adoption.

Moreover, the growing number of strategic initiatives undertaken by the market players significantly drive the adoption. For instance, in March 2024, Noridian Healthcare Solutions, LLC partnered with Acorn Credentialing to elevate health plans’ provider enrollment and credentialing operations. Together, the companies accelerated onboarding processes and reduced abrasion caused by slow and inefficient processes.

According to an article published by MedTrainer, a software company highlighted that physicians spend USD 2,000 to 3,000 annually to submit credentialing applications to the payers. In addition, salary of an average medical staff credentialing specialist in the U.S. was USD 43,558 in 2023. Automated credentialing offers significant advantages over manual credentialing processes in the healthcare industry. It allows healthcare organizations to prioritize patient care over administrative duties, increasing efficiency, and reducing resource utilization. This streamlined process helps save money & time and optimizes return on investment for healthcare organizations. Thus, credentialing process automation saves around USD 29,000 annually for physicians and around 3 hours required for filling credentialing information.

Moreover, integration capabilities are crucial for healthcare IT infrastructure, allowing different systems to communicate and share data seamlessly. Credentialing software that integrates with other healthcare systems, such as electronic health records and practice management systems, enhances interoperability & data exchange. Thus, prominent players in the market are focusing on advancements in integration capabilities. For example, Symplr is making advancements in its Connected Enterprise vision by integrating its SaaS solutions with a unified user interface, an API Gateway (featuring EHR integration), and a shared range of platform services. This allows synchronized workflows across solutions.

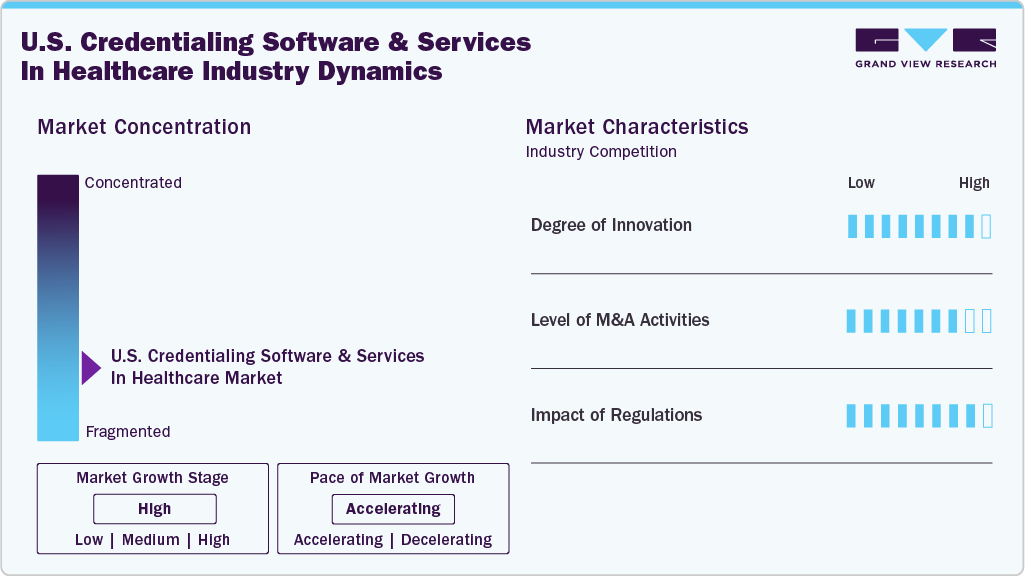

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. credentialing software and services in healthcare market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous players introduce new products characterized by advancements in artificial intelligence (AI), machine learning (ML), and big data technologies. For instance, in August 2024, Simplify Healthcare launched Provider1.Credentialing, an AI-powered solution designed to streamline provider credentialing for health insurers. The platform offers automated primary source verification, real-time compliance monitoring, and seamless integration with existing systems, enhancing operational efficiency and accuracy in the credentialing process.

The level of partnerships & collaboration activities by key players in the industry is high to increase their capabilities, expand product portfolios, and improve competencies. For instance, In January 2024, CareCloud, Inc. partnered with Kovo HealthTech Corporation, a healthcare technology and billing-as-a-service company. The partnership enables Kovo’s customers to access advanced credentialing assistance, EHR solutions, practice management software, and a unified clearinghouse.

The impact of regulations on the market is moderate. Increasing regulatory compliance requirements for credentialing software & services highlights the need for robust security measures and data protection standards. For instance, in October 2022, compliance with the Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act is essential in the healthcare sector. These standards focus on safeguarding confidential information and ensuring secure electronic data transfer.

The level of regional expansion in industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Case Study:

Challenge:

An extensive health system in the Northeast, one of the largest integrated healthcare delivery and financing institutions in the U.S., was experiencing significant challenges with its existing credentialing and enrollment platform. The system suffered from fragmented modules that lacked interoperability, inadequate tools for managing multi-facility privileging, and cumbersome workflows for gathering provider documentation. These issues led to prolonged enrollment processes, duplicate documentation efforts, and reliance on external reporting methods. The vendor's poor communication also resulted in delayed issue resolutions and system upgrades.

Solution:

The health system systematically searched for a new credentialing and enrollment partner. After evaluating six vendors through detailed technical assessments and extensive demonstrations, Acorn Credentialing was selected as the only provider meeting all specified requirements. Acorn's platform offered features such as Mobile Capture for streamlined documentation collection, scalable privileging forms suitable for multi-facility organizations, and robust dashboard and reporting capabilities. The platform's linear design and user-friendly interface, coupled with Acorn's responsive and adaptable team, aligned with the health system's need for a true partnership rather than just a vendor relationship

Outcome

By implementing Acorn credentialing integration engine, the company reduced administrative burdens, improved provider onboarding experiences, and strengthened compliance and operational efficiency across the organization

Component Insights

The software segment dominated the credentialing software and services in healthcare market with the largest revenue share of 61.13% in 2024. Healthcare credentialing software enables healthcare organizations and insurance companies to effectively store and manage the records of healthcare providers while ensuring that they possess the required certifications and licenses to practice. Deploying credentialing software solutions accelerates the provider enrollment process and improves its precision.

Hence, market players are focused on launching credentialing solutions and partnerships to improve operational workflows, financial efficiencies, and patient safety outcomes. For instance, in February 2024, Medallion introduced a one-day credentialing solution for healthcare associations to quickly and accurately transform the credentialing procedure. The solution can help complete primary source verifications instantly and with almost 100% accuracy. It offers Instant Primary Source Verifications (PSVs), Automated Quality Assurance (QA), and NCQA Compliance.

The services segment is anticipated to grow at grow at a significant CAGR from 2025 to 2033. Services offered include real-time status updates, automated verification processes, and personalized assistance designed to optimize business operations, save resources and time, and ensure compliance & accuracy. For instance, the professional services provided by Applied Statistics & Management Inc. are delivered by a team of skilled data services experts with extensive experience in integrating diverse credentialing systems and data streams. It ensures a seamless and productive implementation process. By leveraging its expertise, the company aims to minimize downtime and disruptions, facilitating a smooth and swift transition to the new system for uninterrupted operations. Moreover, the role of credentialing services in the optimal functioning of a medical practice is significant and leads to the fastest growth over the coming years.

Functionality Insights

The credentialing and enrollment segment dominated the market with the largest revenue share in 2024. Credentialing and enrollment function as a substantial checks and balances system that effectively ensures the maintenance of high quality and standards in the Healthcare system. In addition, it offers advantages, such as helping reduce medical blunders and malpractice, facilitating insurance reimbursements, assisting in retaining staffing levels, and more. Hence, market players are undertaking several initiatives to develop, advance, and promote credentialing and enrollment solutions considering the abovementioned advantages. For instance, in August 2022, QGenda launched QGenda Credentialing, which automates provider privileging, credentialing, and payer enrollment. It enables health systems to reduce administrative time and enhance data compliance and accuracy significantly.

The provider information management segment is expected to grow at the fastest CAGR from 2025 to 2033. Provider information management, also known as Provider Data Management (PDM), leverages technology, services, and procedures to facilitate healthcare organizations in efficiently gathering, consolidating, and managing extensive information about the providers in their ecosystems.

Deployment Type Insights

The cloud-based segment held the largest revenue share in 2024. Utilizing cloud-based medical credentialing software helps harness the potential of cloud computing to simplify and automate the credentialing process. Cloud-based medical credentialing software can generate analytics and reports, which can be used to monitor and improve the credentialing process and compliance and save significant time. For instance, Credsy.com, an organization specializing in delivering cloud-based credentialing solutions, has saved over 100,000 administrative hours for healthcare entities within the U.S. One of its clients, Virtual Care, experienced an 80% reduction in onboarding time and a 65% increase in provider credentialing speed. This improvement in efficiency has allowed Virtual Care to attend to more patients and generate higher revenues.

The on-premise segment is expected to grow at a significant CAGR from 2025 to 2033. On-premises data storage enables local data retention, providing greater control over sensitive information. It reduces the risk of data breaches or unauthorized access to company information. Moreover, on-premises solutions can be beneficial for companies that must comply with strict regulations. In addition, on-premises systems offer several performance benefits, including low latency and a short feedback loop for rapid changes. In the event of an outage, on-site personnel can make necessary adjustments to the infrastructure, ensuring uninterrupted business operations.

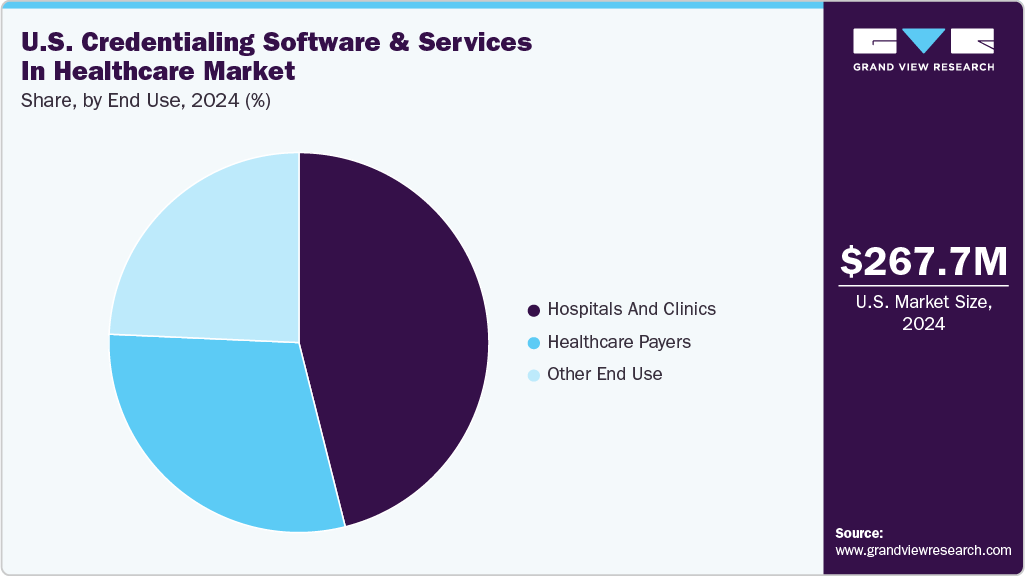

End Use Insights

The hospitals and clinics segment dominated the market with the largest revenue share of 45.1% in 2024. The credentialing process is mandatory for all physicians who intend to provide patient care within a hospital setting, regardless of whether they are employed or working as independent practitioners. The automated process helps hospitals with quick billing & reimbursement, compliance, quality of care, productivity & efficiency, and payment & reimbursement. Hence, hospitals and clinics opt for automated credentialing solutions that help them optimize their operations, resulting in high operational efficiency and revenue.

The healthcare payers’ segment is expected to grow at the fastest CAGR during the forecast period. Payer credentialing is an ongoing process that spans the entire duration of the provider's career. Completing this process enables the provider to continue billing a specific payer. To make the credentialing process efficient and quick, numerous payers opt for credentialing services contributing to the segment's growth. Moreover, numerous companies are boosting the segment through product launches, partnerships, and acquisitions, among other strategic initiatives. For instance, in January 2024, DentalXChange introduced a credentialing platform called CredentialConnect, designed for dental practices and DSOs to simplify the payer credentialing process.

Key U.S. Credentialing Software And Services In Healthcare Company Insights

The market is fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key U.S. Credentialing Software And Services In Healthcare Companies:

- symplr

- HealthStream, Inc.

- Simplify Healthcare Technology

- Global Healthcare Exchange, LLC.

- Bizmatics, Inc. (Constellation Software Inc.)

- Naviant

- OSP Labs

- Wybtrak, Inc.

- Applied Statistics & Management, Inc.

- 3WON

- HCA Management Services, L.P.

- Neolytix

- CureMD Healthcare

- Modio Health

- MedTraine

- Verisys

Recent Developments

-

In March 2025, DISA Global Solutions partnered with symplr to deliver an integrated, automated solution for workforce compliance, credentialing, and background screening. This collaboration aims to enhance operational efficiency and risk management for organizations in highly regulated industries by combining DISA’s compliance services with symplr’s healthcare operations technology.

-

In January 2025, MedTrainer partnered with Propelus to enhance provider credentialing processes in the healthcare industry. This partnership aims to automate license verifications across all 50 states, streamline onboarding, and ensure ongoing compliance for healthcare organizations.

“The combined capability gives our small and medium-sized customers a streamlined, highly automated, and design-to-fit credentialing solution, which is needed in today's increasingly complex environment”

Steve Gallion, CEO of MedTrainer

-

In February 2024, Applied Statistics and Management Inc. (ASM) announced that its premier software, MD-Staff, received the 2024 Best in KLAS Award for Credentialing. This award highlights MD-Staff’s dedication to delivering remarkable credentialing offerings and its ongoing support for healthcare organizations globally.

-We are immensely honored to receive the 2024 Best in KLAS Award for Credentialing, marking our fourth consecutive win.

- Nick Phan, Executive Vice President at ASM.

-

In April 2023, symplr, a provider of enterprise healthcare operations software, unveiled four new product suites as a key component of its Connected Enterprise initiative. The suites align with credentialing services as they ensure that credentialed staff are efficiently managed & utilized, optimizing workforce resources.

-The healthcare industry continues to face financial, workforce, and competitive pressures. The latest innovations to our software will help hospitals, health systems and other care delivery organizations optimize operations so that they can continue to excel, avoiding costly inefficiencies that waste precious resources.”

- Brian Fugere, Chief Product Officer of symplr.

U.S. Credentialing Software And Services In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 288.39 million

Revenue forecast in 2033

USD 493.56 million

Growth rate

CAGR of 6.95% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, functionality, deployment type, end use

Key companies profiled

symplr; HealthStream, Inc.; Bizmatics, Inc. (Constellation Software Inc.); Naviant; OSP Labs; Wybtrak, Inc.; Applied Statistics & Management, Inc.; 3WON; HCA Management Services, L.P.; Neolytix; CureMD Healthcare; Modio Health; MedTrainer; Verisys; Simplify Healthcare Technology; Global Healthcare Exchange, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Credentialing Software And Services In Healthcare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. credentialing software and services in healthcare market report based on component, functionality, deployment type, and end use:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Credentialing and Enrollment

-

Provider Information Management

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud Based

-

On-Premise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Healthcare Payers

-

Other End use

-

Frequently Asked Questions About This Report

b. The U.S. credentialing software and services in healthcare market size was estimated at USD 267.72 million in 2024. and is expected to reach USD 288.39 million in 2025.

b. The U.S. credentialing software and services in healthcare market expected to grow at a compound annual growth rate of 6.95% from 2025 to 2033 to reach USD 493.56 million by 2033.

b. The software segment dominated the credentialing software and services in healthcare market with the largest revenue share of 61.13% in 2024. Deploying credentialing software solutions accelerates the provider enrollment process and improves its precision

b. Some of the key players in U.S. credentialing software and services market are symplr, HealthStream, Bizmatics, Inc. (a part of Constellation Software Inc.), Naviant, OSP Labs, Wybtrak, Inc., Applied Statistics & Management, Inc., 3WON, HCA Management Services, L.P., Neolytix, CureMD Healthcare, Modio Health, MedTrainer, and Verisys, Simplify Healthcare Technology, Global Healthcare Exchange, LLC

b. Key factors that are driving the market growth include increasing regulatory and compliance requirements, growing complexity in provider networks, rise in healthcare fraud and patient safety concerns, shift toward digital transformation in healthcare, increasing awareness of the advantages of credentialing solutions, growing adoption of cloud-based solutions, rising technological advancements in healthcare IT infrastructure, and a growing number of strategic initiatives undertaken by the market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.