- Home

- »

- Consumer F&B

- »

-

U.S. Dairy Alternatives Market Size, Industry Report, 2030GVR Report cover

![U.S. Dairy Alternatives Market Size, Share & Trends Report]()

U.S. Dairy Alternatives Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Soy, Almond), By Product (Milk, Yogurt), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores), And Segment Forecasts

- Report ID: GVR-4-68040-539-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dairy Alternatives Market Trends

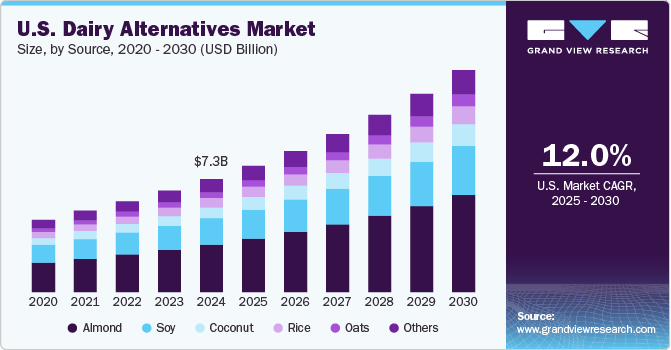

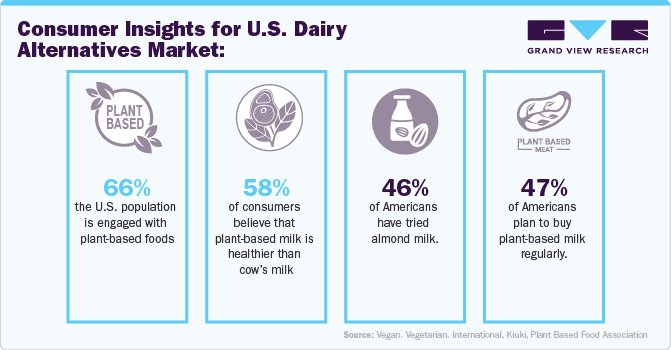

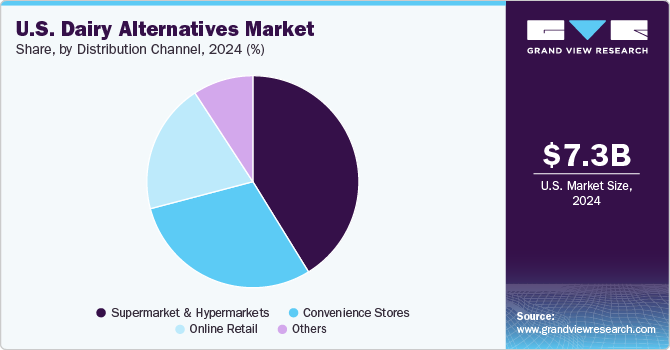

The U.S. dairy alternatives market size was valued at USD 7.27 billion in 2024 and is expected to grow at a CAGR of 12.0% from 2025 to 2030. The growing number of health-conscious consumers and the growing prevalence of lactose intolerance in the U.S. are primarily driving the market. In addition, the growing popularity of the vegan diet and an increased plant-based diet fuels the growth of the dairy alternative market in the U.S. According to the 2024 data published by the World Population Review, about 36% of the U.S. population is lactose intolerant. The growing availability of diverse products catering to diverse consumer preferences further surges growth in the U.S. market.

A growing number of health-conscious consumers are seeking alternatives to traditional dairy products that are lower in calories, fat, and cholesterol. According to data published by the United Health Foundation, about 36.9% of Americans reported having high cholesterol levels. Dairy alternatives such as almond milk, oat milk, and soy milk are seen as healthier choices for many individuals.

The rising prevalence of dairy allergies and lactose intolerance among the U.S. population fuels the dairy alternatives market. For instance, according to FARE (Food Allergy Research & Education) data, approximately 6.2 million Americans are allergic to milk. As a significant portion of the U.S. population is lactose intolerant or has a dairy allergy, the demand for dairy alternatives is rising in the U.S. In addition to allergies and lactose intolerance, the growing trend toward veganism and plant-based diets is a significant driver. Consumers are increasingly avoiding animal-based products for ethical, environmental, or health reasons. Dairy alternatives, especially plant-based milks and cheeses, are essential in meeting the dietary needs of people following a vegan lifestyle.

The rising health concerns, such as dairy allergies, intolerance to lactose, and growing health-conscious trends, are driving product innovation in the dairy alternatives industry. In addition, there is an increase in the popularity of dairy alternatives such as plant-based cheeses, ice creams, and yogurts. These innovations help meet the evolving tastes and preferences of consumers, further fueling the market's expansion. For instance, in January 2025, Organic Valley expanded its product line to oat-based creamers and launched organic oat-based creamers sourced from organic farms based in the U.S. The new creamers will be available across the U.S. and are available in 3 variants: Vanilla, caramel, oatmeal cookie, and cinnamon spice.

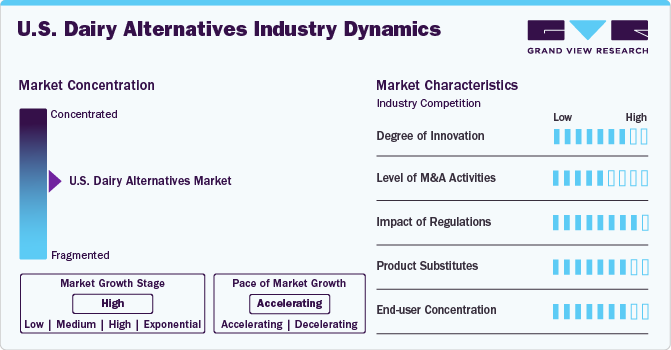

Market Concentration & Characteristics

The U.S. dairy alternatives industry is highly innovative, with continuous advancements in product formulations, flavor profiles, and nutrient profiles. Brands are experimenting with plant-based ingredients like oats, almonds, and coconuts to create healthier and sustainable alternatives. Consumer demands for lactose-free, vegan, or low-sugar options often drive innovations. For instance, in February 2024, Califia Farms launched plant-based milk, which is available at supermarkets, including Walmart, Target, and other retail stores across the nation.

The U.S. dairy alternatives industry has seen a moderate to high level of mergers and acquisitions (M&A) as companies seek to expand their product portfolios, enhance production capabilities, strengthen market presence, and improve attributes such as product packaging. For instance, in July 2024, Califia Farms acquired Uproot Inc., a leading plant-based milk dispenser system. Through this acquisition, Uproot’s solution will help Califia Farms enhance sustainability by reducing packaging.

The FDA regulates dairy alternatives in the U.S. Food canning establishments in the U.S. and foreign establishments that process and export foods to the U.S. are subject to regulations that require registration of the establishments (FCE) and filing of scheduled processes (SIDs). The FCE registration and SID regulations for thermally processed low-acid and acidified foods packaged in hermetically sealed containers are found in Title 21 CFR 113 and 114.

In the U.S., dairy alternatives face competition not only from other plant-based products but also from traditional dairy products. Plant-based milk, such as oat or almond milk, competes with cow’s milk, while plant-based yogurts and cheeses challenge their dairy counterparts. Additionally, advances in lab-grown dairy and dairy-free protein sources could further influence this competitive landscape.

The market is increasingly concentrated among health-conscious consumers, vegans, lactose-intolerant individuals, and those with dietary restrictions. While these segments are growing, adoption in mainstream populations is rising due to increased awareness about sustainability and plant-based diets. However, penetration into older generations and more traditional consumers remains slower.

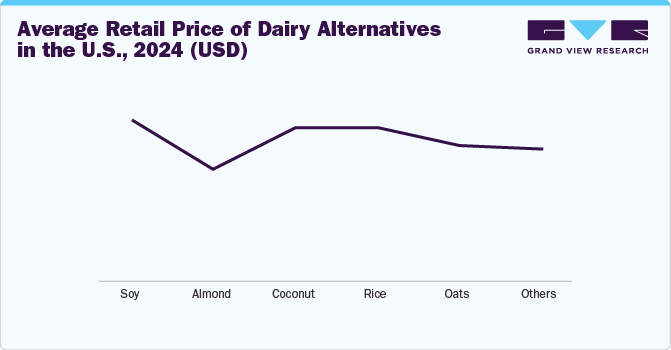

Pricing Analysis:

The pricing analysis of dairy alternatives in the U.S. reveals that these products typically carry a premium over traditional dairy items, owing to the use of specialized ingredients like almonds, oats, soy, and coconut. Plant-based milk, yogurt, and cheese are the most widely available dairy alternatives, with pricing influenced by factors such as the type of plant base, nutritional content, ingredient quality, and brand positioning. Plant-based butter and ice cream, often marketed as dairy-free and lactose-free options, show price variations based on their formulations and added health benefits, such as probiotics or fortified vitamins. These products' pricing trends reflect the growing demand for plant-based, allergen-friendly, and health-conscious alternatives in the U.S. market.

Source Insights

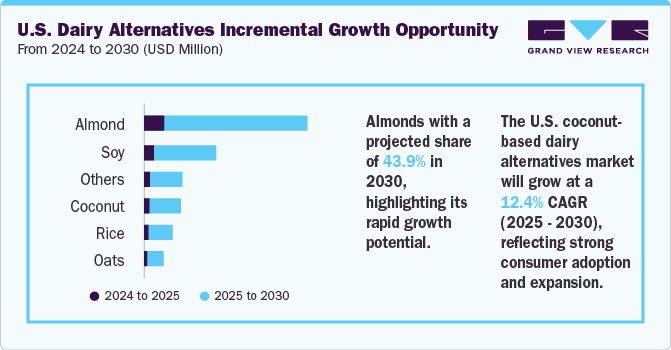

Almond sources for dairy alternatives accounted for a share of 41.9% of the U.S. revenue in 2024. Almonds play a crucial role in driving the U.S. dairy alternatives industry due to their versatility, nutritional benefits, and sustainability. Almond-based products, such as almond milk, have gained popularity as consumers seek plant-based, lactose-free, and lower-calorie alternatives to traditional dairy. Almonds are rich in vitamins, minerals, and healthy fats, making them an attractive option for health-conscious consumers. For instance, according to the Almond Board of California data, almond milk consumption exceeded milk substitutes in the U.S., accounting for a 77% share of volume in 2021. In addition, almond farming has a relatively lower environmental impact compared to dairy farming. For instance, according to the data published in January 2022 by Global Change Data Lab, almond milk has lower greenhouse emissions and uses less land compared to dairy and soy. With almonds being widely available and their production continuing to grow, almond-based dairy alternatives are becoming a key component of the expanding plant-based market in the U.S.

The coconut sources for dairy alternatives market is projected to grow at a CAGR of 12.4% from 2025 to 2030. Coconut-based products are becoming a significant driver in the market due to their unique flavor profile, nutritional benefits, and appeal to those with dietary restrictions. Coconuts are rich in healthy fats, particularly medium-chain triglycerides (MCTs), and are perceived as beneficial for heart health and weight management.

The oats source market is projected to grow at a CAGR of 12.2% from 2025 to 2030. Oats have emerged as a leading source of dairy alternatives in the U.S. market, driven by their mild flavor, creamy texture, and nutritional benefits. The key players are introducing new dairy alternative products sourced from oats to cater to rising demand. For instance, in September 2021, Valio Ltd launched a new product line of oat yogurts under its brand Oddlygood.

Product Insights

The dairy alternative milk market accounted for a share of 65.7% of the revenue in 2024. The growing demand for plant-based milk in the U.S. dairy alternatives industry is driven by a combination of health, environmental, and ethical factors. Consumers are increasingly seeking dairy alternatives due to concerns over lactose intolerance, dairy allergies, and the perceived health benefits of plant-based diets. For instance, according to the data published by the National Library of Medicine in January 2021, American consumers prefer plant-based milk as compared to dairy milk due to various concerns such as lactose intolerance and a healthy diet. Additionally, heightened awareness of the environmental impact of animal agriculture, including concerns over greenhouse gas emissions, water use, and land degradation, is pushing consumers toward sustainable options. Ethical considerations surrounding animal welfare also play a significant role in the shift towards plant-based milk. Owing to such concerns, in 2023, 44% of U.S. households bought plant-based milk.

The dairy alternative ice cream market is projected to grow at a CAGR of 13.6% from 2025 to 2030. The plant-based ice cream market is driven by increasing consumer demand for healthier, more sustainable, and ethical food choices. Many individuals are opting for plant-based ice cream due to lactose intolerance, dairy allergies, or a growing preference for vegan diets. For instance, according to the GFI (Good Food Institute), one out of ten U.S. households bought plant-based ice cream in 2023. Health-conscious consumers are attracted to plant-based options that offer lower saturated fat and fewer calories, while still providing indulgent flavors and textures. The growing preference for plant-based ice creams by consumers is driving key players in the market to introduce new products. For instance, in March 2024, Eclipse introduced plant-based ice creams in 3 variants: peanut butter pretzel, hazelnut chocolate truffle, and coffee almond crunch flavors.

Distribution Channel Insights

The sales of dairy alternatives through supermarkets & hypermarkets accounted for a share of around 41.2% of the U.S. revenue in 2024. Supermarkets and hypermarkets are key drivers of the market, as they provide widespread accessibility and convenience for consumers seeking plant-based products. The increasing demand for dairy alternatives has led these retailers to expand their product offerings, featuring a variety of plant-based milk, cheese, yogurt, and ice cream options. Consumers are drawn to the one-stop shopping experience and the ability to easily compare and purchase dairy alternatives alongside traditional dairy products. Key companies in the market are introducing new products through supermarkets to cater to rising demand. For instance, in April 2022, KLIMON INC introduced almond-based ice creams in Walmart stores with 5 delicious flavors: morning brew, caramel brûlée, mint, cherry bomb, and sunrise bang.

The online retail channels are projected to grow at a CAGR of 12.8% from 2025 to 2030. The growth of U.S. dairy alternative online retail distribution channels is primarily driven by increasing consumer demand for plant-based products fueled by health-consciousness, lactose intolerance, and ethical concerns surrounding animal welfare. Convenience and accessibility also play a significant role, as online platforms offer easy access to a variety of dairy alternatives that may not be available in traditional brick-and-mortar stores. Additionally, the rise of e-commerce and direct-to-consumer models allows brands to offer personalized experiences and subscription services, enhancing customer loyalty.

Key U.S. Dairy Alternatives Company Insights

Many brands in the U.S. dairy alternatives industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to meet consumer needs and preferences better.

Key U.S. Dairy Alternatives Companies:

- Chobani, LLC

- Danone S.A.

- Hain Celestial

- Daiya Foods

- Eden Foods

- SunOpta

- Melt Organic

- Oatly AB

- Blue Diamond Growers

- Ripple Foods

- Organic Valley

- Living Harvest

U.S. Dairy Alternatives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.12 billion

Revenue forecast in 2030

USD 14.28 billion

Growth Rate (Revenue)

CAGR of 12.0% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, Product, and Distribution Channel

Country scope

U.S.

Key companies profiled

Chobani, LLC; Danone S.A.; Hain Celestial; Daiya Foods; Eden Foods; SunOpta; Melt Organic; Oatly AB; Blue Diamond Growers; Ripple Foods; Organic Valley; Living Harvest

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. dairy alternatives market report on the basis of source, product, and distribution channel.

-

Source Outlook (Revenue, USD Million; 2018 - 2030)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dairy alternatives market was estimated at USD 7.27 billion in 2024 and is expected to reach USD 8.12 billion in 2025.

b. The U.S. dairy alternatives market is expected to grow at a compound annual growth rate of 12.0% from 2025 to 2030 to reach USD 14.28 billion by 2030.

b. Almond source dominated the U.S. dairy alternatives market with a share of 41.88% in 2024. Almonds play a crucial role in driving the U.S. dairy alternatives market due to their versatility, nutritional benefits, and sustainability. Almond-based products, such as almond milk, have gained popularity as consumers seek plant-based, lactose-free, and lower-calorie alternatives to traditional dairy.

b. Some of the key market players in the U.S. dairy alternatives market are Chobani, LLC, Danone S.A., Hain Celestial, Daiya Foods, Eden Foods, SunOpta, Melt Organic, Oatly AB, Blue Diamond Growers, Ripple Foods, Organic Valley, and Living Harvest.

b. The growing number of health-conscious consumers and the growing prevalence of lactose intolerance in the U.S. are primarily driving the market. In addition, the growing popularity of the vegan diet and an increased plant-based diet fuels the growth of the dairy alternative market in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.