- Home

- »

- Advanced Interior Materials

- »

-

U.S. Deburring Machine Market, Industry Report, 2030GVR Report cover

![U.S. Deburring Machine Market Size, Share & Trends Report]()

U.S. Deburring Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Operation Mode (Automatic, Semi-automatic, Manual), By Deburring Media, By End-use (Automotive, Aerospace & Defense, Electronics), And Segment Forecasts

- Report ID: GVR-4-68040-705-4

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Deburring Machine Market Summary

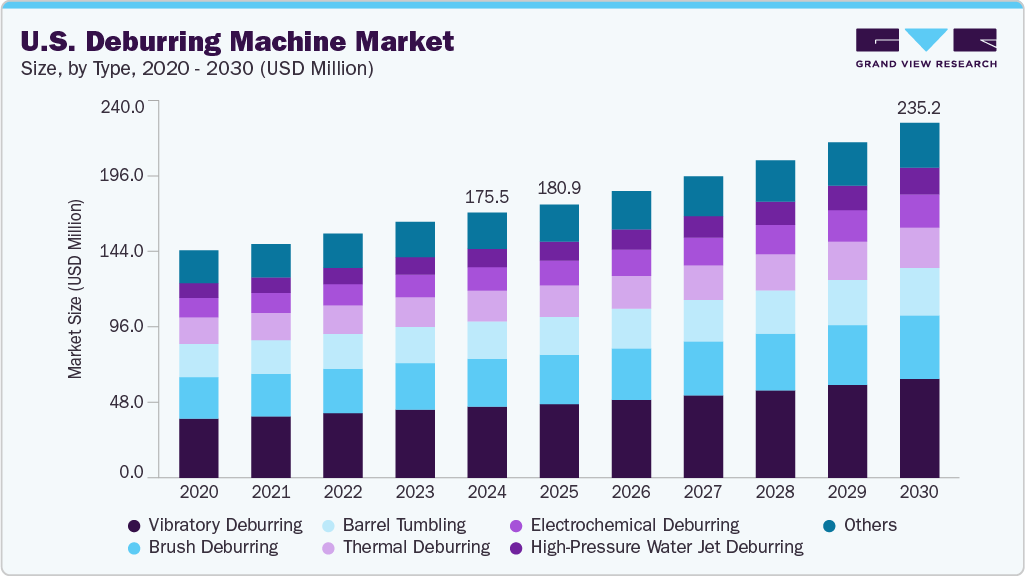

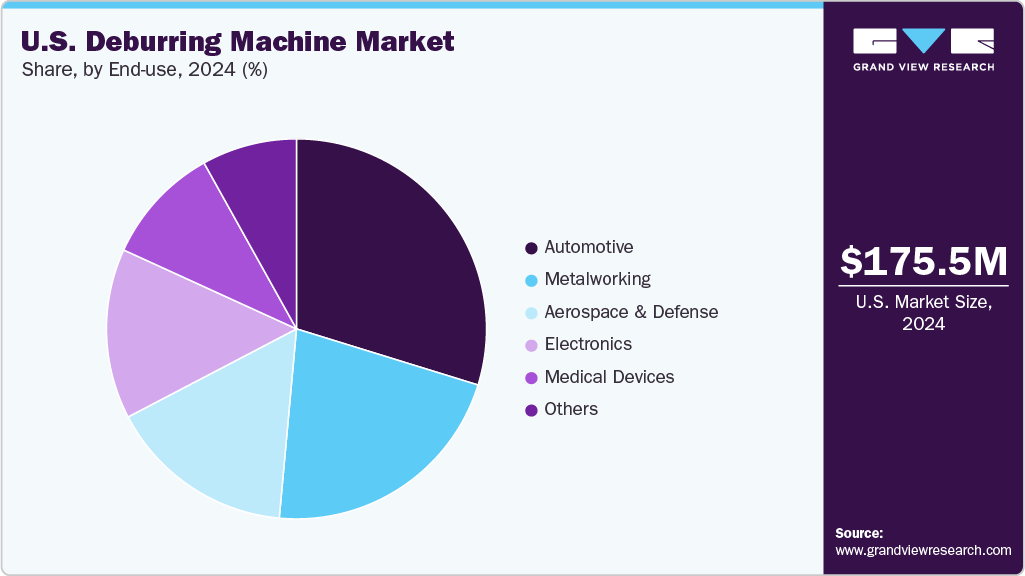

The U.S. deburring machine market size was estimated at USD 175.5 million in 2024 and is projected to reach USD 235.2 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The market growth is due to increasing demand for precision finishing in key manufacturing sectors such as automotive, aerospace, electronics, and medical devices.

Key Market Trends & Insights

- By type, the vibratory deburring segment held the largest market revenue share of 26.8% in 2024.

- By operation mode, the automatic segment accounted for the revenue share of 54.8% in 2024.

- By deburring media, ceramic media segment held the revenue share of 37.9% in 2024.

- By end use, the automotive segment dominated the market with a revenue share of 29.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 175.5 Million

- 2030 Projected Market Size: USD 235.2 Million

- CAGR (2025-2030): 5.4%

U.S. deburring machine industry is being significantly shaped by advancements in automation, particularly through the adoption of Industry 4.0 technologies. It involves integrating digital technologies such as AI, IoT, and robotics into manufacturing processes, enabling smart, real-time monitoring and adaptive control of deburring operations. This shift enhances precision, reduces defects, and optimizes production workflows, making AI-driven deburring machines, highly attractive to manufacturers aiming for zero-defect production and improved throughput.

Type Insights

The vibratory deburring segment held the largest market revenue share of 26.8% in 2024. This growth is due to its versatility, cost-effectiveness, and ability to process various part sizes and materials. It is commonly used in high-volume industries such as automotive and metalworking as it provides consistent surface finishing and efficient batch processing. Its low maintenance requirements and scalability make it popular for mass production environments.

The high-pressure water jet deburring segment is expected to grow at the fastest CAGR of 6.9% over the forecast period. This growth is driven by the increasing need for precise and environmentally friendly deburring methods. It is especially suitable for delicate or complex parts where mechanical deburring might cause damage. With stricter environmental regulations and a preference for non-abrasive processes, this clean and residue-free technique is gaining popularity in industries such as aerospace, medical devices, and electronics.

Operation Mode Insights

The automatic segment held the largest market share and is expected to grow rapidly during the forecast period. This dominance is due to the segment’s high efficiency, reliable performance, and compatibility with smart manufacturing systems. Automatic deburring machines are especially suited for high-volume production settings, such as the automotive and electronics industries, where accuracy and speed are crucial. Their ability to lower labor costs and reduce human errors has made them the preferred option for large manufacturers focused on boosting productivity and ensuring quality.

The semi-automatic segment is expected to grow at a significant rate over the forecast period. This growth is largely driven by small and medium-sized enterprises (SMEs) that require manual flexibility and automated efficiency. Semi-automatic machines offer a cost-effective solution for handling varying production volumes. As more manufacturers seek to upgrade their processes without fully automating, this segment is gaining popularity in both developing and mature markets.

Deburring Media Insights

The ceramic media segment dominated the market with the largest revenue share in 2024. This is due to its versatility, durability, and high effectiveness for heavy-duty material removal. It is extensively used in industries such as automotive, aerospace, and metal fabrication due to its ability to work well with hard metals and produce high-quality surface finishes. The long lifespan and efficiency of ceramic media in aggressive deburring processes make it the most trusted choice among manufacturers.

The steel media segment is expected to grow at the fastest CAGR over the forecast period. Its strong durability, aggressive cutting capabilities, and suitability for demanding applications drive this growth. Steel media is increasingly favored in sectors such as automotive and metal fabrication, where fast material removal and reliable performance are critical. As manufacturers look for cost-effective and long-lasting solutions for tough metal parts, the demand for steel media increases.

End Use Insights

The automotive segment led the U.S. deburring machine market and is expected to grow rapidly over the forecast period. This leadership is driven by the sector’s large-scale production demands and strict quality standards. Deburring ensures the safety and performance of critical components such as engine parts, transmission systems, and braking mechanisms. Furthermore, the growing shift toward electric vehicles has increased the need for precise deburring of battery housings and lightweight metal parts, further boosting demand in this segment.

The aerospace and defense segment is expected to grow at a significant rate over the forecast period. This growth is attributed to the industry’s strict safety, tolerance, and surface quality. Components such as structural parts, turbine blades, and precision fasteners require burr-free finishes to maintain performance and reliability.

Key U.S. Deburring Machine Company Insights

-

Some of the key players operating in the U.S. deburring machine industry include Precision Surfacing Solutions, Abtex, LLC, OP USA Inc. and others.

-

Precision Surfacing Solutions is a leading precision surface finishing equipment manufacturer, offering advanced grinding, lapping, polishing, and deburring technologies. It provides customized turnkey solutions for fine grinding, profile grinding, bore honing, and polishing across various industries, focusing on micron-accuracy surface finishes.

Key U.S. Deburring Machine Companies:

- Precision Surfacing Solutions

- Abtex, LLC

- OP USA Inc.

- Loeser GmbH

- Dynabrade, Inc.

- United Surface Solutions LLC

- ARKU Maschinenbau GmbH

Recent Developments

-

In February 2025, Abtex LLC introduced the Bradex DD-8, a deburring unit for high mix, low volumes.

-

In September 2024, ARKU Inc. announced a multi-million-dollar investment to establish new operations in Greer, South Carolina. The facility, located at 2740 S. Highway 14, will provide contract leveling services for parts, sheets, and plates.

U.S. Deburring Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 180.9 million

Revenue forecast in 2030

USD 235.2 million

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, operation mode, deburring media, end use

Key companies profiled

OP USA Inc., Loeser GmbH, Dynabrade, Inc . United Surface Solutions LLC, ARKU Maschinenbau GmbH, Precision Surfacing Solutions, Abtex, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Deburring Machine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. deburring machine market report based on type, operation mode, deburring media, and end use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vibratory Deburring

-

Barrel Tumbling

-

Brush Deburring

-

Thermal Deburring

-

Electrochemical Deburring

-

High-Pressure Water Jet Deburring

-

Others

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Deburring Media Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic

-

Steel

-

Plastic

-

Organic Compounds

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Electronics

-

Medical Devices

-

Metalworking

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. deburring machine market size was estimated at USD 175.5 million in 2024 and is expected to be USD 180.9 million in 2025.

b. The U.S. deburring machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 235.2 million by 2030.

b. Automatic is the leading operation mode segment, accounting for 54.8% share in 2024, due to its high efficiency, reliable performance, and compatibility with smart manufacturing systems.

b. Some of the key players operating in the U.S. deburring machine market include Precision Surfacing Solutions; Abtex, LLC; OP USA Inc.; Loeser GmbH; Dynabrade, Inc.; United Surface Solutions LLC; ARKU Maschinenbau GmbH.

b. Key factors driving the U.S. deburring machine market include the growing demand for high-precision components across industries like automotive, aerospace, and electronics along with increased automation in manufacturing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.