- Home

- »

- Advanced Interior Materials

- »

-

U.S. Decoupling Membrane Market, Industry Report, 2030GVR Report cover

![U.S. Decoupling Membrane Market Size, Share & Trends Report]()

U.S. Decoupling Membrane Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Polyethylene-Based Membranes, Polypropylene-Based Membranes, Rubber-Based Membranes), By End-use And Segment Forecasts

- Report ID: GVR-4-68040-713-0

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Decoupling Membrane Market Summary

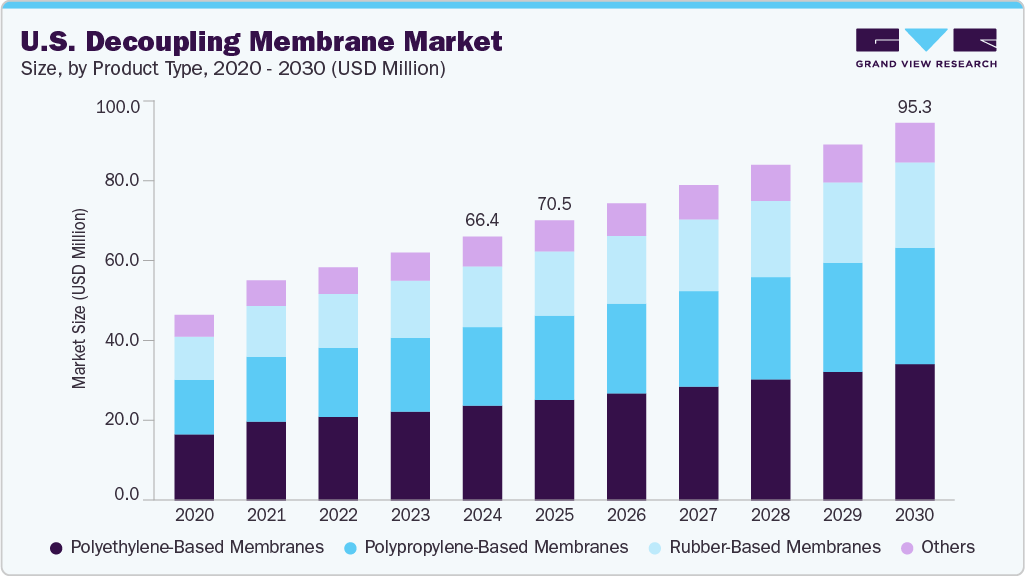

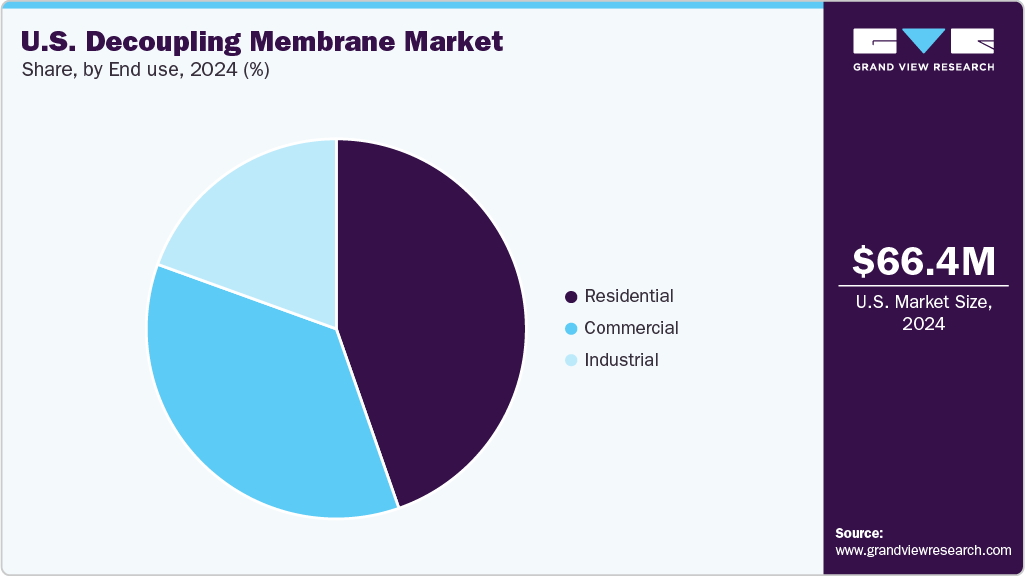

The U.S. decoupling membrane market size was estimated at USD 66.4 million in 2024 and is projected to reach USD 95.3 million by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The market is expected to expand due to the growing focus on building durability, effective moisture management, and ease of renovation.

Key Market Trends & Insights

- Based on product type, polyethylene-based membranes accounted for a revenue share of 35.9% in 2024.

- By end-use, the residential segment held a revenue share of 29.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.4 Million

- 2030 Projected Market Size: USD 95.3 Million

- CAGR (2025-2030): 6.2%

As construction activity increases in the U.S., especially in residential and commercial remodeling projects, builders and contractors prioritize solutions that provide long-term protection for flooring systems. According to a report by the U.S. Census Bureau, total U.S. construction spending reached USD 2.15 trillion in April 2025, indicating strong growth in building activities that drive demand for durable flooring solutions such as decoupling membranes. Decoupling membrane serves as an important intermediary layer installed between subfloors and tile surfaces in U.S. construction projects. Their main function is to absorb structural movement and stress, preventing cracks and damage to tiles. By minimizing stress transfer from the subfloor to the tile, these membranes improve the durability and lifespan of flooring systems commonly used in American homes and commercial buildings.

Moisture-related problems and tile failures can result in expensive repairs and structural issues, making moisture management a critical concern in the U.S. construction industry. Consequently, decoupling membranes have become a standard solution in U.S. residential and commercial renovation projects to ensure long-term protection and reduce maintenance costs.

Several factors drive the rising demand for decoupling membrane within the U.S. market. Rapid urbanization in metropolitan areas and increased consumer spending on home improvement projects encourage the adoption of advanced flooring technologies. Awareness among U.S. builders, architects, and homeowners about the benefits of crack isolation, vapour control, and uncoupling properties has grown significantly, positioning these membranes as a valuable investment. The growing preference for large-format tiles in U.S. homes and commercial spaces, which are more vulnerable to subfloor imperfections, further supports the need for a decoupling membrane.

Product Type Insights

The polyethylene-based decoupling membrane segment led the market in 2024, capturing the largest market revenue share of 35.9%. This is due to their excellent performance, durability, and widespread residential and commercial construction use. These membranes provide strong waterproofing, crack isolation, and chemical resistance, making them well-suited for high-moisture areas such as bathrooms, kitchens, and basements.

The polypropylene-based membrane is expected to grow at the fastest CAGR over the forecast period. Their increasing demand is driven by cost-effectiveness, lightweight nature, and ongoing innovations in composite materials. These membranes are easier to install, offer good tensile strength, and have become popular in price-sensitive markets and among DIY consumers.

End Use Insights

The residential segment led the market in 2024, accounting for the largest market revenue share, and is expected to grow at the fastest CAGR during the forecast period. Increased home renovations, remodelling projects, and new housing developments drive this growth. Homeowners place greater emphasis on durable and moisture-resistant flooring, particularly in areas such as kitchens, bathrooms, and basements. The common use of ceramic and stone tiles in residential interiors has made a decoupling membrane a preferred choice to prevent tile cracking and water damage. Moreover, the growing DIY home improvement trend and the availability of easy-to-install membrane products have further boosted adoption in the residential sector.

The commercial sector is expected to grow at the fastest CAGR during the forecast period. This expansion is supported by increased construction in hospitality, healthcare, retail, and office buildings, where durability, hygiene, and long-term performance are essential. Commercial buildings often feature large-format tiles and face higher foot traffic, making them more susceptible to subfloor movement and stress, which a decoupling membrane effectively addresses. As commercial builders focus more on lifecycle cost savings and meeting regulatory standards, the demand for high-performance membrane systems is rapidly increasing.

Key U.S. Decoupling Membrane Company Insights

Some of the key players in the U.S. decoupling membrane industry include Schluter Systems, LATICRETE International, Inc., CUSTOM Building Products, and MAPEI Corporation.

- Custom Building Products is a leading manufacturer of tile and stone installation systems. It provides a wide array of products, including mortars, grouts, and waterproofing membranes, designed to meet the needs of both residential and commercial projects.

Key U.S. Decoupling Membrane Companies:

- Schluter Systems

- LATICRETE International, Inc.

- CUSTOM Building Products

- MAPEI Corporation

- Noble Company

- Ardex Americas

Recent Developments

-

In April 2025, LATICRETE introduced the NXT Pedestal System in the U.S. market, offering a reliable and flexible solution for raised exterior flooring.

-

In October 2024, Schluter Systems introduced its new products, Schluter-DITRA-PS peel and stick uncoupling membrane and Schluter-PRIMER-PS, a specially designed primer for peel and stick membrane use.

U.S. Decoupling Membrane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.5 million

Revenue forecast in 2030

USD 95.3 million

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use

Key companies profiled

Schluter Systems, LATICRETE International, Inc., Custom Building Products, MAPEI Corporation, Noble Company, Ardex Americas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Decoupling Membrane Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. decoupling membrane market report based on product type, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene-Based Membrane

-

Polypropylene-Based Membrane

-

Rubber-Based Membrane

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. decoupling membrane market size was estimated at USD 66.4 million in 2024 and is expected to reach USD 70.5 million in 2025.

b. The U.S. decoupling membrane market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 95.3 million by 2030.

b. The polyethylene-based membranes segment led the market and accounted for the largest revenue share, 35.9%, in 2024, due to their superior performance characteristics, durability, and broad adoption in both residential and commercial construction projects.

b. Schluter Systems, LATICRETE International, Inc., Custom Building Products, MAPEI Corporation, Noble Company, and Ardex Americas are prominent companies in the U.S. decoupling membranes market.

b. Key factors driving demand in the U.S. decoupling membranes market include rising construction and renovation activities, increasing use of large-format tiles, and growing awareness of moisture control and crack prevention.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.