- Home

- »

- Medical Devices

- »

-

U.S. Dental Implant Market Size, Share, Trends, Report, 2030GVR Report cover

![U.S. Dental Implant Market Size, Share & Trends Report]()

U.S. Dental Implant Market Size, Share & Trends Analysis Report By Type (Titanium, Zirconia), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-197-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

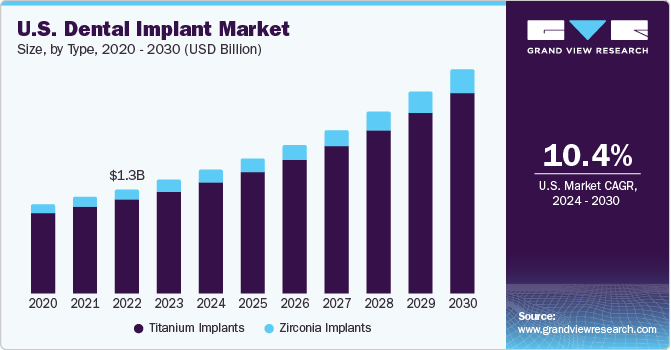

The U.S. dental implant market size was estimated at USD 1.5 billion in 2023 and is projected to register a compounded annual growth rate (CAGR) of 10.4% from 2024 to 2030. This growth is attributable to the country’s wide availability of resources, higher per capita income of the population, more concern about esthetics, and higher patient awareness. Major factors influencing the market growth include increased demand and varied applications for dental implants as well as prosthetics.

Software solutions such as CAD/CAM-based dental restorations and prosthetics are relatively more precise and can be produced or designed in a day, whereas conventional techniques involve using temporary restorations for several weeks as the final restoration gets designed. Accordingly, technological advancements in the field are propelling market growth.

The curbing of aesthetic procedures during the COVID-19 pandemic has led to a post-pandemic boom in the market. The closure of dental clinics during COVID-19 lockdowns created a significant backlog, thus propelling overall market growth for dental treatment, including dental implants. Moreover, the increasing preference for cosmetic dentistry procedures, attributable to the advent of social media among the urban population, plays an important role in the market growth. According to the American Academy of Implant Dentistry (AAID), in the U.S., more than 150 million people are missing a tooth. However, the patients treated are just over 1 million, with approximately 2.5 million implantations, leaving scope for further market growth through dental restorations.

Market Concentration & Characteristics

The U.S. dental implant market is characterized by evolving technologies, regulatory considerations, materials innovation, and increasing globalization and outsourcing of manufacturing processes to leverage cost advantages and specialized capabilities.

According to the World Dental Federation, globally, nearly 30% of individuals aged 65 to 74 have no natural teeth, and this burden is expected to increase with a rapidly aging population. Consequently, the U.S. market for dental implants is characterized by a high degree of innovation. Increasing patient awareness and high disposable income are expected to serve as high-impact drivers. In addition, innovative solutions such as nanotechnology, plasma integration in osseointegration, bioactive materials that aid tissue regrowth, and smart technology with miniature sensors in implants are expected to revolutionize the market and fuel its growth.

The market is further characterized by a high level of strategic activities, such as mergers, acquisitions, and collaborations. To promote the reach of their offerings and increase their product capabilities, major players have resorted to acquisition of companies leading in a technological development in the market. For instance, in June 2022, Henry Schein, a key market participant in the U.S., acquired Condor Dental, a dental distribution service organization, to leverage their distribution channels for product promotion.

The regulatory framework surrounding medical devices, especially dental implants, have been amended since the COVID-19 pandemic. Moreover, dental implant marketed and manufactured in the U.S. must qualify the criteria set by the American Dental Association (ADA) and U.S. Food and Drug Administration (FDA). Major players focusing on research and development initiatives are helped by academic and government institutions working on studies to incorporate varied technologies. For instance, in August 2023, RevBio, a leading global manufacturer of dental implants, received FDA approval to conduct their U.S.based clinical trial for dental implant stabilization.

The use of dental bridges and dentures has decreased, and denturists as well as oral surgeons favor the use of dental implants. Their efficient technique and long term favorability has led to high product expansion in the market. As per an article published by the AAID, implants coated with antimicrobial covering are anticipated to be the upcoming trend, with research proving their effectiveness in preventing bacterial growth and tooth decay. Moreover, for further market dominance in patient-specific restorative solutions, in October 2023, ZimVie Inc. announced the launch of multi-platform product solutions that aid dental laboratories.

The U.S. dental implant industry is characterized by the parity in healthcare choices seen across the country. With the teledentistry services sector aiding patient access to dental care, major global market players are also able to expand operations in the country and collaborate with Dental Service Organizations (DSOs) to aid a larger audience. For instance, Dental Care Alliance, a DSO based in Florida, was acquired by the Mubadala Investment Company. Dental Care Alliance operates 390 practices and is active in 22 states, thus aiding major control for the investment firm.

Type Insights

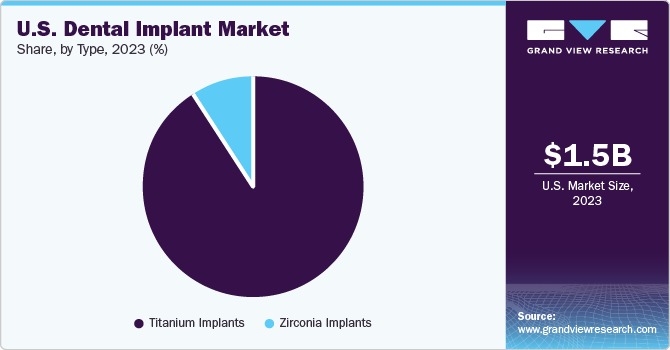

The titanium implants segment led the dental implant market with a revenue share of 91% in 2023, and is anticipated to grow significantly from 2024 to 2030. Titanium implants are non-allergic and their biocompatibility aids dental restorative procedures by avoiding bacterial infections. Moreover, studies have also inferred that porous titanium implants, a prototype under development, can last a lifetime without replacement. For instance, in May 2022, Osstem Implant introduced the KS implant system, offering improved fatigue fracture toughness and a diverse implant portfolio, thus contributing to the enhancement of dental implant technology.

The zirconia implants is the fastest growing segment in the U.S. dental implant market. The favorability for zirconia implants arises from their esthetic appeal and bacterial resistance. Moreover, zirconia implants have proven to have no chronic inflammation post-implant, and is thus being preferred over its counter-alternative. Most major market players offer zirconia implants due to their enhanced structure. For instance, in March 2022, Neodent, a leading dental implant company under the Straumann Group, launched Zi, a zirconia implant system that allows for immediate placement with high-end aesthetics owing to the modern naturally tapered implant design.

Key U.S. Dental Implant Company Insights

The market is fragmented with the prominent players positively impacting its growth. Some of the key players include Straumann Holding AG; Envista Holdings Corporation; DENTSPLY Sirona Inc; and Zimmer Biomet Holdings, Inc. These companies are collaborating with regional players to expand their services geographically.

Market players have resorted to varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and local expansions and partnerships. For instance, the global market players are collaborating with local, private DSOs to provide better dental service and cater to a larger audience.

Key U.S. Dental Implant Companies:

The following are the leading companies in the U.S. dental implant market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. dental implant companies are analyzed to map the supply network.

- Henry Schein Inc.

- Straumann Holding AG

- Nobel Biocare Services AG

- DENTSPLY Sirona Inc

- Zimmer Biomet Holdings, Inc.

- Osstem Implant Co Ltd

- Kyocera Corporation

- BioHorizons IPH, Inc.

- Bicon, LLC

- Dentium Co., Ltd.

- Thommen Medical AG

Recent Developments

-

In May 2023, Allisone Technologies announced the acquisition of Spotimplant, an AI-based software for dental implant identification, combining both companies’ commitment to utilizing smart technology in dental implants.

-

In March 2023, DENTSPLY Sirona launched the OmniPaper Implant System, offering flexibility, sustained bone care, and esthetic appearance, along with digital workflows for seamless fitting.

-

In July 2022, Envista Holdings Corporation, a leading player in the U.S., extended their commercial partnership with Dentalcorp Holdings Ltd. to be the official dental implant provider for their DSOs.

-

In June 2022, ZimVie announced the launch of a new, FDA-cleared T3 PRO Tapered Implant and Encode Emergence Healing Abutment in the U.S. that provide more natural tissue healing for greater esthetics and easy scanning for workflow efficiency.

U.S. Dental Implant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.65 billion

Revenue forecast in 2030

USD 2.98 billion

Growth rate

CAGR of 10.4% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Henry Schein Inc.; Straumann Holding AG; Nobel Biocare Services AG; DENTSPLY Sirona Inc; Zimmer Biomet Holdings, Inc.; Osstem Implant Co Ltd; Kyocera Corporation; BioHorizons IPH, Inc.; Bicon, LLC; Dentium Co., Ltd.; Thommen Medical AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Implant Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental implant market report based on type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium Implants

-

Zirconia Implants

-

Frequently Asked Questions About This Report

b. The U.S. dental implant market is estimated at USD 1.5 billion in 2023 and is expected to reach USD 1.66 billion in 2024.

b. The U.S. dental implant market is expected to grow at a CAGR of 10.4% from 2024 to 2030 to reach USD 2.98 billion in 2030.

b. Titanium implants led the dental implant market with a revenue share of 91% in 2023, and is anticipated to grow significantly over the forecast period.

b. Some of the key players operating in the U.S. dental implant market include Straumann Holding AG; Envista Holdings Corporation; DENTSPLY Sirona Inc.; and Zimmer Biomet Holdings, Inc. These companies are collaborating with regional players to expand their services geographically.

b. Key driving factors include the country’s wide availability of resources, higher per capita income, more consciousness about esthetics, and higher patient awareness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."