- Home

- »

- Medical Devices

- »

-

U.S. Dental X-ray Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Dental X-ray Market Size, Share & Trends Report]()

U.S. Dental X-ray Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Analog, Digital), By Type (Intraoral, Extraoral), By Application (Medical, Cosmetic Dentistry), And Segment Forecasts

- Report ID: GVR-4-68040-282-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dental X-ray Market Size & Trends

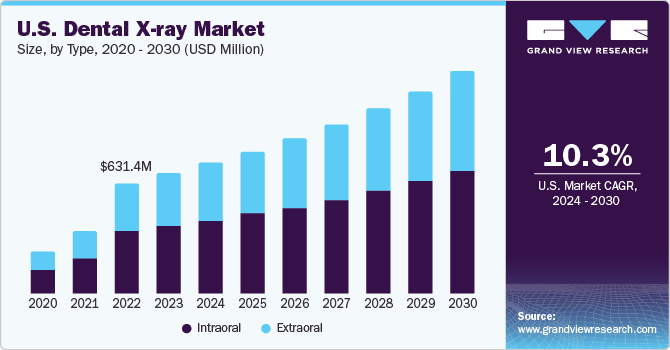

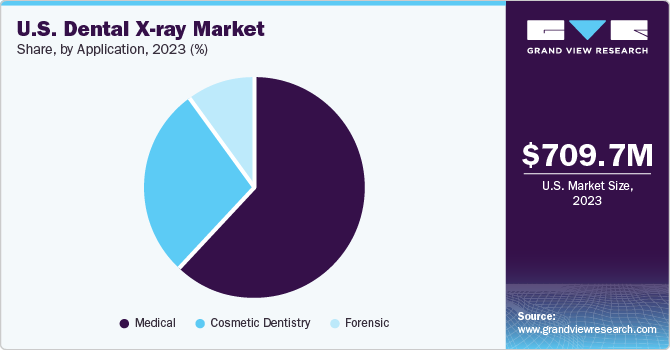

The U.S. dental X-ray market size was estimated at USD 709.73 million in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030. The market growth is driven by technological developments in dental X-rays, rising incidences of dental ailments, and increasing demand for cosmetic dentistry services. Further, the availability of technologically advanced products and a high number of key players in the country contribute to the industry's growth.

Furthermore, substantial developments have been observed in the market. For instance, in May 2019, Air Techniques, Inc. introduced ScanX Classic View as part of their ScanX View family line, which includes a cutting-edge digital radiography system. Such launches are expected to help the companies hold a stronger position in the U.S. dental X-ray industry and strengthen their portfolio. In addition, in October 2021, Athlos Oy was granted 510(k) acceptance for DC-Air, a next-generation intraoral X-ray imaging sensor, heralding a new era in X-ray imaging technology. All these innovations drive the market growth.

Many private dental practices, advanced diagnostic centers with cutting-edge X-ray equipment, and dental clinics distinguish the country. The U.S. is a leader in adopting and advancing dental X-ray technologies, significantly contributing to its dominance in the market. This creative landscape is combined with a well-established regulatory framework, which propels the market's growth.

As dental imaging methodologies advance technologically, market players are innovating and introducing new products. For instance, in March 2022, Second Opinion, a real-time AI-powered pathology diagnosis system, received FDA certification from Pearl, a leader in dental AI solutions. Using patient X-rays, this solution was intended to help dentists correctly identify various common dental diseases. Furthermore, in August 2021, the U.S. Food and Drug Administration granted 510(k) pre-market certification to Surround Medical Systems for their innovative PORTRAY dental X-ray equipment. All these innovations are opportunistic for the growth of the market.

Moreover, integrating AI enhances operational efficiency and clinical consistency, particularly for digital X-rays. For instance, in May 2022, VideaHealth received the FDA's 510(k) clearance for their AI-powered Videa Caries Assist, a cavity detection algorithm. Similarly, in April 2022, Carestream Dental introduced the Neo Edition of the CS 8200 3D Family, featuring CBCT imaging. The market is anticipated to experience notable growth and market share expansion during the forecast period, driven by these advancements and benefits.

Market Concentration & Characteristics

The market growth stage is high and the pace of the market growth is accelerating. The U.S. dental X-ray market is characterized by a high degree of innovation. In September 2022, Midmark Venture, a prominent dental solutions provider focusing on advancing care delivery through strategic clinical environment design, launched the Midmark Extraoral Imaging System (EOIS) product line. This collection consists of 2D panoramic, all-encompassing 3D, CBCT imaging X-ray tools and cephalometric accessories. By introducing the EOIS 3D device, Midmark encourages familiar dental professionals to embrace a 3D approach, which is likely to drive improvement and ensure the success of their practices.

The industry is characterized by a substantial number of mergers and acquisitions (M&A) activities. Several market participants are involved into M&A strategies for market expansion, technological innovation, and strategic positioning to capitalize on the growing demand for advanced dental X-ray solutions. For instance, in April 2022, Envista Holdings Corporation acquired the Intra-Oral Scanner from Carestream Dental as part of its long-term plan to digitize dental workflows by concentrating on its fastest-growing Specialty Products & Technologies sector.

The dental X-ray industry in the U.S. is also subject to increasing regulatory scrutiny. The country has a well-established healthcare infrastructure and is witnessing growth in healthcare spending. Additionally, the market penetration of these systems is further enhanced by attractive healthcare reimbursements and a robust growth in government initiatives.

Product Insights

The analog segment dominated the market, accounting for 60% market share in 2023. This growth is credited to contemporary & high-quality dental technology and equipment availability. Thin-film diagnostic images of the body's internal structures are obtained using analog X-ray devices. The need for efficient diagnostic imaging and the rise in chronic illness cases, including cancer and arthritis, in the U.S. are predicted to fuel the segment's expansion. The growing geriatric population is also contributing to the market's expansion.

The digital segment is anticipated to register the fastest CAGR during the forecast period.Due to advantages including faster speeds and greater flexibility, many medical specialists are replacing their analog systems with digital ones, contributing to the segment's growth. There are several advantages of employing digital X-rays in dental practices, including reduced radiation exposure, ease of use with small sensors, lesser wait times, high accuracy, and less waste & environmental impact.

In addition, enhanced diagnostic accuracy is improved by access to more detailed images and data. Patients can feel secure in knowing that their oral specifications are considered while customizing their diagnosis and treatment plan. Subtle, invisible problems to the naked eye, such as tumors, gum disease, infections in the bone, concealed regions of decay, and other anomalies, can be found with digital X-rays. The market growth throughout the research period can be attributed to these benefits over traditional X-ray technologies in dentistry.

Type Insights

The intraoral segment accounted for the largest market revenue share in 2023. Dentists can repair decays and keep an eye on the general health of the jawbones and teeth by using the detailed images that intraoral X-ray provide. Intraoral radiological imaging is the most utilized diagnostic technique in dentistry. Numerous procedures, including diagnosing caries and determining endodontic file positions, can be carried out using intraoral imaging. The spatial and contrast resolution of the intraoral X-ray segment is opportunistic for market expansion. For instance, in August 2021, the U.S. Food and Drug Administration approved the innovative 3D intraoral X-ray technology based on research from UNC-Chapel Hill, with faster, more detailed imaging and less need of radiation. With 3D technology, dental diseases can be detected more accurately and early on, allowing patients to begin treatment sooner and receive higher-quality dental care.

The extraoral segment is anticipated to register the fastest CAGR over the forecast period. The extraoral segment includes dental X-ray systems that capture images of the skull, jaw, and facial structures outside the mouth. Advancements in technology have led to the development of more sophisticated extraoral imaging devices, such as Cone Beam Computed Tomography (CBCT) scanners. These systems provide high-quality 3D images with minimal radiation exposure, making them increasingly popular among dental professionals. Moreover, technological advancements in extraoral X-ray systems, such as panoramic and cone-beam computed tomography (CBCT) imaging, enhance diagnostic capabilities and provide detailed images for comprehensive treatment planning. These innovations attract dental practitioners and patients, further fueling the growth of the extraoral segment in the market.

Application Insights

The medical segment accounted for the largest market revenue share in 2023. Dental radiography helps dentists identify oral health problems such as cysts or abscesses, examine tooth decay levels, and determine the severity of disorders such as cavities, tumors, and fractures. Increased patient knowledge, rising dental caries cases, and a growing need for precise patient diagnosis & treatment planning are attributed to this market growth. For instance, in February 2022, DENTSPLY SIRONA Inc. announced the launch of its medical-grade 3D printing solution and its partnership with Google Cloud. Due to the centralized nature of medical facilities, dental X-ray products can be integrated into patient care in a coordinated and effective manner, which supports the segment's overall growth.

The cosmetic dentistry segment is anticipated to register the fastest CAGR over the forecast period. Cosmetic dentistry aims to improve oral health by improving the appearance of teeth, gums, and mouth. Dental bonding, porcelain veneers, smile makeovers, teeth whitening, complete mouth reconstruction, gum lifts & contouring, and other operations are standard cosmetic procedures. Enhancing dental aesthetics in terms of position, color, alignment, form, size, and overall smile appearance is the main goal of cosmetic dentistry. The primary drivers of the market growth are the growing elderly population, increasing acceptance of cosmetic dentistry, rise in dental problems, and introduction of novel imaging technologies.

Key U.S. Dental X-ray Company Insights

Some of the key players operating in the market include Dentsply Sirona, Carestream Dental, LLC, Danaher, PLANMECA OY, and Air Techniques, Inc.

-

Dentsply Sirona is one of the most extensive dental supplies and equipment manufacturers across the world. The company's extensive portfolio comprises dental consumables, lab equipment, CAD/CAM & imaging technology, medical devices, and specialty goods in orthodontics, endodontics, and implants.

-

Carestream Dental, LLC makes digital dental systems to enhance dentistry, simplify technology, and enhance lives. The company provides practice management software, computer-aided design (CAD) for orthodontics, and other related products to satisfy the needs of dental clinics.

Key U.S. Dental X-ray Companies:

- Dentsply Sirona

- Carestream Dental, LLC

- Danaher

- PLANMECA OY

- Air Techniques, Inc.

- LED Medical Diagnostics Inc.

- Vatech Co. Ltd.

- Midmark Corporation

- Envista Holdings Corporation

- Varex Imaging Corporation

Recent Developments

-

In June 2023, Luna Lite announced the launch of the Luna Lite automated laser-guided dental x-ray positioner. With its revolutionary design, this X-ray machine promises to transform the industry and benefit patients and dentists by increasing productivity and comfort.

-

In February 2022, Overjet received a U.S. patent for its ability to detect anatomical features and quantify disease on dental X-rays with its AI technology. This achievement highlighted the company’s Overjet's novel approach to AI-driven dental imaging.

-

In April 2021, Carestream Dental introduced the CS 2400P. This mobile generator offers all the features of a mobile device while producing a solid X-ray beam necessary for excellent image quality.

-

In March 2021, Air Techniques, Inc. announced a collaboration with Dentsply Sirona on the SICAT software. The software enables the dentists to provide patients with the best possible experience with integrated SICAT software and ProVecta 3D Prime.

U.S. Dental X-ray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 791.82 billion

Revenue forecast in 2030

USD 1.42 billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application

Country scope

U.S.

Key companies profiled

Dentspl Dentsply Sirona; Carestream Dental, LLC; Danaher PLANMECA OY; Air Techniques, Inc.; LED Medical Diagnostics Inc.; Vatech Co. Ltd.; Midmark Corporation; Envista Holdings Corporation; Varex Imaging Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental X-ray Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental X-ray market report based on product, type, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog

-

Digital

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intraoral

-

Bitewing

-

Periapical

-

Occlusal

-

-

Extraoral

-

Panoramic

-

CBCT

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cosmetic Dentistry

-

Forensic

-

Frequently Asked Questions About This Report

b. The U.S. dental X-ray market size was valued at USD 709.73 million in 2023 and is expected to reach USD 791.82 million in 2024

b. The U.S. dental X-ray market is projected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030 to reach USD 1.42 billion by 2030

b. The analog segment dominated the market, accounting for around 60% in 2023. This rise is credited to contemporary, high-quality dental technology and equipment availability. Thin-film diagnostic images of the body's internal structures are obtained using analog X-ray products. The need for efficient diagnostic imaging and the rise in chronic illness cases, including cancer and arthritis, in the U.S. are predicted to fuel the segment's expansion.

b. Some of the key players operating in the market include Dentsply Sirona, Carestream Dental, LLC, Danaher, PLANMECA OY, and Air Techniques, Inc.

b. The market's growth is driven by technological developments in dental X-rays, rising incidences of dental problems in the U.S. and increasing demand for cosmetic dentistry. The presence of a large population with oral/dental disorders in the U.S. the availability of technologically advanced products, and a high number of key players in the country contribute to the industry's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.