- Home

- »

- Disinfectants & Preservatives

- »

-

U.S. Detergent Alcohols Market Size, Industry Report, 2030GVR Report cover

![U.S. Detergent Alcohols Market Size, Share & Trends Report]()

U.S. Detergent Alcohols Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Application (Laundry Detergents, Dishwashing Detergents, Personal Care & Cosmetics, Industrial Cleaners), And Segment Forecasts

- Report ID: GVR-4-68040-617-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Detergent Alcohols Market Trends

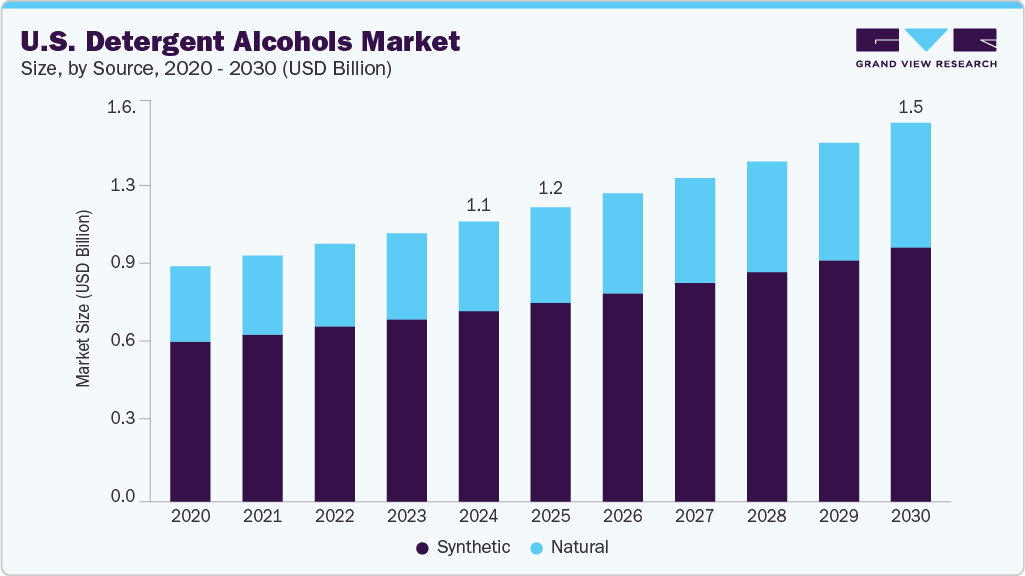

The U.S. detergent alcohols market size was estimated at USD 1.15 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market is primarily driven by rising consumer demand for sustainable and bio-based cleaning products, regulatory push toward environmentally friendly and biodegradable surfactants, and increasing hygiene awareness across residential and industrial sectors. Manufacturers are prioritizing the use of naturally derived detergent alcohols to align with green chemistry initiatives and meet stringent labeling standards such as the EPA Safer Choice and the USDA BioPreferred. The shift toward concentrated and high-performance formulations in laundry and dishwashing segments, coupled with growth in personal care and cosmetic applications, is accelerating the consumption of both natural and synthetic detergent alcohols across the value chains.

The market presents strong growth opportunities driven by the rising adoption of plant-based and biodegradable ingredients across home care, personal care, and institutional cleaning applications. Increasing consumer preference for clean-label and eco-certified products is opening new avenues for manufacturers offering RSPO-certified and non-GMO natural alcohols. Moreover, the expansion of green chemistry and circular economy initiatives is encouraging innovation in bio-based alcohol production technologies, including enzymatic and fermentation processes. Strategic partnerships between oleochemical producers and major FMCG companies are also expected to create long-term demand visibility, particularly in premium and performance-oriented formulations.

Despite promising growth prospects, the market faces notable challenges such as feedstock price volatility, especially for natural detergent alcohols derived from palm and coconut oils, which are influenced by climatic, geopolitical, and supply chain factors. The market also contends with increasing regulatory scrutiny around sustainability claims, requiring transparent and traceable sourcing practices. Synthetic detergent alcohol producers face pressure to reduce their carbon footprint, as petrochemical-derived ingredients face pushbacks from environmentally conscious consumers.

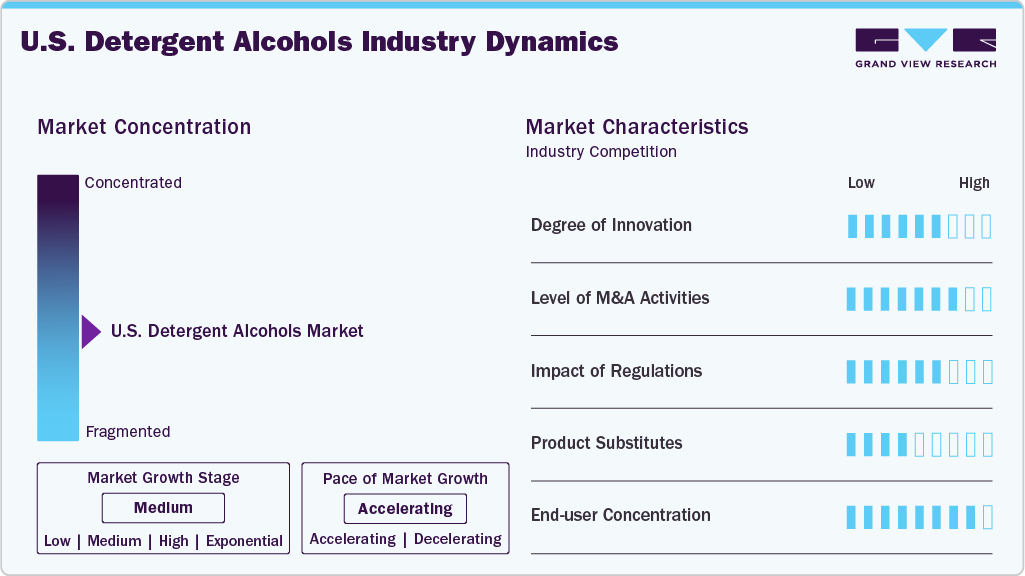

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Stepan Company, Kraton Corporation, and Procter & Gamble, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

These companies are strategically focused on vertical integration, geographic expansion, and product innovation to enhance their market position. These companies are also investing in R&D and digital platforms to improve operational efficiency and meet evolving customer demands for environmentally responsible and high-performance formulations.

Source Insights

Natural detergent alcohols, sourced from renewable feedstocks like palm kernel and coconut oil, are gaining momentum in the US market due to growing demand for sustainable and biodegradable ingredients. This shift is driven by consumer preference for eco-labeled products and regulatory support for green chemistry initiatives. Natural alcohol is increasingly used in personal care and home care applications, with manufacturers focusing on traceability and certifications such as RSPO and USDA BioPreferred to enhance market credibility.

Synthetic detergent alcohols, produced from petrochemical feedstocks through processes like Ziegler and Oxo, continue to serve high-volume applications such as industrial cleaners and conventional laundry detergents. They offer cost efficiency and consistent quality, making them suitable for performance-driven formulations. However, rising environmental concerns and regulatory scrutiny on fossil-based inputs are prompting industry players to evaluate greener alternatives and invest in cleaner production technologies to sustain long-term viability.

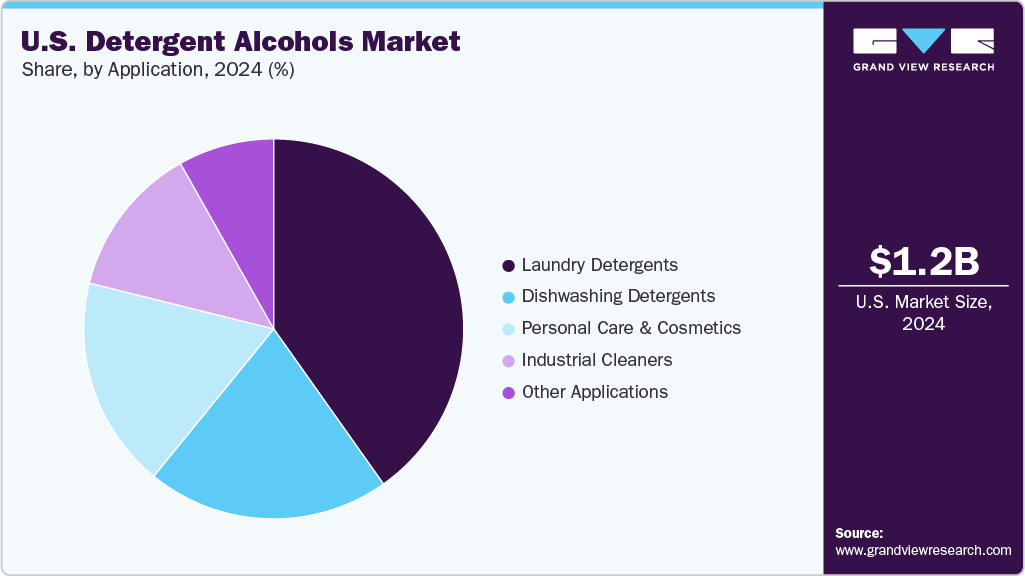

Application Insights

Laundry detergents represent the largest application segment, driven by strong consumer demand for high-performance and concentrated cleaning products. Detergent alcohols are key intermediates in the production of alcohols, ethoxylates and sulfates, widely used in both liquid and powder formulations. Dishwashing detergents, particularly automatic variants, are also a significant application area, where low-foaming, grease-cutting surfactants derived from detergent alcohols are essential. Growing adoption of eco-friendly and phosphate-free formulations continues to support demand in these categories.

In personal care and cosmetics, detergent alcohols are used in the manufacture of mild surfactants for shampoos, body washes, and facial cleansers, with the segment benefiting from the clean-label and sulfate-free trends. Industrial cleaners, which rely on synthetic alcohol-based surfactants for degreasing and disinfecting, account for a stable share, supported by institutional hygiene standards. Other applications, such as agrochemical emulsifiers and textile auxiliaries, represent niche but consistent demand, contributing to overall market diversification.

Key U.S. Detergent Alcohols Company Insights

Key players operating in the U.S. detergent alcohols market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Detergent Alcohols Companies:

- Stepan Company

- Kraton Corporation

- Procter & Gamble

- Vantage Specialty Chemicals, Inc.

- Colonial Chemical

- Pilot Chemical Company

- Oleon NV

- Essential Labs

- Rita Corporation

U.S. Detergent Alcohols Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.19 billion

Revenue forecast in 2030

USD 1.54 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source

Country scope

U.S.

Key companies profiled

Stepan Company; Kraton Corporation; Procter & Gamble; Vantage Specialty Chemicals, Inc.; Colonial Chemical; Pilot Chemical Company; Oleon NV; Essential Labs; Rita Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Detergent Alcohols Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. detergent alcohols market report based on application, and source.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Laundry Detergents

-

Dishwashing Detergents

-

Personal Care & Cosmetics

-

Industrial Cleaners

-

Other Applications

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

Frequently Asked Questions About This Report

b. The global U.S. detergent alcohols market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.19 billion in 2025.

b. The U.S. detergent alcohols market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 1.54 billion by 2030.

b. The synthetic segment accounted for the largest revenue share due to its cost-effectiveness, consistent quality, and large-scale availability, making it the preferred choice for high-volume applications in industrial and household cleaning products.

b. Some of the key players operating in the U.S. detergent alcohols market include Stepan Company, Kraton Corporation, Procter & Gamble, Vantage Specialty Chemicals, Inc., Colonial Chemical, Pilot Chemical Company, Oleon NV, Essential Labs, Rita Corporation.

b. The market is driven by rising demand for cleaning and personal care products, fueled by growing hygiene awareness, urbanization, and population growth. Additionally, the shift toward sustainable formulations is boosting the adoption of bio-based US Detergent Alcohols across key applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.