- Home

- »

- Medical Devices

- »

-

U.S. Dialysis Centers Market Size, Industry Report, 2030GVR Report cover

![U.S. Dialysis Centers Market Size, Share & Trends Report]()

U.S. Dialysis Centers Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (In-center, In-home, SNF-based), By Dialysis (Hemodialysis, Peritoneal Dialysis, Dialysis Chains), By Facility, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dialysis Centers Market Size & Trends

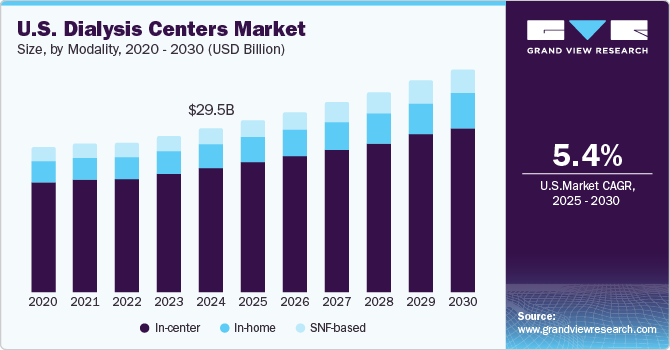

The U.S. dialysis centers market size was estimated at USD 29.51 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. Factors driving market growth include the high prevalence of renal diseases, particularly end-stage renal disease (ESRD) and chronic kidney disease (CKD). Currently, nearly 808,000 individuals are living with ESRD in the U.S., with approximately 69% undergoing hemodialysis and 31% receiving kidney transplants. The prevalence of CKD affects about 35.5 million U.S. adults, or 14% of the adult population, with age being a significant risk factor-34% of those affected are aged 65 and older. The demand for dialysis services and treatment options, including hemodialysis and peritoneal dialysis, is expected to rise substantially with the aging population.

Technological advancements in dialysis systems play a pivotal role in enhancing treatment efficiency and improving patient outcomes. According to the National Kidney Foundation, innovations in home dialysis systems have encouraged a shift towards home healthcare, with approximately 12% of dialysis patients opting for home-based therapies as of 2023. Recent initiatives such as the Transitional Add-on Payment Adjustment (TDAPA) are designed to support home dialysis training, increasing patient comfort and flexibility while further bolstering demand for home healthcare in the U.S. These advancements enable patients to receive care in familiar settings, thereby fostering greater adherence to treatment protocols.

Moreover, favorable reimbursement policies from the Centers for Medicare & Medicaid Services (CMS) significantly bolster market growth. In June 2023, CMS proposed a 1.6% payment increase for freestanding dialysis facilities under the 2024 ESRD prospective payment system, raising the base rate to USD 269.99. Moreover, a 2.6% payment boost was projected for hospital-based facilities. This financial support was expected to enhance access to dialysis services, increase revenues, and foster innovation within the industry.

Furthermore, the expansion of dialysis centers is a notable trend, particularly in states such as California and Alabama, which boast high prevalence rates of renal diseases. A 2024 JAMA Network Study examined the geographic density of dialysis centers and early dialysis initiation in the country. Accordingly, California has approximately 6.56 dialysis facilities per 1,000 ESRD patients, while Alabama exhibits a robust infrastructure with between 13.07 and 17.50 facilities per 1,000 ESRD patients. The ongoing establishment of new outpatient dialysis centers aims to facilitate improved patient access to care, reduce travel burdens, and enhance overall outcomes in the evolving landscape of the hemodialysis and peritoneal dialysis industry in the U.S.

Modality Insights

The in-center segment dominated the market and accounted for a share of 75.6% in 2024, attributed to its well-established infrastructure and patient preference for supervised care. This modality provides immediate access to medical professionals, ensuring comprehensive management of complex health needs, thereby enhancing patient safety and treatment effectiveness.

In-home dialysis centers are expected to grow at the fastest CAGR of 7.0% over the forecast period. The growing patient preference for the convenience, flexibility, and comfort of home-based treatment significantly contributes to segment growth. Furthermore, advancements in home dialysis technology and supportive reimbursement policies have enhanced accessibility, driving the adoption of these therapies in the market.

Dialysis Insights

Hemodialysis led the market with a revenue share of 89.4% in 2024. Hemodialysis represents around 88.7% of all dialysis treatments, a trend driven by the rising prevalence of chronic kidney disease (CKD), especially within the aging population and individuals with comorbidities such as diabetes and hypertension, contributing to the increased demand for this treatment modality.

Peritoneal dialysis is expected to register the fastest CAGR of 6.1% over the forecast period, propelled by enhanced patient independence, improved quality of life, and the convenience associated with home treatment. Furthermore, supportive reimbursement policies and increasing awareness of home-based therapies have significantly bolstered patient adoption, further reinforcing the demand for these treatment options.

Facility Insights

The dialysis chains segment held the largest market share of 82.9% in 2024, owing to their extensive networks and operational efficiencies. Established chains, such as DaVita and Fresenius, deliver standardized quality of care across numerous locations, thereby ensuring both accessibility and efficiency for patients in need of dialysis services, ultimately enhancing patient experiences.

Independent facilities are projected to experience rapid growth over the forecast period. These facilities typically employ a patient-centered approach, resulting in improved health outcomes. Moreover, they focus on serving local communities, which enhances accessibility and cultivates robust relationships with patients and their families, thereby reinforcing trust and commitment to quality care within the community.

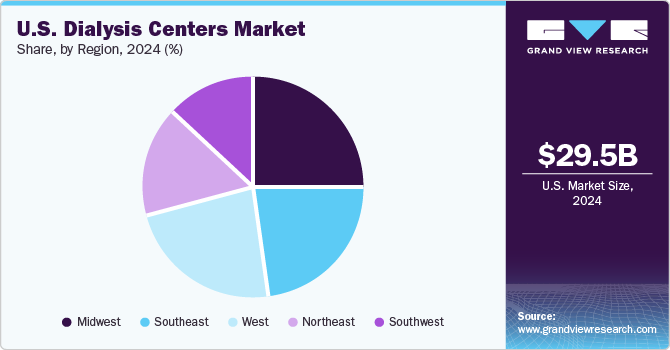

Regional Insights

Midwest U.S. Dialysis Centers Market Trends

Midwest U.S. dialysis centers market dominated the global market with a revenue share of 25.5% in 2024. Key drivers of market growth include the high prevalence of chronic kidney disease (CKD) and a robust healthcare infrastructure. Particularly in states such as Illinois, around 15% of the adult population is affected by CKD. The proliferation of dialysis facilities and an extensive network of nephrologists enhance patient access, while supportive reimbursement policies and community health initiatives promote the adoption of dialysis services in the Midwest, essential for renal care expansion.

Southwest U.S. Dialysis Centers Market Trends

The dialysis centers market in the Southwest U.S. is expected to register the fastest CAGR of 5.7% in the forecast period. The rising prevalence of CKD and end-stage renal disease, especially in states such as Texas, is propelling market growth. With approximately 14% of adults affected by CKD in Texas, the expansion of dialysis facilities and favorable reimbursement policies improve access to care. Furthermore, growing awareness of kidney health and the advantages of timely dialysis services are driving increased demand in this region.

Key U.S. Dialysis Centers Company Insights

Some key companies operating in the market include Fresenius Medical Care AG; U.S. Renal Care, Inc.; DaVita Inc.; Innovative Renal Care; DCI; SATELLITE HEALTHCARE; and Northwest Kidney Centers; among others. Strategic initiatives encompass mergers and acquisitions, expansion into home dialysis services, and technological innovations, with companies prioritizing enhanced patient care and operational efficiency to sustain market leadership.

-

DaVita Inc. is a provider of kidney dialysis services in the U.S., operating approximately 2,675 outpatient centers. Specializing in end-stage renal disease (ESRD), the company has a 37% market share and prioritizes quality care for Medicare and government-insured patients.

-

Dialysis Care Center delivers comprehensive dialysis services nationwide, offering both in-center and home dialysis options for chronic kidney disease patients. The center emphasizes personalized care and community engagement to ensure accessibility and support throughout the treatment process.

Key U.S. Dialysis Centers Companies:

- Fresenius Medical Care AG

- U.S. Renal Care, Inc.

- DaVita Inc.

- Innovative Renal Care

- DCI

- SATELLITE HEALTHCARE

- Northwest Kidney Centers

- Centers for Dialysis Care

- Rogosin Institute

- Dialysis Care Center

- USCF Health (The Regents of The University of California)

- Rhode Island Hospital, Department of Health Rhode Island

- University of Iowa Hospital & Clinics

- Saint Anthony Hospital

- Rush University Children’s Hospital

Recent Developments

-

In November 2024, Adventist Health Tillamook partnered with Dialysis Clinic, Inc. to reopen the Tillamook Kidney Center, enhancing local dialysis services and addressing community healthcare needs through a support campaign for necessary equipment.

-

In September 2024, Northwest Kidney Centers opened a flagship clinic in downtown Seattle, consolidating operations to enhance access to life-sustaining dialysis care for patients in the region and investing USD 57 million in facilities.

-

In September 2024, Fresenius Medical Care reported over 14,000 U.S. patients utilizing its NxStage systems for home hemodialysis, while launching the upgraded NxStage VersiHD with GuideMe Software to enhance user experience.

-

In August 2024, Guy A. Medaglia announced his retirement as president and CEO of Saint Anthony Hospital, concluding a successful tenure marked by financial stability, improved patient care, and expanded services.

-

In April 2024, UCSF Health commenced construction of the USD 4.3 billion Helen Diller Hospital, enhancing access to complex care, including dialysis services through its dedicated center for chronic kidney failure treatments.

U.S. Dialysis Centers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.98 billion

Revenue forecast in 2030

USD 40.39 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Modality, dialysis, facility, region

Country scope

U.S.

Key companies profiled

Fresenius Medical Care AG; U.S. Renal Care, Inc.; DaVita Inc.; Innovative Renal Care; DCI; SATELLITE HEALTHCARE; Northwest Kidney Centers; Centers for Dialysis Care; Rogosin Institute; Dialysis Care Center; USCF Health (The Regents of The University of California); Rhode Island Hospital, Department of Health Rhode Island; University of Iowa Hospital & Clinics; Saint Anthony Hospital; Rush University Children’s Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dialysis Centers Market Report Segmentation

This report forecasts revenue growth at the country and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dialysis centers market report based on modality, dialysis, facility, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

In-center

-

In-home

-

SNF-based

-

-

Dialysis Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis

-

Peritoneal Dialysis

-

-

Facility Outlook (Revenue, USD Million, 2018 - 2030)

-

Dialysis Chains

-

Independent Facilities

-

Hospital-based

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The in-center segment dominated the U.S. dialysis centers market with a share of around 76% in 2024. This is attributable to high adoption of the service. The in-center services are required for ESRD patients in need of hospitalization for other reasons, suffering from acute kidney failure mainly arising from trauma, and early-stage ESRD patients.

b. Some of the key players operating in the U.S. dialysis centers market include Fresenius Medical Care AG & Co. KGaA; U.S. Renal Care, Inc.; DaVita Inc.; American Renal Associates; Dialysis Clinic, Inc.; Satellite Healthcare; Northwest Kidney Centers; Centers for Dialysis Care; Rogosin Institute; and Dialysis Care Center, USCF Health, Rhode Island Hospital , University of Iowa Hospital & Clinics; Saint Anthony Hospital, Rush Unit Children’s Hospital.

b. The key factors driving the U.S. dialysis centers market growth include high prevalence of End-Stage Renal Disease (ESRD), favorable reimbursement, and long waiting period for transplant.

b. The U.S. dialysis centers market was estimated at USD 29.51 billion in 2024 and is expected to reach USD 30.98 billion in 2025.

b. The U.S. dialysis centers market is expected to grow at a compound annual growth rate of 5.44% from 2025 to 2030 and is expected to reach USD 40.39 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.