- Home

- »

- Next Generation Technologies

- »

-

U.S. Digital Avatar Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Digital Avatar Market Size, Share & Trends Report]()

U.S. Digital Avatar Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Interactive Digital Avatar, Non-interactive Digital Avatar), By Category, By Industry Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-248-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Digital Avatar Market Size & Trends

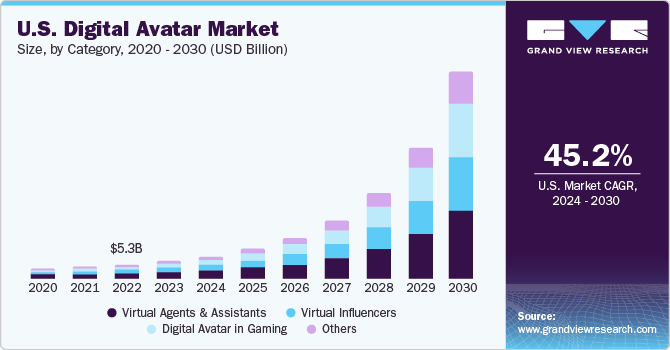

The U.S. digital avatar market size was valued at USD 6.59 billion in 2023 and is expected to grow at a CAGR of 45.2% from 2024 to 2030. The rising demand for authentic and personalized characters in gaming, virtual reality (VR), augmented reality (AR), social media, and e-commerce sectors for online interactions by companies drives the growth of the market. Digital avatars help companies create engaging and intelligent interactions with customers.

In 2023, the U.S. accounted for over 35% of the global digital avatar market. VR and AR applications are expected to drive the growth of the market as digital avatars are used in these industries to represent users with more realistic and immersive experiences. The growing popularity of social media among people is also supporting the market. Social media uses digital avatars to represent users and to communicate with others in a personalized way.

Businesses are using digital avatars to incorporate into various operations, such as digital marketing, advertising, consumer interactions, etc. AI is also transforming the market with the help of integrated voice synthesis and voice recognition to enhance human interactions and communications.

Furthermore, advancement in artificial intelligence (AI) also serves as a key driver for the market. AI helps create sophisticated yet realistic digital avatars that can interact in real-time within virtual or augmented spaces. AR and VR technologies offer immersive environments necessary for the deployment of these avatars. AI also enables avatars to understand and respond to user inputs in a manner, thus contributing to the intelligence and autonomy of these avatars.

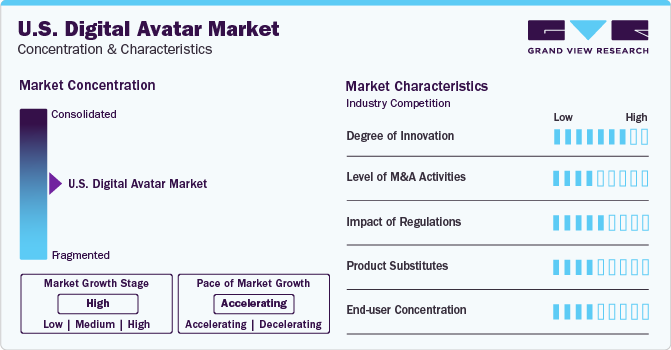

Market Concentration & Characteristics

The market for digital avatars is characterized by a high degree of innovation. For instance, in March 2023, X-Avatar created an expressive implicit human avatar model that can process 2 inputs: 3D posed scans and RGB-D images. This avatar reproduces the human body expressions, hand motions, and other physical traits.

The level of mergers and acquisitions is moderate to high in the market. For instance, in 2022, Apple acquired avatar startup Xander, signaling its commitment to compete in the digital avatar market. The acquisition suggests Apple’s intention to leverage Xander’s technology, which is expected to be integrated into the company’s VR/AR headsets.

The market is also subject to regulation compliance as introducing a digital avatar comes with some legal challenges. Registration & rights, and identity theft are some major regulatory issues related to the use of digital avatars. Ignorance of legal understanding could attract huge legal liability.

End-use concentration is also moderate to high in the market. Digital avatars are utilized by a range of industries from retail & e-commerce to healthcare, gaming & entertainment, education & training, automotive, and it & telecom, among others. The gaming & entertainment industry is the largest user of digital avatars due to the immersive and interactive experiences provided by them.

Industry Vertical Insights

The gaming & entertainment sector dominated the market with the highest revenue share in 2023. The industry leads the market due to the popularity of video games, and the incorporation of digital avatars into them, especially multiplayer online role-playing games. These online platforms revolve around avatars representing players which offer an immersive and realistic experience that allows users to identify, customize, and engage more profoundly with the digital world.

The BFSI segment captured the second largest share of the market. This sector utilizes digital avatars in customer relationship services to represent their brand and values. These avatars are an embodiment of these institutions. They help these institutions solve customer queries in real-time, and offer efficient, personalized and seamless customer service. These avatars are also used for advertising and promotion of the products & services.

Category Insights

Based on category, the virtual agents & assistants segment dominated the market with the largest revenue share in 2023. Virtual agents & assistants are conversational software that reduce the response time by responding to customer savings using AI. Businesses implement these software to provide 24/7 assistance and support to enhance customer satisfaction and retention. Another major benefit of applying virtual agents is that they can handle multiple customer queries simultaneously. It reduces the response time and operational costs as well.

The virtual influencer segment is expected to grow with the highest CAGR over the forecast period. Virtual influencers allow a higher degree of creative freedom by producing unattainable content with humans. This helps brands target the correct set of customers and generate higher engagement and large social media reach. Furthermore, brands can also collaborate with virtual influencers to create new and unique experiences to attract younger audiences.

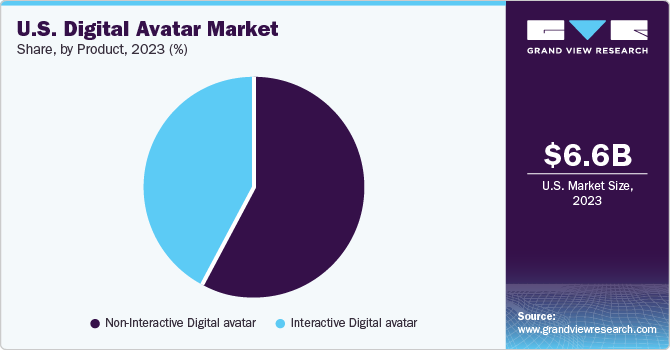

Product Insights

Based on products, the market can be segmented into interactive digital avatars and non-interactive digital avatars. The interactive segment dominated the market with the highest revenue share of around 57% in 2023. This is due to the growing demand for these avatars in customer service, entertainment, healthcare, and education sectors. These are used for various purposes for providing engaging experiences. Interactive avatars are also used in animated films and gaming for personalized experiences as they have the ability to provide a human-like real experience.

A non-interactive digital avatars are implemented in various industry verticals, such as films, video games, and virtual reality experiences. These avatars are used by businesses to perform the role of welcome hosts on their websites to describe the products or services and introduce the company.

Key U.S. Digital Avatar Company Insights

Some of the leading companies in the market include UneeQ, Microsoft Corporation, and NVIDIA Corporation.

-

Nvidia is a software and fabless company that is engaged in the designs and supplies graphics processing units (GPUs), application programming interfaces (APIs) and high-performance computing and system on a chip units (SoCs) for the mobile computing and automotive market. Nvidia is also among the leading suppliers of AI hardware and software.

-

UneeQ is an intelligent AI interface company, which is involved in developing advanced autonomous digital human platform available for customer interactions. The company delivers digital human experiences in marketing, sales and service roles.

Soul Machines, AI Foundation, and Spatial Systems, Inc. are some of the emerging companies in the market.

-

AI Foundation is an American artificial intelligence company. In June 2023, the company launched AI.XYZ, a platform for people to create their own AI assistants. AI.XYZ enables users to design their own AI assistants that can safely support them in both personal and professional settings.

Key U.S. Digital Avatar Companies:

- Epic Games, Inc.

- Pinscreen Inc.

- Soul Machines

- NEON (SAMSUNG)

- AI Foundation

- Microsoft Corporation

- NVIDIA Corporation

- UneeQ

- Didimo, Inc.

- Spatial Systems, Inc.

- Deepbrain AI

- Wolf3D

Recent Developments

-

In April 2023, Spheroid Universe, an extended reality metaverse company, launched artificial intelligence (AI) avatars that inhabit the world through AR.

-

In March 2023, a leading software and video game developer Epic Games Inc. launched a powerful toolset designed for their MetaHuman framework named ‘MetaHuman Animator.’

U.S. Digital Avatar Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.59 billion

Revenue forecast in 2030

USD 79.18 billion

Growth rate

CAGR of 45.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, and industry vertical

Country scope

U.S

Key companies profiled

Epic Games, Inc., Pinscreen Inc., Soul Machines, NEON (SAMSUNG), AI Foundation, Microsoft Corporation, NVIDIA Corporation, UneeQ, Didimo, Inc., Spatial Systems, Inc., Deepbrain AI, Wolf3D

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Avatar Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. digital avatar market report based on product, category, and industry vertical:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Interactive Digital avatar

-

Non-Interactive Digital avatar

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Agents & Assistants

-

Virtual Influencers

-

Digital Avatar in Gaming

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Gaming & Entertainment

-

Education & Training

-

Automotive

-

IT & Telecom

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. digital avatar size was estimated at USD 6.59 billion in 2023 and is expected to reach USD 8.44 billion in 2024.

b. The U.S. digital avatar market is expected to grow at a compound annual growth rate of 45.2% from 2024 to 2030 to reach USD 79.18 billion by 2030.

b. The virtual agents & assistants segment accounted for the largest revenue share of around 37% in 2023 owing to increasing demand for these software solutions among businesses to provide 24/7 assistance and support to enhance customer satisfaction and retention.

b. Some key players operating in the U.S. digital avatar market include Epic Games, Inc., Pinscreen Inc., Soul Machines, NEON (SAMSUNG), AI Foundation, Microsoft Corporation, NVIDIA Corporation, UneeQ, Didimo, Inc., Spatial Systems, Inc., Deepbrain AI, and Wolf3D

b. Key factors that are driving the U.S. digital avatar market growth include authentic and personalized characters for online interactions and increased deployment of AI-avatars in customer-facing scenarios, including retail and sales office environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.