- Home

- »

- Next Generation Technologies

- »

-

U.S. Digital Signage Market Size, Industry Report, 2030GVR Report cover

![U.S. Digital Signage Market Size, Share & Trends Report]()

U.S. Digital Signage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Component, By Technology, By Screen Size, By Resolution, By Content Category, By Location, By Application, And Segment Forecasts

- Report ID: GVR-2-68038-463-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Digital Signage Market Size & Trends

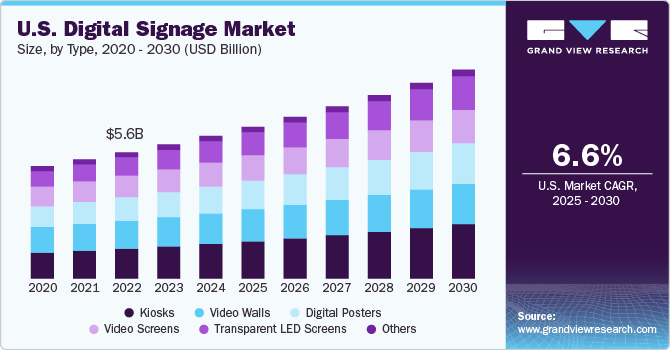

The U.S. digital signage market size was estimated at USD 6,364.1 million in 2024 and is anticipated to grow at a CAGR of 6.6% from 2025 to 2030. This growth can be attributed to IoT, AI, and cloud technology advancements, driving personalized, interactive solutions across sectors like retail, transportation, and public services. Investments in smart cities, public infrastructure, and sustainability initiatives, along with the expansion of Digital Out-of-Home (DOOH) advertising, are boosting demand for dynamic displays in urban centers, hospitality, healthcare, and education. In addition, the retail sector's shift toward omnichannel experiences and the rise in the adoption of energy-efficient signage are further driving the U.S. market.

The rise of retail and e-commerce industries also fuels the demand for 4K embedded displays. Retailers increasingly integrate advanced technologies to create more engaging and personalized shopping experiences. Smart shelves and digital displays guide customers, showcase product information, and facilitate seamless purchasing processes. The high-resolution and large-screen format of 4K embedded displays can make this interaction more dynamic and appealing, driving customer satisfaction and sales. As retailers compete in a fast-evolving market, leveraging 4K display technology becomes a strategic necessity to maintain their market position. Integrating advanced technology into public and private spaces accelerated the adoption of 4K embedded displays. With the growing demand for smart infrastructure, cities and businesses are investing in state-of-the-art digital systems that enhance user interaction, information dissemination, and overall connectivity. This drive for smart technology in urban development, combined with the push towards sustainability and energy efficiency, further boosts the demand for high-quality embedded displays that meet these requirements. This will boost the growth of the U.S. Digital Signage Market.

Furthermore, the growth of the global event and entertainment industry is fueling the demand for high-resolution displays. From concerts and sports events to large-scale exhibitions and conferences, event organizers are adopting 4K displays to offer attendees a premium viewing experience. These displays provide vivid and detailed visuals that can cater to the demands of high-profile events, enhancing audience engagement and ensuring that crucial information is conveyed clearly. The increasing use of digital displays for live streaming and broadcasting also drives the demand for 4K technology as broadcasters strive to deliver high-quality content to audiences, whether in venues or via online streaming platforms and this increases the application of U.S. Digital Signage Market.

The U.S. digital signage market benefits from adopting interactive kiosks as part of broader efforts to enhance customer service and streamline business operations. For instance, in the retail sector, kiosks provide customers with personal recommendations based on their preferences and past purchases, helping retailers increase sales and improve customer satisfaction. These kiosks can be integrated with loyalty programs, enabling businesses to offer targeted promotions and personalized discounts that appeal to individual customers. The 2024 Square Future of Restaurants Report reveals that 79% of consumers believe kiosks simplify ordering. Additionally, 44% appreciate kiosks enabling them to browse the menu at their own pace, while 38% value the ease with which kiosks allow them to search for their favorite menu items. This ability to tailor marketing efforts to specific audiences ensures higher engagement rates and encourages repeat business. Moreover, interactive kiosks facilitate seamless check-in and check-out processes in the hospitality industry, improving customer experience and reducing waiting times.

Type Insights

The kiosks segment accounted for a market share of over 24% in 2024.The growing emphasis on targeted advertising and location-based marketing fueling the demand for kiosks in the digital signage market. Digital kiosks enable businesses to deliver personalized content tailored to specific audiences based on location, time of day, and other contextual factors. Supermarkets, malls, and shopping centers deploy digital kiosks to showcase promotions or events in nearby stores, driving foot traffic and increasing sales. This shift toward more personalized, data-driven marketing strategies highlights the value of kiosks for businesses which are looking to optimize their advertising reach and return on investment (ROI).

The transparent LED screens segment is anticipated to grow at a significant CAGR of 8.0% during the forecast period. Increasing use of transparent LED screens in the automotive and industrial sectors drives market growth. In the automotive industry, manufacturers and dealerships are incorporating these screens into showrooms to showcase product features, technical specifications, and promotional offers. Transparent screens allow potential buyers to view the vehicle while engaging with digital content, providing an enhanced and futuristic sales experience. In industrial settings, these screens are used in control rooms and production floors for real-time monitoring, displaying key operational metrics while ensuring the visibility of machinery and workspace. This dual functionality makes them particularly valuable in industries prioritizing efficiency and innovation.

Component Insights

The hardware segment accounted for the largest market share in 2024. The increasing need for robust and weather-resistant hardware for outdoor digital signage applications drives the segment's growth. Outdoor advertising remains a critical component of marketing strategies, necessitating hardware that can withstand diverse environmental conditions. Manufacturers invest in durable materials, weatherproof casings, and advanced cooling technologies to ensure digital signage hardware can operate reliably in harsh outdoor environments.

The software segment is expected to grow at a significant rate during the forecast period. The growth of omnichannel marketing strategies has also driven demand for comprehensive digital signage software solutions. Brands increasingly seek ways to create a seamless and integrated experience across physical and digital channels. Digital signage software is crucial in ensuring that messaging is consistent and synchronized with other marketing efforts, whether online, on mobile apps, or in-store. Moreover, businesses seek software solutions to support multimedia content, including video, interactive displays, and live social media feeds, to captivate and maintain audience attention. Integrating such diverse content types into a cohesive, easy-to-manage platform is driving the growth of the software segment in the digital signage market.

Technology Insights

The LCD segment accounted for the largest market share in 2024. The growth of retail and hospitality industries is a significant driver for expanding the LCD segment in the digital signage market. Retailers increasingly use digital signage to create more interactive and personalized shopping experiences, with LCD screens playing a key role in showcasing product information, promotional content, and in-store advertisements. In high-traffic locations such as shopping centers and large department stores, the ability of LCDs to deliver vibrant, high-resolution displays has proven essential for capturing consumers' attention. Similarly, the hospitality sector uses LCD screens for menu boards, information displays, and interactive directories that improve customer service and streamline operations.

The OLED segment is expected to grow at a significant rate during the forecast period. Increasing focus on enhancing in-store experiences drives segment growth. OLED displays are particularly effective because of their superior visual quality, making them highly engaging. Retailers and luxury brands use OLED screens to create unique, eye-catching advertisements and product showcases that cater to customers and provide a more interactive shopping experience. These displays can be used for everything from displaying high-definition product images and videos to interactive touch interfaces that guide customers through product information or allow them to customize their shopping experience.

Screen Size Insights

The 32 to 52 inches segment accounted for the largest market share in 2024. The rise of interactive and self-service solutions is a key driver for adopting the digital signage market's 32 to 52 inches segment. As customers seek faster and more convenient ways to interact with services, businesses are implementing digital displays that can double as interactive kiosks for self-service ordering, information retrieval, and customer feedback. This size range strikes a perfect balance by being large enough to be easily viewable while maintaining a compact form that doesn't disrupt space planning. In sectors such as hospitality, transport, and public services, 32 to 52 inches screens are used to streamline check-ins, provide real-time travel information, and facilitate ticketing processes, improving operational efficiency and reducing wait times.

The more than 52 inches segment is expected to grow at a significant rate during the forecast period. The demand for larger digital signage is also driven by the adoption of innovative marketing strategies focusing on visual storytelling and experiential marketing. Large-format displays, which fall into the category of more than 52 inches, allow businesses to use high-resolution video, eye-catching graphics, and interactive content that engages viewers and encourages them to interact with the brand. This has led to a surge in investment by companies that want to stand out in a crowded market and deliver powerful, impactful messaging. In addition, larger displays facilitate multiple content layers and dynamic content rotation, improving viewer engagement and retention and further enhancing the marketing impact for companies.

Resolution Insights

The 4K segment accounted for the largest market share in 2024. The rise of 4K content creation and its accessibility fuels the growth of this segment. The availability of 4K video cameras, production tools, and content management systems has made it easier for businesses to create high-quality, 4K-compatible media. This trend is important as companies can leverage more visually engaging content tailored for 4K displays without facing significant production barriers.

The 8K segment is expected to grow at a significant rate during the forecast period. There is an increasing need for high-quality visuals in various professional and commercial settings. The unparalleled resolution of 8K displays, offering four times the pixel density of 4K and sixteen times that of FHD, delivers sharper, more vivid images and more detailed content. This resolution is particularly valuable for applications where clarity and detail are crucial, such as in large retail environments, control rooms, museums, art galleries, and high-end broadcasting.

Content Category Insights

The non-broadcast segment accounted for the largest market share in 2024. Non-broadcast digital signage is increasingly adopted in the corporate sector to enhance internal communication and employee engagement. Offices use these systems for various purposes, including displaying announcements, sharing company updates, showcasing key performance indicators, and even recognizing employee achievements. By replacing static bulletin boards with dynamic, visually engaging displays, organizations improve the dissemination of information and encourage a more connected workforce. Additionally, integrating real-time data into non-broadcast signage ensures employees receive relevant and timely updates.

The broadcast segment is expected to grow at a significant rate during the forecast period. The widespread adoption of high-definition (HD) and ultra-high-definition (UHD) displays in broadcast digital signage contribute to market growth. The transition to UHD formats, including 4K and 8K resolutions, ensures that content appears sharp and vibrant, enhancing viewer retention and engagement. The improved visual quality is particularly beneficial for fashion, automotive, and hospitality industries, where detailed imagery can significantly influence consumer decisions.

Location Insights

The in-store segment accounted for the largest market share in 2024. The rise of omnichannel retailing drives the expansion of in-store digital signage. Modern consumers often use a combination of online and in-store channels when making purchasing decisions, and retailers are adapting to this by creating cohesive, integrated experiences. In-store digital signage complements online and mobile marketing strategies by reinforcing brand messaging, promoting digital offers, and seamlessly guiding customers through purchasing. This connectivity is crucial for catering to shoppers with a seamless offline and online shopping experience.

The out-store enterprise segment is expected to grow at a significant rate during the forecast period. The need for enhanced brand visibility and outdoor advertising opportunities has also propelled the growth of out-of-store digital signage. Large-scale LED billboards, projection mapping, and interactive installations are becoming common in high-traffic areas, making advertisements more prominent and eye-catching. These displays are often strategically placed to reach targeted demographics, whether commuters on their daily routes, tourists exploring popular landmarks, or sports fans attending large events. Such strategic placement ensures maximum exposure and engagement with the target audience, driving the demand for more out-of-store digital signage solutions.

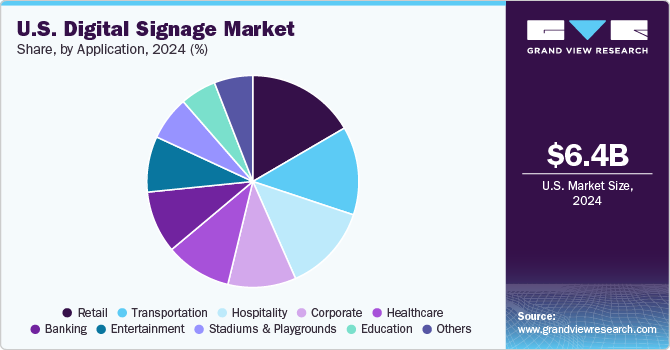

Application Insights

The retail segment accounted for the largest market share of over 18% in 2024. Integrating digital signage with omnichannel retailing strategies is a significant factor driving segment growth. With the rise of click-and-collect services and in-store pickup, digital signage is crucial in guiding customers through their shopping journeys. Displays can direct customers to pick up points, highlight online-exclusive deals available for in-store purchases, or promote complementary products. Furthermore, real-time inventory updates displayed on digital screens ensure that customers have accurate information about product availability, enhancing convenience and reducing frustration. This seamless blending of online and offline channels positions digital signage as a cornerstone of modern retail infrastructure.

The healthcare segment is expected to grow at a significant CAGR during the forecast period. Hospitals and clinics need to ensure that important health and safety protocols are communicated to staff and visitors, especially during public health crises or high patient influxes. Digital signage allows for the quick and efficient dissemination of safety instructions, emergency alerts, and guidelines, ensuring that everyone in the facility is informed and prepared to act when necessary. This capability is crucial for minimizing risks and ensuring compliance with health regulations, thus protecting patients and healthcare workers. These factors are driving the growth of the segment during the forecast period.

Key U.S. Digital Signage Company Insights

The key market players in the U.S. digital signage industry include Panasonic Corporation, Samsung Electronics Co., Ltd.,Sharp NEC Display Solutions, Microsoft Corporation, LG Electronics, and Cisco Systems, Inc. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key U.S. Digital Signage Companies:

- Daktronics Dr.

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- Sharp NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Scala

- Winmate Inc.

Recent Developments

-

In March 2024, Samsung Electronics America partnered with Quest Technology Management to launch an innovative managed service offering cutting-edge digital signage solutions tailored for small and midsize businesses (SMBs). This exclusive service, available through Telarus technology advisors, provides SMB owners with an all-in-one managed package that helps modernize business environments. It simplifies content creation and device management and features advanced displays to enhance brand visibility. Through this partnership, Quest and Telarus give SMB owners access to Samsung Display's comprehensive portfolio, including premium monitors, self-service kiosks, indoor and outdoor LED signage, and EV charging stations.

-

In January 2024, Cisco Systems, Inc. partnered with Microsoft Corporation and Samsung Electronics Co. Ltd. to enhance hybrid meeting experiences. The partnership provides Front Row with an inclusive content layout for Microsoft Teams Rooms. This feature integrates seamlessly with Samsung’s newly launched 105” Smart Signage, featuring a 21:9 aspect ratio and 5K resolution, as well as Samsung’s 4K Smart Signage displays. Combining Cisco’s RoomOS-powered collaboration appliances, Samsung’s Smart Signage technology, and the Front Row enables seamless collaboration, effectively bridging the gap between remote and in-person participants.

-

In January 2024, LG Business Solutions, a division of LG Electronics, launched the LG CreateBoard in the U.S., a versatile solution designed to support various learning environments, including in-person, remote, and hybrid settings. This advanced education tool features an interactive display with up to 40-point multi-touch capabilities, allowing users to annotate digital files in real time and utilize tools for content creation, sharing, and management. The LG CreateBoard lineup includes updated 65-, 75-, and 86-inch models and a newly added 55-inch version. The compact 55-inch model delivers the full functionality of the CreateBoard, making it ideal for smaller classrooms, meeting rooms, and offices while ensuring visibility for all students regardless of room size or seating arrangement.

U.S. Digital Signage Industry Report Scope

Report Attribute

Details

Market size in 2025

USD 6,771.0 million

Market Size forecast in 2030

USD 9,322.0 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, component, technology, screen size, resolution, content category, location, application

Country scope

U.S.

Key companies profiled

Daktronics Dr.; BrightSign LLC; Cisco Systems, Inc.;

Intel Corporation; KeyWest Technology, Inc.;

LG Electronics; Microsoft Corporation; Sharp NEC Display Solutions; Omnivex Corporation;

Panasonic Corporation; Samsung Electronics Co. Ltd.; Scala; and Winmate Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Signage Market Report Segmentation

This report forecasts market size growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. digital signage market report based on type, component, technology, screen size, resolution, content category, location, and application.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Video Walls

-

Video Screens

-

Transparent LED Screens

-

Digital Posters

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Display

-

Media Player

-

Projectors

-

Others

-

-

Software

-

Services

-

Installation Services

-

Maintenance & Support Services

-

Consulting Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

E-paper

-

-

Screen Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

8K

-

4K

-

Full HD (FHD)

-

HD

-

Lower than HD

-

-

Content Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

In-store

-

Out-store

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transportation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. digital signage market size was estimated at USD 6,364.1 million in 2024 and is expected to reach USD6,771.0 million in 2025

b. The global U.S. digital signage market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 9,322.0 million by 2030

b. The retail end use segment dominated the U.S. digital signage market with a share of over 18% in 2024. Integrating digital signage with omnichannel retailing strategies is a significant factor driving segment growth. With the rise of click-and-collect services and in-store pickup, digital signage is crucial in guiding customers through their shopping journeys.

b. This growth can be attributed to advancements in IoT, AI, and cloud technologies, driving personalized, interactive solutions across sectors like retail, transportation, and public services. Investments in smart cities, public infrastructure, and sustainability initiatives, along with the expansion of Digital Out-of-Home (DOOH) advertising, are boosting demand for dynamic displays in urban centers, hospitality, healthcare, and education.

b. Some key players operating in the U.S. digital signage market include Daktronics Dr., BrightSign, LLC, Cisco Systems, Inc., Intel Corporation, KeyWest Technology, Inc., LG Electronics, Microsoft Corporation, Sharp NEC Display Solutions, Omnivex Corporation, Panasonic Corporation, Samsung Electronics Co., Ltd., Scala, and Winmate Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.