- Home

- »

- Next Generation Technologies

- »

-

Audience Analytics Market Size, Share, Industry Report 2030GVR Report cover

![Audience Analytics Market Size, Share & Trends Report]()

Audience Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Application, By Enterprise Size, By End-use, By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-155-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Audience Analytics Market Summary

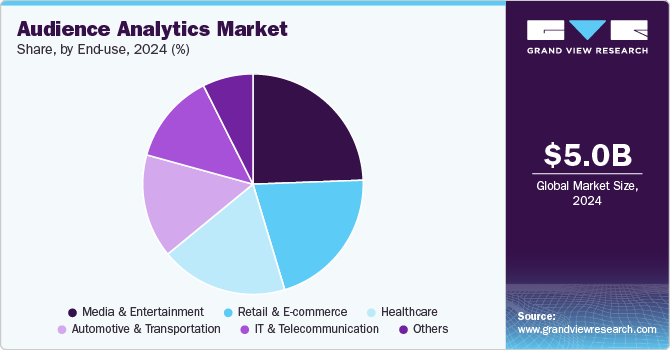

The global audience analytics market size was estimated at USD 5,002.1 million in 2024 and is projected to reach USD 9,962.6 million by 2030, growing at a CAGR of 12.5% from 2025 to 2030. The global market is experiencing significant growth, driven by the increasing adoption of data-driven strategies across industries.

Key Market Trends & Insights

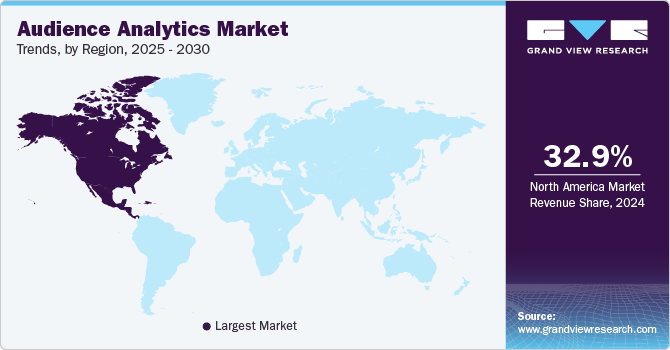

- North America audience analytics market dominated the market with the largest revenue share of 32.9% in 2024.

- The U.S. audience analytics market leads the North American market, driven by its mature digital economy and the presence of major analytics providers.

- Based on component, the solution segment led the market with the largest revenue share of 65.4% in 2024.

- Based on application, the customer experience segment led the market with the largest revenue share of 40.7% in 2024.

- Based on enterprise size, the large-size enterprises segment led the market with the largest revenue share of 55.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,002.1 Million

- 2030 Projected Market Size: USD 9,962.6 Million

- CAGR (2025-2030): 12.5%

- North America: Largest market in 2024

Businesses are utilizing audience analytics to gain deeper insights into customer behavior, preferences, and engagement patterns. The integration of advanced technologies such as artificial intelligence and machine learning has further enhanced the capabilities of these tools, making them more efficient and precise. With the proliferation of digital platforms, the need for real-time analytics has become crucial for optimizing marketing campaigns and improving customer experiences. This surge in demand underscores the growing importance of audience analytics in the modern business sector.

The market's expansion is supported by a rise in digital advertising and the growing focus on personalized marketing efforts. Companies are investing in analytics platforms to better understand audience demographics and deliver targeted content. The increased availability of consumer data, coupled with advancements in cloud computing, has facilitated the scalability of audience analytics solutions. Regulatory frameworks addressing data privacy and security, however, present challenges that companies need to navigate carefully. Despite these hurdles, the benefits of audience analytics in driving business outcomes continue to outweigh the challenges.

Emerging markets are contributing to the growth of audience analytics due to rapid digitalization and increased internet penetration. Businesses in these regions are increasingly adopting analytics solutions to enhance customer engagement and gain competitive advantages. The expansion of e-commerce platforms and the popularity of social media have amplified the demand for audience insights. Strategic partnerships and acquisitions among key players are further fueling innovation and expanding market reach. This dynamic environment signals a promising trajectory for the global market in the coming years.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 65.4% in 2024, due to its widespread adoption across industries. These solutions provide businesses with actionable insights into customer behavior, enabling improved decision-making and strategy formulation. Advanced features such as predictive analytics, sentiment analysis, and real-time tracking have made these tools indispensable for companies aiming to stay competitive. The availability of customizable dashboards and seamless integration with existing systems has further boosted their appeal. This dominance is expected to persist as organizations increasingly prioritize data-driven approaches to enhance operational efficiency.

The services segment is anticipated to witness at a rapid CAGR during the forecast period, fueled by the increasing need for implementation, maintenance, and consulting. Companies are seeking expert guidance to maximize the value derived from their analytics solutions. Managed services, in particular, are gaining traction, offering businesses end-to-end support for seamless analytics operations. The rising complexity of data ecosystems has also driven demand for professional services to ensure optimal deployment and customization. This upward trend highlights the critical role of services in complementing and enhancing the effectiveness of audience analytics solutions.

Application Insights

Based on application, the customer experience segment led the market with the largest revenue share of 40.7% in 2024, due to its critical role in enhancing customer satisfaction and loyalty. Businesses are utilizing analytics to better understand customer journeys, preferences, and pain points. This segment benefits from the increasing focus on personalized interactions, which drive higher engagement and retention rates. Advanced tools that analyze feedback and sentiment across multiple channels have become essential for improving service quality. As customer-centric strategies remain a priority for organizations, the dominance of this segment is expected to continue.

The sales and marketing management segment is anticipated to experience robust CAGR during the forecast period, driven by the need for targeted and data-driven campaigns. Businesses are using analytics to identify high-value customers, refine lead generation, and optimize conversion rates. Real-time insights into audience behavior are enabling marketers to adapt strategies quickly and improve campaign effectiveness. This growth is further fueled by advancements in predictive analytics, which help forecast trends and customer responses. As competition intensifies across industries, the demand for analytics in sales and marketing is set to expand significantly.

Enterprise Size Insights

Based on enterprise size, the large-size enterprises segment led the market with the largest revenue share of 55.3% in 2024, due to their substantial resources and extensive customer bases. These organizations invest heavily in advanced analytics tools to gain comprehensive insights into audience behavior and preferences. Their ability to handle large-scale data collection and analysis has allowed them to optimize strategies and enhance customer engagement effectively. Many large enterprises are utilizing analytics to drive global marketing initiatives and measure campaign performance across diverse markets. This dominance is supported by their focus on long-term investments in technology to maintain competitive advantages.

The small and medium-sized enterprises (SMEs) segment is anticipated to witness at a rapid CAGR during the forecast period, as they increasingly recognize the value of data-driven decision-making. Cost-effective and scalable analytics tools are enabling SMEs to compete with larger organizations by improving customer targeting and engagement. These businesses are also leveraging cloud-based solutions to minimize infrastructure costs and access advanced analytics capabilities. The rising adoption of digital marketing strategies among SMEs has further accelerated the demand for audience insights. This trend highlights the growing significance of analytics in driving the success of SMEs in competitive markets.

End-use Insights

Based on end-use, the media and entertainment segment led the market with the largest revenue share of 24.4% in 2024, due to its heavy reliance on understanding viewer preferences and consumption patterns. Companies in this sector use analytics to customize content, optimize distribution channels, and enhance audience engagement. The growing popularity of streaming platforms and personalized recommendations has amplified the demand for advanced analytics tools. Moreover, these tools help media companies track real-time audience behavior, ensuring content relevance and maximizing advertising revenues. This dominance is expected to persist as content providers continue to prioritize audience-driven strategies.

The IT & Telecommunication segment is anticipated to grow at the fastest CAGR during the forecast period, due to its expanding customer base and increasing data generation. Advanced analytics tools help companies better understand customer behavior and preferences, enabling personalized communication strategies. The sector's reliance on real-time insights is driving the adoption of AI and machine learning technologies for audience analysis. This growth is further supported by the rising demand for enhanced customer engagement and retention strategies.

Regional Insights

North America audience analytics market dominated the market with the largest revenue share of 32.9% in 2024.The North American market is highly developed, owing to the region's technological advancements and strong focus on innovation. Businesses across sectors rely on analytics to enhance decision-making and improve customer engagement. Increasing adoption of AI and machine learning in analytics solutions further strengthens the market. With robust investments in data-driven strategies, North America remains a dominant player in this space. The presence of tech-savvy consumers has also fueled demand for sophisticated analytics tools.

U.S. Audience Analytics Market Trends

The U.S. audience analytics market leads the North American market, driven by its mature digital economy and the presence of major analytics providers. Organizations prioritize customer insights to optimize marketing and operational efficiency. The country’s businesses are early adopters of cutting-edge technologies, contributing to their strong foothold in analytics adoption. The U.S. market’s focus on scalability and personalization ensures its continued growth trajectory.

Europe Audience Analytics Market Trends

The Europe audience analytics market is driven by the need for compliance with data privacy laws such as GDPR and an emphasis on customer-centric strategies. Companies across the region are leveraging analytics to gain insights into diverse audience behaviors. The adoption of cloud-based analytics solutions has been particularly strong, aiding scalability and cost-efficiency. Europe’s focus on digital transformation is further accelerating the market’s expansion.

Asia Pacific Audience Analytics Market Trends

The audience analytics market in Asia-Pacific is growing rapidly, fueled by digitalization and a surge in e-commerce activities. Businesses in this region are increasingly adopting analytics tools to stay competitive in fast-evolving markets. The rising number of internet users and expanding mobile connectivity drive demand for audience insights. Asia-Pacific is expected to witness substantial growth as more companies recognize the value of data-driven strategies. Government efforts to support digital growth are helping drive the market’s growth.

Key Audience Analytics Company Insights

Some of the key companies in the audience analytics industry include Adobe, Oracle Corporation, IBM Corporation, SAS Institute Inc., Google LLC, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

IBM Corporation is improving audience analytics with AI and machine learning to better analyze customer data. Their tools help businesses understand behaviors and predict trends. This makes it easier for companies to offer more personalized services. IBM’s focus on automation also enhances the efficiency of data processing and decision-making.

-

Google LLC uses its vast data to provide real-time audience insights. Its advertising and cloud services help businesses track and understand customer actions. This allows companies to optimize marketing strategies and engage more effectively with their audience. Google’s advanced analytics tools also provide actionable insights for improving customer experiences.

Key Audience Analytics Companies:

The following are the leading companies in the audience analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Oracle Corporation

- IBM Corporation

- SAS Institute Inc.

- Google LLC

- Audiense

- Comscore, Inc.

- Sightcorp

- Unifi Software

- Telmar

- Quividi

- AnalyticsOwl

- Akamai Technologies

- NetBase Solutions

- JCDecaux Group

Recent Developments

-

In November 2024, IBM Corporation collaborated with the Ultimate Fighting Championship (UFC) Organization to create the UFC Insights Engine, powered by IBM’s watsonx AI platform. This engine aims to provide real-time insights during live events, enhancing fan experiences with match projections and victory outcomes across UFC broadcasts and digital platforms. This collaboration marks a significant step in UFC’s adoption of AI to improve fan engagement.

-

In June 2024, WPP plc, a U.K.-based communication company, and IBM Corporation launched WPP Open for B2B, an AI-powered solution built on IBM's Watsonx platform to address complex B2B marketing challenges. In collaboration with LinkedIn, the platform aims to provide real-time insights and personalized experiences for clients, enhancing the effectiveness of B2B marketing campaigns.

-

In January 2024, GroupM, a U.S.-based media company, announced an industry-first collaboration with Google to integrate behavioral data into the Choreograph insights platform through Google's Audience Insights API, providing enhanced marketing insights based on web, search, and YouTube behaviors. This integration will enable GroupM clients to access real-time audience segments, helping to improve media planning, content, and activation strategies globally.

-

In July 2023, GrowthLoop Inc., a U.S.-based data-driven marketing and AI company, expanded its partnership with Google Cloud to transform marketing using advanced analytics and generative AI, leveraging tools such as BigQuery and Vertex AI. This collaboration has led to innovations like Marve for AI-driven audience segmentation and Maestro for customer journey orchestration, helping businesses create personalized marketing campaigns more efficiently.

Audience Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,524.8 million

Revenue forecast in 2030

USD 9,962.6 million

Growth rate

CAGR of 12.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, application, enterprise size, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Brazil ;KSA; UAE; South Africa

Key companies profiled

Adobe; Oracle Corporation; IBM Corporation; SAS Institute Inc.; Google LLC; Audiense; Comscore, Inc.; Sightcorp; Unifi Software; Telmar; Quividi; AnalyticsOwl; Akamai Technologies; NetBase Solutions; JCDecaux Group.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audience Analytics Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global audience analytics market report based on component, application, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Competitive Analysis

-

Sales & Marketing Management

-

Customer Experience

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Enterprises

-

Small and Medium Sized Enterprises

-

-

End-use (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunication

-

Healthcare

-

Retail & E-Commerce

-

Automotive & Transportation

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global audience analytics market size was estimated at USD 5,002.1 million in 2024 and is expected to reach USD 5,524.8 billion in 2025.

b. The global audience analytics market is expected to grow at a compound annual growth rate of 12.5% from 2025 to 2030 to reach USD 9,962.6 billion by 2030

b. North America dominated the audience analytics market with a share of 32.9% in 2024. Factors such as advent of AI-powered analytics tools, and surge in digital transformation initiatives are propelling market growth in the region.

b. Some key players operating in the audience analytics market include Adobe, Oracle Corporation, IBM Corporation, SAS Institute Inc., Google LLC, Audiense, Comscore, Inc., Sightcorp, Unifi Software, Telmar, Quividi, AnalyticsOwl, Akamai Technologies, NetBase Solutions, and JCDecaux Group.

b. Key factors driving the audience analytics market growth include increasing demand for personalized marketing, advancements in AI and big data technologies, and the growing adoption of digital platforms for audience engagement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.