U.S. Drone Battery Market Summary

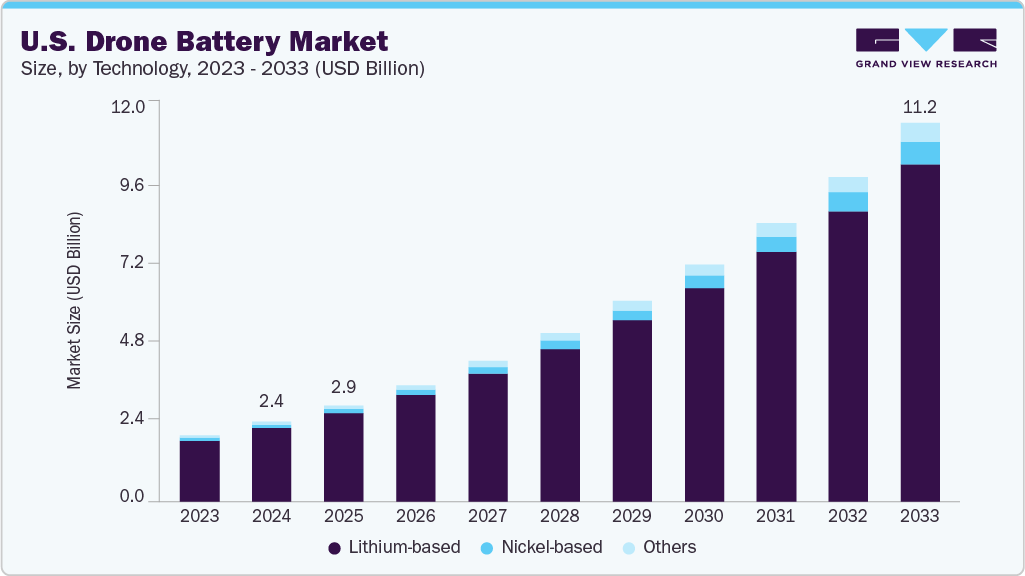

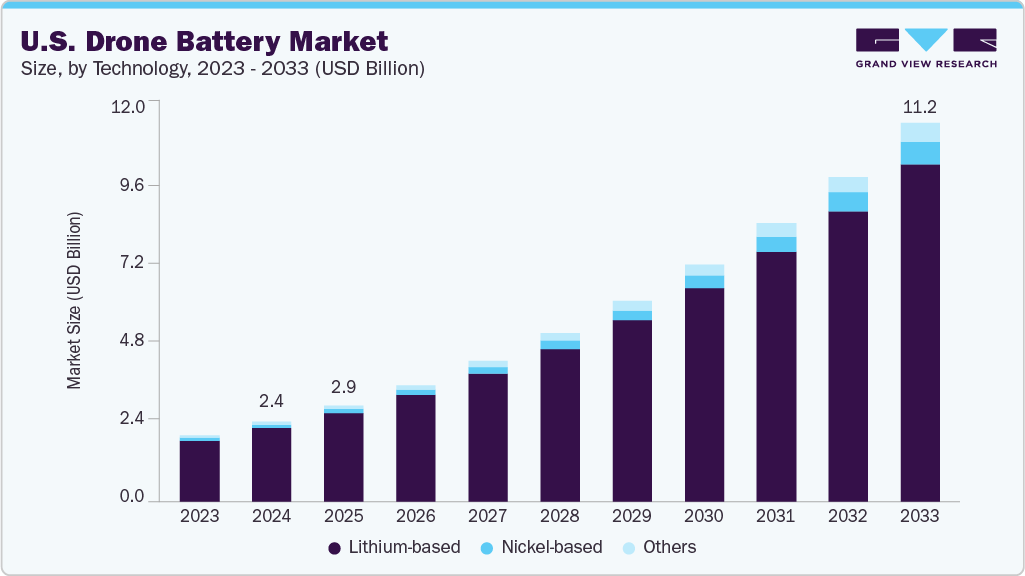

The U.S. drone battery market was estimated at USD 2.36 billion in 2024 and is projected to reach USD 11.20 billion by 2033, growing at a CAGR of 18.7% from 2025 to 2033. The market is primarily driven by the expanding use of drones in commercial and military sectors.

Key Market Trends & Insights

- By technology, the lithium-based segment held the highest market share of 92.12% in 2024.

- Based on point of sale, the OEMs segment held the highest market share of 72.02% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.36 Billion

- 2033 Projected Market Size: USD 11.20 Billion

- CAGR (2025-2033): 18.7%

In the commercial segment, industries such as agriculture, construction, logistics, and media increasingly adopt drones for tasks like crop monitoring, site inspection, parcel delivery, and aerial photography. These applications demand longer flight times, faster recharge capabilities, and lightweight batteries, boosting the demand for advanced lithium-based and hybrid battery technologies. Simultaneously, the U.S. Department of Defense continues to invest in drone capabilities for surveillance, reconnaissance, and tactical operations, requiring high-performance, rugged battery systems capable of sustaining long missions in challenging environments.

Innovation in battery technology is a critical market growth factor. Companies are investing heavily in R&D to improve energy density, reduce charging time, and enhance the overall life cycle of batteries. Advancements in lithium-sulfur, solid-state batteries, and graphene-based cells are showing promise for next-generation drones. Moreover, integrating smart battery management systems (BMS) helps monitor battery health and performance in real time, improving flight safety and operational efficiency. OEMs and aftermarket players increasingly adopt these technological upgrades, leading to a robust market evolution.

Government regulations and infrastructure improvements are also positively influencing the drone battery industry in the U.S. The Federal Aviation Administration (FAA) has been progressively easing restrictions and offering waivers for commercial drone usage, enabling wider deployment. This regulatory support is fostering confidence among drone operators and investors alike. In parallel, developing drone charging stations, battery swapping infrastructure, and rapid charging solutions improves drone operability and convenience. These policy and infrastructure enhancements create a favourable ecosystem for battery manufacturers and drone operators to scale their operations efficiently.

Drivers, Opportunities & Restraints

The U.S. drone battery industry is propelled by the growing use of drones across commercial, industrial, and defense applications. Sectors like agriculture, logistics, construction, and public safety increasingly rely on drones for data collection, surveillance, and delivery services, requiring batteries with high energy density, long cycle life, and fast-charging capabilities. At the same time, rising defense budgets and technological upgrades in military UAVs are driving demand for rugged and high-performance battery systems. The push for automation and real-time aerial analytics further fuels innovation and adoption in battery technology.

The FAA's regulatory relaxation, particularly around BVLOS operations and drone deliveries, unlocks new use cases for drones, particularly in urban logistics and infrastructure monitoring. This creates opportunities for battery manufacturers to develop customized, lightweight, and high-capacity solutions. In addition, the growing aftermarket ecosystem, covering battery replacement, refurbishing, and modular battery-swapping stations, is expected to thrive as drone fleets expand. Emerging technologies such as solid-state batteries and wireless charging systems also represent untapped potential for players looking to differentiate in a competitive landscape.

Despite the growth outlook, several challenges restrain the U.S. drone battery industry. Safety concerns around lithium-ion batteries, including fire hazards and thermal runaway, can limit their deployment in certain missions or require expensive safety protocols. Environmental issues, such as the lack of scalable recycling infrastructure and the ethical sourcing of raw materials like lithium and cobalt, also raise sustainability questions. Moreover, the high cost of advanced batteries and limited flight time relative to traditional fuel-based UAV systems can be a barrier to adoption, particularly for small operators with budget constraints.

Technology Insights

Lithium-based Batteries held the largest market revenue share of over 92.12% in 2024. Lithium-based batteries, particularly lithium-ion and lithium-polymer variants, are the dominant power source for drones in the U.S. due to their high energy density, lightweight structure, and ability to deliver consistent power output. The growing demand for longer flight times, faster charging, and better payload efficiency in commercial applications, such as delivery, surveillance, mapping, and agriculture, continues to drive the adoption of lithium-based batteries. Their adaptability to various drone sizes and mission types, decreasing unit costs and widespread availability make them the preferred choice for OEMs and aftermarket providers.

Several technology trends are shaping the evolution of lithium-based batteries in the drone segment. Innovations include the development of lithium-silicon and lithium-sulfur chemistries, which offer greater energy density and extended flight duration. Battery manufacturers also integrate smart battery management systems (BMS) to enhance thermal control, safety, and predictive maintenance. Moreover, modular battery designs and swappable units are gaining traction to support continuous drone operations, especially in logistics and emergency services. These advancements are collectively improving the performance, safety, and operational flexibility of drones across various industries in the U.S.

Point of Sale Insights

OEMs held the largest segment share of 72.02% in 2024. The Original Equipment Manufacturers (OEMs) play a critical role in shaping battery demand through integrated system design and growing drone sales across sectors. As commercial and enterprise drone usage increases, OEMs focus on offering high-performance, pre-installed lithium-based batteries tailored to specific applications such as delivery, inspection, and defense. The OEM channel benefits from end-user preference for factory-fitted, certified battery systems that ensure optimal compatibility, safety, and warranty coverage. This is particularly important in regulated sectors like defense and public safety, where reliability and compliance are paramount.

The aftermarket segment is gaining momentum as drone usage expands and fleets mature, driving the need for battery replacements, upgrades, and maintenance. Operators in commercial sectors like agriculture, surveying, and logistics often require spare batteries to support high utilization rates and minimize downtime. Cost-sensitive buyers also turn to aftermarket options to reduce operational expenses, especially as battery performance degrades. The demand for high-capacity and rapid-charging batteries in the replacement market encourages third-party vendors to offer competitive, compatible solutions with shorter lead times and lower price points than OEMs.

Key U.S. Drone Battery Company Insights

Some key players in the U.S. market include EaglePicher Technologies, Packet Digital LLC, AeroVironment, Inc., MaxAmps, Inc., Amprius Technologies, and RRC Power Solutions.

Key U.S. Drone Battery Companies:

- Eaglepicher Technologies

- Packet Digital

- AeroVironment

- MaxAmps

- Amprius

- RRC Power Solutions

- SolidEnergy Systems

- Oxis Energy

Recent Developments

-

In December 2024, the U.S. Defense Innovation Unit (DIU) launched the FASTBAT‑U initiative to accelerate the development and manufacturing of advanced drone batteries, prioritizing high-performance, safe, and domestically producible solutions for defense and civilian use. The program emphasizes collaboration between established and emerging companies, pushing for scalable battery production within the U.S. or allied nations, and aims to mitigate geopolitical supply risks, especially in light of past Chinese export restrictions on drone batteries.

-

In June 6, 2025, a presidential executive order was issued aimed at revitalizing the U.S. drone industry by fast-tracking beyond-visual-line-of-sight (BVLOS) regulations, prioritizing American-made drones (including battery systems), and bolstering national security by limiting reliance on foreign components. This move is expected to stimulate demand for domestically produced drone batteries, encouraging investment and innovation in U.S. battery technologies, while reducing exposure to disruptions from foreign suppliers.

U.S. Drone Battery Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 2.85 billion

|

|

Revenue forecast in 2033

|

USD 11.20 billion

|

|

Growth rate

|

CAGR of 18.7% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative Units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Technology, point of sale

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Eaglepicher Technologies; Packet Digital; AeroVironment; MaxAmps ; Amprius ; RRC Power Solutions ; SolidEnergy Systems ; Oxis Energy

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Drone Battery Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. drone battery market report based on technology and point of sale:

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium-based

-

Nickel-based

-

Others

Point of Sale Outlook (Revenue, USD Million, 2021 - 2033)