- Home

- »

- Next Generation Technologies

- »

-

U.S. Drone Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Drone Market Size, Share & Trends Report]()

U.S. Drone Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Product, By Technology, By Payload Capacity, By Power Source, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-741-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Drone Market Size & Trends

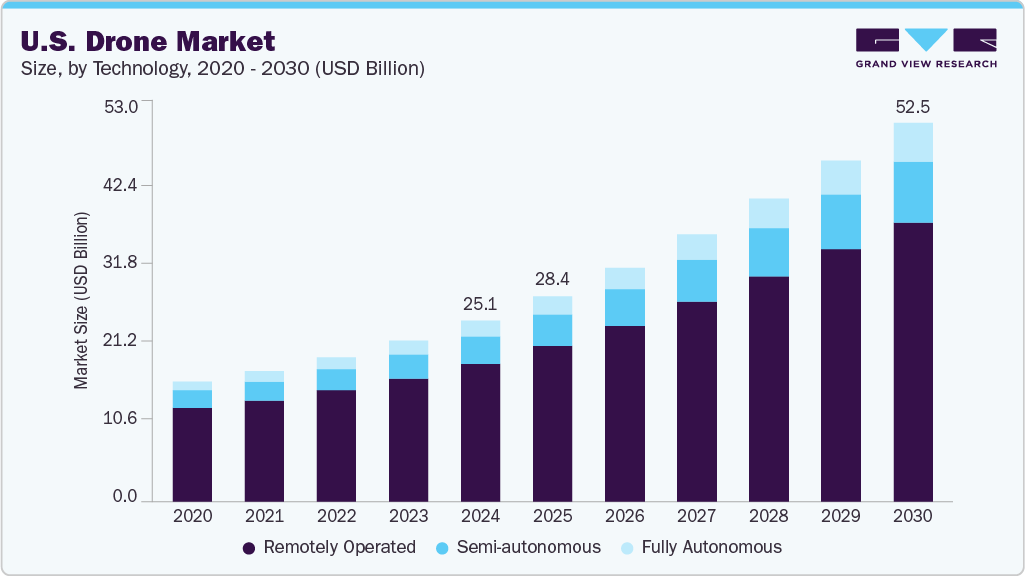

The U.S. drone market size was estimated at USD 25.07 billion in 2024 and is expected to grow at a CAGR of 13.0% from 2025 to 2030. The increasing integration of AI and advanced analytics is transforming the market by enabling greater autonomy, smarter navigation, and faster data insights. Businesses are rapidly adopting drone-as-a-service models, lowering operational costs and driving accessibility for industries such as agriculture, logistics, and energy. Growing investments in drone delivery and urban air mobility are reshaping transportation, while regulatory frameworks are evolving to ensure safe airspace adoption. With advancements in battery technology and expanding use in emergency response, drones are becoming indispensable tools across both commercial and public sectors.

The U.S. drone industry is entering a pivotal stage as the FAA advances new frameworks for Beyond Visual Line of Sight (BVLOS) operations. Moving beyond restrictive waiver-based systems, these rules are expected to allow commercial drones to fly extended distances with improved safety oversight. This regulatory shift is crucial for enabling large-scale applications in last-mile delivery, infrastructure monitoring, and precision agriculture. Companies that align early with BVLOS standards will secure first-mover advantages and set new benchmarks for operational efficiency.

The industry is witnessing a major transition from selling drones as hardware products to delivering value through analytics and data-driven services. Increasingly, drones are being deployed as mobile sensors that collect high-resolution imagery and operational data for industries such as energy, construction, and agriculture. With AI enhancing this raw data into predictive insights, organizations are now able to optimize asset management, crop health, and disaster response strategies. This shift toward recurring analytics services is reshaping the market, making data the most valuable output of drone operations.

The rise in unauthorized drone sightings and airspace intrusions has brought counter-UAS technologies into sharp focus. Security systems combining radar, RF detection, acoustic sensors, and AI-based vision are becoming critical tools for airports, energy facilities, and government agencies. This has created a dual-track growth market where investments in drone defense solutions parallel drone adoption. As airspace management becomes more complex, providers of counter-UAS systems will secure expanding budgets from both the defense sector and commercial operators.

The logistics sector is experimenting with hybrid delivery systems that pair drones with trucks to optimize last-mile efficiency. Research shows that these integrated models can significantly reduce costs and increase delivery flexibility under uncertain demand conditions. By dynamically allocating which deliveries are handled by drones and which remain truck-based, companies can achieve both speed and cost-effectiveness. Logistics providers that adopt these hybrid frameworks are likely to set new standards for customer experience and operational competitiveness.

Drones are becoming indispensable tools for environmental monitoring, helping companies and governments achieve sustainability goals. From monitoring deforestation and carbon emissions to tracking the health of ecosystems, drones provide high-quality, real-time data that supports climate accountability. This capability is also vital for validating carbon credits and strengthening ESG reporting standards across industries. Firms that specialize in eco-focused drone services are aligning with global sustainability priorities and tapping into a rapidly expanding market segment.

Component Insights

The hardware segment led the U.S. drone market with the highest share of over 59.0% in 2024, owing to the strong demand for advanced drone components such as frames, sensors, propulsion systems, and navigation modules. Continuous innovations in lightweight materials, high-resolution imaging, and long-endurance batteries are driving adoption across both defense and commercial applications. Hardware investments remain critical as performance and reliability directly impact drone efficiency, safety, and mission success. As a result, manufacturers focusing on next-generation hardware technologies are expected to maintain a competitive advantage and capture sustained market growth.

The services segment is expected to grow at the fastest CAGR of over 14.0% from 2025 to 2030, driven by the expanding use of drones in public safety and emergency response operations. Police, fire departments, and disaster management agencies are adopting drone services for rapid situational awareness, search-and-rescue missions, and crowd monitoring. Service providers enable these agencies to access advanced drone fleets and data processing capabilities without heavy upfront investment. As urbanization and climate risks intensify, outsourced drone services will become indispensable in enhancing emergency preparedness and response efficiency.

Product Insights

The multi-rotor segment accounted for the largest share of the U.S. drone industry in 2024, primarily driven by its unmatched versatility and operational efficiency. These drones empower industries such as construction, agriculture, logistics, and emergency services with precise aerial data and rapid deployment capabilities. Their ability to hover, perform stable flights, and capture high-resolution imagery positions them as the go-to solution for inspection, mapping, and delivery. As industries accelerate digital transformation and automation, the dominance of multi-rotor drones will continue to drive scalability, innovation, and adoption across the market.

The hybrid segment is expected to grow at the fastest CAGR from 2025 to 2030, owing to its ability to combine the endurance of fixed-wing drones with the versatility of multi-rotor platforms. These drones deliver extended flight times, larger payload capacities, and superior range, making them highly effective for applications such as long-range inspections, border surveillance, and large-scale agricultural monitoring. By overcoming the limitations of both fixed-wing and multi-rotor models, hybrid drones are emerging as a game-changer in mission-critical operations. As demand for advanced capabilities accelerates across defense, logistics, and infrastructure, the hybrid category will play a pivotal role in reshaping the U.S. drone market landscape.

Technology Insights

The remotely operated segment accounted for the largest market share in 2024, driven by its proven reliability and versatility across commercial, industrial, and defense applications. These drones allow operators to maintain real-time control, ensuring precise execution of tasks such as inspection, surveillance, mapping, and delivery. Their mature technology and ease of integration into existing workflows make them a preferred choice for organizations seeking operational efficiency and regulatory compliance. As demand for accurate, safe, and cost-effective drone solutions grows, remotely operated drones will continue to dominate the U.S. market and set the benchmark for other operational categories.

The fully autonomous segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by advances in AI, machine learning, and sensor integration that enable drones to operate without human intervention. These drones are increasingly deployed in logistics, surveillance, agriculture, and industrial inspections, where continuous operations and rapid decision-making are critical. Their ability to perform complex missions efficiently and safely reduces labor costs and enhances operational scalability. As technology matures and regulatory frameworks support autonomous operations, fully autonomous drones are set to become a major growth engine in the U.S. drone market.

Payload Capacity Insights

The up to 2KG segment accounted for the largest market share in 2024, driven by its affordability, ease of use, and wide applicability across commercial, recreational, and industrial operations. Lightweight drones offer simplified deployment, reduced regulatory hurdles, and lower operational costs, making them highly attractive for small businesses, delivery services, and hobbyists. Their compact design and versatility enable applications in inspection, mapping, agriculture, and last-mile logistics without requiring extensive infrastructure or specialized training. As demand for flexible, cost-effective drone solutions grows, the up to 2KG category is expected to continue dominating the U.S. drone industry.

The 2 KG to 19KG segment is expected to grow at the fastest CAGR from 2025 to 2030, primarily driven by its optimal balance between payload capacity, flight endurance, and operational flexibility. These drones are increasingly adopted for commercial deliveries, industrial inspections, agriculture, and emergency response missions where heavier payloads are required. Their ability to carry specialized sensors, cameras, and small cargo expands their use cases across multiple industries, enabling more efficient and data-driven operations. As businesses seek scalable and versatile drone solutions, this segment is poised to become one of the fastest-growing categories in the U.S. drone industry.

Power Source Insights

The battery-powered segment accounted for the largest market share in 2024, owing to its efficiency, reliability, and suitability for a wide range of commercial, industrial, and recreational applications. Battery-powered drones offer low operational costs, minimal maintenance, and reduced environmental impact compared with fuel-based alternatives, making them highly attractive to businesses and hobbyists alike. Advances in lithium-ion and high-capacity batteries are extending flight times and payload capabilities, further driving adoption across inspection, delivery, mapping, and surveillance missions. As industries increasingly prioritize cost-effective and eco-friendly solutions, battery-powered drones are expected to maintain their dominance in the U.S. drone market.

The hydrogen fuel cell segment is expected to grow at the highest CAGR from 2025 to 2030, driven by its potential to deliver longer flight times, higher energy density, and zero-emission operations. This technology is gaining traction in heavy-lift drones, long-endurance missions, and defense applications where conventional batteries are limited by weight and runtime. Companies investing in hydrogen fuel cell solutions are positioning themselves to meet the growing demand for sustainable, high-performance drone operations. As regulatory support for clean energy and environmental sustainability increases, hydrogen-powered drones are poised to emerge as a key growth segment in the market.

End Use Insights

The military segment held the largest share of the U.S. drone industry in 2024. The increasing deployment of drones for surveillance, reconnaissance, combat support, and intelligence operations is driving strong demand. Advanced technologies such as AI-enabled autonomous navigation, long-endurance platforms, and modular payloads are enhancing operational effectiveness and mission success. With rising defense budgets, government funding, and strategic collaborations between defense contractors, military applications will continue to lead the market and fuel long-term growth.

The consumer segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by growing interest in recreational flying, aerial photography, and hobbyist applications. Lightweight, easy-to-operate drones with integrated cameras and user-friendly controls are making drone technology more accessible to the public. Advances in battery life, stability, and affordability are further accelerating adoption among hobbyists and content creators. As technology becomes more intuitive and features expand, the consumer segment is expected to sustain steady growth while encouraging broader drone awareness and engagement.

Key U.S. Drone Company Insights

Some of the key players operating in the market include Northrop Grumman and Lockheed Martin.

-

Northrop Grumman focuses on high-end defense UAVs and autonomous systems, including the Global Hawk and MQ-4C Triton. Its drones specialize in long-endurance, high-altitude surveillance and intelligence collection for military and government customers. The company integrates advanced sensors, radar, and communications technologies to support complex, global operations. Northrop Grumman’s expertise in large-scale aerospace systems enables delivery of mission-ready unmanned platforms for defense and national security.

-

Lockheed Martin specializes in military drones and autonomous systems, integrating advanced avionics, sensors, and payloads for ISR (Intelligence, Surveillance, and Reconnaissance) and combat support. Its UAVs are designed to operate in complex, networked defense environments for real-time situational awareness. The company leverages decades of aerospace experience to provide high-performance, mission-critical unmanned solutions. Lockheed Martin also develops integrated defense solutions that connect drones with broader military command and control networks.

Some of the emerging market players in the market include Shield AI and Skydio.

-

Shield AI focuses on AI-powered autonomous drones for military operations, especially in GPS-denied or contested environments. Its drones specialize in reconnaissance, intelligence collection, and tactical support while operating fully autonomously. Shield AI uses advanced machine learning and computer vision algorithms to navigate complex environments without human intervention. The company is emerging as a key defense technology innovator by providing drones that enhance soldier safety and operational effectiveness.

-

Skydio specializes in autonomous drones powered by AI for obstacle avoidance and intelligent navigation, making it a leader in enterprise and government applications. Its drones are widely used for inspection, mapping, and public safety operations, where reliability and autonomy are critical. Skydio’s technology reduces operator workload while enhancing safety and operational efficiency in complex environments. The company has rapidly gained traction with U.S. federal, state, and local agencies due to its domestic manufacturing and compliance with national security requirements.

Key U.S. Drone Companies:

- AeroVironment

- Northrop Grumman

- RTX (Raytheon Technologies)

- L3Harris Technologies

- Lockheed Martin

- General Atomics

- Teledyne FLIR

- Boeing

- Skydio

- BlueHalo

- 3D Robotics (3DR)

- Shield AI

Recent Developments

-

In June 2025, ZenaTech introduced its Drone-as-a-Service (DaaS) platform for U.S. defense and government agencies through strategic partnerships with Bromelkamp Government Relations and Winning Strategies Washington. The service allows agencies to access advanced drones, including the ZenaDrone 1000, IQ Nano, and IQ Square, without capital investment in equipment, pilots, or regulatory compliance. This initiative positions ZenaTech to accelerate the adoption of scalable, AI-driven aerial capabilities that align with evolving defense and security priorities.

-

In May 2025, Flytrex and Wing launched the first U.S. drone delivery collaboration using Unmanned Traffic Management (UTM) to enable real-time, automated coordination of BVLOS flights. The initiative, piloted near Dallas, Texas, allows both companies to share flight data and dynamically adjust routes to prevent conflicts in low-altitude airspace. Conducted under the FAA’s UTM Operational Evaluation, the project marks a scalable step toward safely integrating multiple commercial drone operators into the national airspace.

-

In April 2025, the U.S. National Drone Association (USNDA) launched the DroneWERX White list Program, branded as “The Warfighter’s Reddit,” to connect frontline needs with American-made drone and counter-drone technologies. The initiative creates a transparent platform for showcasing solutions, offering prototyping grants, field testing, and accelerated pathways from concept to acquisition without acting as a formal approval process. Set to pilot in Florida throughout 2025, the program will roll out publicly at the National Drone Conference in December.

-

In February 2025, IDB Lab partnered with 19Labs to launch the GALE | Force drone delivery system, aimed at transporting essential medical supplies to remote communities in Guyana’s hinterland. The initiative will support more than 20,000 residents across 15 telemedicine centers by improving supply chain efficiency, reducing waste, and ensuring timely access to medicines and lab testing. Beyond healthcare delivery, the project also creates training and job opportunities for local drone operators and technicians, offering a scalable model for wider adoption.

U.S. Drone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.44 billion

Revenue forecast in 2030

USD 52.51 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, product, technology, payload capacity, power source, and end use

Country scope

U.S.

Key companies profiled

AeroVironment, Northrop Grumman, RTX (Raytheon Technologies), L3Harris Technologies, Lockheed Martin, General Atomics, Teledyne FLIR, Boeing, Skydio, BlueHalo, 3D Robotics (3DR), Shield AI

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Drone Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. drone market report based on component, product, technology, payload capacity, power source, and end use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Frames

-

Control system

-

Power & propulsion system

-

Camera system

-

Navigation system

-

Transmitter

-

Wings

-

Others

-

-

Software

-

Services

-

Integration & engineering

-

Maintenance & support

-

Training & education

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-wing

-

Multi-rotor

-

Single-rotor

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely operated

-

Semi-autonomous

-

Fully autonomous

-

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 2KG

-

2 KG to 19KG

-

20KG to 200KG

-

Over 200KG

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery-powered

-

Gasoline-powered

-

Hydrogen fuel cell

-

Solar

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Prosumer

-

Toy/Hobbyist

-

Photogrammetry

-

-

Commercial

-

Inspection/ maintenance

-

Mapping & surveying

-

Photography/ filming

-

Surveillance & monitoring

-

Localization/ detection

-

Spraying/ seeding

-

Others

-

-

Military

-

Intelligence, surveillance, target acquisition, and reconnaissance (ISTAR)

-

Communication

-

Combat operations

-

Military cargo transport

-

Precision strikes

-

Others

-

-

Government & law enforcement

-

Frequently Asked Questions About This Report

b. The U.S. drone market size was estimated at USD 25.07 billion in 2024 and is expected to reach USD 28.44 billion in 2025.

b. The global U.S. drone market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 52.51 billion by 2030.

b. The hardware segment dominated the U.S. drone market with a share of over 59% in 2024, owing to rising investments in advanced drone components such as sensors, cameras, navigation systems, and propulsion technologies that enhance performance, durability, and operational efficiency.

b. Some key players operating in the U.S. drone market include AeroVironment, Northrop Grumman, RTX (Raytheon Technologies), L3Harris Technologies, Lockheed Martin, General Atomics, Teledyne FLIR, Boeing, Skydio, BlueHalo, 3D Robotics (3DR), and Shield AI.

b. Key factors that are driving the market growth include increasing adoption of drones for commercial applications, rising demand for advanced sensors and imaging systems, and growing investments in defense and surveillance operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.