- Home

- »

- Medical Devices

- »

-

U.S. Drug Device Combination Products Market, Industry Report, 2030GVR Report cover

![U.S. Drug Device Combination Products Market Size, Share & Trends Report]()

U.S. Drug Device Combination Products Market Size, Share & Trends Analysis Report By Product (Infusion Pumps, Transdermal Patches, Orthopedic Combination Products, Photodynamic Therapy Devices, Drug Eluting Stents) And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-233-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

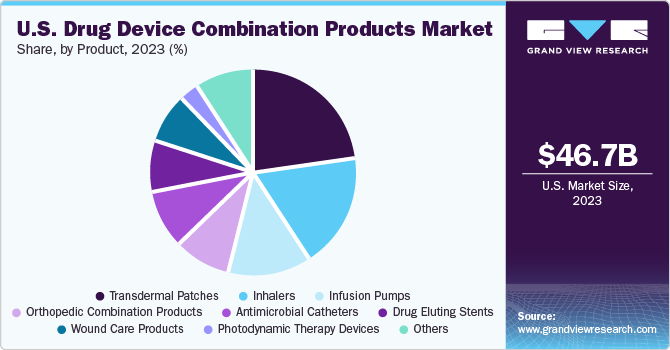

The U.S. drug device combination products market size was estimated at USD 46.71 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. The market growth can be attributed to the growing prevalence of chronic diseases, rising need for minimally invasive drug-delivery devices, and technological advances in drug-delivering devices.

Widespread prevalence of chronic diseases such as diabetes, cancer, cardiovascular diseases, multiple sclerosis, and asthma within the country, driving the demand for drug devices. Adopting drug-delivery devices for managing chronic diseases propels the market growth. According to the National Institute of Diabetes, and Digestive and Kidney Diseases statistics, there are 38.4 million individuals were diagnosed with diabetes in 2021, accounting for 11.6% of the U.S. population. Moreover, 8.7 million adults had diabetes but remained undiagnosed, constituting 22.8% of the undiagnosed diabetic population.

In addition, various key companies are implementing different strategic measures to tackle the increasing challenge of diabetes, focusing on the advancement and introduction of prefilled syringes like insulin auto-injectors. For instance, in December 2022 Biocorp's Mallya device received 510(k) clearance from the U.S. FDA for diabetes treatment. Such regulatory approvals accelerate emerging companies to create innovative drug-device combinations, leading to market growth.

The U.S. drug device combination products market accounted for around 40% of the global drug device combination products market in 2023. Due to technological advances in the drug delivery pathways, there is an accelerating demand for minimally invasive drug delivery devices. The rising research on drug delivery pathways for better efficiency and favorable patient outcomes is projected to boost their acceptance over the forecast period. Furthermore, several key companies provide funds to promote research and development activities at institutes, thereby contributing to growth opportunities. For instance, in October 2022, Eli Lilly announced USD 92.5 million to Purdue University to initiate a pharmaceutical scholarship program. This collaboration would support the development of novel drug-delivering therapies for patients.

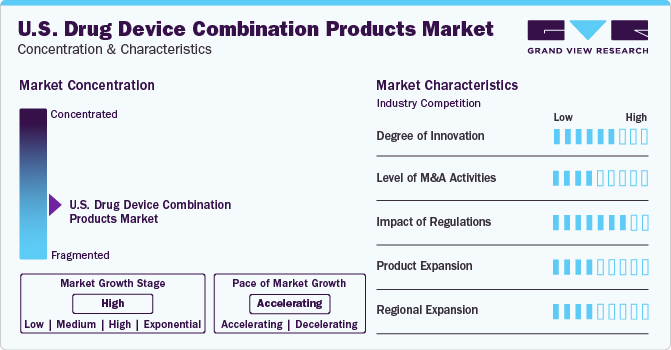

Market Characteristics & Concentration

The U.S. drug-device combination products industry exhibits notable fragmentation, with numerous companies commanding substantial market shares, underscoring its dynamic nature.

Comapnies and Institutes are increasingly focusing on launching drug devices to maintain their positions and strengthen their market presence. This strategic approach is vital for companies to stay competitive and adapt to changing dynamics. For instance, in September 2022, Teleflex Incorporated announced its Arrow Pressure Injectable Midline portfolio in the U.S., aimed at improving line identification clarity and enhancing patient care.

Industry participants are actively involved in acquiring smaller companies to expand their market positions. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in January 2024, Kindeva Drug Delivery announced the acquisition of Summit Biosciences, a specialized organization focused on nasal drug development and manufacturing. This strategic move enhances Kindeva's capabilities in the nasal drug delivery sector, further solidifying its position as a leader in innovative drug delivery solutions.

Regulatory bodies like the U.S. FDA uphold stringent quality standards to ensure the safety and efficacy of healthcare products, including drug-device combination products. The collaborative efforts between pharmaceutical and medical device companies, along with partnerships with regulatory authorities, are anticipated to propel market growth. For instance, in July 2023, Becton, Dickinson and Company announced FDA 510(k) Clearance approval for an updated version of the BD Alaris Infusion System. This clearance encompasses updated hardware features for the Point-of-Care Unit (PCU), syringe pumps, autoidentification modules, Patient-controlled Analgesia (PCA) pumps, large-volume pumps, and respiratory monitoring.

Several companies strategically focus on regional expansion to serve a wide range of customers and capitalize on growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local industry needs, and enhance their share by targeting diverse customer segments. For instance, in June 2023, Evonik announced a new facility expansion in Indiana, U.S. for pharmaceutical lipids for USD 220 million. This facility, supported by the U.S. government's Biomedical Advanced Research and Development Authority (BARDA), aims to enhance the production of lipids crucial for mRNA vaccines and other nucleic acid therapies.

Product Insights

Based on product, transdermal patches dominated the market with a share of 23% in 2023. The growth of this segment is driven by increasing launches and approvals of these skin patches due to their higher efficacy in drug delivery. For instance, in January 2024, Starton Therapeutics announced the launch of STARSILON, a new transpatch delivering platform. This move would expand the company’s portfolio and significantly enhance its capacity to integrate platform technology for the accelerated and expanded development of transdermal drug products. Moreover, regulatory approvals positively impact the demand for these patches. For instance, in March 2022, the U.S. Food and Drug Administration approved ADLARITY, a weekly patch designed to provide consistent doses of donepezil continuously via the skin. Thus, new launches and approvals fuel the growth of this segment.

The drug-eluting stents segment is expected to witness the fastest CAGR growth from 2024 to 2030. This segment is further segmented into coronary stents and peripheral vascular stents, which provide support to patients with cardiovascular disorders. The U.S. population is highly impacted by cardiovascular disorders. For instance, according to CDC statistics, heart disease is a potential cause of death, accounting for 695,000 people in the U.S. Moreover, coronary heart disease is considered to be the most common entity contributing to the health diseases sector. Such a surge in cardiovascular disorders further increases the demand for drug-eluting stents and thereby accelerates market growth.

Key U.S. Drug Device Combination Products Company Insights

The major companies include Abbott, Stryker, Eli & Lilly and Terumo medical corporation among others. Promient companies consistently prioritize the development and enhancement of novel technologies to improve patient outcomes and significantly enhance device efficiency. Furthermore, they are engage in mergers and acquisitions, innovative product launches, regulatory approvals, and regional product expansion strategies to further boost market growth.

Key U.S. Drug Device Combination Products Companies:

- Abbott

- Eli Lilly

- Terumo Medical Corporation

- Stryker

- Viatris, Inc

- Boston Scientific Corporation

- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- W. L. Gore & Associates, Inc

- Mylan

- Allergan

- Cook Medical

- Flowonix Medical, Inc.

Recent Developments

-

In February 2024, German company-LTS LOHMANN Therapie-Systeme AG announced the launch of UDENYCA on-body injector (OBI) utilizing the LTS Sorrel wearable drug delivery platform in the U.S. This U.S. FDA approved device would assist Udenyca patients in receiving the drug in the comfort of their home and is intended to lower a patient's risk of infection after they have received chemotherapy.

-

In January 2024, Kindeva Drug Delivery has introduced new analytical services for pharmaceutical, biopharmaceutical, and medical device companies.The company would offer stability testing, injectables testing, transdermal analytical support, extractable and leachable testing, container closure integrity testing, and elemental impurity testing.

U.S. Drug Device Combination Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 50.11 billion

Revenue Forecast in 2030

USD 78.34 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

Abbott; Eli Lilly; Terumo Medical Corporation; Stryker; Viatris, Inc; Boston Scientific Corporation; Becton, Dickinson and Company (BD); Teleflex Incorporated

W. L. Gore & Associates, Inc; Mylan; Allergan; Cook Medical; Flowonix Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S.Drug Device Combination Products Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. drug device combination products market report based on, product:

-

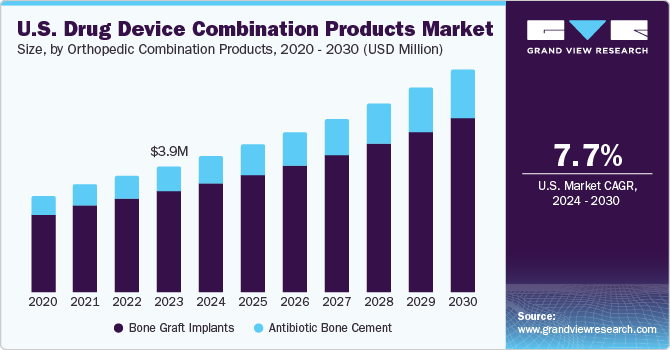

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infusion Pumps

-

Volumetric

-

Disposables

-

Syringes

-

Ambulatory

-

Implantable

-

Insulin

-

-

Orthopedic Combination Products

-

Bone Graft Implants

-

Antibiotic Bone Cement

-

-

Photodynamic Therapy Devices

-

Transdermal Patches

-

Drug Eluting Stents

-

Coronary Stents

-

Peripheral Vascular Stents

-

-

Wound Care Products

-

Inhalers

-

Dry Powder

-

Nebulizers

-

Metered Dose

-

-

Antimicrobial Catheters

-

Urological

-

Cardiovascular

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. drug device combination products market size was estimated at USD 46.71 billion in 2023 and is expected to reach USD 50.11 billion in 2024.

b. The U.S. drug device combination products market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 78.34 billion by 2030.

b. Based on product, the transdermal patches held largest market share with a share of 23.0% in 2023. This is attributable to extensive new product development activities for transdermal patches conducted by prominent players across this country.

b. Some key players operating in the U.S. drug device combination products market include Abbott; Terumo Corporation; Stryker Corporation; Mylan N.V.; Medtronic; Allergan plc; Boston Scientific Corporation; Novartis AG; C.R. Bard; Teleflex Incorporated; and W. L. Gore & Associates, Inc.

b. Key factors that are driving the U.S. drug device combination products market growth include growing patient and physician preference for minimally invasive procedures and consistent-dosing treatment alternatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."