- Home

- »

- Medical Devices

- »

-

U.S. Dry Eye Treatment Devices Market, Industry Report, 2030GVR Report cover

![U.S. Dry Eye Treatment Devices Market Size, Share & Trends Report]()

U.S. Dry Eye Treatment Devices Market Size, Share & Trends Analysis Report By Technology (BBL, IPL, MGX, Combination (MGX+IPL)), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-236-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

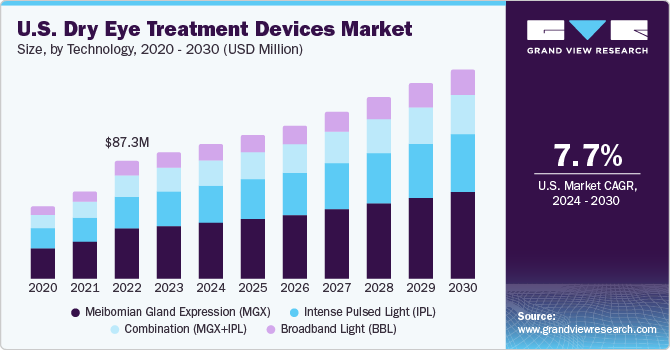

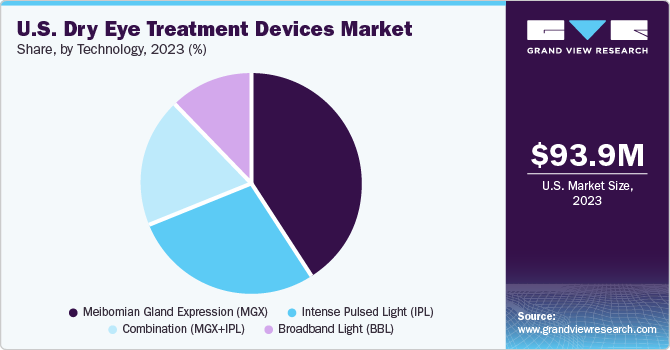

The U.S. dry eye treatment devices market size was estimated at USD 93.9 million in 2023 and is anticipated to grow at a CAGR of 7.7% from 2024 to 2030. The prevalence of Dry Eye Diseases (DED) in the U.S. continues to grow at a rapid pace, creating an increased demand for advanced and effective therapies. According to an article published in the NCBI, the prevalence of DED is approximately 6.8% of the adult population in the U.S. or around 16 million diagnosed cases.

Increasing prevalence of dry eye disorders is linked to the growing incidence of risk factors including prolonged exposure to digital screens, overuse of contact lenses, glaucoma, diabetes, and Sjogren's syndrome. It is estimated that people in the U.S. spend an average time of more than 10 hours per day using visual display terminals. The average screen time is increasing every year at a substantial extent due to the growth of the internet network.

The therapeutic landscape for the treatment and management of dry eye diseases has transformed drastically with care providers being more inclined to target the root cause of the syndrome than offering temporary relief solutions. This shift is likely to bode well for the market over the upcoming years. The strengthening presence of prominent market players such as J&J Vision, Sight Sciences, Alcon, and MiBo Medical Group in the country is opportunistic for the demand growth. The presence of key players ensures rapid availability of advanced technologies in the country. For instance, the novel blink-assisted thermal technology, TearCare, was commercialized first in the U.S.

Market Characteristics & Concentration

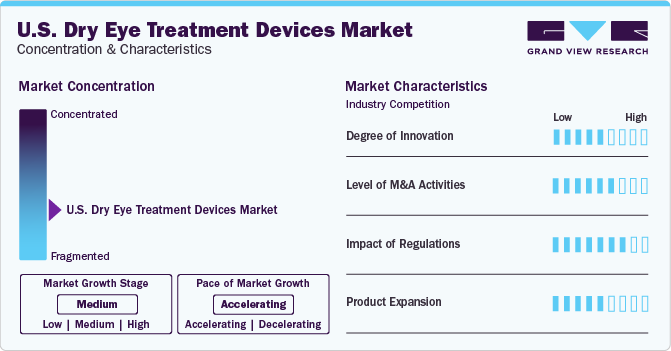

The industry growth stage is medium (CAGR 5-10%) and pace of the growth depicts an accelerating trend. The U.S. dry eye treatment devices industry is fragmented, which is marked by the presence of large number of companies competing for the market share. The industry is in moderate growth stage and will continue its trajectory in the coming 5-6 years.

The growing preference for minimally invasive treatment is influencing the device technology ecosystem of the industry. Practitioners are realizing the earning potential of treating patients with dry eyes at their offices, rather than referring the patients to other centers. This can be attributed to the rising patient preference for targeted, minimally invasive, and quick therapy for dry eyes. Furthermore, the presence of programs educating eye care professionals about the patient and practice benefits of adopting dry eye treatment devices is anticipated to propel the market growth. In addition, financial services are offered by manufacturers and third parties to practitioners for the procurement of dry eye treatment devices boosting the demand for these devices. Hence, the high competition in the ophthalmology service industry, where patients easily switch over service providers for quality treatment is expected to be a major factor driving the demand for state-of-the-art treatment devices.

The U.S. dry eye treatment devices industry is characterized by a moderate level of M&A and collaboration activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in June 2023, Zhaoke Ophthalmology (China) signed a strategic agreement with Eyedetec Medical (U.S.), for the distribution of Eye Lipid Mobilizer (ELM) device in Asian countries. ELM is purposed to treat moderate to critical DED through by stabilizing the oil layer of the eye’s tear film.

The industry is influenced by regulatory norms and quality protocols imposed by various organizations, including the FDA. Standard treatment guidelines are mandated by healthcare organizations for managing DED. However, manufacturers have to align with stringent premarket approval procedures for thermal pulsation system. Manufacturers of IPL- and BBL-based technological devices for skin disease treatment are planning to enter the global dry eye treatment devices market, owing to the growing number of studies showing the effectiveness of these technologies in dry eye treatment.

Technology Insights

The MGX segment held the largest market share of 41.2% in 2023. MGX is used for diagnosis and treatment of Meibomian Gland Dysfunction (MGD), which is one of the causes for dry eye. For diagnosing MGD, eye specialists examine oil from the eyelids to determine if there is clogging in the glands. For treatment, MGX can help deal with blockages and clogging of the glands. Specialists use tiny forceps or paddle-like instruments to compress the lower and upper eyelid to obtain the oil. Eye doctors may also apply warm compressors and thermal pulsation with MGX for a smoother secretion of oil from the clogged the gland. A large number of companies are developing heat pumps to enter the market and contribute to the treatment of dry eye. For instance, MiBo Medical Group has developed the MiBo ThermoFlo series—therapeutic medical devices that can deliver consistent emissive heat, helping in the softening and mobilizing of lipid secretions.

The combination (IPL+MGX) segment is anticipated to register the fastest CAGR during the forecast period. Several studies are being conducted to understand the effectiveness of intense pulsed light (IPL) + Meibomian gland expression (MGX) for treating dry eye. IPL is used for warming up the meibomian glands or to calm the blood vessels surrounding the meibomian glands, while MGX is performed to extract the liquid accumulated near the glands to avoid MGD, which is a causative factor for dry eye.

Key U.S. Dry Eye Treatment Devices Company Insights

Key U.S. dry eye companies include Johnson & Johnson Vision Care, Sight Sciences, and Alcon, Inc., among others. The companies in the industry are undertaking various strategic initiatives including mergers & acquisitions, new product development, joint ventures, and partnerships to expand their market penetration. Furthermore, continuous R&D efforts are being undertaken by industry players for safe and effective solutions in management of dry eye symptoms. Such activities are expected to bring novel and innovative medical devices into the market, fueling its growth over the forecast period.

Key U.S. Dry Eye Treatment Devices Companies:

- MiBo Medical Group

- Sight Sciences

- Lumenis

- ESW Vision

- Johnson & Johnson Vision Care

- Alcon, Inc.

Recent Developments

-

In November 2023, Lumenis unveiled the launch of OptiPlus, a dual radiofrequency device for treating dry eye inflammation. The device transmits heat throughout various layers of tissues for increasing blood circulation and target inflammation caused by dysfunction of Meibomian gland.

-

In May 2023, Bausch + Lomb and Novaliq GmbH announced the FDA approval of MIEBO, an ophthalmic solution for treatment of DED. MIEBO is the first ever FDA-approved dry eye disease treatment that targets tear evaporation directly.

U.S. Dry Eye Treatment Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 99.7 million

Revenue forecast in 2030

USD 155.4 million

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Technology

Country scope

U.S.

Key companies profiled

Lumenis; ESW Vision; Johnson & Johnson Vision Care; MiBo Medical Group; Alcon Inc.; Sight Sciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dry Eye Treatment Devices Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dry eye treatment devicesmarket report based on technology:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Broadband Light (BBL)

-

Intense Pulsed Light (IPL)

-

Meibomian Gland Expression (MGX)

-

Combination (MGX+IPL)

-

Frequently Asked Questions About This Report

b. The U.S. dry eye treatment devices market size was estimated at USD 93.9 million in 2023 and is expected to reach USD 99.7 million in 2024.

b. The U.S. dry eye treatment devices market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 155.4 million by 2030.

b. Based on technology, MGX segment U.S. dominated the dry eye treatment devices market with a share of 41.2% in 2023. This is attributable to the rising prevalence of dry eye and an increasing number of contact lens users.

b. Some key players operating in the U.S. dry eye treatment devices market include Lumenis, ESW Vision, Johnson & Johnson Services, Inc., MiBo Medical Group, Alcon, and Sight Sciences.

b. Key factors that are driving the U.S. dry eye treatment devices market growth include rising healthcare need to treat the root cause of dry eye syndrome, an increasing number of research activities related to IPL & BBL

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."