- Home

- »

- Medical Devices

- »

-

Dry Eye Treatment Devices Market Size, Share Report, 2030GVR Report cover

![Dry Eye Treatment Devices Market Size, Share & Trends Report]()

Dry Eye Treatment Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (MGX, Combination (MGX+IPL)), By End-use (Hospitals, Ophthalmic Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-042-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

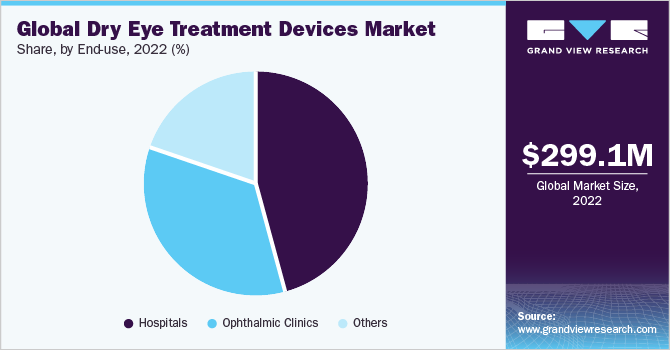

The global dry eye treatment devices market size was estimated at USD 299.1 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The rising demand for faster and non-invasive treatment approaches that provide long-term relief from dry eye symptoms is a key factor expected to drive the market. For instance, an intense pulsed light (IPL) per session lasts approximately 15-20 minutes, and 4-5 sessions are optimal to provide long-term relief from dry eye symptoms. Therefore, the rising preference among patients who are unhappy and uncomfortable with the frequent application of eye drops to alleviate dry eye symptoms is expected to fuel the market growth.

The increasing prevalence of dry eye syndrome and meibomian gland dysfunction (MGD) globally is anticipated to propel the growth of the market. The growing burden of dry eye can be attributed to the rising incidence of causative risk factors such as overuse of contact lenses, prolonged exposure to digital screens, diabetes, glaucoma, and Sjogren's syndrome. For instance, Americans are estimated to spend an average time of more than 10 hours a day at visual display terminals. The average screen time has always been increasing each year remarkably due to the expansion of the global internet network. COVID-19 is expected to negatively impact the market growth. Fewer hospital visits during this pandemic are expected to decrease the adoption of dry eye treatment devices. Moreover, as the eyes act as one of the entrance points for the virus, a large number of ophthalmic treatments have decreased owing to the threat of the virus, thereby hindering market growth.

The therapeutic landscape in the management of dry eye syndrome is changing drastically with eye care providers getting more inclined to treat the root cause of the disease than providing solutions for temporary relief. This phenomenon is anticipated to bode well for the market shortly. Moreover, the eye care providers are equipping their facilities with IPL and MGX treatment devices realizing the financial benefits of treating the patients at their office rather than referring them to other centers.

Several market players are focusing on various strategies including product launches, mergers and acquisitions, partnerships, and collaborations to build a strong market presence. For instance, in April 2022, Alcon introduced the Systane iLux2 Meibomian Gland Dysfunction (MGD) thermal pulsation system for the treatment of dry eye. In addition, in January 2020, ESW Vision supported an investigator-initiated clinical study held in New Zealand to evaluate the efficacy of IPL treatment in dry eyes.

The availability of alternative treatment, the high cost of laser treatment, numerous contraindications associated with IPL, and the lack of an efficient health insurance policy in several countries are the factors limiting its adoption rate. For instance, the average treatment cost of intense pulsed light is approximately USD 700, which is practically unaffordable for patients having low- to middle-level income.

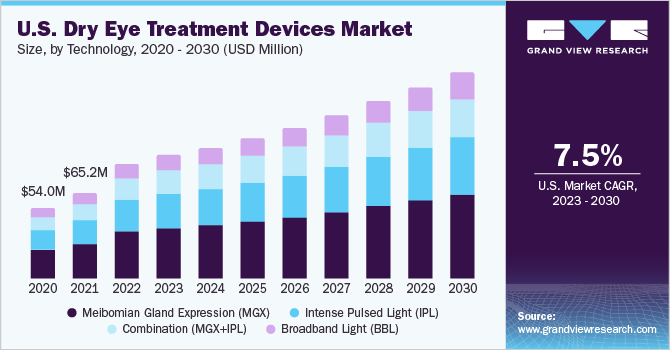

Technology Insights

In terms of technology, the MGX segment held the largest revenue share of 41.2% in 2022. MGX is considered one of the efficient options for treating MGD, one of the leading causes of dry eye disease. It helps in dealing with the blockage present around the meibomian gland and helps remove it using equipment such as forceps, warm compressors, and thermal pulsation systems. The frequent launches of technologically advanced products with high portability, enhanced patient comfort, and improved therapeutic efficacy are expected to propel the growth of this segment during the forecast period. For instance, Tearcare by Sight Sciences is a thermal pulsation system to treat evaporative dry eyes. It is uniquely designed to facilitate open-eye procedures, thus increasing patient comfort.

The intense pulsed light (IPL) segment is anticipated to register a CAGR of 7.5% over the forecast period. The active measures undertaken by market players to reinforce their distribution network through collaborations and partnerships are anticipated to contribute to segment growth. For instance, in April 2020, I-Med Pharma, a Canadian company specializing in dry eye management technologies, received distribution rights to sell E-Eye (IPL technology) from ESW Vision in Canada.

A combination of intense pulsed light (IPL) and MGX technology is anticipated to register the fastest CAGR of 7.6% during the forecast period. Ongoing clinical trial studies to understand the effectiveness of this combined technology in treating dry eye disease are expected to contribute to segment growth.

End-use Insights

Based on end-use, the hospitals segment held the largest market share in 2022 and is expected to witness significant growth in the next few years. The number of treatments given in hospitals is higher than in any other healthcare setting, owing to the availability of hospitals for primary care in several developing economies and supportive reimbursement policies.

The ophthalmic clinics segment is anticipated to held highest CAGR over the forecast period. Several factors such as increasing number of individuals visiting ophthalmic clinics in developing economies, especially in rural areas, and easy accessibility are anticipated to boost the demand for ophthalmic equipment in ophthalmic clinics.

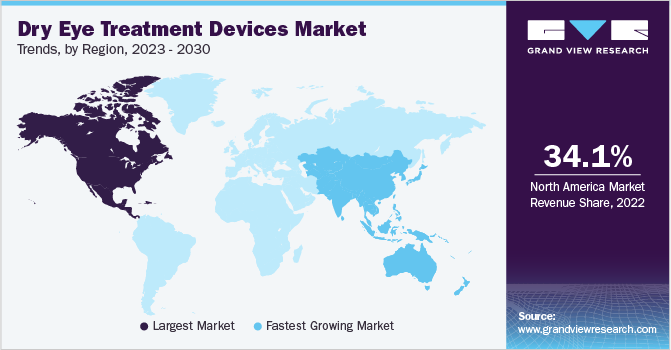

Regional Insights

In terms of region, North America held the largest revenue share of 34.1% in 2022. The high prevalence of dry eye disease, increasing R&D expenditure, and the growing number of ophthalmology trade conferences and expos in the U.S. and Canada significantly contributed to the market growth. The prevalence of Dry Eye Diseases (DED) in the U.S. continues to grow at a rapid pace, creating an increased demand for advanced and effective therapies. According to an article, the prevalence of DED is approximately 6.8% of the adult population in the U.S. or around 16 million diagnosed cases. The prevalence is higher in females as compared to males. Approximately 60% of patient visits to eye care providers are due to DED. The increasing incidence of risk factors, such as systemic diseases (diabetes), high digital device usage, and a growing aging population, is anticipated to further increase the burden of DED in the U.S.

Asia Pacific is anticipated to grow at the fastest CAGR of 8.1% during the forecast period. The presence of a large patient pool is expected to drive the demand for these devices. The burden of DED in China, Japan, and India is expected to contribute to the increase in the adoption of newer treatment options. To meet the growing demand, global players are looking to launch technologically advanced devices in the region. For instance, in June 2023, Zhaoke Ophthalmology, an ophthalmic pharmaceutical company based in China signed a licensing agreement with Eyedetec Medical, a U.S.-based medical device manufacturer for supplying Eye Lipid Mobilizer (ELM) in Asian regions. ELM was designed for the relief of moderate to severe DED through the stabilization of the oil layer of the eye’s tear film. In addition, in September 2019, Lumenis announced that it received a CFDA Mark for the commercial sale of its M22 Optima IPL in China for treating dry eye. Apart from China, the device is approved for use in South Korea, New Zealand, and Australia.

Europe is expected to register a significant CAGR of 7.7% during the forecast period. The development of insurance policies, the increasing prevalence of dry eye disease in the region, and growing product approvals for dry eye treatment are expected to contribute to regional market growth. For instance, in May 2019, Quantel Medical, a medical laser and ultrasound technology company based in France, received CE approval for Lacrystim IPL, which is a dry eye treatment device.

Key Companies & Market Share Insights

The market players are undertaking various strategies such as mergers & acquisitions, new product development, joint ventures, and partnerships to increase their market penetration. For instance, in April 2023, Sun Pharma launched CEQUA, a novel ophthalmology treatment in India for patients who have DED with a commonly occurring condition of inflammation. CEQUA is delivered with nanomicellar (NCELL) technology.

In addition, in April 2021, Lumenis Ltd., the inventor of IPL technology & the largest energy-based medical device company for aesthetic, ophthalmic, and surgical applications in the world, announced the Food and Drug Administration (FDA) approval for its latest IPL device OptiLight. Key companies are observed to initiate programs to increase awareness regarding advanced treatment technologies in dry eye syndrome among eye care providers to gain a competitive edge. In May 2020, Alcon launched an awareness program called “No Reason to Wait: Success Starts Now” to educate patients and professionals about the importance and benefits of treating the root cause of MGD. This initiative is expected to boost the commercial sale of its dry eye treatment devices such as iLux and Systane. Some prominent players in the global dry eye treatment devices market include:

-

MiBo Medical Group

-

Sight Sciences

-

Lumenis

-

ESW Vision

-

Johnson & Johnson Vision Care

-

Alcon, Inc.

Dry Eye Treatment Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 322.3 million

Revenue forecast in 2030

USD 537.5 million

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Lumenis; ESW Vision; Johnson & Johnson Vision Care; MiBo Medical Group; Alcon Inc.; Sight Sciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

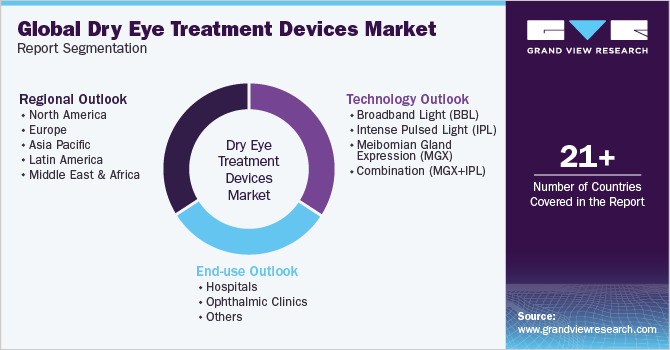

Global Dry Eye Treatment Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dry eye treatment devices market report based on technology, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Broadband Light (BBL)

-

Intense Pulsed Light (IPL)

-

Meibomian Gland Expression (MGX)

-

Combination (MGX+IPL)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dry eye treatment devices market size was estimated at USD 299.1 million in 2022 and is expected to reach USD 322.3 million in 2023.

b. Some key players operating in the dry eye treatment devices market include Lumenis, ESW Vision, Johnson & Johnson Services, Inc., MiBo Medical Group, Alcon, and Sight Sciences.

b. The global dry eye treatment devices market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 537.5 million by 2030.

b. North America dominated the dry eye treatment devices market with a share of 34.2% in 2022. This is attributable to the rising prevalence of dry eye and an increasing number of contact lens users in the region.

b. Key factors that are driving the dry eye treatment devices market growth include rising healthcare need to treat the root cause of dry eye syndrome, an increasing number of research activities related to IPL & BBL, & developing reimbursement framework in several countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.