- Home

- »

- Medical Devices

- »

-

U.S. Durable Medical Equipment Market Size, Report, 2030GVR Report cover

![U.S. Durable Medical Equipment Market Size, Share & Trends Report]()

U.S. Durable Medical Equipment Market Size, Share & Trends Analysis Report By Product (Monitoring And Therapeutic Devices, Personal Mobility Devices), By End Use (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-926-5

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

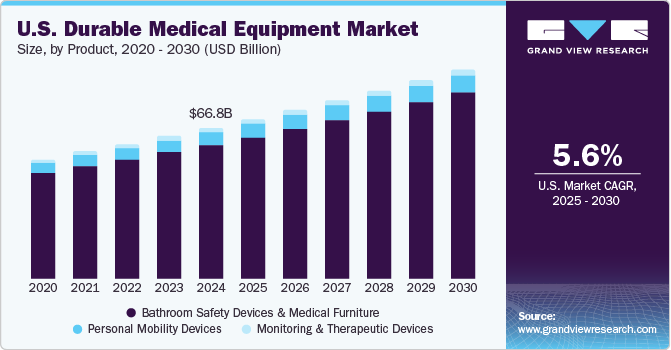

The U.S. durable medical equipment market size was valued at USD 66.81 billion in 2024 and is projected to grow at a CAGR of 5.61% from 2025 to 2030. The market is majorly driven by the rising product demand due to the growing geriatric population that is susceptible to various chronic diseases. According to America’s Health Rankings 2023 annual report, approximately 43% of the U.S. population, totaling 133 million people, was suffering from one or more chronic illnesses in 2022. Moreover, in the same year, more than 29 million adults were reported to be suffering from three or more chronic conditions. These chronic conditions, including arthritis, asthma, chronic kidney disease, Chronic Obstructive Pulmonary Disease (COPD), cardiovascular disease, cancer, depression, and diabetes, collectively contribute to the rising need for hospitalization.

The COVID-19 pandemic has initially disrupted the industry due to the lack of accessibility of the products to customers. The pandemic has affected the operations and financial condition of various market players. The DME suppliers have encountered interruptions in the supply chain, such as significant delays and order cancellations, as a result of public health and economic emergencies related to the COVID-19 pandemic.

Furthermore, rising geriatric population is a significant factor propelling the growth of the U.S. DME industry. As the world's population ages, there is a subsequent increase in the demand for healthcare services and infrastructure to address the unique & evolving healthcare needs of older adults. According to America's Health Rankings 2022 data, nearly 58 million adults aged 65 and above presently reside in the U.S., constituting around 17.3% of the nation's population. Projections indicate that by 2040, this proportion is anticipated to grow to 22%. As the last of the baby boomer generation reaches older adulthood in 2030, estimations suggest that over 73.1 million older adults will be living in the U.S. The geriatric population is more prone to chronic health conditions, such as cardiovascular diseases, respiratory disorders, and orthopedic issues. Durable medical equipment such as wheelchairs, canes, and crutches play a vital role in facilitating the safe and efficient movement of elderly patients within facilities, supporting their treatment and care. Thus, due to the increasing geriatric population, the demand for durable medical equipment is expected to grow in the near future.

Furthermore, the geriatric population often requires long-term care and assistance, leading to an increased demand for durable medical equipment, especially those designed for long-term care use. This equipment has become integral in different settings such as home care, and hospitals, including acute and chronic hospitals in different regions & states. Therefore, the growing geriatric population serves as a key factor fueling the growth of the U.S. durable medical equipment market, necessitating the development and adoption of innovative & specialized equipment to meet the end use requirements of an aging demographic.

Industry Dynamics

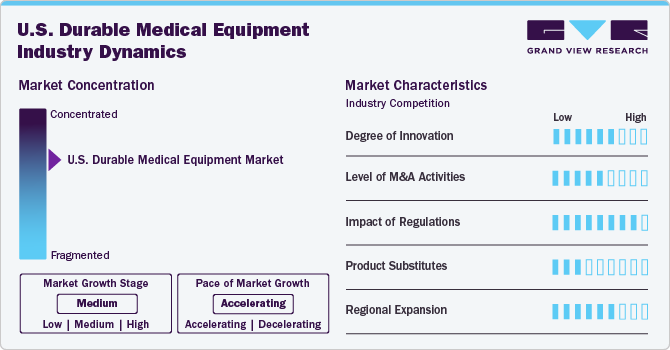

The market growth stage is moderate at an accelerating pace. The market is characterized by a moderate-to-high degree of growth. Key drivers include a combination of technological advancements, aging demographics, and the increasing prevalence of chronic diseases. The market is characterized by a diverse range of products, including mobility aids, respiratory equipment, and patient monitoring devices. Regulatory frameworks, such as Medicare reimbursement policies, significantly influence market dynamics, shaping the competitive landscape and market entry barriers.

The market showcases a strong trend toward home healthcare solutions, emphasizing patient convenience and cost-effectiveness. Advances in materials and design contribute to durable and user-friendly equipment, while a focus on telehealth integration further propels the market forward. As the healthcare landscape evolves, the industry continues to adapt, offering innovative solutions that cater to the evolving needs of healthcare providers and patients alike. For instance, in January 2024, Robooter, a mobility device manufacturer specializing in robotic technology for the elderly and disabled, introduced its innovative power wheelchair X40 at the Consumer Electronics Show (CES) 2024 in Las Vegas. The company expanded its product range with the launch of the E Series in 2023, emphasizing adaptability for both indoor and outdoor use. This strategic move caters to the diverse needs of elders and individuals with disabilities. Robooter's focus on the U.S. market is evident through its active efforts to strengthen partnerships with local collaborators. Participation in CES, alongside esteemed American collaborators, underscores the company's dedication to expanding its presence and advancing accessibility solutions in the U.S. market. The impact of Robooter's technological advancements is poised to contribute significantly to the evolution of mobility solutions within the industry.

The market is marked by a significant degree of innovation, propelled by rapid technological advancements and a heightened adoption of advanced products, especially in home care settings. This innovation surge is fueled by a growing demand for home care services, driving the development and integration of cutting-edge technologies such as artificial intelligence, big data analytics, and remote monitoring within the DME sector. Companies heavily investing in these technological advancements gain a competitive edge, contributing to the market's overall growth and reflecting a dynamic landscape that continually meets evolving healthcare needs through innovation.

Regulations play a pivotal role in shaping the market. Stringent regulatory frameworks, particularly related to reimbursement policies such as those governed by Medicare, significantly influence market dynamics. Compliance with these regulations poses challenges but is crucial for market entry. The regulatory environment fosters a standardized approach, ensuring the safety and efficacy of DME. It also acts as a key determinant in the competitive landscape, affecting product development and market access for companies operating in the U.S. DME sector. Overall, regulations have a profound impact, guiding industry practices and contributing to the market's stability and credibility.

The market is witnessing a notable level of merger and acquisition activities. Companies within the sector are strategically consolidating to enhance their market presence, broaden product portfolios, and achieve economies of scale. M&A transactions are driven by the pursuit of synergies, technological advancements, and the need for strategic partnerships to navigate evolving healthcare landscapes. This trend indicates a dynamic market where businesses are aligning resources to capitalize on growth opportunities and address challenges, ultimately influencing the competitive landscape and shaping the future trajectory of the U.S. DME market.

For instance, in November 2023, Humana Inc., a health and well-being company, partnered with national organizations Rotech Healthcare Inc. and AdaptHealth Corp. to provide DME services. This collaboration is set to commence on July 1 under a value-based structure that aims to enhance health support for Humana Medicare Advantage HMO members in their homes. Each national DME provider will serve specific regions of the country, marking a strategic move in the evolving DME market.

Product substitutes vary depending on the specific equipment category and the intended use. In mobility aids, lightweight manual wheelchairs or powered exoskeletons may substitute traditional motorized wheelchairs. For respiratory equipment, portable oxygen concentrators and wearable CPAP devices are gaining traction as substitutes for bulkier traditional machines due to their convenience and ease of use.

The market is experiencing notable regional expansion as companies strategically broaden their geographic footprint. This trend reflects a proactive approach to tap into diverse healthcare needs across different regions, capitalize on emerging opportunities, and establish a stronger market presence. Regional expansion allows DME providers to adapt their offerings to local requirements and regulations, fostering increased accessibility and enhancing their competitive position in the dynamic U.S. healthcare landscape.

End Use Insights

The hospital segment dominated the market in 2024, driven by a surge in patients with rising chronic diseases in the country. Hospitals, equipped with advanced medical technology and skilled healthcare professionals, are the primary facilities for addressing these disorders. Moreover, the growing number of hospitals is expected to drive the demand for durable medical equipment. For instance, in September 2023, Orlando Health introduced Florida’s first orthopedic hospital to provide physician training, orthopedic care, and rehabilitation space. Thus, the increasing number of hospitals is expected to boost the demand for durable medical equipment, including mattresses, bedding devices, and patient positioning devices, thus helping drive segment growth in the coming years.

Home healthcare is expected to witness the highest growth rate over the forecast period due to the cost-saving approach for the patient to get remote healthcare services. The rising preference for home-based care aligns with a broader trend in the healthcare industry, emphasizing convenience, reduced healthcare costs, and the comfort of receiving medical services within the familiar environment of one's home. This surge in demand for durable medical equipment within the home healthcare setting reflects a transformative shift in patient care delivery. As the industry continues to adapt to these changing dynamics, the market stands ready to play a pivotal role in shaping the future landscape of patient-centric healthcare.

Product Insights

The monitoring and therapeutic devices segment held the largest revenue share of over 91.40% in 2024 due to the increasing prevalence of chronic diseases requiring long-term care. In addition, increasing patient preference for at-home medical treatment or remote medical services over an in-patient setting is contributing to the segment growth. In monitoring and therapeutic devices, neuromonitoring techniques are expected to witness growth over the forecast period as they are becoming a part of standard medical practices and are routinely used during many surgical procedures. According to the data published by the CDC in May 2024, about 38 million individuals in the U.S. have diabetes, and approximately 98 million American adults are prediabetic. Moreover, as per the data published by the National Heart, Lung, and Blood Institute in October 2023, COPD affects around 16 million adults in the U.S. Thus, the growing patient population suffering from chronic diseases across the U.S. is anticipated to support the segment growth in the coming years.

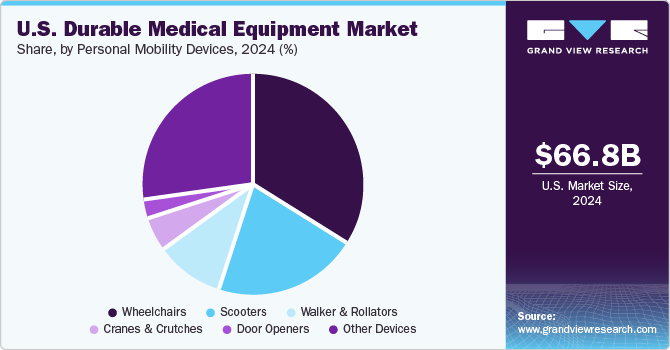

The personal mobility devices segment is anticipated to register the fastest growth rate during the forecast period. The growing geriatric population and rising chronic illnesses are expected to create more need and demand for mobility products over the forecast period as these factors generally reduce the ability to move and perform physical tasks to maintain independent functioning. Moreover, aged people are more prone to falls, which can cause fatal or non-fatal injuries.

Key U.S. Durable Medical Equipment Company Insights

Key companies in the U.S. DME market are proactively driving industry evolution through strategic initiatives like mergers & acquisitions, regional expansion, and innovative product development. With a focus on capturing a substantial market share, these players introduce cutting-edge technologies and diversified products. The market landscape is characterized by a mix of major players, local distributors, and suppliers. The key emphasis is on providing cost-efficient products with remote usability. Notably, trends such as strategic home healthcare solutions, artificial intelligence integration, and expanded telehealth capabilities are pivotal, addressing evolving healthcare needs and propelling overall market growth. This dynamic landscape sets new industry standards, fosters healthy competition, and enhances the overall quality of products and services in the industry.

Key U.S. Durable Medical Equipment Companies:

- Invacare Corp.

- Sunrise Medical

- Arjo

- Medline Industries, Inc.

- GF Healthcare Products, Inc.

- Carex Health Brands, Inc.

- Cardinal Health

- Drive DeVilbiss Healthcare

- NOVA Medical Products

- Kaye Products, Inc.

- Inogen, Inc.

- Thermo Fisher Scientific Inc.

- Abbott

- Medtronic

- Baxter

- B. Braun SE

- Boston Scientific Corporation

- BD

- PAUL HARTMANN AG

Recent Developments

-

In August 2024, Medline successfully completed the acquisition of the surgical solutions business from Ecolab Inc. This acquisition strengthens Medline's position in the surgical products sector, expanding its portfolio of offerings to healthcare providers.

-

In June 2024, Abbott received U.S. FDA clearance for two new over-the-counter CGM systems. These advanced CGM systems are designed to offer individuals greater accessibility and convenience in managing their glucose levels without requiring a prescription.

-

In June 2024, Boston Scientific Corporation announced that it entered into a definitive agreement to acquire Silk Road Medical, Inc. This medical device company has developed a pioneering platform for preventing stroke in patients with carotid artery disease through a minimally invasive procedure known as Transcarotid Artery Revascularization (TCAR).

-

In March 2024, Sunrise Medical introduced the QUICKIE Q50 R Carbon, the lightest folding power wheelchair in the QUICKIE lineup, weighing just 32 lbs. This compact and easily transportable wheelchair is designed for effortless storage and maneuverability, offering an ideal solution for individuals who wish to stay active & independent without the hassle of a bulky and heavy mobility device.

-

In January 2024, Novo Nordisk entered research collaborations with Omega Therapeutics and Cellarity to explore novel treatment approaches for cardiometabolic diseases.

U.S. Durable Medical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.66 billion

Revenue forecast in 2030

USD 92.83 billion

Growth Rate

CAGR of 5.61% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Product, end-use

Key companies profiled

Invacare Corp., Sunrise Medical, Arjo, Medline Industries, Inc., GF Healthcare Products, Inc., Carex Health Brands, Inc., Cardinal Health, Drive DeVilbiss Healthcare, NOVA Medical Products, Kaye Products, Inc., Inogen, Inc., Thermo Fisher Scientific Inc., Abbott, Medtronic, Baxter, B. Braun SE, Boston Scientific Corporation, BD, PAUL HARTMANN AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Durable Medical Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. durable medical equipment market report based on product, and end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Mobility Devices

-

Wheelchairs

-

Electric Wheelchairs

-

Manual Wheelchairs

-

-

Scooters

-

Walker and Rollators

-

Cranes and Crutches

-

Door Openers

-

Other Devices

-

-

Bathroom Safety Devices and Medical Furniture

-

Commodes and Toilets

-

Mattress & Bedding Devices

-

-

Monitoring and Therapeutic Devices

-

Blood Glucose Monitors

-

Continuous Passive Motion (CPM)

-

Infusion Pumps

-

Nebulizers

-

Oxygen equipment

-

Continuous Positive Airway Pressure (CPAP)

-

Suction Pumps

-

Traction Equipment

-

Others

-

Insulin Pumps

-

Ostomy Bags & Accessories

-

Wound Care Products

-

Cardiology Devices

-

Vital Signs Monitor

-

Respiratory Supplies

-

Urinary Supplies

-

Diabetic Supplies

-

Incontinence Products

-

Orthopedic Braces & Support

-

Muscle Stimulators

-

Others

-

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Home Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. durable medical equipment market size was established at USD 66.81 billion in 2024 and is expected to reach USD 70.66 billion in 2025.

b. The U.S. durable medical equipment market is expected to grow at a compound annual growth rate of 5.61% from 2025 to 2030 to reach USD 92.83 billion in 2030.

b. The monitoring and therapeutic devices segment dominated the U.S. durable medical equipment market with a share of 91.40% in 2024. This is attributable to their ease of use, convenience, and patient preference for the equipment.

b. Some key players operating in the U.S. DME market include Invacare Corp., Sunrise Medical, Arjo, Medline Industries, Inc., GF Healthcare Products, Inc., Carex Health Brands, Inc., Cardinal Health, Drive DeVilbiss Healthcare, NOVA Medical Products, Kaye Products, Inc., Inogen, Inc., Thermo Fisher Scientific Inc., Abbott, Medtronic, Baxter, B. Braun SE, Boston Scientific Corporation, BD, and PAUL HARTMANN AG.

b. Key factors that are driving the U.S. durable medical equipment market growth include an increase in the prevalence of chronic disease, rapid technological advancements, and a rising aging population.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. DME Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Ancillary Market Outlook

3.2. Regulatory Scenario

3.3. Reimbursement Scenario

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.1.1. Increasing prevalence of chronic diseases requiring long-term care

3.4.1.2. Rapidly growing geriatric population

3.4.1.3. Technological advancements

3.4.2. Market Restraint Analysis

3.4.2.1. High purchase and maintenance costs

3.4.2.2. Lack of skilled professionals to handle this equipment

3.4.3. Market Opportunity Analysis

3.4.3.1. Increasing penetration of home healthcare services and staff

3.4.3.2. Merger and acquisitions

3.4.4. Market Challenge Analysis

3.4.4.1. Product recall

3.4.4.2. Rising competition

3.5. DME Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Bargaining power of suppliers

3.5.1.2. Bargaining power of buyers

3.5.1.3. Threat of substitutes

3.5.1.4. Threat of new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political & Legal Landscape

3.5.2.2. Economic and Social Landscape

3.5.2.3. Technological landscape

3.5.3. COVID-19 Impact Analysis

3.5.3.1. Disrupted DME

3.5.3.2. Obstacles in DME

Chapter 4. DME Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. DME Market: Product Movement Analysis & Market Share, 2024 & 2030

4.3. Personal Mobility Devices

4.3.1. Personal Mobility Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2. Wheelchairs Market

4.3.2.1 Wheelchairs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2.2 Electric Wheelchairs Market

4.3.2.2.1 Electric Wheelchairs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2.3 Manual Wheelchairs Market

4.3.2.3.1 Manual Wheelchairs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.3. Scooters Market

4.3.3.1 Scooters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.4. Walker and Rollators Market

4.3.4.1 Walker and Rollators Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.5. Cranes and Crutches Market

4.3.5.1 Cranes and Crutches Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.6. Door Openers Market

4.3.6.1 Door Openers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.7. Other Devices Market

4.3.7.1 Other Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Bathroom Safety Devices and Medical Furniture

4.4.1. Bathroom Safety Devices and Medical Furniture Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2. Commodes and Toilets Market

4.4.2.1 Commodes and Toilets Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.3. Mattress & Bedding Devices Market

4.4.3.1 Mattress & Bedding Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Monitoring and Therapeutic Devices

4.5.1. Monitoring and Therapeutic Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.2. Blood Sugar Monitors Market

4.5.2.1 Blood Sugar Monitors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3. Continuous Passive Motion (CPM) Market

4.5.3.1 Commodes and Toilets Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.4. Infusion Pumps Market

4.5.4.1 Infusion Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.5. Nebulizers Market

4.5.5.1 Nebulizers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.6. Infusion Pumps Market

4.5.6.1 Infusion Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.7. Oxygen Equipment Market

4.5.7.1 Oxygen Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.8. Continuous Positive Airway Pressure (CPAP) Market

4.5.8.1 Continuous Positive Airway Pressure (CPAP) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.9. Suction pumps Market

4.5.9.1 Suction Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.10. Traction equipment Market

4.5.10.1 Traction Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11. Others Market

4.5.11.1 Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.2 Insulin Pumps Market

4.5.11.2.1 Insulin Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.3 Ostomy Bags & Accessories Market

4.5.11.3.1 Ostomy Bags & Accessories Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.4 Wound Care Products Market

4.5.11.4.1 Wound Care Products Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.5 Cardiology Devices Market

4.5.11.5.1 Cardiology Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.6 Vital Signs Monitor Market

4.5.11.6.1 Vital Signs Monitor Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.7 Respiratory Supplies Market

4.5.11.7.1 Respiratory Supplies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.8 Urinary Supplies Market

4.5.11.8.1 Urinary Supplies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.9 Diabetic Supplies Market

4.5.11.9.1 Diabetic Supplies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.10 Incontinence Products Market

4.5.11.10.1 Incontinence Products Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.11 Orthopedic Braces & Support Market

4.5.11.11.1 Orthopedic Braces & Support Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.12 Muscle Stimulators Market

4.5.11.12.1 Muscle Stimulators Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.11.13 Others Market

4.5.11.13.1 Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. DME Market: End Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. DME Market: End Use Movement Analysis & Market Share, 2024 & 2030

5.3. Hospitals

5.3.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Specialty Clinics

5.4.1. Specialty Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Ambulatory Surgical Centers

5.5.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Diagnostic Centers

5.6.1. Diagnostic Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Home Healthcare

5.7.1. Home Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Others

5.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Competitive Landscape

6.1. Market Participant Categorization

6.2. Key Company Profiles

6.2.1. Invacare Corporation

6.2.1.1. Company Overview

6.2.1.2. Financial Performance

6.2.1.3. Product Benchmarking

6.2.1.4. Strategic Initiatives

6.2.2. Sunrise Medical

6.2.2.1. Company Overview

6.2.2.2. Financial Performance

6.2.2.3. Product Benchmarking

6.2.2.4. Strategic Initiatives

6.2.3. Arjo

6.2.3.1. Company Overview

6.2.3.2. Financial Performance

6.2.3.3. Product Benchmarking

6.2.3.4. Strategic Initiatives

6.2.4. Medline Industries, Inc.

6.2.4.1. Company Overview

6.2.4.2. Financial Performance

6.2.4.3. Product Benchmarking

6.2.4.4. Strategic Initiatives

6.2.5. GF Healthcare Products, Inc.

6.2.5.1. Company Overview

6.2.5.2. Financial Performance

6.2.5.3. Product Benchmarking

6.2.5.4. Strategic Initiatives

6.2.6. Carex Health Brands, Inc.

6.2.6.1. Company Overview

6.2.6.2. Financial Performance

6.2.6.3. Product Benchmarking

6.2.6.4. Strategic Initiatives

6.2.7. Cardinal Health

6.2.7.1. Company Overview

6.2.7.2. Financial Performance

6.2.7.3. Product Benchmarking

6.2.7.4. Strategic Initiatives

6.2.8. Drive DeVilbiss Healthcare

6.2.8.1. Company Overview

6.2.8.2. Financial Performance

6.2.8.3. Product Benchmarking

6.2.8.4. Strategic Initiatives

6.2.9. NOVA Medical Products

6.2.9.1. Company Overview

6.2.9.2. Financial Performance

6.2.9.3. Product Benchmarking

6.2.9.4. Strategic Initiatives

6.2.10. Kaye Products, Inc.

6.2.10.1. Company Overview

6.2.10.2. Financial Performance

6.2.10.3. Product Benchmarking

6.2.10.4. Strategic Initiatives

6.2.11. Inogen, Inc.

6.2.11.1. Company Overview

6.2.11.2. Financial Performance

6.2.11.3. Product Benchmarking

6.2.11.4. Strategic Initiatives

6.2.12. Thermo Fisher Scientific Inc.

6.2.12.1. Company Overview

6.2.12.2. Financial Performance

6.2.12.3. Product Benchmarking

6.2.12.4. Strategic Initiatives

6.2.13. Abbott

6.2.13.1. Company Overview

6.2.13.2. Financial Performance

6.2.13.3. Product Benchmarking

6.2.13.4. Strategic Initiatives

6.2.14. Medtronic

6.2.14.1. Company Overview

6.2.14.2. Financial Performance

6.2.14.3. Product Benchmarking

6.2.14.4. Strategic Initiatives

6.2.15. Baxter

6.2.15.1. Company Overview

6.2.15.2. Financial Performance

6.2.15.3. Product Benchmarking

6.2.15.4. Strategic Initiatives

6.2.16. B. Braun SE

6.2.16.1. Company Overview

6.2.16.2. Financial Performance

6.2.16.3. Service Benchmarking

6.2.16.4. Strategic Initiatives

6.2.17. Boston Scientific Corporation

6.2.17.1. Company Overview

6.2.17.2. Financial Performance

6.2.17.3. Product Benchmarking

6.2.17.4. Strategic Initiatives

6.2.18. BD

6.2.18.1. Company Overview

6.2.18.2. Financial Performance

6.2.18.3. Product Benchmarking

6.2.18.4. Strategic Initiatives

6.2.19. PAUL HARTMANN AG

6.2.19.1. Company Overview

6.2.19.2. Financial Performance

6.2.19.3. Product Benchmarking

6.2.19.4. Strategic Initiatives

6.3. Heat Map Analysis/ Company Market Position Analysis

6.4. Estimated Company Market Share Analysis, 2024

6.5. List of Other Key Market Players

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. U.S. DME Market, by Product, 2018 - 2030 (USD Million)

Table 4. U.S. DME Market, by End Use, 2018 - 2030 (USD Million)

Table 5. Participant’s Overview

Table 6. Financial Performance

Table 7. Service Benchmarking

Table 8. Strategic Initiatives

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 DME Market, Market Segmentation

Fig. 7 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 8 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 9 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 10 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 11 Porter’s Five Forces Analysis

Fig. 12 Country Marketplace: Key Takeaways

Fig. 13 U.S. DME Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- U.S. DME Product Outlook (Revenue, USD Million, 2018 - 2030)

- Personal Mobility Devices

- Wheelchairs

- Electric Wheelchairs

- Manual Wheelchairs

- Scooters

- Walker and Rollators

- Cranes and Crutches

- Door Openers

- Other Devices

- Wheelchairs

- Bathroom Safety Devices and Medical Furniture

- Commodes and Toilets

- Mattress & Bedding Devices

- Monitoring and Therapeutic Devices

- Blood Glucose Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps

- Nebulizers

- Oxygen equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Others

- Insulin Pumps

- Ostomy Bags & Accessories

- Wound Care Products

- Cardiology Devices

- Vital Signs Monitor

- Respiratory Supplies

- Urinary Supplies

- Diabetic Supplies

- Incontinence Products

- Orthopedic Braces & Support

- Muscle Stimulators

- Others

- Personal Mobility Devices

- U.S. DME End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Others

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Country market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Country market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectationsData Collection Matrix

Perspective

Primary research

Secondary research

Supply-side

- Manufacturers

- Technology distributors and wholesalers

- Company reports and publications

- Government publications

- Independent investigations

- Economic and demographic data

Demand-side

- End-user surveys

- Consumer surveys

- Mystery shopping

- Case studies

- Reference customers

Industry Analysis MatrixQualitative analysis

Quantitative analysis

- Industry landscape and trends

- Market dynamics and key issues

- Technology landscape

- Market opportunities

- Porter’s analysis and PESTEL analysis

- Competitive landscape and component benchmarking

- Policy and regulatory scenario

- Market revenue estimates and forecast up to 2030

- Market revenue estimates and forecasts up to 2030, by technology

- Market revenue estimates and forecasts up to 2030, by application

- Market revenue estimates and forecasts up to 2030, by type

- Market revenue estimates and forecasts up to 2030, by component

- Regional market revenue forecasts, by technology

- Regional market revenue forecasts, by application

- Regional market revenue forecasts, by type

- Regional market revenue forecasts, by component

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."