- Home

- »

- Advanced Interior Materials

- »

-

U.S. Earplugs Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Earplugs Market Size, Share & Trends Report]()

U.S. Earplugs Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Foam, Silicone), By Technology (Active Earplugs), By Noise Reduction Rating (10-20 dB, 21-25 dB), By Type, By Application (Industrial & Occupational), And Segment Forecasts

- Report ID: GVR-4-68040-694-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Earplugs Market Summary

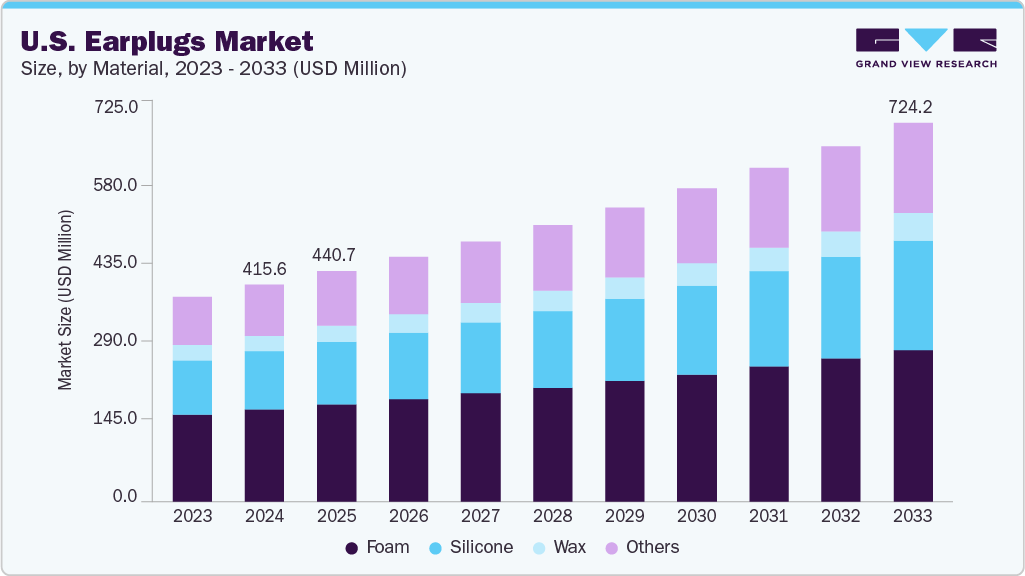

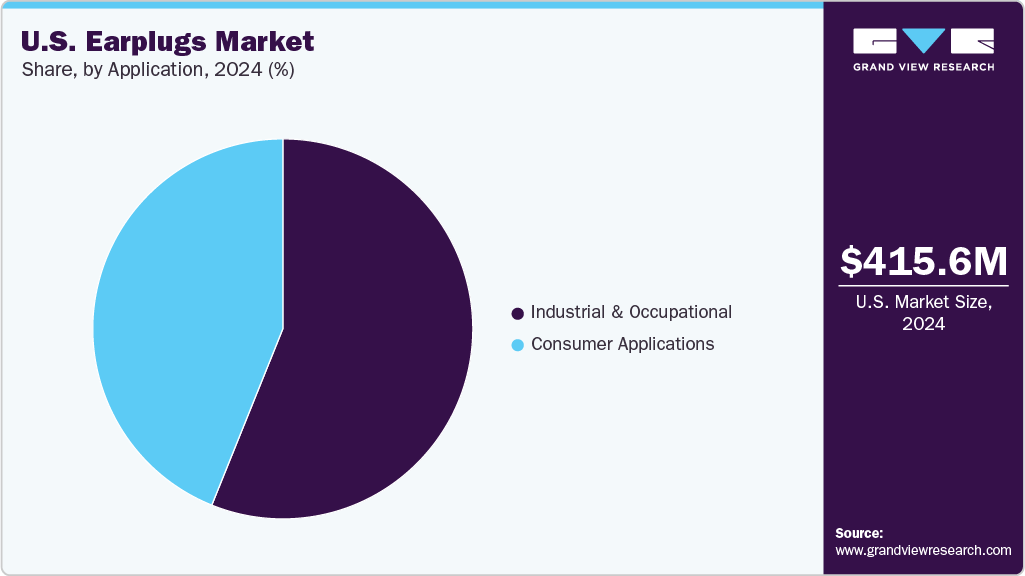

The U.S. earplugs market size was estimated at USD 415.6 million in 2024 and is projected to reach USD 724.2 million by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The market is witnessing growth due to stringent occupational safety regulations set by OSHA and other federal agencies.

Key Market Trends & Insights

- The earplugs market in the U.S. is expected to grow at a substantial CAGR of 6.4% from 2025 to 2033.

- By material, silicone segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033 in terms of revenue.

- By technology, the active earplug segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

- By application, consumer applications segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 415.6 Million

- 2033 Projected Market Size: USD 724.2 Million

- CAGR (2025-2033): 6.4%

These regulations mandate the use of hearing protection in high-noise environments such as construction, manufacturing, and mining. Employers are increasingly adopting earplugs to ensure compliance and protect workers from noise-induced hearing loss. This trend is driving consistent demand across industrial sectors. Increased awareness among consumers about the long-term effects of noise exposure is positively influencing the U.S. market. People are increasingly using earplugs for concerts, travel, shooting sports, and sleeping. The availability of customized and comfortable designs has further boosted their adoption in personal use. As a result, the consumer segment is becoming a key contributor to market expansion.

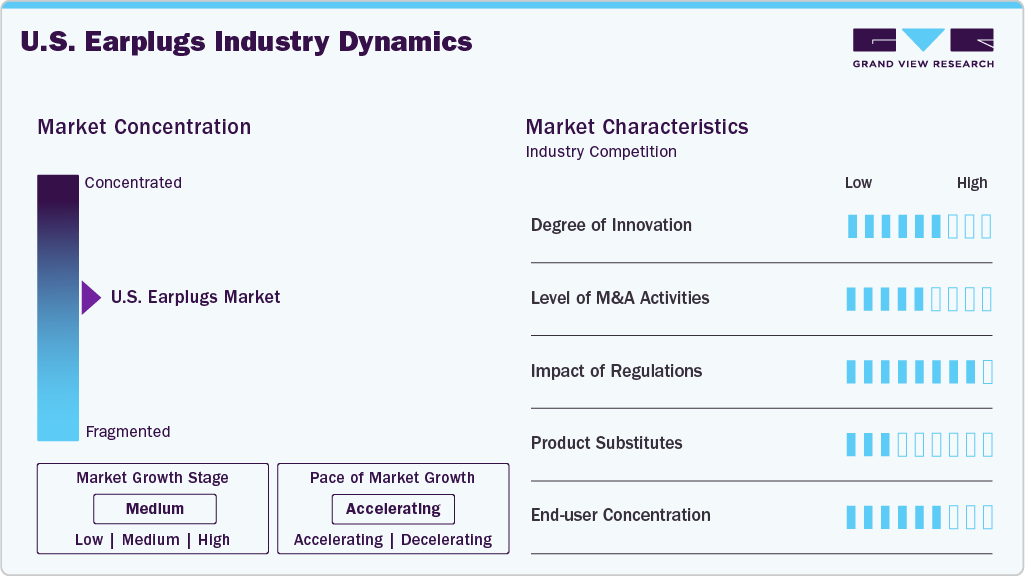

Market Concentration & Characteristics

The market for U.S. earplugs is moderately concentrated, with a few major players holding significant market share. Companies like 3M and PIP Global Safety dominate due to their extensive distribution networks and established brand presence. However, the market also features several smaller regional and niche players offering specialized or custom-fit products. This blend of large and small firms contributes to moderate competition and innovation within the sector.

The U.S. earplugs industry is marked by a steady pace of innovation, especially in terms of comfort, material technology, and noise-filtering efficiency. Manufacturers are investing in ergonomic designs, reusable materials, and smart earplugs with built-in audio features. Innovations aim to cater to both industrial users and personal consumers seeking enhanced protection and usability. This has expanded product offerings and improved user experience.

The earplugs industry in the U.S. has seen moderate M&A activity, primarily driven by large firms acquiring niche companies to diversify their product lines. Strategic acquisitions help players enter new market segments and strengthen their technological capabilities. Such moves also allow companies to expand their customer base and geographical reach. This consolidation trend is helping reshape competitive dynamics.

Regulations in the U.S., particularly from OSHA and ANSI, play a crucial role in shaping the earplugs market. These standards mandate specific noise reduction ratings (NRRs) and testing protocols for workplace hearing protection. Compliance drives demand in industrial sectors while influencing product development and certification. Regulatory oversight ensures quality and consistency, supporting user safety and trust.

Drivers, Opportunities & Restraints

In the U.S., the earplugs market is primarily driven by strict workplace safety regulations enforced by OSHA and NIOSH. High noise levels in industries such as construction, manufacturing, and defense increase the need for hearing protection. Rising awareness of noise-induced hearing loss among workers and employers supports steady demand. In addition, growing adoption of earplugs for recreational use, such as concerts and shooting ranges, contributes to market growth.

The U.S. market presents strong opportunities in the consumer and healthcare segments, particularly for sleep and travel-related earplugs. Demand for personalized and tech-integrated earplugs, including smart and Bluetooth-enabled models, is gaining momentum. Online retail growth provides greater access to innovative products for consumers across regions. Expanding use in schools, hospitals, and public events offers additional avenues for growth.

In the U.S., inconsistent usage compliance in non-regulated sectors limits the full potential of earplug adoption. Many users experience discomfort or improper fit, reducing long-term usage. The market also faces challenges from counterfeit or low-quality imports that affect brand trust and safety performance. Price competition among local and international brands can further pressure profit margins for premium product providers.

Material Insights

Foam earplugs segment dominated the market and accounted for a share of 42.5% in 2024, due to their affordability, wide availability, and high noise reduction capability. They are widely used in industrial settings and meet OSHA standards, making them a preferred choice for workplace safety. Their disposable nature supports hygiene and convenience for large-scale use. The simplicity and effectiveness of foam materials keep them in strong demand across sectors.

Silicone earplugs are anticipated to witness the fastest CAGR over the forecast period, attributed to rising consumer demand for reusable and comfortable options. Their durability and water-resistant properties make them ideal for sleeping, swimming, and travel applications. Increasing focus on sustainable and long-lasting products also boosts silicone adoption. In addition, their hypoallergenic nature appeals to users with skin sensitivities, further accelerating growth.

Technology Insights

Passive earplugs segment accounted for a share of 72.8% in 2024 owing to their affordability, reliability, and widespread use across industrial and recreational sectors. They are commonly used in manufacturing, construction, and public events where basic noise blocking is essential. Passive models meet OSHA compliance standards and are easy to distribute on a large scale. Their disposable nature also makes them ideal for hygienic, short-term use in workplaces.

Active earplugs are the fastest-growing segment in the U.S., fueled by rising demand from military personnel, shooting ranges, and law enforcement agencies. These devices offer advanced sound filtering, allowing users to hear speech and ambient sounds while blocking harmful noise. Growth is also driven by U.S. consumers seeking high-tech solutions for concerts, travel, and occupational use. Integration with Bluetooth and hearing enhancement features further boosts their appeal in the U.S. market.

Noise Reduction Rating Insights

Earplugs with a Noise Reduction Rating (NRR) of 26-29 dB dominate the market and accounted for 35.3% market share in 2024, as their effectiveness in meeting OSHA-mandated protection levels for high-noise environments. These earplugs are widely used in industrial sectors such as construction, manufacturing, and aviation. They strike a balance between strong noise blocking and user comfort, making them suitable for extended wear. Their broad application across regulated workplaces ensures consistent demand.

Earplugs with an NRR of 21-25 dB are the fastest-growing segment in the U.S., driven by rising demand for moderate protection in non-industrial settings. Consumers increasingly use them for activities like sleeping, studying, traveling, and attending live events. These earplugs offer adequate noise control without completely isolating the user from their environment. The shift toward personal wellness and lifestyle-focused hearing solutions is fueling this segment’s rapid growth.

Type Insights

Disposable earplugs segment accounted for a share of 60.6% in 2024owing to their cost-effectiveness, hygiene benefits, and widespread adoption in industrial and healthcare environments. They are particularly favored in workplaces where single-use products reduce the risk of contamination and ensure compliance with OSHA safety guidelines. Their convenience and availability in bulk make them ideal for large-scale distribution. Industries like construction, manufacturing, and aviation heavily rely on disposable options for daily operations.

Reusable earplugs are the fastest-growing segment in the U.S., driven by increasing consumer focus on sustainability, long-term cost savings, and enhanced comfort. These earplugs are gaining popularity in lifestyle applications such as sleeping, concerts, and travel, where users seek durable and eco-friendly options. Advancements in materials like silicone have improved fit and washability, further boosting appeal. Rising environmental awareness and regulatory support for waste reduction are accelerating their adoption.

Application Insights

The industrial and occupational segment accounted for a share of 56.1% in 2024 due to strict regulatory enforcement by OSHA and widespread use across high-noise sectors like construction, manufacturing, mining, and aviation. Employers are mandated to provide hearing protection, making earplugs a standard safety tool. The high volume of daily users in these environments supports consistent bulk demand. In addition, workplace safety initiatives and training programs further reinforce their use.

Consumer applications represent the fastest-growing segment in the U.S., driven by rising awareness of hearing health and lifestyle needs. Individuals increasingly use earplugs for sleeping, traveling, swimming, concerts, and shooting sports. Growth is supported by online retail, customized fit solutions, and innovations like smart or Bluetooth-enabled earplugs. As more Americans seek personal wellness and noise management tools, this segment continues to expand rapidly.

Key U.S. Earplugs Company Insights

Some of the key players operating in the market include 3M, Moldex-Metric, and Hearos

-

3M is a major player in the U.S. market, offering a wide range of hearing protection products designed for industrial, military, and consumer use. The company’s earplugs segment includes foam, push-to-fit, and custom-molded solutions tailored to different noise levels and environments. 3M serves key verticals such as construction, manufacturing, mining, oil & gas, and defense, where noise protection is critical. Its innovations focus on comfort, durability, and compliance with U.S. safety standards. The company also integrates technologies like communication-enabled earplugs for high-noise settings.

-

Moldex-Metric specializes in the development of high-performance hearing protection equipment, with a strong emphasis on earplugs. Its product line includes disposable foam earplugs, reusable models, and banded earplugs designed for industrial workplaces. The company focuses heavily on the construction, metalworking, and petrochemical industries—key verticals where hearing loss prevention is essential. Moldex products are known for ergonomic design, long-wear comfort, and compliance with OSHA and EN standards. The brand also targets environmentally conscious users with PVC-free product options.

Key U.S. Earplugs Companies:

- 3M

- Moldex-Metric

- Hearos

- Radians, Inc.

- Loop Earplugs

- Lucid Hearing Holding Company, LLC

- Magid Glove & Safety Manufacturing Company LLC

- Allens Industrial Products

- Honeywell International Inc

- PIP

Recent Developments

-

In January 2025, Sennheiser launched its SoundProtex earplugs, designed to offer safe listening without compromising audio clarity. The earplugs use a two-stage acoustic filter to balance sound frequencies while reducing volume. Made from hypoallergenic materials, they are reusable and come in multiple sizes for a secure fit. These earplugs are ideal for concerts, travel, and noisy environments, ensuring hearing protection with high sound fidelity.

-

In May 2025, PIP acquired Honeywell’s PPE business, adding well-known brands like Howard Leight and Fibre-Metal to its portfolio. This move expands PIP’s offerings across hearing, eye, and head protection, as well as safety gear for industrial and utility sectors. The acquisition strengthens its U.S. market reach. It positions PIP as a more comprehensive safety solution provider.

-

In May 2023, EarPeace partnered with NEXX Helmets to launch a special line of earplugs designed for motorcyclists. The product features EarPeace’s Contour earplugs in a custom NEXX Cherry color. It offers up to 27 dB noise reduction while allowing clear communication during rides. This collaboration highlights both brands’ focus on enhancing rider safety and comfort.

U.S. Earplugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 440.7 million

Revenue forecast in 2033

USD 724.2 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, technology, noise reduction rating, type, and application

Country scope

U.S.

Key companies profiled

3M; Moldex-Metric; Hearos; Radians, Inc.; Loop Earplugs; Lucid Hearing Holding Company, LLC; Magid Glove & Safety Manufacturing Company LLC; Allens Industrial Products; Honeywell International Inc; PIP.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Earplugs Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. earplugs market report based on material, technology, noise reduction rating, type, and application:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Foam

-

Silicone

-

Wax

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Earplugs

-

Passive Earplugs

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable

-

Reusable

-

-

Noise Reduction Rating Outlook (Revenue, USD Million, 2021 - 2033)

-

10-20 dB

-

21-25 dB

-

26-29 dB

-

30-33 dB

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial & Occupational

-

Automotive

-

Construction

-

Energy

-

Aviation

-

Healthcare

-

Mining

-

Others

-

- Consumer Applications

-

Frequently Asked Questions About This Report

b. The U.S. earplugs market size was estimated at USD 415.6 million in 2024 and is expected to be USD 440.7 million in 2025.

b. The U.S. earplugs market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 724.2 million by 2033.

b. Passive earplugs segment accounted for a share of 72.8% in 2024 owing to their affordability, reliability, and widespread use across industrial and recreational sectors. They are commonly used in manufacturing, construction, and public events where basic noise blocking is essential. Passive models meet OSHA compliance standards and are easy to distribute on a large scale.

b. Some of the key players operating in the U.S. earplugs market include 3M; Moldex-Metric; Hearos; Radians, Inc.; Loop Earplugs; Lucid Hearing Holding Company, LLC; Magid Glove & Safety Manufacturing Company LLC; Allens Industrial Products; Honeywell International Inc.; PIP.

b. Key factors driving the U.S. earplugs market include strict occupational safety regulations, growing awareness of hearing protection, and increased usage across both industrial and personal applications. Rising noise exposure in sectors like construction and defense fuels demand for effective solutions. Additionally, lifestyle trends and innovations in comfort and technology are expanding consumer adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.