- Home

- »

- Medical Devices

- »

-

U.S. Electroencephalography Devices Market, Industry Report, 2030GVR Report cover

![U.S. Electroencephalography Devices Market Size, Share & Trends Report]()

U.S. Electroencephalography Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (32-Channel, Multichannel), By Type (Portable Device, Standalone Device), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-235-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

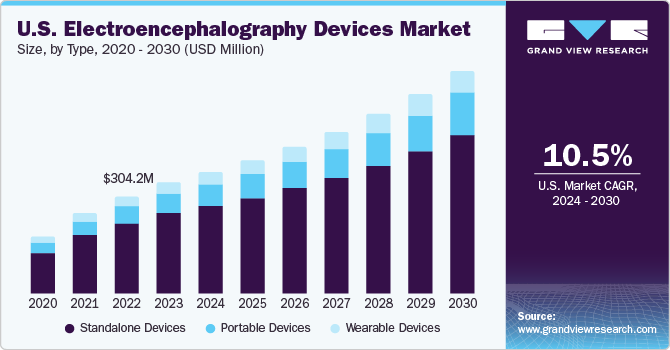

The U.S. electroencephalography devices market size was valued at USD 348.6 million in 2023 and is anticipated to expand at a CAGR of 10.55% from 2024 to 2030. The growing burden of neurological disorders due to lifestyle changes, traumatic brain injury, and increasing substance use and addiction are some of the factors majorly contributing to the market growth. Furthermore, adoption of smart electroencephalography (EEG) devices and technologically advanced devices such as Artificial Intelligence (AI) & data analytics are expected to drive market growth.

Rising prevalence of neurological disorders is a concerning trend that has been observed in recent years. Some common neurological disorders are epilepsy, Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, and migraine headaches. This has led to an increase in demand for diagnostic tools & technologies that can help healthcare providers identify and effectively manage these conditions. EEG devices are one such technology that has become more widely used in recent years. The U.S. electroencephalography devices market accounted for 29% of the global electroencephalography devices market in 2023.

While EEG has been around for several decades, there is a continuous need for development of technologically advanced diagnostic systems such as portable EEG systems for improved accuracy and sensitivity of EEG data, and real-time monitoring of brain. Wearable EEG systems, virtual reality & augmented reality interfaces, multimodal imaging techniques, and closed-loop systems are also emerging areas of development that have the potential to significantly improve the accuracy, convenience, & patient experience of EEG diagnostics.

In addition, the increasing geriatric population, growing cases of accidents lead to brain injuries, and technological advancements are promoting market growth. For instance, in November 2022, Cadwell Laboratories, Inc. launched Arc EEG software version 3.0 SP3, which is compatible with all Arc EEG systems, such as Arc Essentia, Zenith, Apollo+ 32- and 64- channel, Apollo 32-channel, Arc Alterna, and Easy III.

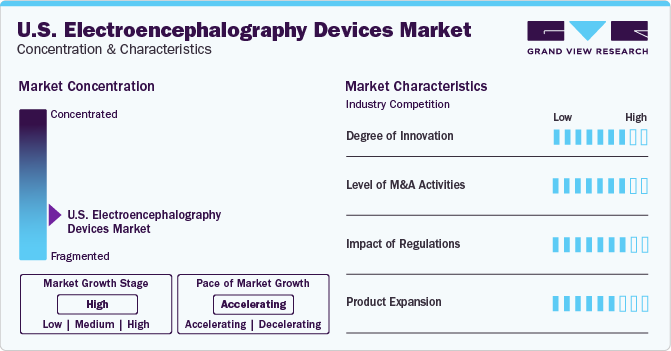

Market Concentration & Characteristics

The U.S. EEG devices industry is highly fragmented with the presence of several domestic and international players with a significant market share. New product launches, mergers & acquisitions, partnerships, and facility expansions are some of the major strategies undertaken by key companies to increase their presence. Development of technologically advanced products, such as portable devices, for measuring neurological disorders will further stimulate industry growth.

Companies are introducing a variety of innovative products to maintain competitiveness. This has created opportunities for new companies to enter the market and for existing companies to expand their operations as well. For instance, in May 2022, Sharp HealthCare initiated a long-term project-through a USD 2 billion investment-of expanding its medical facilities in San Diego. This involves building a new emergency and trauma expansion in Serra Mesa.

Major companies are adopting several strategies like mergers & acquisitions and partnerships & collaborations to increase their capabilities, expand their product portfolios, and stay competitive. For instance, in July 2022, Natus Medical, Inc. announced that it was acquired by ArchiMed, an investment firm specializing in the healthcare sector. According to the closing merger contract, Natus stockholders were given USD 33.50 in cash in exchange for each share of their Natus common stock.

Reimbursement policy in the U.S. is favorable for providers and patients when compared to other nations. The favorable reimbursement scenario provides access to healthcare services related to brain treatment to a large portion of the population. Subsequently, it creates a demand for cost-effective and efficient electroencephalography devices. Hence, many companies are seeking U.S. FDA approval to launch their products in the U.S. For instance, in January 2022, Neurosteer Inc. received the U.S. FDA approval for its single-channel Electroencephalogram (EEG) brain monitoring platform. This system helps in the early detection of presymptomatic cognitive diseases, such as Alzheimer’s, dementia, and Parkinson’s.

Product Insights

The 32-channel EEG segment accounted for the largest share of 27.44% in 2023. The high acceptance by physicians and technological development are the major factors for its dominance. In addition, increasing prevalence of neurological disorders, such as Attention Deficit Hyperactive Disorder (ADHD), Alzheimer’s disease, and Parkinson’s disease are some of the drivers responsible for its high share.

The multichannel EEG segment is expected to witness the fastest CAGR over the forecast period. The numerous brain activity recording abilities associated with multichannel EEG gives a competitive advantage over other products. Systems such as Neuron-Spectrum-1/BFB can monitor HR, EMG, respiratory rate, GSR, SpO2, and temperature, providing data on multiple parameters for the biofeedback training process. Thus, a wide presence of key companies and their multichannel EEG device offerings are expected to drive market growth.

Type Insights

The standalone devices segment accounted for the largest share of 87.80% in 2023. Standalone EEG devices operate independently without the need for a separate computer or software. These devices typically have builtin displays and storage capabilities for recording & storing EEG data. Standalone EEG devices are often used in remote or field settings where access to a computer is limited or impractical. They can also be used in emergencies, such as in diagnosing and treating seizures, where immediate EEG monitoring is required. These factors are expected to positively impact the segment’s growth further.

The portable devices segment is expected to witness the fastest CAGR over the forecast period. Portable EEG devices are compact and lightweight devices that can measure & record electrical activity in the brain, making them ideal for use in mobile and remote environments. Key initiatives are adopted by companies to hold a large market share by introducing and offering novel portable devices. These factors are expected to have a positive impact on market growth.

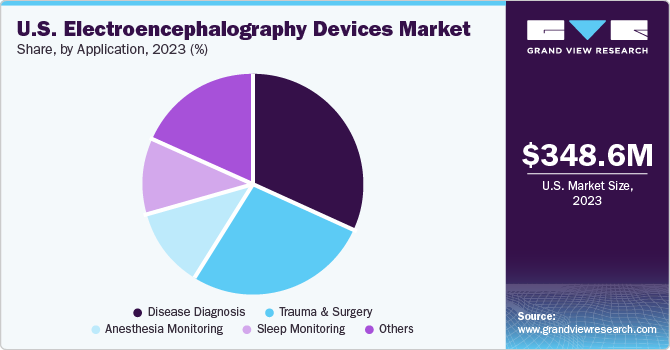

Application Insights

The disease diagnosis segment accounted for the largest share of 87.80% in 2023. EEG devices can be used to diagnose various neurological disorders and conditions. EEG can also diagnose sleep disorders such as sleep apnea and insomnia. The information obtained from EEG recordings can be used to guide treatment decisions and improve patient outcomes. Hence, the segment is expected to witness further growth in the forthcoming years.

The trauma & surgery segment is expected to witness the fastest CAGR over the forecast period. During surgery or traumatic events, these EEG devices can help detect changes in brain activity that may be indicative of injury or trauma, such as changes in brain wave patterns or electrical activity. According to the American Association for Surgery of Trauma, traumatic brain injury (TBI) is the leading cause of death in the U.S., with an annual incidence of 1 million cases. Thus, increasing prevalence of TBIs is anticipated to drive market growth.

End-use Insights

The hospitals segment accounted for the largest share of 87.80% in 2023. Overall, EEG devices play an important role in hospitals by providing doctors with valuable information about brain activity that can be used to diagnose and treat various neurological conditions. Thus, increasing investment in developing novel hospitals may boost the demand and adoption of EEG devices.

The diagnostic centers segment is expected to witness the fastest CAGR over the forecast period. Laboratories prefer examining the brain activity of neurological disorder patients in diagnostic centers to identify diseases due to their effectiveness in providing instant results without long waiting times. Ambulatory EEG machine devices are widely used in these diagnostic centers to diagnose sleep disorders. Thus, increasing demand for EEG devices in diagnostic centers is expected to propel segment growth.

Key U.S. Electroencephalography Devices Company Insights

The U.S. registers rapid growth majorly owing to the presence of a large number of medical device companies. Some of the prominent U.S. electroencephalography device companies operating in the market include Natus Medical, Inc., Electrical Geodesics, Inc., Medtronic, NeuroWave Systems, Inc., Compumedics Ltd., and Emotiv.

Furthermore, strategic initiatives undertaken by these companies to strengthen the product portfolio, a wide presence of key companies, and their multichannel offerings are expected to drive market growth.

Key U.S. Electroencephalography Devices Companies:

- Natus Medical, Inc.

- Electrical Geodesics, Inc.

- Medtronic

- NeuroWave Systems, Inc.

- Compumedics Ltd.

- Noraxon U.S.A., Inc.

- Cadwell Laboratories, Inc.

- Nihon Kohden America, Inc.

Recent Developments

-

In March 2023, Brain Products GmbH unveiled its newest EEG headset, the X.on. This wireless headset offers ease of use, a stylish design, and comfortable wear while providing top-notch data quality. It is equipped with sponge electrodes placed at F3, F4, C3, C4, P3, and P4

-

In November 2022, Emotiv partnered up with X-trodes to create a device that can measure brain activity and physiological responses outside of a laboratory. The device incorporates X-trodes' wearable technology with EMOTIVPRO, Emotiv's EEG data platform for neuroscience studies.

-

In April 2022, ANT Neuro introduced eego 24, an ultraportable EEG amplifier for monitoring brain activity. This product is a lightweight 24-channel amplifier, capable of continuous operation and powered without an internal battery

-

In January 2022, Neurosteer Inc. announced that it received approval from the U.S. FDA for its single-channel Electroencephalogram (EEG) brain monitoring platform. This system helps in the early detection of presymptomatic cognitive diseases, such as Alzheimer’s, dementia, and Parkinson’s

U.S. Electroencephalography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 380.8 million

Revenue forecast in 2030

USD 695.1 million

Growth rate

CAGR of 10.55% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use

Country scope

U.S.

Key companies profiled

Natus Medical, Inc.; Electrical Geodesics, Inc.; Medtronic; NeuroWave Systems, Inc.; Compumedics Ltd.; Noraxon U.S.A., Inc.; Cadwell Laboratories, Inc.; Nihon Kohden America, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electroencephalography Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electroencephalography market report based on products, type, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

8-channel EEG

-

21-channel EEG

-

25 channel EEG

-

32-channel EEG

-

40-channel EEG

-

Multi-channel EEG

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone Devices

-

Portable Devices

-

Wearable Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma & Surgery

-

Disease Diagnosis

-

Anesthesia Monitoring

-

Sleep Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. electroencephalography devices market size was estimated at USD 348.6 million in 2023 and is expected to reach USD 380.8 million in 2024.

b. The U.S. electroencephalography devices market is expected to grow at a compound annual growth rate of 10.55% from 2024 to 2030 to reach USD 695.1 million by 2030.

b. 32-channel EEG dominated the U.S. electroencephalography devices market with a share of 27.44% in 2023. Technological advancement in 32-channel EEG products and their high adoption by healthcare professionals are the major factors driving growth.

b. Some key players operating in the U.S. electroencephalography devices market include Natus Medical, Inc., Electrical Geodesics, Inc.; Medtronic; NeuroWave Systems, Inc.; Compumedics Ltd.; Noraxon U.S.A., Inc.; Cadwell Laboratories, Inc.; Nihon Kohden America, Inc.

b. Key factors that are driving the market growth include increasing prevalence of neurological disorders and rising awareness about them are major factors contributing to the growth. High incidence of Alzheimer’s, epilepsy, dementia, multiple sclerosis, Parkinson’s disease, and stroke has been key in the rising adoption of electroencephalography (EEG) devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.