- Home

- »

- Medical Devices

- »

-

U.S. Electrophysiology Mapping And Ablation Devices Market Report, 2033GVR Report cover

![U.S. Electrophysiology Mapping And Ablation Devices Market Size, Share & Trends Report]()

U.S. Electrophysiology Mapping And Ablation Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure Type (EP Ablation Procedures, Stand-Alone EP Diagnostic Procedures), By Product Coverage, And Segment Forecasts

- Report ID: GVR-4-68040-694-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electrophysiology Mapping and Ablation Devices Market Summary

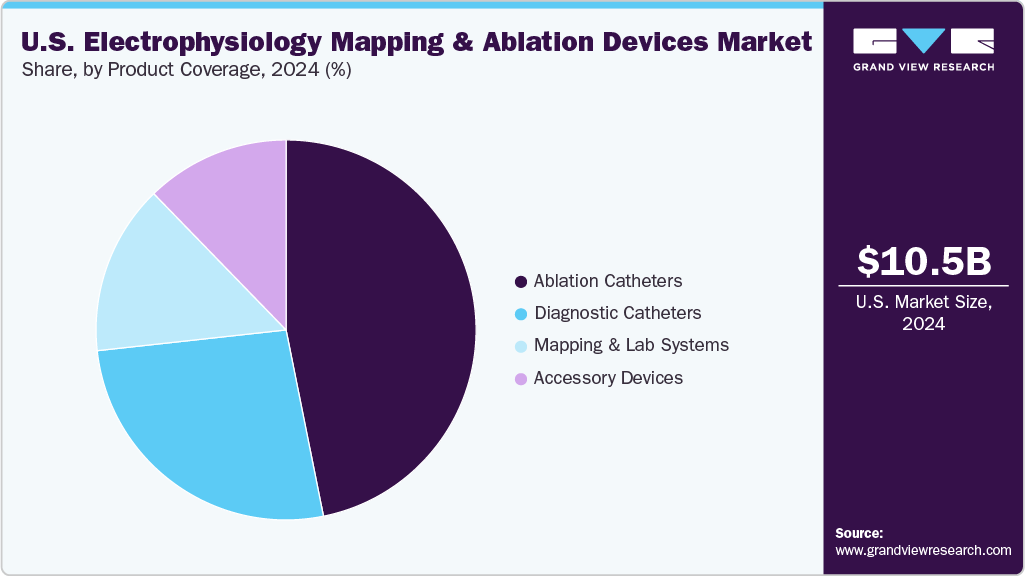

The U.S. electrophysiology mapping and ablation devices market size was estimated at USD 10.47 billion in 2024 and is projected to reach USD 23.11 billion by 2033, growing at a CAGR of 8.05% from 2025 to 2033. Widespread use of electrophysiology (EP) mapping and ablation devices in the U.S. is being driven by the escalating burden of atrial fibrillation and other complex arrhythmias, particularly among aging and at-risk populations.

Key Market Trends & Insights

- The electrophysiology (EP) mapping and ablation devices industry in the U.S. is expected to grow significantly over the forecast period.

- By product coverage, the ablation catheters segment held the highest market share of 46.84% in 2024.

- Based on procedure type, the EP ablation procedures segment held the highest market share in 2024.

- Based on indication, the atrial fibrillation segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.47 Billion

- 2033 Projected Market Size: USD 23.11 Billion

- CAGR (2025-2033): 8.05%

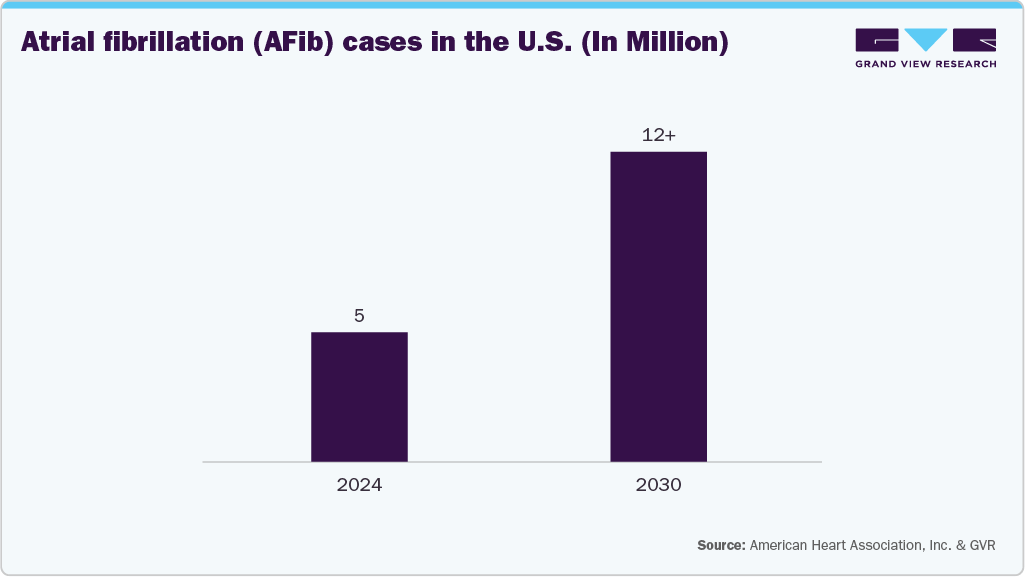

As clinical guidelines increasingly favor early interventional treatment, hospitals and ambulatory centers are expanding their EP capabilities.Rising obesity rates, hypertension, and diabetes prevalence in the U.S. are contributing to increased procedure volumes and accelerating the demand for advanced diagnostic and therapeutic EP technologies. According to the CDC, approximately 12.1 million people in the U.S. will be suffering from atrial fibrillation by 2030. The growing burden of arrhythmias in the U.S., particularly atrial fibrillation, is driving increased adoption of electrophysiology (EP) mapping and ablation devices.

As hospitals and specialty centers expand their cardiac programs, there is a rising demand for tools that enable faster, more accurate diagnosis and targeted treatment. In March 202, Clinical Cardiology published a 25-year analysis of arrhythmia-related deaths in the U.S., reporting 5.05 million deaths among adults aged 35+ from 1999-2023. Mortality fell from 1999 to 2009, then rose steadily, peaking in 2021 during the COVID-19 pandemic before declining slightly.

Technological advancement remains a key driver of market growth. Innovations in 3D mapping systems, pulsed field ablation platforms, and AI-guided navigation are improving precision and reducing procedural risk. These technologies are gaining traction among U.S. providers seeking to streamline workflows, enhance outcomes, and stay ahead in an increasingly competitive electrophysiology landscape. In June 2025, Phillips Medisize launched TheraVolt, its first branded line of medical connectors tailored for high-voltage, high pin-count electrophysiology (EP) mapping and ablation devices. Designed to support pulsed field ablation therapies, TheraVolt offers customizable, sterilization-compatible solutions with high-density integration and platform flexibility.

Growing awareness and screening initiatives across the U.S. are accelerating the use of EP technologies. Community health programs, health system-led outreach, and proactive rhythm monitoring are helping identify arrhythmias earlier. As more patients are diagnosed before complications arise, demand for diagnostic and therapeutic EP procedures and the devices that support them continues to rise. In July 2025, a white paper published by PCNA evaluated the outcomes of a community-based screening initiative targeting atrial fibrillation (AFib) and hypertension in Baltimore, Maryland. The report noted that AFib remains underdiagnosed due to its episodic symptoms, underscoring the growing need for early, minimally invasive diagnostic solutions as cases are projected to rise to 12.1 million by 2030.

Market Concentration & Characteristics

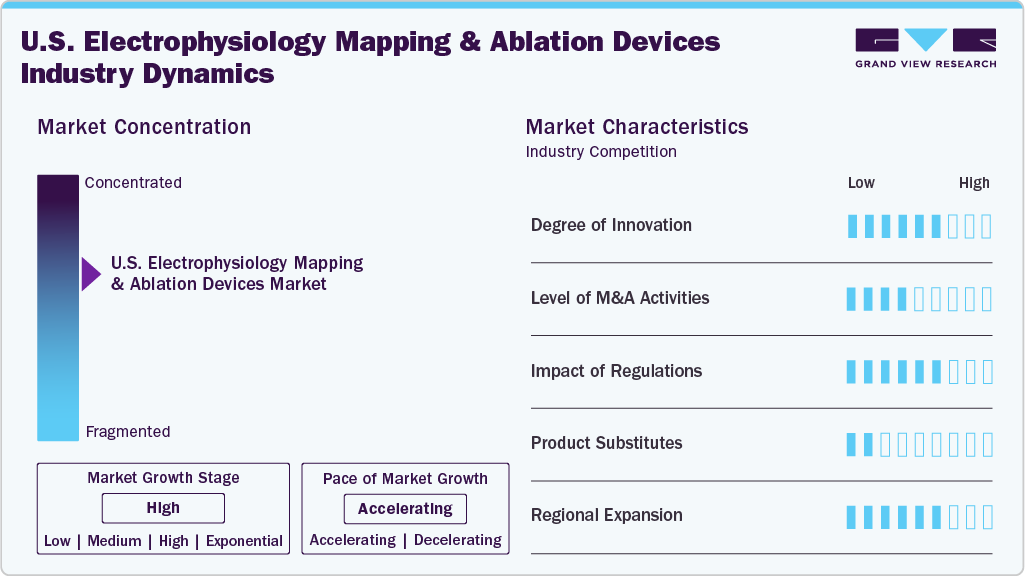

Innovation in the electrophysiology mapping and ablation devices industry is high in the U.S. Rapid advancements in 3D electroanatomical mapping, AI-guided navigation systems, and pulsed field ablation technologies fuel the market. U.S.-based hospitals and academic centers are early adopters of these tools, which enhance procedural precision, reduce complications, and improve patient outcomes. In October 2024, the FDA approved Medtronic’s Affera Mapping and Ablation System featuring the Sphere-9 Catheter, a novel tool combining high-density mapping with pulsed field and radiofrequency ablation capabilities.

The level of mergers and acquisitions in the U.S. electrophysiology (EP) mapping and ablation devices industry is moderate. Most activity is strategic, aimed at acquiring complementary technologies or expanding into new geographies. While the volume of deals is not high, the impact of targeted acquisitions, particularly in software, imaging, or energy delivery, is significant. In November 2024, U.S.-based Boston Scientific Corporation announced its agreement to acquire Cortex, Inc., a medtech company developing the OptiMap System, an FDA-cleared diagnostic mapping solution that identifies AF triggers beyond the pulmonary veins.

Regulatory influence on the electrophysiology (EP) mapping and ablation devices industry is high in the U.S. Given the critical nature of cardiac interventions, the FDA enforces rigorous approval standards, requiring robust clinical data, software validation, and long-term performance evidence. These requirements extend development timelines and increase costs, but also help ensure patient safety. Successfully meeting U.S. regulatory benchmarks enhances credibility and creates a competitive moat for established players.

Product or service substitutes in the electrophysiology (EP) mapping and ablation devices industry are low in the U.S. While options such as antiarrhythmic medications or surgical interventions exist, they are generally less effective, carry greater side effect risks, or are more invasive. In U.S. clinical practice, catheter-based EP procedures remain the gold standard due to their precision, safety profile, and durable outcomes, reinforcing the central role of mapping and ablation systems in arrhythmia care.

Regional expansion in the electrophysiology (EP) mapping and ablation devices industry is moderate to high in the U.S. Companies are focusing on expanding access beyond major urban centers by investing in outpatient EP labs and regional cardiac centers. Growth is also being driven by health systems in underserved and rural areas, enhancing their EP capabilities to meet rising arrhythmia care demand. While workforce shortages and reimbursement variability pose challenges, domestic geographic expansion remains a key strategy for market players.

Procedure Type Insights

By procedure type, the EP ablation procedures segment held the largest market share in 2024, accounting for 88.16% of total revenue, and is expected to grow at the fastest CAGR over the forecast period. This expansion is fueled by the growing prevalence of atrial fibrillation and ventricular tachycardia in the U.S., increasing uptake of next-generation ablation methods such as pulsed field ablation, and strong clinical evidence supporting newer systems in U.S.-based studies and practice settings. In May 2023, Abbott secured FDA approval for its TactiFlex Ablation Catheter, a sensor-enabled device designed to treat atrial fibrillation. As the first catheter globally to combine a flexible tip with contact force technology, it enhances precision and safety during ablation procedures, marking a significant advancement in AFib treatment.

The stand-alone EP diagnostic procedures segment in the U.S. is projected to grow at a significant rate over the forecast period, driven by increasing use of advanced mapping technologies such as 3D electroanatomical systems, rising detection of complex arrhythmias such as atrial fibrillation, and greater adoption of non-therapeutic EP evaluations in outpatient and ambulatory surgical centers. In March 2025, Stereotaxis unveiled the MAGiC Sweep Robotic Mapping Catheter, a high-density EP mapping device developed for use with its robotic magnetic navigation platform. The company filed for FDA 510(k) clearance, underscoring its aim to advance precision diagnostics in U.S. electrophysiology practices.

Product Coverage Insights

By product coverage, the ablation catheters held the largest market share of 46.84% in 2024 and are projected to grow at the fastest CAGR over the forecast period. This leadership is driven by widespread adoption of catheter-based ablation techniques for managing complex arrhythmias such as atrial fibrillation, which affects millions across the U.S. Continued technological innovation, including contact force sensing and pulsed field ablation, is enhancing procedural accuracy and safety, fueling demand across hospitals, outpatient EP labs, and academic medical centers. In July 2025, Boston Scientific received FDA approval to expand the indication of its Farawave and Farawave Nav pulsed field ablation catheters for treating drug-refractory persistent atrial fibrillation. The decision was based on data from the ADVANTAGE AF trial, demonstrating strong efficacy in pulmonary vein isolation and posterior wall ablation.

Diagnostic catheters are the second largest segment in the market, driven by their essential role in accurately mapping cardiac electrical activity prior to ablation. In the U.S., rising arrhythmia burden, particularly atrial fibrillation, has heightened demand for advanced, high-resolution multi-electrode diagnostic catheters. In May 2025, Johnson & Johnson MedTech launched the Soundstar Crystal Ultrasound Catheter in the U.S. for intracardiac echocardiography (ICE) during cardiac ablation procedures. This advanced 2D ICE catheter offers enhanced image quality, improved maneuverability, and seamless integration with the Carto 3 Mapping System, supporting real-time visualization and enabling zero-fluoroscopy workflows in electrophysiology labs.

Key U.S. Electrophysiology Mapping And Ablation Devices Company Insights

Key participants in the global market focus on devising innovative business growth strategies in product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Electrophysiology Mapping And Ablation Devices Companies:

- Siemens Healthineers

- Koninklijke Philips N.V.

- Abbott

- Johnson & Johnson (Biosense Webster)

- GE HealthCare

- Boston Scientific Corporation

- Medtronic

- Biotronik SE & Co KG

- MicroPort Scientific Corporation

- CardioFocus, Inc.

Recent Developments

-

In July 2025, Banner Wyoming Medical Center opened a USD 7.3 million electrophysiology (EP) lab in Casper, significantly reducing the need for patients to travel out of state for routine heart rhythm treatments. Staffed part-time by Colorado-based electrophysiologists, the lab offers advanced procedures like ablations, pacemaker implants, and lead extractions. The facility addresses growing local demand, particularly for atrial fibrillation care, and aims to expand operations as patient volume increases.

-

In April 2025, Merit Medical commercially launched the Ventrax Delivery System in the U.S. for ventricular tachycardia (VT) ablation. The device enables retrograde aortic access with a 95-cm sheath and angled tip for improved catheter reach. Developed with input from Duke Health experts, it addresses a key clinical need in one of EP’s fastest-growing segments.

-

In December 2024, Northwell’s Lenox Hill Hospital became one of the first centers in the U.S. to treat persistent atrial fibrillation using the FDA-approved Affera Mapping and Ablation System. This all-in-one catheter combines high-density mapping with pulsed field and radiofrequency ablation, streamlining the procedure and reducing risks. The system shortens surgery time, improves precision, and enhances recovery for patients with complex Afib.

U.S. Electrophysiology Mapping And Ablation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.44 billion

Revenue forecast in 2033

USD 23.11 billion

Growth rate

CAGR of 8.05% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, product coverage

Country scope

U.S.

Key companies profiled

Siemens Healthineers.; Koninklijke Philips N.V.; Abbott; Johnson & Johnson (Biosense Webster); GE HealthCare; Boston Scientific Corporation; Medtronic; Biotronik SE & Co KG; MicroPort Scientific Corporation; CardioFocus, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electrophysiology Mapping And Ablation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. electrophysiology mapping and ablation devices market report based on procedure type and product coverage:

-

Procedure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

EP Ablation Procedures

-

By Indication

-

Atrial Fibrillation

-

Paroxysmal AF

-

Persistent AF

-

Long standing persistent/permanent

-

-

Right Atrial Flutter

-

Left Atrial Flutter

-

Atrioventricular Nodal Reentry Tachycardia (AVNRT)

-

Right Atrial Tachycardia (AT)

-

Left Atrial Tachycardia (AT)

-

Right Wolff-Parkinson-White (WPW)

-

Left Wolff-Parkinson-White (WPW)

-

Right Ventricular Tachycardia (VT)

-

Left Ventricular Tachycardia (VT)

-

-

-

Stand-Alone EP Diagnostic Procedures

-

By Product Type

-

Focal Ablation Catheter

-

Radiofrequency (RF)

-

Conventional

-

Irrigated-tip

-

Contact-Force-Sensing

-

Standard

-

-

-

Alternative Energy

-

Pulsed Field Ablation

-

-

Balloon Ablation Catheters

-

-

-

-

Product Coverage Outlook (Revenue, USD Million, 2021 - 2033)

-

Mapping & Lab Systems

-

X-Ray Systems

-

Mapping Systems

-

EP Recording Systems

-

ICE Systems

-

RF Ablation Generators

-

Pulsed Field Ablation Generators

-

Cryoablation Generators

-

-

Diagnostic Catheters

-

Conventional

-

Fixed

-

Steerable

-

-

Advanced

-

Ultrasound

-

-

Ablation Catheters

-

Focal Ablation Catheter

-

Radiofrequency (RF)

-

Conventional

-

Irrigated-tip

-

Contact-Force-Sensing

-

Standard

-

-

-

Alternative Energy

-

Pulsed Field Ablation

-

-

Balloon Ablation Catheters

-

-

Accessory Devices

-

Long Introducer Sheaths

-

Fixed

-

Steerable

-

-

Transseptal Needles

-

Conventional

-

RF

-

-

Navigational Accessories

-

-

Frequently Asked Questions About This Report

b. The global U.S. electrophysiology mapping and ablation devices market size was estimated at USD 10.47 billion in 2024 and is expected to reach USD 12.44 billion in 2025.

b. The global U.S. electrophysiology mapping and ablation devices market is expected to grow at a compound annual growth rate of 8.05% from 2025 to 2033 to reach USD 23.11 billion by 2033.

b. The EP ablation procedures segment held the largest share of the U.S. electrophysiology (EP) mapping and ablation devices market in 2024, accounting for 88.16% of total revenue, and is expected to grow at the fastest CAGR over the forecast period. This expansion is fueled by the growing prevalence of atrial fibrillation and ventricular tachycardia in the U.S., increasing uptake of next-generation ablation methods such as pulsed field ablation, and strong clinical evidence supporting newer systems in U.S.-based studies and practice settings.

b. Some key players operating in the U.S. electrophysiology mapping and ablation devices market include Siemens Healthineers, Koninklijke Philips N.V., Abbott, Johnson & Johnson (Biosense Webster), GE HealthCare, Boston Scientific Corporation, Medtronic, Biotronik SE & Co KG, MicroPort Scientific Corporation, and CardioFocus, Inc.

b. Widespread use of electrophysiology (EP) mapping and ablation devices in the U.S. is being driven by the escalating burden of atrial fibrillation and other complex arrhythmias, particularly among aging and at-risk populations. As clinical guidelines increasingly favor early interventional treatment, hospitals and ambulatory centers are expanding their EP capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.